The big, not-entirely-beautiful impact of the new US tax and spending law

Let’s break down all what’s in America’s new tax and spending law – and what it means for markets.

11th July 2025 11:06

Russell Burns from Finimize

- The freshly signed One Big, Beautiful Bill Act is set to give the US economy – and its stocks – a short-term boost. But over time, it's likely to pile on more debt and shave a few points off long-term growth

- A new Federal Reserve chair might aggressively lower interest rates, even with inflation still well above target. Those lower interest rates would, in turn, dampen the allure of US Treasuries and the US dollar, creating serious knock-on effects across financial markets

- International investors may want to consider investing in hedged US stock ETFs that protect them from further currency fluctuations, as further dollar weakness remains a clear and present threat.

The One Big Beautiful Bill Act (OBBBA) is nearly 900 pages long, a sprawling collection of tax breaks, spending cuts, and other measures. And, frankly, no one expects you to read it all. But the bill – which was signed into law on Friday – is worth paying attention to. It’s the cornerstone of the US president’s second-term agenda – and it could have major ripple effects on the markets and your money. So let’s break down what’s in it.

What are the OBBBA’s key components?

The market had been anticipating many of the changes included in the bill, so some of its impact has already been priced into individual stocks and sectors. For example, nuclear-related companies have already seen their share prices rise, while wind and solar companies have seen theirs fall. But there are still some major implications for the wider stock market, bonds, the dollar, and real assets like gold and bitcoin that have yet to fully land. So let’s look at some of the big stuff included in that big bill.

Tax cuts and other provisions. These will extend individual and business tax cuts from the 2017 Tax Cuts and Jobs Act, including incentives to boost manufacturing and expand semiconductor credits. It will raise the State And Local Tax (SALT) deduction cap to $40,000 (£29,500) for households earning up to $500,000 for five years, and make tips and overtime pay tax-exempt up to $25,000 and $12,500, respectively, until 2028.

Spending and entitlement changes. The law will make steep cuts to Medicaid and impose new work requirements on able-bodied adults without dependents. Folk who qualify for food stamps will face stricter work requirements, and states will be forced to shoulder more program costs without federal funding to do so. Defense and border security, meanwhile, will get more money.

Energy and the environment. Clean energy tax credits (for wind, solar, and other renewable energy projects) will go away by 2027. In their place will be more funding for fossil fuel development and nuclear energy.

What’s the likely impact on government debt levels and economy?

Well, there are a few estimates out there and not many of them are pretty.

Ray Dalio, hedge fund guru and founder of Bridgewater Associates has said the law has a few red flags. Not least of which is the fact that it will jack up government spending to about $7 trillion a year, while bringing in just $5 trillion. That shortfall would likely increase total debt from $10 trillion now – split roughly into $1 trillion in interest and $9 trillion in principal – to about $18 trillion down the line, with interest payments alone doubling to $2 trillion a year.

Meanwhile, the Budget Lab at Yale University has estimated there will be a small boost to economic growth that averages 0.2 percentage points per year from 2025 to 2027. Afterward, it sees economic growth slowing considerably – by 2054, economic growth would be nearly 3% smaller than if the bill had never passed.

What’s more, the bill is widely expected to raise the long-term federal debt-to-economic-output ratio from a projected 142% (without the bill) to 183% by 2054. That staggering, 41-point jump has rattled economists and investors. It’s even pushed Elon Musk to float the idea of launching his own political party in protest.

How will the US likely deal with rapidly rising debt levels?

When governments get buried under debt, they’ve generally got just three ways to deal with that: slash spending, hike taxes, or plunge interest rates to exceptionally low levels. The first two are political disasters. (Go figure: voters don’t like to see their benefits cut or their taxes raised.) So that makes the third option a likely winner. So that’s the one Dalio’s betting on.

That means lower interest rates and more money sloshing through the system. We’ve seen this work out well in the past: cheap borrowing typically boosts the economy and pumps up asset prices. Just look at what happened after the global financial crisis or after the initial Covid-19 panic. And, if history is any guide, lower interest rates will also weaken the US dollar, making the country’s exports more competitive and nudging growth higher.

To be clear, this isn’t the best solution in all scenarios. Right now, for example, pushing interest rates down while inflation is running higher could result in lower real interest rates (that’s the rate minus inflation). Combine that with a weakening dollar and ballooning government debt, and US Treasury bonds start to lose their allure – especially among global buyers. That’s already happening, in fact: international investors have been trimming their unhedged US exposure, and the dollar has fallen nearly 10% this year against a basket of six major currencies.

So, what does this mean for your portfolio?

The OBBBA should cheer stock investors in the short term and weaken the dollar a bit more, in the process. And that weaker greenback will likely give a lift to companies that make a lot of their money overseas – for example, Big Tech. That’s assuming, of course, that no digital tax is used as a pawn in the ongoing trade chess game.

That’s one reason why S&P 500 and Nasdaq exchange-traded funds (ETFs) still make good core picks for US investors. Plus, with a new Federal Reserve chair set to take over in May – one that’s expected to favour low rates, in step with the White House – the weaker dollar trend could stick around a while.

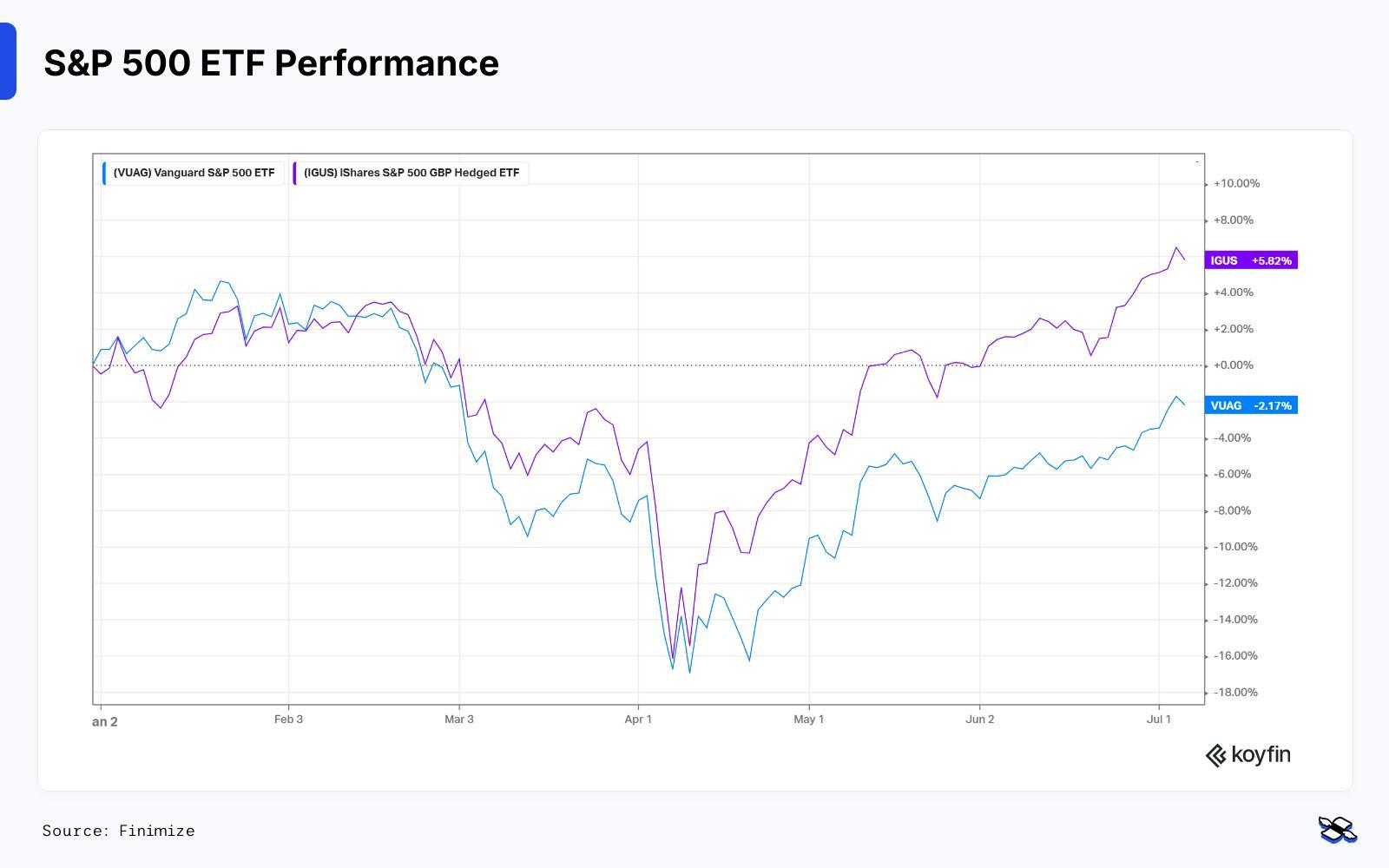

But for investors outside the US, a falling dollar is less friendly: they get smaller returns once the currency conversion’s done. For them, a hedged ETF makes more sense, removing that foreign exchange (forex) risk. The chart below shows how the weaker dollar has undermined S&P 500 returns this year for UK-based investors.

The year-to-date returns for the S&P 500 using an unhedged fund (blue) and a hedged one (purple). Past performance is not a guide to future performance. Source: Koyfin.

Finally, let’s talk about real assets: they look particularly attractive as the US dollar’s appeal drops. Gold’s already up about 26% this year, partly because central banks have made it their number-two reserve asset. Bitcoin’s getting more love, too – its limited supply makes it a popular “digital gold” play in an age of easier money.

That’s why some investors are starting to think the old 60/40 portfolio (60% in stocks, 40% in bonds) would be better with a 60/20/20 format – swapping out some of that bond weight for gold, bitcoin, or other real assets.

Russell Burns is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks