The Analyst: a new angle on the active vs passive debate

An increasingly popular trading strategy has been able to squeeze extra returns in excess of those achieved by active fund managers. Analyst Dzmitry Lipsky explains how it works.

23rd May 2025 13:43

While the debate about active versus passive investing rumbles on, passive strategies have gained significant popularity over the past decade. This surge in interest is largely attributed to their simplicity and the underperformance of many active asset managers.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

One key drawback of passive investing, however, is that returns are generally limited to those of the market index, even if management fees are minimal. Moreover, stock selection and weightings in passive funds are determined by index providers, typically based on market capitalisation. This means that the better a stock performs, the more heavily it is weighted in the index. As a result, this approach led to high valuations and created a bias towards potentially overvalued stocks throughout 2023 and 2024.

This phenomenon has contributed to the rise of market acronyms such as FAANG and, more recently, the Mag 7, reflecting a narrow set of large stocks driving overall index performance. Such concentration increases risk within market cap-weighted indices. Additionally, the current macroeconomic landscape, marked by still relatively high interest rates, geopolitical tensions, and high equity valuations, suggests the possibility of lower future returns.

While market cap-weighted indices have outperformed active counterparts in recent years, historical performance is not always a good indicator of future returns for investors. Consequently, there is growing interest in alternative indexing strategies such as equal-weighted, dividend-weighted, or quality-weighted approaches. At the same time, many investors remain hesitant to take on the risk of active funds, given their higher fees and poor track record in delivering consistent outperformance.

Hybrid approaches

Markets are constantly evolving, driven by investor demand, innovation and rapid technological advancements. In recent years, enhanced indexing and smart beta strategies have emerged as innovative hybrids that blend elements of both active and passive investing. These approaches rely on systematic, rules-based methodologies aimed at achieving better outcomes than traditional index tracking, while still maintaining lower fees than fully active strategies.

Of the two strategies, enhanced indexing is a more conservative approach. It makes only modest adjustments to a market index, assuming lower levels of risk.

- Active or passive: the ultimate guide to investing your ISA

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Typically, an enhanced indexing strategy seeks to closely mirror the characteristics of its benchmark while selectively modifying holdings within constraints to outperform the market index.

In contrast, smart beta strategies often involve taking more active risk by significantly tilting portfolios towards specific factors, or characteristics such as value, growth, or dividend yield, and frequently track custom indices.

How enhanced indexing can help

The objective of enhanced indexing is to generate modest alpha (outperformance) in a cost-effective and risk-controlled manner. These strategies aim to deliver consistent excess returns over time while closely mirroring the characteristics of their reference benchmarks.

Enhanced index strategies work by marginally tilting portfolio composition towards stocks that exhibit favourable performance characteristics. This is typically accomplished using systematic scoring models that rank stocks based on specific characteristics. These scores inform moderate active weights (difference between benchmark weighting of a stock and the fund’s own weighting) while minimising deviation from the index across key areas such as sector, size, and country exposure.

A common approach involves targeting well-known fundamental factors such as value, momentum, quality, size, and low volatility - the so-called Big Five. Each factor captures a different source of return. Fund managers use sophisticated, often proprietary, systems to adjust stock weights based on forward-looking insights, aiming to maintain a low tracking error (the difference of performance between the ETF's portfolio and benchmark), while positioning for outperformance.

- ETF tracking error – what it means and why it is important

- Top 10 tips and tricks for investing in index funds and ETFs

The tracking error level accounts for the size of active weights taken, which are carefully distributed in a balanced manner across market cap, sector and country levels.

This limits concentration of active weights to avoid unintended risk exposures and maintain a portfolio composition that is close to the benchmark, meaning beta-neutral (low volatility). With a focus on consistency of positive performance rather than magnitude, low tracking error strategies may achieve positive excess returns more frequently.

While enhanced indexing typically has higher fees than traditional market-cap-weighted index funds, it remains more cost-efficient than fully active strategies. Fees usually range between 15 and 30 basis points (bps), reflecting the added value of active tilting within a disciplined risk framework.

Potential risks

While enhanced indexing strategies are designed to consistently outperform, they can face challenges in certain market environments such as in 2020 when value and quality factors underperformed. When specific factors remain out of favour, these strategies may experience short-term marginal underperformance.

Furthermore, enhanced indexing strategies tend to be more effective when implemented on a global scale rather than at a regional level. A global approach benefits from a broader investable universe, offering greater market breadth and diversification opportunities.

How to analyse these strategies

The enhanced index universe includes a wide range of investment approaches and risk levels, but these strategies typically exhibit a tracking error of less than 2% and target modest outperformance of up to 2% per annum gross of fees. When successfully implemented, they tend to achieve higher information ratios (a comparison of portfolio returns that exceed a benchmark and how consistent those returns are) than traditional active strategies.

Funds with high information ratios have historically delivered more excess return per unit of active risk than those with lower ratios.

In contrast, fully active strategies often take on significantly higher active risk in pursuit of greater excess returns. However, this higher risk, reflected in elevated tracking error, usually comes with greater variability and less consistency in performance, resulting in lower information ratios.

Therefore, in the case of enhanced indexing, high information ratios demonstrate a manager’s efficient use of their risk budget, as measured by tracking error, to deliver consistent outperformance for investors.

Past performance is not a guide to future performance.

Current opportunities in the market

Over the long term, enhanced index funds may offer an attractive alternative for investors looking to achieve a modest amount of outperformance without paying the premium for traditional active management.

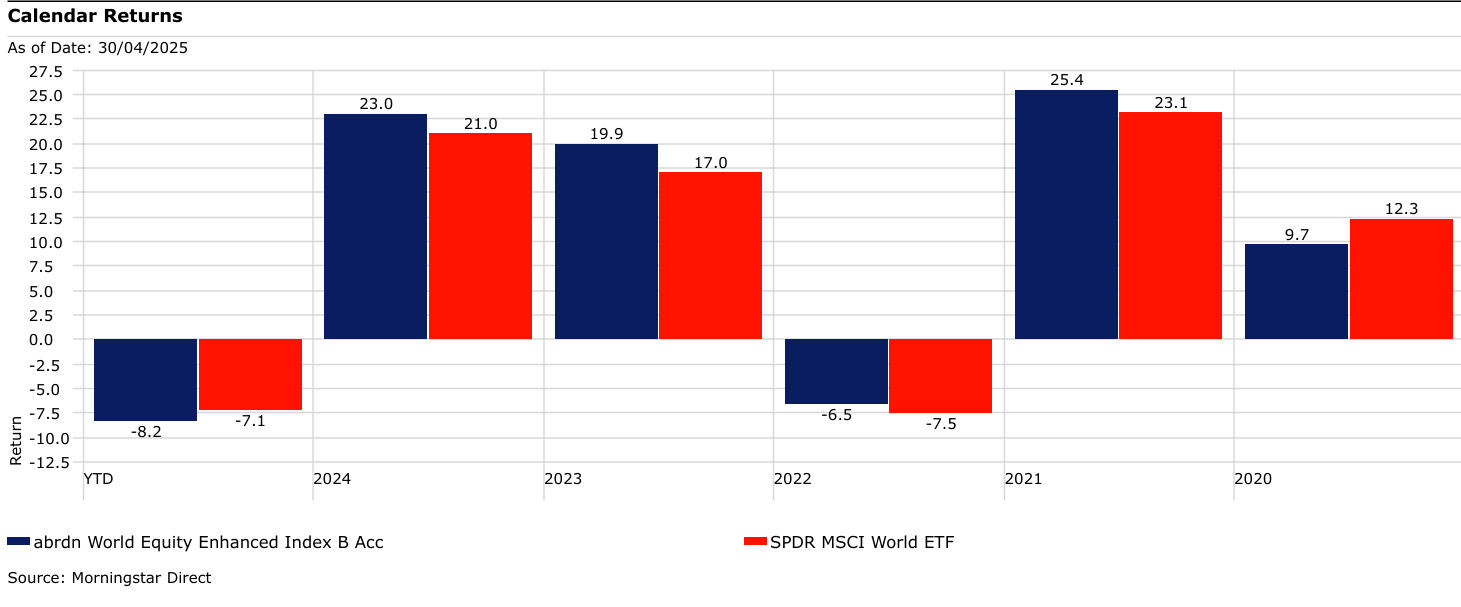

A strong option in this category is the abrdn World Equity Enhanced Index fund, which adjusts three key factors - quality, momentum, and value - to deliver modest but consistent outperformance. At the same time, the fund maintains regional, sector, and style exposures closely aligned with the MSCI World Index, ensuring a consistently low tracking error. The fund’s ongoing charge is just 0.25%.

Aberdeen also offers similar region-specific enhanced index strategies through the abrdn American Equity Enhanced Index, abrdn UK Equity Enhanced Index, and abrdn European Equity Enhanced Index funds.

There are other major providers active in the enhanced index space including JP Morgan, Invesco, and Fidelity. Options include Invesco Global ex UK Enhanced Index fund, Fidelity Global Equity Research Enhanced ETF (LSE:FGLS)and JPM Global Research Enhanced Index Equity Active ETF (LSE:JGRE).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks