FTSE for Friday: how will FTSE 100 end the week?

UK stocks ended higher Thursday but off their peak following the decision to keep interest rates here unchanged. Independent analyst Alistair Strang assesses possible movement in this trading session.

20th September 2024 07:24

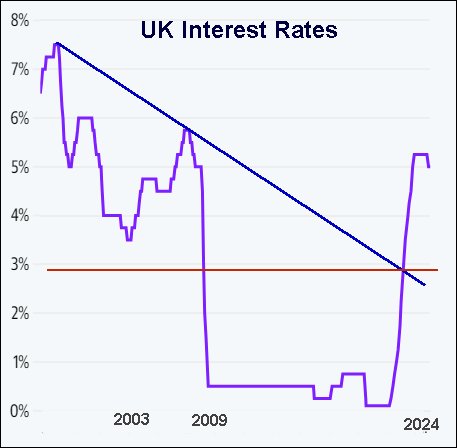

Thursday was slightly interesting, the UK’s FTSE 100 providing a pretty tame day against a backdrop of other markets looking strong. Of course, fully to blame for the lack of enthusiasm was the Bank of England which held interest rates.

Meanwhile, across the pond, the USA suffered a 0.5% cut in rates. Even the European Central Bank opted for action, reducing their rate to 3.5% while the UK continues to be stifled at 5%.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Source: Trends and Targets. Past performance is not a guide to future performance.

We’d like to advocate Friday as looking quite positive for the FTSE 100, but unfortunately, at time of writing, FTSE Futures are experiencing a bit of a hammering, trading around 8,294.

In many ways, this isn’t terribly encouraging, carrying a vague threat of reversal down to 8,270 points or so. Our current expectation is for the market to open down on Friday, ideally above 8,270 points and spend the rest of the day exhibiting some recovery.

On the basis the UK opens around 8,300 points, we shall hope for gains during the morning toward an initial 8,340 points. If bettered, our secondary is at 8,374 points, but we should also admit this gets close to a bigger picture value at 8,403 and a visual chance of some hesitation, at least until next week.

If this triggers, the tightest stop loss level looks like 8,270 points, an extremely kind risk/reward potential.

Our converse scenario looks at the risks should 8,270 break, as reversals to an initial 8,236 points looks possible with our secondary, if broken, calculating at a less likely 8,129 points.

Have a good weekend.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks