The future of AIM: how the small-cap market can survive

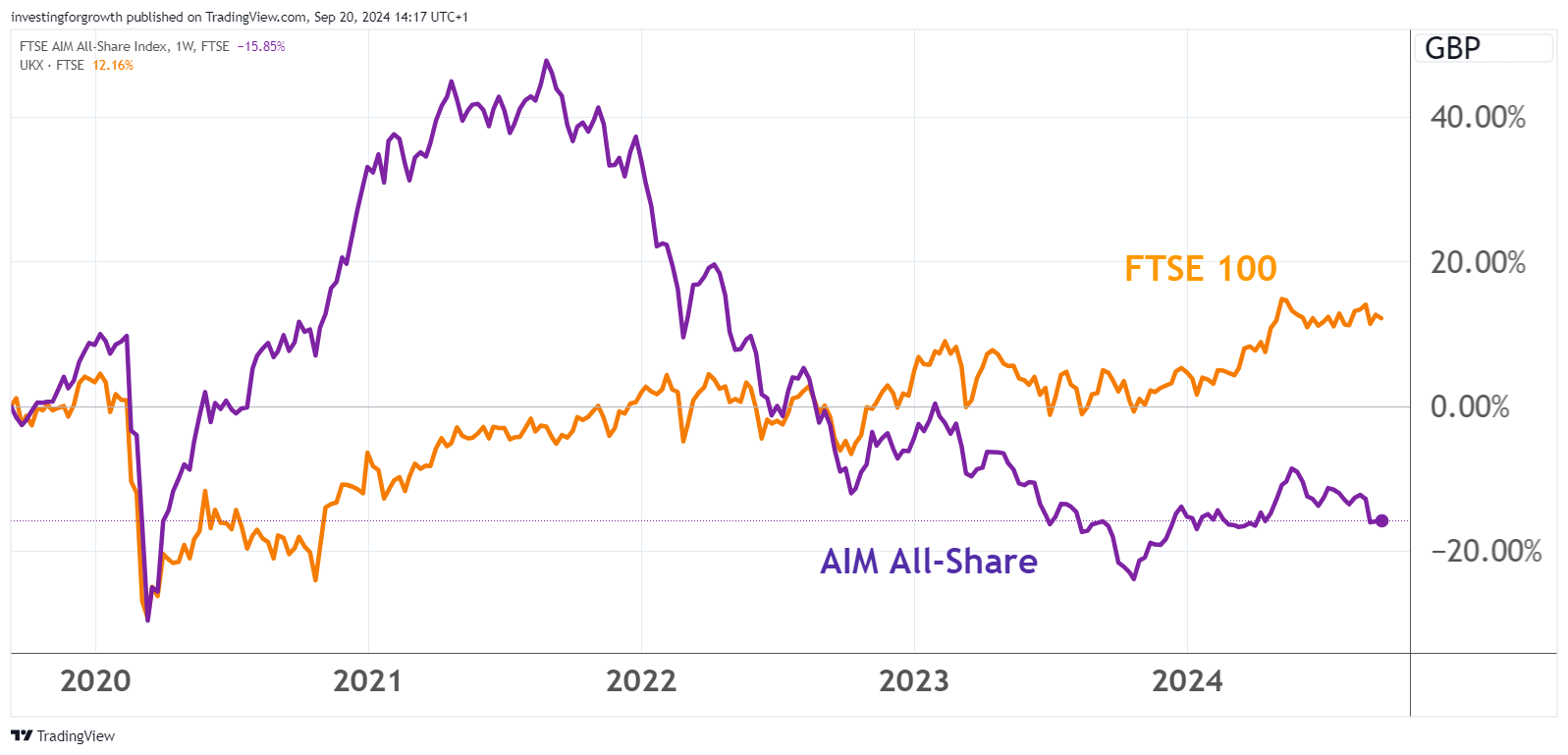

Smaller companies made a spectacular recovery from the pandemic but have moved in the opposite direction to FTSE 100 stocks since. Award-winning AIM writer Andrew Hore reports on some new ideas to revive AIM.

20th September 2024 15:27

It has been tough for small companies for decades, but in recent years it’s got even tougher. The proportion of institutional funds invested in UK smaller companies has dwindled over the years. Greater investor access to international investments and focus on tracker funds has not helped.

In the past two years there has been a £4 billion outflow of funds from UK smaller company funds. Mid-cap funds have also had substantial outflows.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

There is also greater difficulty for small investors to invest in what are perceived to be riskier companies due to international and Financial Conduct Authority (FCA) regulation. This is harming liquidity, although liquidity is still good in many AIM companies.

There is a lack of new admissions, and they are dwarfed by the number of AIM leavers. Low valuations are attracting bidders for the better companies, while other companies are choosing to ditch their stock market quotation.

Charles Hall, head of research at Peel Hunt, has published a note called ‘AIMing higher’. He believes AIM is important for funding business and job growth. He says the junior market has many challenges with the poor relative performance of the market and a mixed reputation.

He wants AIM to have a recharge so that it can get back to providing the finance British business requires. He argues that the new UK government is on a firm enough footing to spark changes that could improve market efficiency and provide those much-needed funds.

The recent UK regulatory activity has focused on making the Main Market more competitive with international rivals and helping it to attract new growth companies. AIM was broadly forgotten. This is despite the fact that AIM companies are substantial taxpayers. If they cannot raise funds to grow, then their tax payments will be lower than they might have been.

- AIM’s best companies of 2024: shortlist revealed

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

AIM is not immune to the general cycles of global stock markets, but it has been performing relatively poorly in recent years. It is continuing to lag the Main Market despite some recovery this year.

Source: TradingView. Past performance is not a guide to future performance.

One of the problems is that investors can be cautious early in a stock market recovery and then pile in when share prices are getting high. This is when there tends to be a flood of new admissions, just like in 2021, and the performance of these new companies has generally been poor.

This then puts off investors when there is much better value in AIM shares. They then languish on low ratings and get snapped up by bidders.

Charles Hall has a range of proposals to improve AIM and attract investment. They include the following areas.

Government-backed funding

He wants the government to use its £5 billion stake in NatWest Group (LSE:NWG) as seed money for a National Wealth Fund to invest in UK smaller companies. That would help to offset the outflow of funds in the past couple of years.

Other suggestions are broadening the focus of the British Business Bank to include investment in quoted shares, plus an increase in funding for the Business Growth Fund (BGF). These organisations could even be used to manage the new fund.

The BGF already has significant stakes in some AIM shares. It backed the recent acquisition by Facilities by ADF (LSE:ADF) of Autotrak Portable Roadways, which hires portable roadways to film and TV sets, as well as for events. It was already a shareholder, and the stake increased from 18.9% to 20.3%.

BGF tends to invest in technology, healthcare and marketing sectors, but it is interested in any potential UK growth business.

Pensions

There are already Mansion House Compact proposals that pension funds should have 5% exposure to private companies, which for these purposes includes AIM companies because it is not a listed market. There is no requirement for this investment to be in UK companies or have any exposure to AIM, though, so this would have to be specified.

Charles Hall’s suggestion that pension funds should have a specific percentage of assets in AIM shares could be problematic. Pension funds have different profiles when it comes to their pensioners, and it may not be appropriate for too high a proportion of funds to be invested in shares that may be difficult to sell.

- 11 ways SIPPs can help you achieve a dream retirement

- How to build a £1million pension and ISA portfolio

If higher pensions contributions are encouraged or mandated, then there would be more cash to invest and some of that could make its way to AIM.

There could also be incentives for SIPP holders to invest in UK assets, as well as the larger funds.

Tax incentives

One thing that AIM cannot complain about is the level of tax incentives, particularly since AIM shares were made eligible for Individual Savings Accounts (ISAs). However, the apparent dropping of plans to have a British ISA focusing on UK shares means that AIM could miss out on additional funding.

The shares are eligible for Venture Capital Trusts (VCTs) and Enterprise Investment Scheme (EIS) investment. There is also exemption from stamp duty, which is still levied on fully listed share transactions.

The ability of VCTs and EIS investors to put money into individual companies is capped at £15 million, a level set 12 years ago, and it would be sensible to increase that limit. Once the current limit is reached it is more difficult for AIM companies to fund the next step in their growth.

The major incentive that has helped AIM is inheritance tax (IHT) relief. Investments in AIM shares held for at least two years are exempt from IHT. There have been fears that this could be removed and that would hit the price of shares in many of the AIM companies that are favourites with IHT funds.

Some companies probably moved from the Main Market to AIM, such as James Halstead (LSE:JHD) and Nichols (LSE:NICL), to gain the benefit of IHT relief and many companies are on ratings that would not be achieved without the demand from IHT funds.

There are also companies that join AIM so there is a market for their founders to sell down their holdings as they reach retirement age. Grocery wholesaler Kitwave Group (LSE:KITW) is a recent example of this, but it has been an excellent share price performer despite a major share disposal by the founder.

Peel Hunt estimates that more than £6 billion is invested in IHT funds and there is more than £5 billion of investments by founders and individuals sorting out their own tax planning. Even a relatively small proportion of those shares coming on to the market would hit share prices.

The broker believes that uncertainty about the continuation of IHT relief has stemmed the flow of new cash into AIM. Things will be clearer after the Budget on 30 October, but the government will probably not end IHT relief. There could continue to be some uncertainty, though.

Charles Hall suggests that any changes to capital gains tax should take account of the benefits of growing companies and have a lower rate for AIM shares. There could also be a reduction in the rate for longer-term holders.

Encouraging IPOs

Peel Hunt is in favour of forming a cornerstone club that could help back new admissions. Another suggestion is making flotation costs tax deductible.

Having a lower corporation tax rate post-flotation does not appear likely to be attractive to the government, and the suggestion that the government should subsidise flotation costs is a long shot.

The current limitation on the amount that can be raised from small investors is likely to be removed by the FCA and that will encourage further investment.

Cost

AIM has always marketed itself as a more lightly regulated market that is not subject to the same level of regulation as the Main Market. Yet, regulation has increased over the past three decades and it is nowhere near as light touch as when it was launched in 1995.

Peel Hunt wants a review to assess regulatory creep and cut out what is not efficient for smaller companies. It wants the government to seek to reduce some of the audit requirements on smaller companies.

Peel Hunt would also like non-executive directors to take a proportion of their remuneration in shares. Futura Medical (LSE:FUM) non-execs take 25% of their fees in shares. This provides a connection to the success of the company.

These are some of the main suggestions in AIMing high. Even the most optimistic person would not expect all of them to become government policy, but if some are put in place then it could increase potential investment in AIM companies. That would provide more opportunities for retail investors as well.

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Please remember, investment value can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a stocks & shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.

Editor's Picks