Fund Spotlight: a rare value fund that’s beaten growth-heavy index over 15 years

The ii Research Team highlights a global equities fund with a contrarian streak.

10th July 2024 10:48

Since the Global Financial Crisis (GFC), there has been a substantial outperformance of growth stocks over value stocks. In the 15 years to end of June 2024, global growth stocks (MSCI ACWI Growth), returned an annualised 14.3% versus 10% for the value equivalent.

What is more, value outperformed growth in only three of those years. This has made for a sizeable challenge for value fund managers to overcome.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

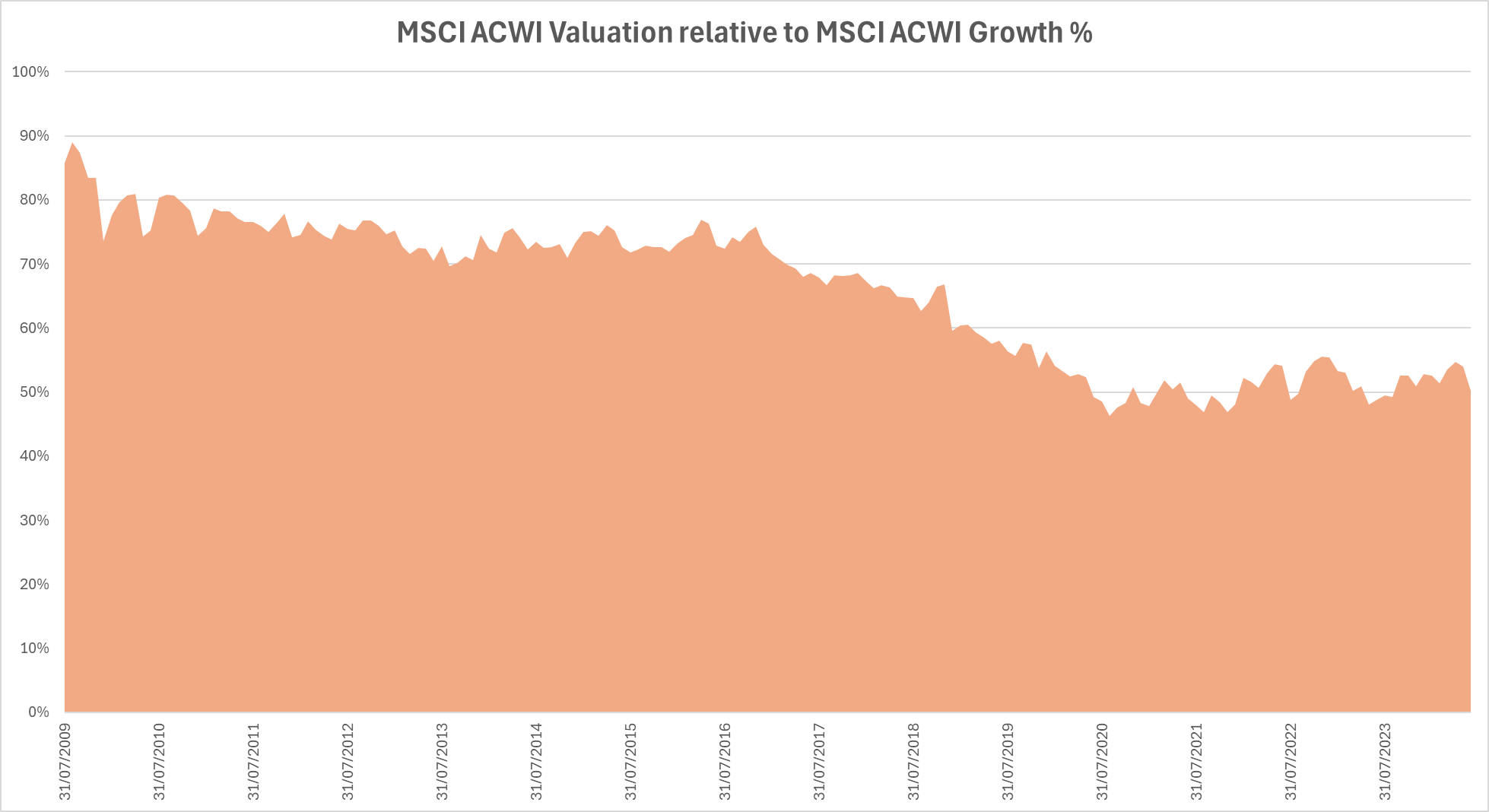

After the GFC, growth and value stocks briefly were trading at relatively similar forward price-to-earnings (P/E) multiples. However, the discrepancy between valuations, in favour of growth, has widened considerably in the years since.

It can usually be expected that value stocks trade at levels closer to (or even below) their fundamental worth, making them cheap compared to growth stocks, but the gulf between the two factors at the moment is exceptional.

The MSCI ACWI Growth index sits at a forward P/E multiple of 27.1x versus 13.6x for value. The below chart shows how the valuation of the MSCI ACWI Value index has fallen when compared on a relative basis to the valuation of MSCI ACWI Growth index.

However, it doesn’t pay to disregard value as a factor, especially at a time where prices of growth companies are so high. Moreover, established value companies can offer a margin of safety to investors, given that they are likely not priced at a substantial premium to their intrinsic worth.

Skilful navigation of the value landscape can allow disciplined managers to unearth fundamentally strong businesses, with positive future prospects that are currently overlooked, or even oversold, by the market. The Dodge & Cox Worldwide Global Stock fund seeks to do just that, and over the past 15 years is one of the only large-cap value global equity fund available to UK investors to beat the rather growth-heavy MSCI ACWI index. The fund has returned 12.7% annualised versus 12.3% for its benchmark (MSCI ACWI index).

- Five value funds your portfolio is probably missing (but shouldn’t be)

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Importantly, the bottom-up strategy does not rely on a broader market rally in value companies to perform well – and has also generated substantial outperformance (an annualised 2.3%) over a broad value index (MSCI ACWI Value) since inception. At the same time, it has achieved one of the strongest upside capture ratios of the wider global fund peer group despite its value bias.

While Dodge & Cox may not be a name familiar to everyone in the UK, this US fund house manages near $300 billion (£234 billion) in assets and has a rich history of applying rigorous principles of long-term, value-focused investing across its funds since being founded in San Francisco in 1930.

What does the fund invest in?

Dodge & Cox Worldwide Global Stock fund invests in established companies across the globe that look undervalued relative to their long-term fundamental strengths and profit opportunities.

The approach to defining “value” is holistic, not just focusing on companies trading at low valuations, but considering share prices in the context of the heterogeneous dynamics of a particular business. This can lead to some forays into stocks not typically associated with value, such as top holding Alphabet Inc Class A (NASDAQ:GOOGL).

The thesis centres on the idea that sentiment towards, and prices of, companies are far more volatile than a firm’s underlying fundamentals, and therefore the fund takes a longer term (three to five-year) approach to investing to look past short-term noise.

The process utilises in-house company research to define a portfolio (now 84 stocks) from the bottom up. The investment committee overseeing the fund, which houses a number of long-tenured experts, considers aggregate risk exposures, aiming to maintain exposures across most major economic sectors without any excessive concentrations.

- Fund managers give their take on what Labour's win means for markets

- Funds, trusts and shares to look beyond the ‘Magnificent Seven’

There’s a big focus on fundamental valuations of businesses, as well as strength of franchises, quality of management and the dynamics of competition. Often, the managers leverage opportunities thrown up by market dislocations and uncertainty to find potential additions.

Versus global peers, the portfolio leans unsurprisingly towards lower-multiple “value” names and includes a little more exposure to mid-caps. Given the fundamental valuation focus and management’s contrarian streak, the portfolio does diverge a good deal from the MSCI ACWI benchmark and its global equity peers, from a stock, sector and geographic perspective.

For example, while Alphabet is a top holding, the fund largely steers clear of expensive technology names holding 4% (which is a 20% underweight). Instead, they have long found rafts of value opportunities across financials at 30% (14% overweight) and healthcare at 21% (10% overweight). Further, the portfolio bucks consensus by weighting just over 50% to the US, one of the lowest weightings of its global peers and around 14% underweight versus benchmark.

Also of note is that allocation of 10% to the UK market is triple the benchmark weighting.

How has the fund performed?

Due to taking a long-term approach to finding undervalued and unloved companies, performance can be rocky. So far in 2024, the fund has returned just over 6%, around half that of its benchmark index.

While the large financials and small tech allocation worked well for the fund, the overweight to healthcare dragged on returns. Relative underperformance can also be partly attributed to the index being very much driven by mega-cap technology names: NVIDIA (NASDAQ:NVDA), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Meta Platforms (NASDAQ:META), and Apple (NASDAQ:AAPL) – companies to which the fund either doesn’t allocate or is underweight.

However, despite the underweight to the US and tech, over the past three years, the fund is ahead of its index and peers and demonstrated good resilience in the face of the market turmoil of 2022 when its benchmark global index fell over -8% and the fund returned a positive 4.9%.

| Investment | 01/07/2023 - 30/06/2024 | 01/07/2022 - 30/06/2023 | 01/07/2021 - 30/06/2022 | 01/07/2020 - 30/06/2021 | 01/07/2019 - 30/06/2020 |

| Dodge & Cox Worldwide Global Stock Fund | 14.4 | 8.3 | 4.3 | 37.5 | -6.4 |

| MSCI ACWI index | 20.1 | 11.3 | -4.2 | 24.6 | 5.2 |

| Morningstar Global Large-Cap Value Equity Sector | 12.2 | 8.6 | -1.0 | 25.4 | -5.8 |

Source: Morningstar Total Return (GBP) to 30/06/2024. Past performance is not a guide to future performance.

Why do we recommend this fund?

Dodge & Cox Worldwide Global Stock Fund offers a differentiated exposure to global equities. The bottom-up search for undervalued companies encourages a sector and geographic allocation that is notably diverged from growth-heavy global indices.

We saw in 2022 how this diversified exposure protected investors when growth fell from favour, but the fund’s focus on finding businesses where fortunes and market perceptions are poised to inflect has succeeded over the long term, in spite of the stylistic headwinds for value investors.

The fund is backed by a strong management team overseeing the funds via an investment committee structure, and supported by the deep research resource of Dodge and Cox. The yearly fee of 0.63% is competitive and the fund holds a place on ii’s Super 60 list as an adventurous global equities option.

The latest factsheet can be viewed here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks