How to value Tesla, with Elon Musk behind the wheel

The EV innovator has seen its shares driven off a cliff this year. And that could make it a prime opportunity – or a risk. So Russell Burns' spent some time kicking the tires.

25th April 2025 09:44

Russell Burns from Finimize

It’s impossible to talk about Tesla Inc (NASDAQ:TSLA) without talking about Elon Musk. This company’s not just an EV maker – it’s one of those rare firms whose very image is tightly enmeshed with its CEO. For years, that connection was a huge asset. Musk’s mission to revolutionize transportation and reduce fossil fuel dependence made Tesla a symbol of innovation and progress. Consumers weren’t just buying a car (and a fairly luxurious one, at that) – they were buying into a vision of the future.

But the brand’s image has recently become… more complicated. And its shares have suffered a major slump. But those two facts are not the whole story.

Let’s be honest: there’s a lot to unpack here. Far more than we can get into in a few screens and charts. So, I’m going to set aside much of the social, political, and personality issues at play here and just take a look at the stock.

Overview: let’s get up to speed

Tesla’s stock went on a massive rally late last year, more than doubling in just two months, fueled with excitement over what a Trump presidency might mean for the company. The boost didn’t last. The EV maker’s stock has fallen almost 50% from its December highs and now trades lower than it did on election day. Musk’s high-profile position as White House senior advisor and head of the unofficial Department of Government Efficiency, and his vocal support for far-right parties in Europe have sparked an intense consumer backlash against the brand – one that’s already left significant scars.

Tesla’s share price, from 2020 to 2025. Source: Koyfin.

It’s fair to say that Musk’s high-profile foray into White House politics – from his outspoken commentary on his social media platform, to his $288 million contribution to Donald Trump’s reelection campaign and his moves to downsize the federal government with sweeping layoffs and cost cuts – have not been good for Tesla’s stock. Quite the opposite: it’s alienated a big segment of consumers and investors.

In the past few months, there have been peaceful protests and organized boycotts, but also outright vandalism to the company’s dealerships and charging stations, and privately owned Tesla cars in the US and across Europe.

Meanwhile, some shareholders have voiced concerns about Musk’s role in politics and have complained that the CEO is spread too thin, with the White House, Tesla, SpaceX, social media platform X, and his other ventures all competing for attention. Some analysts have asked whether Musk has become too great a distraction to lead the EV maker. Another, from JPMorgan, noting how fast the brand has lost value, said there’s simply no comparison in the entire history of the auto industry.

Last month, Musk hosted a rare and unscheduled all-hands meeting at Tesla’s Texas Gigafactory, where he laid out an optimistic vision for the EV maker and urged employees not to sell their stocks. Shares bounced a little after the pep talk, with some investors feeling reassured that Musk might provide new leadership and focus on the company.

It’s in his best interest, after all: the sharp plunge that Tesla’s shares have taken could cause a potential headache for Musk. The CEO used Tesla stock as collateral to fund other investments – and a much further decline in the share price could risk a so-called margin call – which could force him to stump up billions of dollars more to the banks that have loaned him the money.

The thing is: it’s tough for investors to get a feel for where Tesla’s stock should trade. Wall Street analysts can’t agree: their target prices range from $120 to $515 – a span that’s much wider than normal for almost any company, let alone one with a market capitalization of around $800 billion. As a result, the share price tends to move on market narrative, rather than near-term fundamentals.

The revenue engine: here’s what keeps Tesla running

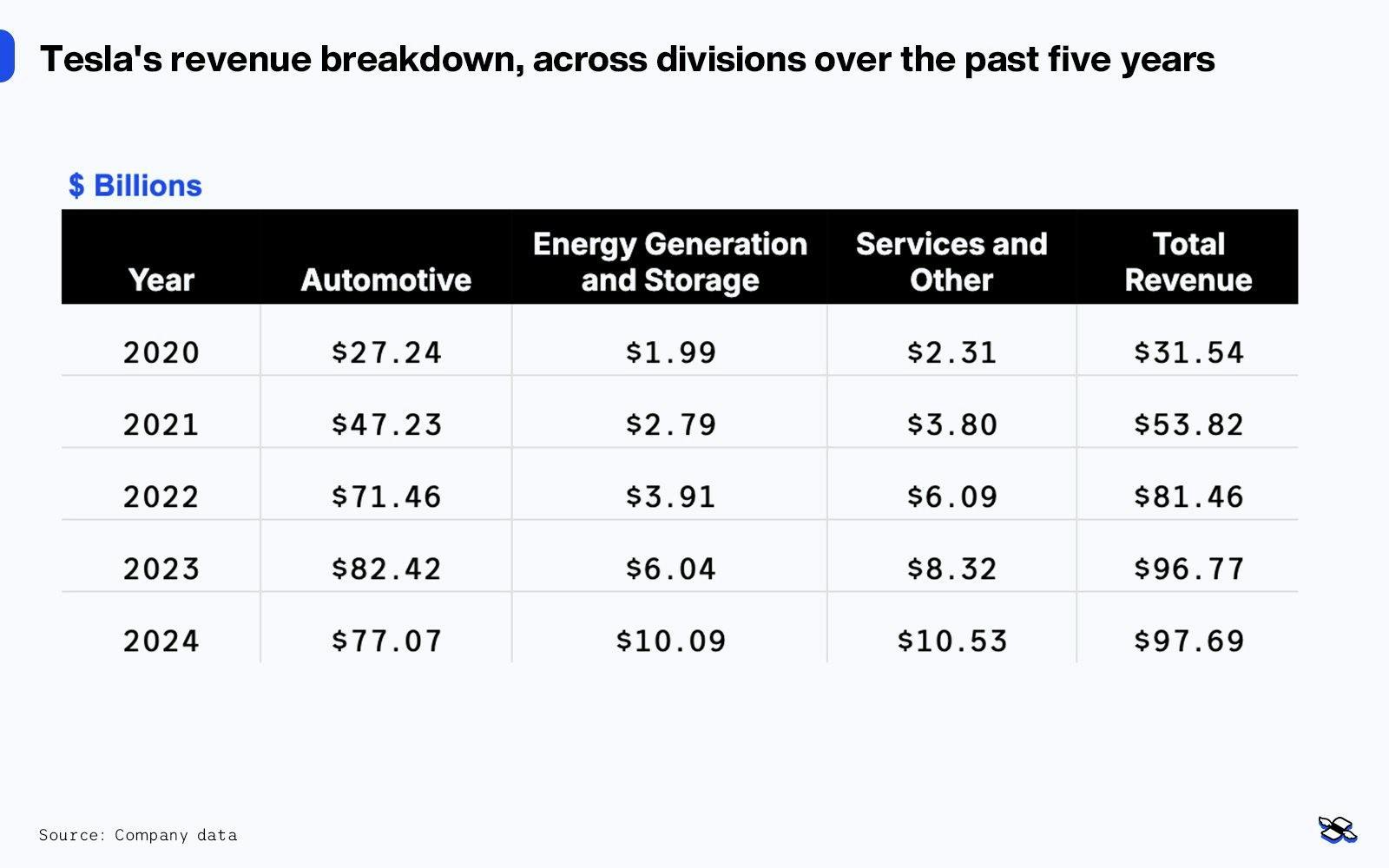

The biggest driver for the company – not surprisingly – is its cars. The EV maker shipped around 1.79 million vehicles in 2024, slightly less than the 1.81 million in 2023, ending an ever-upward trend that began back in 2011. Together, those deliveries produced revenues of $77 billion in 2024. The company’s much smaller energy generation and storage division and its services division, meanwhile, both posted gains for the year.

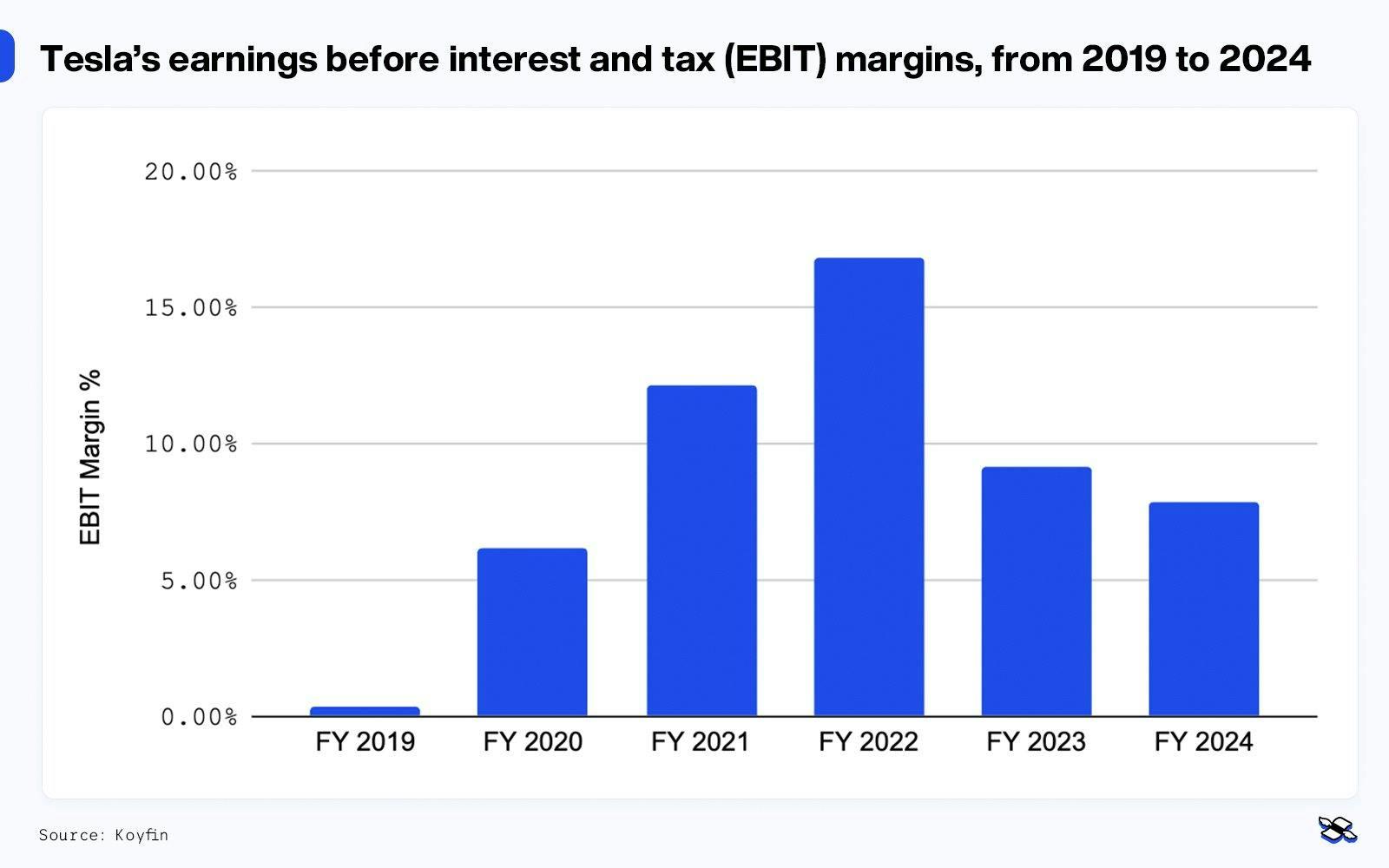

Overall, Tesla sales and profits saw huge growth from 2020 to 2022, slower growth in 2023, and then actually dipped in 2024. Operating margins also fell last year, as Tesla cut prices on its Model 3 and Model Y cars to try to stimulate sales.

Tesla's revenue breakdown, across divisions over the past five years (in billions of dollars). Source: Company data.

So, with flat revenues, lower pricing, and inflation-increasing input costs, Tesla’s margins have come under pressure. After hitting a peak of 16.7% in 2022, operating margins fell to just 6.9% in 2024.

Tesla’s earnings before interest and tax (EBIT) margins, from 2019 to 2024. Source: Koyfin.

To Tesla’s credit, it has built a “vertically integrated” business – which basically means it controls key parts of its supply chain. It designs and makes its own batteries, electric motors, and charging infrastructure, and it sells vehicles directly to customers, rather than forging traditional dealership ties. This strategy has historically enabled Tesla to operate with higher margins than your typical automaker.

But let’s not forget, not every Tesla product has four wheels – the company also makes money across its tech services and energy divisions.

Tesla is as much a technology company as an automaker (more, even). And its network services division handles software maintenance, upgrades, and other things. The unit has been growing steadily, bringing in $10 billion in revenues in 2024. That’s thanks to monthly packages for car owners – like Premium Connectivity at $9.99 a month and Full Self-Driving (FSD) capability at $99 a month. And the broader the number of users for those services, the higher the recurring revenues and the higher the profit margins – just like with the big software companies. In fact, these recurring revenues have led some investors to value Tesla like a tech or software company – which allows it a far higher valuation than what’s typically afforded to a plain-old automaker.

Tesla’s big in clean energy – and not just on the road. Its energy division develops and sells battery-based energy storage solutions, including the Powerwall for homes, bigger-scale products for commercial use, and utility-scale applications that can help stabilize the grid. The division has been growing at a rapid pace and – like the network division – it also generated $10 billion in revenues in 2024. Plus, Tesla has recently begun opening its Supercharger network to other brands (under a government-funded program), and that could create a new revenue line.

Around the track: the competition

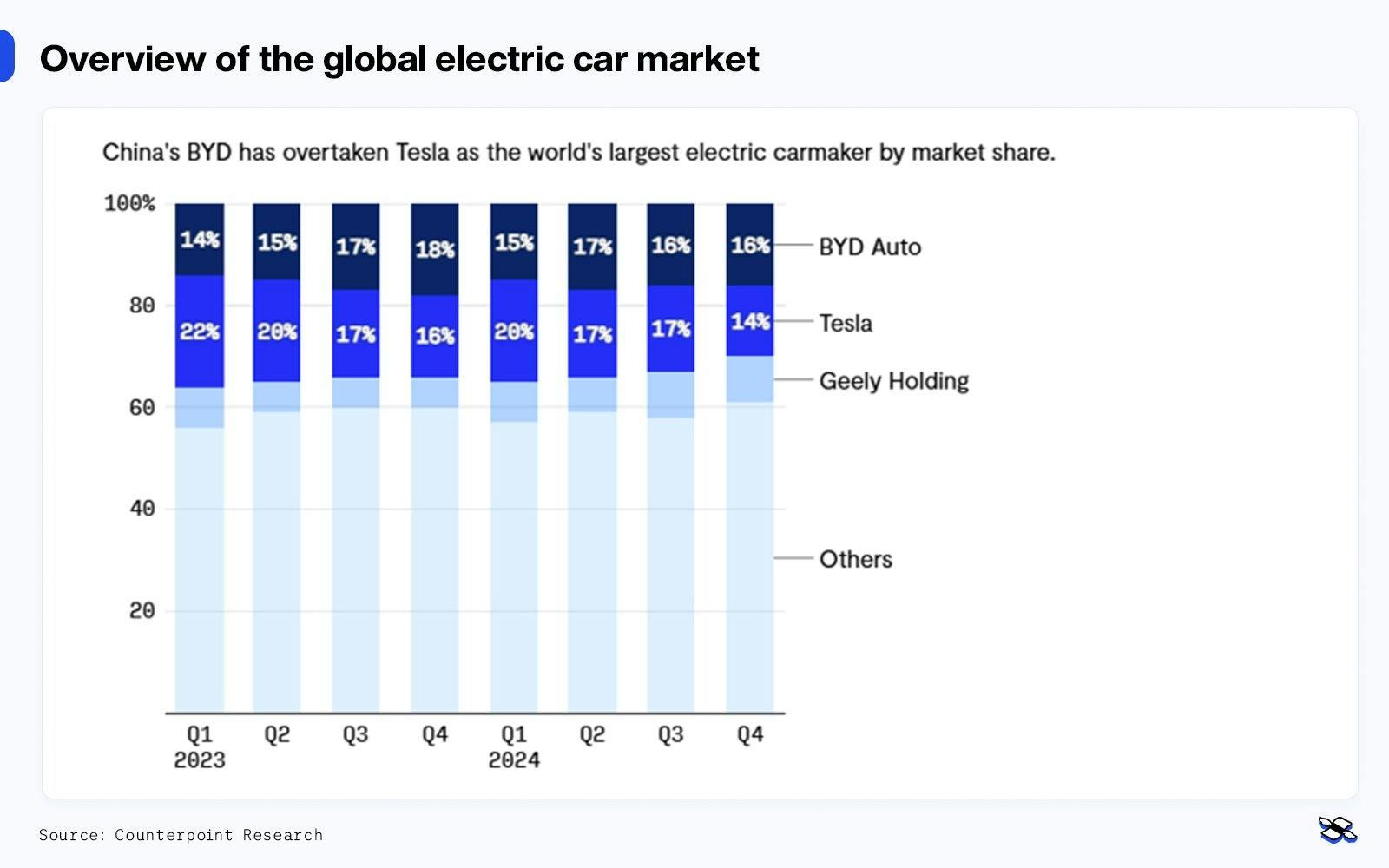

Tesla competes against all the major auto brands, but its most formidable global competitor is BYD Co Ltd Class H (SEHK:1211), the Chinese carmaker that has rapidly become the world’s biggest seller of EVs. BYD delivered 4.2 million vehicles in 2024 (including plug-in hybrids), more than double Tesla’s numbers. And it did so while being effectively locked out of the US market – by some super-high tariffs imposed during the last administration.

BYDs look sleek and they’re hugely popular among Chinese consumers, who collectively buy more EVs than any other market. The company offers a wide range of models – from budget compacts to luxury vehicles – and has built a strong domestic supply chain, which includes the production of its own batteries (the BYD Blade Battery). What’s more, BYD’s sticker prices start below $10,000 in China – that’s something Tesla hasn’t matched, and maybe never will.

As BYD and other Chinese EV makers (like NIO Inc ADR (NYSE:NIO), XPeng Inc ADR (NYSE:XPEV), and Geely Automobile Holdings Ltd (SEHK:175)) have expanded, the global competition has heated up, threatening to melt away Tesla’s first-mover advantage. BYD became the world’s biggest electric carmaker in 2024, grabbing the wheel form Tesla.

Overview of the global electric car market. Source: Counterpoint Research.

It’s not just those Chinese rivals that are appearing closer in Tesla’s rear-view mirror: Europe’s automakers (Volkswagen AG (XETRA:VOW), Stellantis NV (NYSE:STLA), Mercedes-Benz Group AG (XETRA:MBG), etc.) have been rolling out dozens of new EV models and setting aggressive sales targets, aiming to leverage their home turf advantage.

In the US, meanwhile, Ford Motor Co (NYSE:F) and General Motors Co (NYSE:GM) are juggling the transition from gasoline engines to hybrid and all-electric – which has proved to be a complex, costly endeavor. Detroit’s automakers carry legacy baggage: a big product lineup, a sprawling factory network, and a unionized workforce with contractual agreements that can slow the pace of an overhaul. So, as they pivot to EVs, these brands are looking first to popular models: for example, Ford with its F-150 Lightning electric pickup, and GM with its Chevy Silverado. And if that’s step one, then step two is challenging Tesla’s models on performance and price – as GM hopes to do with its Cadillac Lyriq.

Not to be forgotten: American EV startups like Rivian Automotive Inc Class A (NASDAQ:RIVN) and Lucid Group Inc Shs (NASDAQ:LCID) are scrapping for market attention too, and they’re doing cool stuff in their niches – Rivian in electric adventure trucks and Lucid in luxury sedans. They’re much smaller players, though, and still unprofitable.

That said, Tesla’s lineup is still just a handful of models (the S, 3, X, Y, and the Cybertruck, and maybe someday, the Roadster). There’s no mass-market hatchback for those who navigate small European streets and no minivan for the groceries-dogs-and-kids chauffeur. And let’s face it, that aging, stagnant product portfolio has left openings for the company's rivals while also weighing on sales. Sure, the upgraded Y model is being launched globally this year, but so far, only in China and Norway.

Key figures: Tesla sales this year

If investors have lost confidence in Tesla, it’s not for nothing. The company’s sales have dropped in all the major markets this year. Now, the firm itself doesn’t break out sales by region, but trade groups and governments do. And it’s worth tracking those numbers, alongside Tesla’s own figures.

According to Tesla’s most recent filing, it delivered 336,681 vehicles in the first three months of the year worldwide – down 13% from the same period last year, for its worst showing since the second quarter of 2022. The EV maker is blaming some of that weakness on the fact that it had to upgrade factory lines across all four of its global factories to prepare for the rollout of the new Model Y, which cost it several weeks of production. But that, by no means, accounts for all of the drop.

According to the European Automobile Manufacturers’ Association, Tesla’s sales across the EU, UK, Iceland, Liechtenstein, Norway, and Switzerland fell over 40% in February compared to the year before – despite a 28.4% rise in EV sales over the same period. What’s more, Tesla’s share of the European market slipped to 1.8% from 2.8%. And those drops coincided with protests over Musk’s political stances.

In China, sales were weak in January and February, but picked up in March with the launch of the revamped Model Y. Tesla sold 78,828 EVs in China in March, up 157% from the month before, but down 11% compared to March of 2024.

In the US, Tesla sales declined by more than 13% in January, compared to the same month last year, according to data from auto industry analysis firm Wards Intelligence. And in February, motorists traded in a record number of Teslas. And that may have just been the start: in March, trading in your Tesla in protest of Musk became a TikTok trend.

Agree or disagree with these consumers’ decisions, they’re having an impact. Those lower vehicle sales have cut to the core of the company’s central revenue source. And they’ve hit the rest too: fewer sales mean fewer folks buying those monthly software packages. So it’s no wonder analysts have started to pencil in lower forecasts.

Now, Tesla fans might argue that all the bad news has been factored in already – and to them, it makes sense to buy the dip. The pick-up in Model Y sales in China, they may say, just shows that the EV maker is still competitive – regardless of what anyone feels about Musk.

They might have a point, but Chinese competition is both a short-term and a long-term threat for this EV maker. And no amount of US tariffs can stave off a loss of market share in the rest of the world.

The road ahead: Tesla’s growth drivers

Tesla’s big bet on autonomous driving is shaping up to be a major piece of its future profit puzzle. With billions of real-world miles driven, the company’s got a huge data lead that will be tough for startups to match. Unlike the other lidar or radar models out there, Tesla’s approach is vision-only – meaning it relies on cameras and neural networks to operate. Its goal is to achieve truly autonomous driving, without pre-mapped environments.

Let’s be clear, though: Tesla’s Full Self-Driving (FSD) system isn’t fully there yet. It’s a Level 2 system, so motorists have to remain alert and in the driver’s seat. Nonetheless, on Tesla’s most recent earnings call, Musk predicted that by midyear, Tesla will roll out an “autonomous ride-hailing” service in at least one city (Austin) and will expand its driverless offerings by the end of the year. If Tesla pulls that off – whether with robotaxis or a fully driverless FSD update – that could be a game-changer, unlocking a high-margin driverless ride-hailing business and cementing Tesla’s valuation as a high-flying tech stock.

Of course, that’s only if that actually happens. Musk has made big promises about driverless tech before and not delivered. So you can understand why investors might not be falling over themselves in autonomous excitement. Besides, Tesla’s not likely to have the space all to itself. Alphabet Inc Class A (NASDAQ:GOOGL)’s Waymo self-driving unit has been developing Level 4 autonomy, using lidar, radar, cameras, and detailed mapping. And that means its vehicles can operate without human intervention in designated areas. It has already launched in San Francisco, Phoenix, Los Angeles, and Austin, and plans to launch in Washington, DC, in 2026.

Exciting as all this driverless business is, there’s another futuristic bet that Tesla’s making that could be even cooler: humanoid robots. AI-powered, person-shaped robots like the “Optimus” Tesla bot that’s currently in development could be the next big thing, opening up a whole new industry, and untold revenue streams.

So investors will be looking for hints about all that when the company announces first-quarter results on April 22nd, along with any signals from Musk about potential plans to quit his senior White House gig.

Potential detours: the tariff impact

Major global automakers will likely have to raise US vehicle prices to reflect higher import taxes – and most will be more seriously impacted than Tesla, whose supply chain is predominantly domestic. But that’s not to say Tesla’s in for an easy ride: tariffs are expected to squeeze margins across both its auto and energy segments. An estimated 40% of the materials used in the company’s electric batteries come from China, whose goods have been saddled with steep import taxes.

It’s tricky to pin down just how tough things could get for Tesla – the tariff situation has been a moving target and no one knows exactly how things will shake out. But here’s what we do know: the US-China trade war could throw a wrench in the works for Tesla – especially when it comes to getting approval for its self-driving vehicles. Plus, the automaker’s ties to the current tariff-wielding president might not do the brand many favors among Chinese consumers.

Tesla has already stopped taking orders in China for its Model S sedans and Model X sport utility vehicles, thanks to the 125% tariffs between the US and China. Makes sense: those models are imported from the US, while the Model 3 and Model Y cars are built in the company’s Shanghai factory. The impact could be small: the imported Model S and Model X represent just a fraction of Tesla’s sales in China, at just under 2,000 vehicles last year, compared to more than 600,000 cars sold.

It’s not nothing though: even Musk has said the tariffs are a big deal. And some analysts say the hit to Tesla’s earnings could reach $3 billion, according to Barron’s. With earnings before interest and tax (EBIT) expected to be around $9 billion in 2025, a $3 billion dent seems severe, but you get the idea: it’s going to be a real drag on profits.

But don’t forget the bigger picture: tariffs like these usually slow global economic growth and consumer spending, so car sales by volume will likely slide below previously expected levels.

The sticker price: Tesla’s stock valuation

When it comes to investing, looking ahead is everything – and with Tesla, you need a really long time horizon to justify how the stock is valued right now. So much of the company’s value is tied up in future sales and the belief that Musk will actually deliver on his futuristic promises. And if those things don’t pan out, this stock’s got a long way to fall. On the other hand, if Musk and Tesla deliver on those promises, the gains could be huge.

Tesla’s an automaker, sure, but it’s really a tech company. Now, traditional automakers (your Ford, Volkswagen, Toyota Motor Corp ADR (NYSE:TM), Honda Motor Co Ltd ADR (NYSE:HMC), Bayerische Motoren Werke AG (XETRA:BMW) types) typically trade at a price-to-earnings (P/E) ratio somewhere around, say, 6x or 12x based on forward estimates. An exotic luxury machine like Ferrari NV (MTA:RACE), on the other hand, justifies an exhilarating 46x based on 2025 forward estimates. Then there’s Tesla: it trades at a stratospheric 108x. And that’s essentially because investors and analysts have been all-in on Musk’s vision – a growth picture that’s driven (almost sequentially) by EVs, self-driving vehicles, robotaxis, and Optimus humanoid robots.

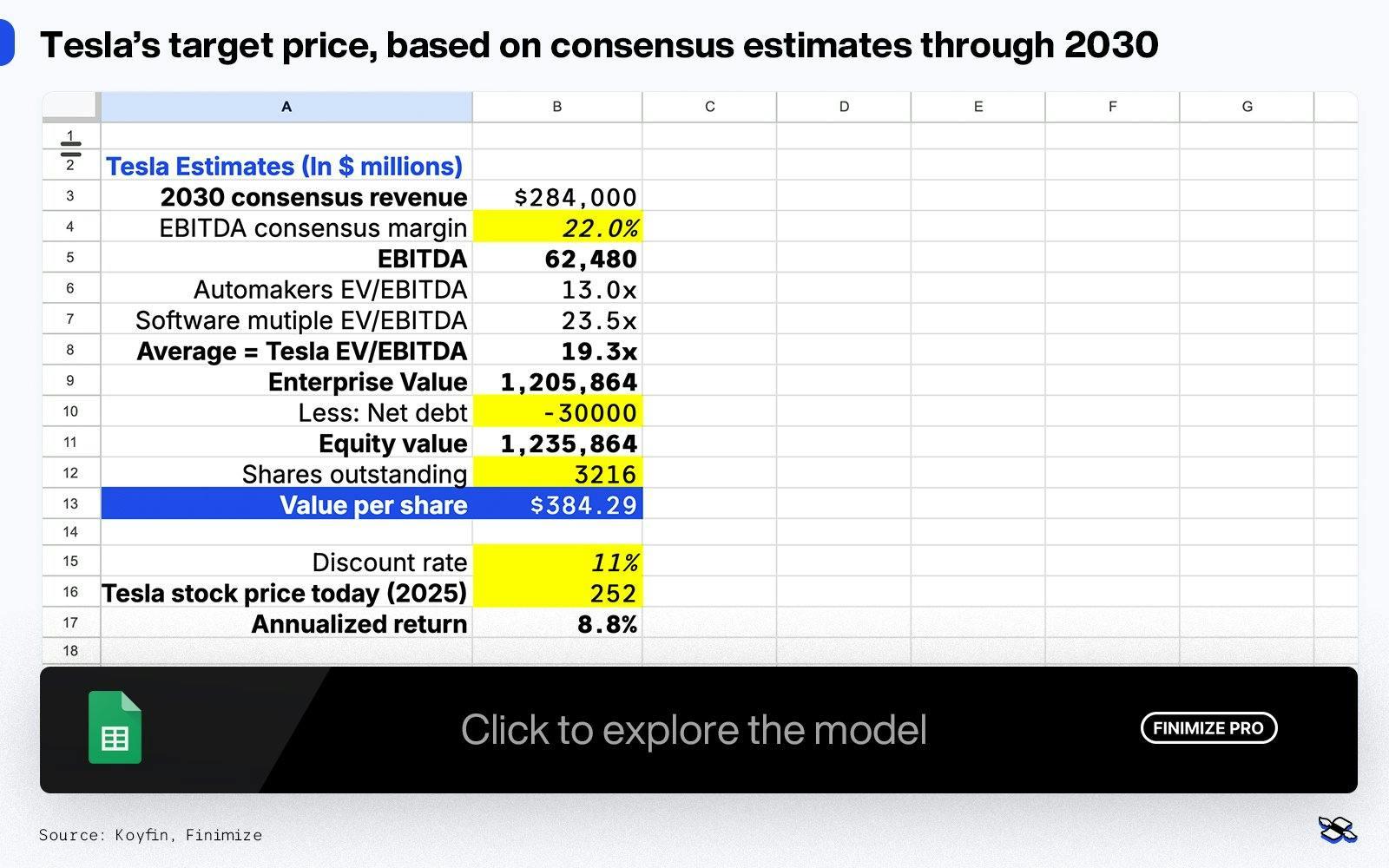

And Wall Street is still betting big on Tesla’s future, despite what that recent 50% drop implies. Analysts expect revenues to soar to around $284 billion by 2030, a roughly 200% increase over last year’s $97 billion. They’re also predicting that the company’s earnings before interest, tax, depreciation, and amortization (EBITDA) margin will jump back to 22%, from 2024’s 13.3%, with an EBITDA of about $62 billion. And look, those are pretty punchy sales and margin estimates, especially when you consider the current state of the economy and the recent loss of brand value. Typically, you don’t see such a high stock valuation based on goals that are still five years off – but that’s the Elon Musk effect for you. This stock is tightly enmeshed with the man, remember, and his vision (and the continued hype that surrounds it) tends to push expectations through the roof.

As for the numbers themselves: if you assume a 13x enterprise-value-to-EBITDA multiple for the auto-related business (that’s the high end for car companies) and a 23x multiple for the tech business (that’s a reasonable multiple for a software-as-a-service stock), with a 60% weighting toward tech as the business unit’s earnings will become more dominant in the future if Tesla fulfills on its ambitions, you get an average multiple of 19.3x EBITBA.

Factor in Tesla’s net cash position of around $30 billion, and you get a fair value of $384 per share – a chunky leap higher from today’s price of $252. That works out to just under a 9% compounded annual return, based on an 11% discount rate. That’s pretty good – but it doesn’t leave much wiggle room if things don’t go precisely to plan. The average 12-month target price is around $312.

Tesla’s target share price, based on consensus estimates through 2030. Sources: Koyfin, Finimize.

Of course, there’s nothing to say that the consensus of voices from Wall Street is correct. And, hey, you may have your own notions about what’s next for Tesla, or what valuation multiples to use for the different businesses. So here’s a model you can use to game out what the stock will do if you’re right. (Just make a copy of the template first, so you can actually adjust what’s in the cells to match your view.)

The big risks for Tesla are pretty obvious. If it fails to crack the autonomous driving puzzle and continues losing EV market share, that $384 target starts to look like an absolute pipe dream. But if the firm delivers, and Optimus humanoid robots start rolling off the assembly line, the company could see its share price perk right up. And that’s the thing with this stock: it’s all about the future – which makes story and sentiment almost as important as the stock’s numbers (at least in the short term).

Russell Burns is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks