ii Community: members vote on cutting cash ISA limit

A new poll on the ii Community app shows a significant minority backing the chancellor ahead of next week’s Mansion House speech, voting in favour of cutting the cash ISA allowance.

9th July 2025 12:15

With the cash ISA’s future reportedly hanging in the balance, a snap poll by interactive investor on the ii Community app, reveals two-thirds of investors believe the annual limit should remain untouched at £20,000.

Individual savings accounts, ISAs for short, are one of the UK’s most-loved tax wrappers, attracting billions of pounds of new money every year. But the amount you can save into the cash version looks in jeopardy, with Rachel Reeves expected to unveil plans to cut the allowance at her Mansion House speech on 15 July.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The chancellor is yet to confirm the rumours but has previously said that although the £20,000 overall ISA allowance will remain, encouraging more people to invest is firmly on the government’s radar. The thinking is if there’s less scope to save into cash ISAs every year, more money will flow into the stocks and shares version, improving consumer outcomes and boosting the UK stock market.

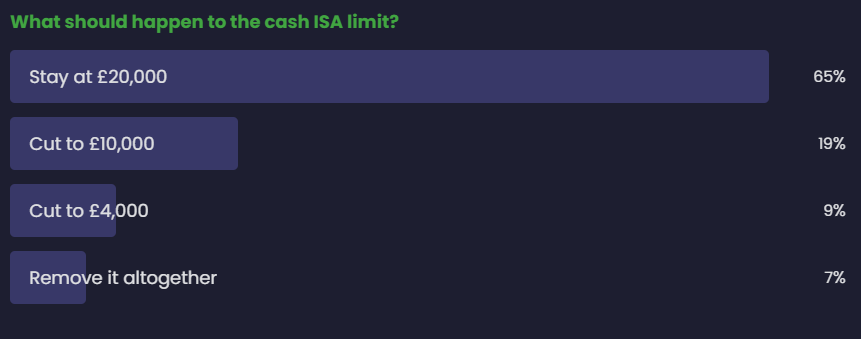

Given how divisive this matter has proved, interactive investor asked members on its ii Community app: “What should happen to the cash ISA limit?” The poll ran for 24 hours, gathering a healthy 617 votes. So far, the conversation thread includes more than 170 comments.

Source: interactive investor

The results showed that almost two-thirds (65%) of investors felt the current £20,000 cash ISA limit should remain, urging the government to explore alternative ways to plug the investing gap.

- Labour set to slash cash ISA limit. Is it the right approach?

- Should you ditch your cash ISA for a stocks and shares ISA?

- Why investing trumps cash over the long term

However, a third of investors believed Reeves should wield the axe in one way or another. Around one in five (19%) thought the cash ISA allowance should be halved to £10,000, 9% voted to cut it to £4,000, while 7% went for the nuclear option, believing cash ISAs should be scrapped altogether.

Here’s a selection of verbatim comments from those who voted to keep the £20K cash limit:

“Many do not have the inclination or want to take the risk of investing in the stock market. The real reason for reducing the maximum for a cash ISA is to collect more tax.”

“I voted 20k, while people should generally invest in the stock market for better returns, there are good reasons for not doing so when looking at shorter-term holdings. This screams nanny state, and those that aren't investing are unlikely to be swayed by this. Better financial education is the long-term answer, not pandering to the investment companies.”

“Cash ISAs in my view are personally a waste of time. Is it still the habit of providers to offer lower interest rates on cash ISAs and pocket savers’ tax breaks? However, I think with the UK poor pension system, anything that encourages saving is good. And there's always the chance a cash ISA investor will at some time go into stocks. The stocks and shares limit should be raised and inflation linked.”

Investors in favour of a cut explain reasons why:

“I voted £4k. I think anyone with more than that per year should consider the investment ISA. Obviously I think that should stay at £20k or increase.”

“Cut to 10k just to stimulate the discussion and increase education in investing. Many people are investing in ex-UK [exchange-traded funds] though, so need to do something to ensure at least some of the money is invested in the UK stock market.”

“If people are sensible, it will make no difference to the cash ISA being reduced - just take out a stocks and shares ISA and put it in a money market fund with actually more interest.”

“I voted to remove cash ISA altogether. I fail to see why I can put £20,000 into a savings account at my bank and be taxed on the interest earned but can put the same amount into an ISA and not be taxed on the interest earned. Both should be treated in the same way.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: The content posted by members within ii Community does not reflect the views of interactive investor and does not constitute professional financial advice. When you invest, your capital is at risk. See the ii Community terms for more information.

Please remember, investment value can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a stocks & shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Editor's Picks