Chinese brands are challenging Western rivals – and investor assumptions

If you’re clinging to the big-name consumer and tech stocks, it’s time to look around. Chinese rivals are scaling up and hitting the giants where it hurts: relevance, profit, and growth.

25th July 2025 10:02

- Chinese brands are going globally – fast. Domestic saturation, digital speed, and cultural confidence are pushing Chinese firms to challenge Western incumbents across industries, from EVs to fashion

- Brand recognition isn’t the strength it used to be – firms such as Apple, Starbucks, and Disney face rising competition, especially in Asia, where local players are faster, cheaper, and (increasingly) better

- Investors need to adjust their expectations – reassess growth assumptions and valuation multiples for global giants, while keeping an eye on Chinese disruptors that are venturing abroad.

If you still dismiss Chinese brands as knock-offs or cut-price clones, it’s time to update your thinking. Companies such as Shein, BYD Co Ltd Class H (SEHK:1211), and Pop Mart International Group Ltd Ordinary Shares (SEHK:9992) are now consumer go-tos – and they’re gaining loyalty, buzz, and pricing power a lot faster than their Western rivals.

And if you’re holding shares in legacy giants such as Starbucks Corp (NASDAQ:SBUX), Apple Inc (NASDAQ:AAPL), or The Walt Disney Co (NYSE:DIS), it’s worth taking a closer look at the competition. Brand recognition alone isn’t the competitive advantage it once was – not when younger consumers are shifting loyalty towards faster, fresher, and often cheaper alternatives.

China’s shifting from factory floors…to flagship brands

For decades, Chinese firms have been the world’s contract manufacturers – the invisible players behind the logos of Western brands. But that’s been changing. Across China, companies are now creating brands of their own – and doing it faster, smarter, and often better than the bigger guys.

Some of that comes down to the intensity of China’s domestic market. Surviving it – let alone thriving in it – means competing on speed, price, innovation, and customer insight. It’s an environment that sharpens a business. No surprise, then, that it’s churned out some of the world’s most operationally ruthless companies.

But there’s another reason we’re seeing this global push: China’s consumer growth is slowing. Disposable income is under pressure, youth unemployment is stubbornly high, and confidence in the local economy has slipped. Brands that once focused squarely on at-home growth are now looking overseas to keep their momentum going.

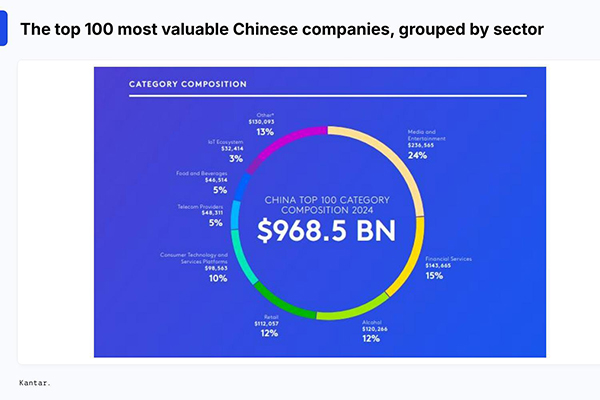

The top 100 most valuable Chinese companies, grouped by sector. Source: Kantar.

And now, Western brands are losing ground

Western consumer giants have spent decades building brand empires in China. Now, the edge they’ve honed is threatened. Here are some examples of that.

Starbucks, once the default for premium coffee in China, has been overtaken by Luckin, which now leads in both store count and cup sales. Meanwhile, Cotti – an even younger rival – is catching up fast. Both Luckin and Cotti offer comparable drinks for half the price of Starbucks, and with smoother digital ordering and faster service, too. Starbucks’ slower, more expensive model has struggled to keep pace with these agile challengers. And the competition is only going to become more intense. Cotti, and upstarts Chagee and Heytea are all actively expanding abroad – with plans to plant caffeinated flags in Southeast Asia, the Middle East, and the US. So now Starbucks will have to face pressure not only in China, but also in markets it has dominated without question.

Apple could also be shaken to its…core. Its premium edge has been fading in China as Xiaomi Corp Class B (SEHK:1810) and Huawei close the gap on hardware, design, and smart-home integration. Xiaomi, in particular, refreshes its products more often and prices everything more competitively. If you’re an Apple shareholder, the growing appeal of Android-based devices that offer 90% of the experience at just half the price should raise your eyebrows. Right now in India, Southeast Asia, and parts of Europe, Xiaomi is winning over digital-first, budget-conscious buyers – and they might never look back.

Tesla, meanwhile, has been overtaken by BYD in global EV sales. BYD’s edge lies in its battery integration, mid-tier pricing, and production scale. Sure, Tesla Inc (NASDAQ:TSLA) still leads in branding and tech cachet – but BYD’s newer models are narrowing that gap fast. For investors, the big question now is whether Tesla’s competitive edge (its “moat”) will hold as EVs become more mainstream and value-driven. BYD’s been expanding in Europe and Latin America, so the threat to Tesla’s international growth story is real.

Nike Inc Class B (NYSE:NKE) and adidas AG (XETRA:ADS) have both lost market share to Li Ning Co Ltd (SEHK:2331) and ANTA Sports Products Ltd (SEHK:2020). These sportswear brands lean heavily on Chinese identity and design cues that resonate with a younger, digitally native consumer base. They’ve also expanded their global ambitions through strategic sponsorships and international retail pushes.

Pop Mart has been building momentum with its “Labubu” dolls and other toy collectibles – slowly but surely putting up a credible fight to the Disney empire. Its gremlin-meets-elf Labubu dolls are now hot commodities – not only in China, but also across more than 20 international markets. With celebrities such as Rihanna and David Beckham helping raise its profile, Pop Mart has evolved from China-based trend into a serious global pop culture player.

And then there’s Shein. The e-commerce brand’s core weapon is speed: it can take a trend from social media to its online storefront in just days. That kind of pace makes the legacy fast-fashion innovators like Hennes & Mauritz AB Class B (OMX:HM B) and Zara (Inditex) look glacial by comparison. Shein’s AI-driven demand model means it can produce goods in small batches and scale up only the stuff that works. That’s leaner and far less wasteful than H&M’s seasonal bulk-buy approach. And, with those advantages, Shein’s able to win on prices, too. So investors in traditional retail have to be asking how those older rivals plan to keep up.

Here’s what this all means for you

What ties all these stories together is that Chinese brands are using data, cultural fluency, and ruthless efficiency to beat Western rivals – in China and globally. They don’t need to win on every front. They just need to be good enough on brand and better on value.

If you’re holding Western consumer or tech stocks, ask yourself why. If you’re counting on legacy brand strength to keep competitors at bay, keep in mind, that’s a lot weaker than it used to be.

I’m not saying Chinese consumer stocks are a guaranteed win – geopolitics, regulation, and foreign sentiment can all turn on a dime. But right now, Chinese brands are scaling up, pushing out, and challenging hefty Western players across categories. And some of the biggest names in folks’ portfolios are more exposed than they might seem.

Here’s how to think about it:

- Reassess your assumptions about brand strength. For years, companies like Apple, Starbucks, and Disney have banked on their brands to justify their premium pricing – especially in China. But as local competitors catch up, that edge could slip. And when relevance starts to fade, so do profits

- Reassess growth assumptions – and the multiples that come with them. If a stock’s priced for prestige – with fat margins and global scale baked in – it’s worth checking whether those assumptions still hold. Slower sales in China, shrinking pricing power, or sharper competition all chip away at the case. Multiples built on legacy strength might be due for a rethink

- Spot the disruptors with global ambitions. BYD is no longer a China-only story – it’s outselling Tesla around the world and expanding fast in Europe and Latin America. Chagee, Luckin, and Pop Mart are testing overseas markets too – and could quickly become multibillion-dollar players

- Find the investable angles. Some high-growth names – like Pop Mart, Haidilao International Holding Ltd (SEHK:6862), and BYD – trade in Hong Kong or New York. For those still private or harder to access, consider broader emerging market consumer ETFs or funds with exposure to Asia’s rising middle class.

This isn’t about picking sides – it’s about following the momentum. China’s brand engine is moving upmarket and overseas. And it’s not just showing up – it’s showing off.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of Aberdeen.

finimize is a newsletter, app and community providing investing insights for individual investors.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks