How to become an ISA millionaire

As ISAs turn 25 years old, we crunch the numbers on how to become an ISA millionaire. Just how easy is it to scale those investing heights and reach a cool £1 million?

13th June 2024 13:10

This year marks the 25th anniversary of individual savings accounts (ISAs), which were introduced in April 1999, taking over from PEPs and Tessa’s.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

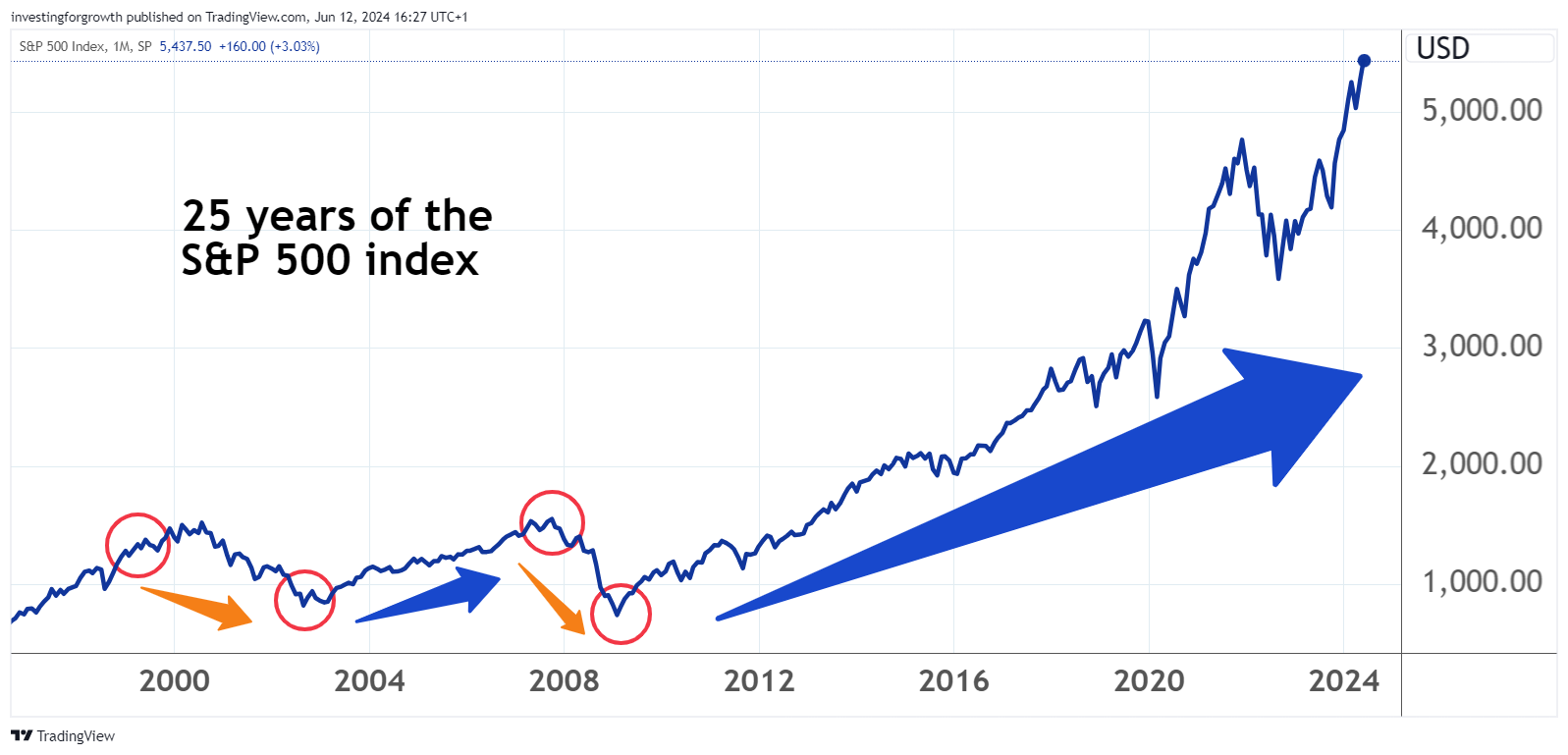

In the late 1990s, the stock market was gripped by a dotcom bubble that saw some early internet shares trade at vastly inflated prices, only to crash to earth through 2000-02. But better things were to come for investors over the next 25 years.

Who wants to be an ISA millionaire?

Here, we take a look at how someone who started investing in a Stocks and Shares ISA in April 1999 would have performed over the past 25 years.

We’ve crunched the numbers based on four investors, each maxing out their ISA allowance over 25 years, but with very different investing strategies (please note scenarios exclude investing fees):

1) Buying British – FTSE All Share

Isabella started investing in April 1999, putting the maximum in her ISA at the beginning of each tax year in the FTSE All-Share index. By April 2024, her investments were worth an amazing £618,000.

2) Cautious cash

Darren invested the same amounts but stuck with the safety of cash. By April 2024, his investments grew to just £365,000, stymied by long-term low interest rates.

3) Going global – MSCI World

Sanjay went global and invested his ISA allowances in the MSCI world index. By April 2024, he had amassed just shy of £1 million (£987,000). Close, but no cigar.

4) Back in the US – S&P 500

Lisa backed the US and invested in the S&P 500, Wall Street’s main index. By April 2024 she had hit the jackpot, with her final ISA portfolio worth a cool £1,364,197. Her investments enjoyed a strong finish, growing an amazing 28% in the last year.

5) The rise and rise of the US

With the benefit of hindsight, it’s no surprise that Lisa, the investor in American stocks, wins the prize with her £306,560 of regular investments swelling to more than £1.3 million over 25 years!

But in 1999, the dominance of the US was less certain. In fact, as late as April 2012 the UK investor was actually outperforming the US, as UK shares took less of a hit during the dotcom crash and financial crisis.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- ISA insights: guides, investment ideas and tax tips

In April 1999, the S&P 500 was trading around 1,340, peaking less than a year later during the internet boom at 1,552. But in the third quarter of 2002 it had halved to 768. Five years later it had more than doubled to 1,576 before hitting a low of 666 in 2009 before a recovery following the financial crash. The rest is history.

The last 10 years have seen the rise and rise of US shares, both in value and as a proportion of the total global stock market, leaving US investors quids in. The rise of Big Tech has left other markets lagging by comparison.

Source: TradingView. Past performance is not a guide to future performance.

Of course, a repeat performance over the next 25 years is far from guaranteed, so arguably diversifying your portfolio with a global fund is a safer long-term option.

And the popularity of UK shares in recent months shows that there are still many who believe the UK is due a turnaround. The FTSE 100 is currently riding high, finally rewarding the patience of long-term investors.

Bumpy investment growth

It’s a common investing myth that returns are spread evenly over time, but it couldn’t be further from the truth. In fact, investing growth was extremely bumpy across the 25 years, with most growth coming in the last 14 years during an era of record low interest rates, with some long periods of negative growth. If investors had given up and bailed out after the dotcom bubble burst or the financial crash, they would have fallen far short of their £1 million prize.

- Lump sum vs regular investing: which is best for my ISA?

- How to build a £1 million pension and ISA portfolio

- My first five years as an ISA investor

Frustratingly, positive returns were a long time coming. Someone investing £1,000 in April 1999 in the S&P 500, would have taken 11 years to see positive returns, their investment shrinking to just £721 by April 2003, rising and then falling again to £820 in April 2009, due to the financial crisis.

It was after April 2010, particularly in the US, that returns really began to take off, rewarding the patience of long-term investors. The investor above would have seen their £820 swell to an amazing £7,975 by April 2024, with annual returns in the S&P 500 averaging a stonking 16% from 2010 to 2024.

It just goes to prove that patience really is a virtue when it comes to investing!

No crystal ball needed

But what about the next 25 years? The good news is that you don’t need a degree in investing to grow your wealth, and there are many simple strategies to beat both cash and inflation in the long run.

Our research shows that two extremely simple strategies would have both reached £1 million over 25 years. The power of regular investing and sticking with your long-term investing goals are key lessons here.

For investors, the last 25 years have seen many twists and turns, but despite short-term setbacks, regular investors saw fantastic long-term gains.

Not many of us can afford to invest the whole ISA allowance every year, but picking a simple tracker fund and getting started with regular investing remains one of the best ways to build long-term wealth.

So, who wants to be an ISA millionaire? As for me, I wouldn’t say no! Here’s wishing you successful investing for the next 25 years!

Please remember, investment value can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a stocks & shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks