The logic of early bird ISA investing amid Trump tariff volatility

Being an ISA early bird could help your journey to becoming an ISA millionaire – despite current market volatility as Trump’s tariffs take effect, writes Myron Jobson.

9th April 2025 12:17

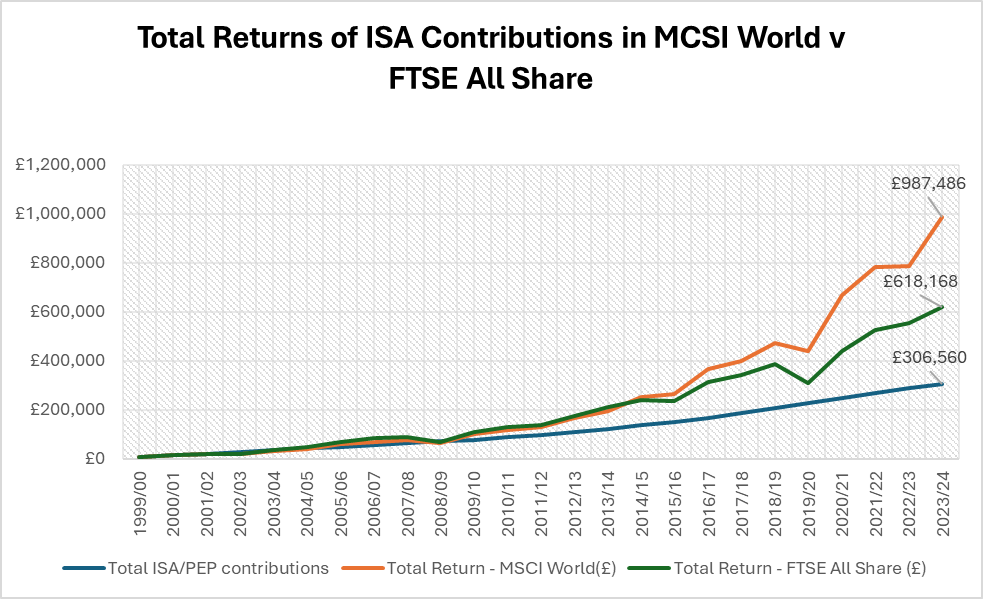

- Someone who invested the full ISA allowance on 6 April every year since 1999 in the MSCI World Index (£326,560 invested) would have a portfolio worth £973,724 over the 26 years of ISAs

- This means that those who invested the full ISA allowance into the FTSE All-Share Index would have a portfolio worth £665,696 over the 26-year period*

- Early bird investing through market volatility: tariffs test investor nerves but not the fundamentals

- interactive investor’s fund expert shares the top value opportunities for the new tax year.

Since the creation of ISAs (26 years ago), investing early birds who use their full ISA allowance every year on 6 April could now have a portfolio worth almost £1 million, finds new calculations from interactive investor – the number one home for ISA millionaires.**

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

This is true even in periods of market volatility, where early bird investors are able to secure the current top value opportunities, and have the benefit of time to reap the rewards of compounding returns.

The data revealed that someone who invested the full ISA allowance (£326,560 invested in total) into the MSCI World Index on 6 April each tax year since 1999 would now have a portfolio worth £973,724 (to 5 April 2025).

The same contributions to the FTSE All-Share Index over the same period would have resulted in a slightly smaller portfolio value of £665,696.

Habits of ISA millionaires: being an early bird and allowing time to do the work

Overall, this mirrors that actions of interactive investor’s ISA millionaires, where recent data showed that almost one-third (32%) of their contributions last year were made between 6 and 30 April 2024 – just after the new tax year began.

The average ISA millionaire at interactive investor also had an average age of 73 – investing their money over the long term, giving their money ample time in the market and getting the benefit of compounding returns.

Early bird investing as Trump’s tariffs take effect

Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “The recent market volatility sparked by President Donald Trump’s tariff wars give even the most seasoned investors pause.

“But for early bird investors, time is a powerful ally. The earlier you start investing, the more time your money has to benefit from compounding – where gains build on previous gains. This long-term growth potential can far outweigh the short-term noise caused by geopolitical uncertainty or economic jitters.”

The power of drip feeding amid heightened market volatility

Jobson adds: “A phased approach, like drip-feeding into investments every month, can help mitigate risk while still getting a foot in the door amid heightened market volatility. This strategy involves investing a fixed amount at regular intervals, regardless of market conditions. When prices are low, your money buys more units; when prices are high, it buys fewer. Over time, this helps to smooth out the highs and lows of the market, lowering the average cost per unit and reducing the risk of entering the market at an unfavourable moment.

“Known as pound cost averaging, this strategy also encourages discipline. Rather than trying to second-guess the market it allows you to invest steadily and calmly, taking emotion out of the equation. This approach can be particularly valuable during times of heightened uncertainty, when markets are more susceptible to knee-jerk reactions.”

Total returns achieved by investing full ISA allowance in MSCI World/FTSE All Share from 6 April 1999 to 5 April 2025

*Source: interactive investor/Morningstar. Past performance is not a guide to future performance.

ii’s expert outline some value opportunities at the start of a new tax year

Giving an overview of opportunities, Tom Bigley, fund analyst at interactive investor, explains: “Investors seeking value opportunities will often compare the price to earnings (P/E) ratios of different markets to determine which areas appear attractively valued. From a developed markets perspective, European and UK markets which have long been out of favour with investors have outperformed the US market on a relative basis this year and remain attractively valued, trading on P/E ratios of 14.7 and 12.4 respectively.

“In recent years, UK equities have been subject to persistent outflows and slow economic growth, but relative political stability and being a lesser target from US tariffs could stand to benefit the UK going forward. In Europe, valuations have increased recently, particularly in some areas including defence. However, it still represents relative value compared to the US market which is trading on a P/E of 20.9 at the time of writing.

“Those familiar with investing in emerging markets will be aware of the valuation gap between India and China, the two largest weightings of the EM Index. In recent years Indian equities have been one of the strongest performing markets globally and trade on a premium of 19.2. In contrast, Chinese equities are trading on a P/E of 12.5. Disruption to the property sector, poor consumer sentiment, slower growth, and tariff concerns have all impacted valuations. Through this period, the Chinese government has proven willing to provide stimulus which may encourage investors to view this as an opportunity to tap into China’s compelling innovation without the premium valuations of the US.”

Fund pick: Fidelity Special Values Investment Trust (FSV)

Bigley notes: “Fidelity Special Values Ord (LSE:FSV) Trust takes an all-of-market approach to finding out-of-favour UK equities. Managers Alex Wright and Jonathan Winton follow a look for companies that are undervalued by the market and are also permitted a small overseas allocation. The portfolio typically holds companies trading at lower valuation multiples than the wider market. This valuation and contrarian focus makes for benchmark differentiation and typically leads the managers to allocate heavily to small/mid-cap segment of the market.

“While capital appreciation is the predominant goal for FSV, the yield of 3% is not insubstantial and, as per the managers’ dictum, makes for a smoothing of returns over the long-term. Despite a strong track record for the trust, FSV trades on a current discount of over 5%.

“The UK market has so far been resilient in withstanding this US-centric storm. It is the view of management that there are numerous attractive opportunities the current market at low valuations, particularly in periods of high volatility.”

Fund pick: BlackRock Continental European Income Fund

Bigley adds: “The BlackRock Continental European Income fund is a flexible, high-conviction portfolio of large, well established European businesses. The fund is currently yielding 3.9% and has historically beaten the yield of the benchmark by 50%. Management seeks to invest in quality companies with sustainable and growing dividends. Quality is defined as businesses that have strong corporate governance, a strong competitive position and financial discipline as well as earnings stability.

“The portfolio is constructed with a degree of pragmatism, tilting towards either stocks featuring above-average dividends or stocks growing their dividends, depending on the opportunity set and expected risk/reward. The fund’s quality bias and style-agnostic approach means that returns differ from most equity income peers, which tend to have a value bias. The managers' approach leads to a steadier return profile and to outperformance during periods of market weakness, with strong risk-adjusted returns when compared to both peers and the benchmark.”

Fund pick: HSBC MSCI China ETF

Bigley adds: “For those looking for broad exposure to the Chinese market, the HSBC MSCI China ETF GBP (LSE:HMCH) invests passively in over 580 large and mid-cap China-listed companies.

“The index tracked includes both on and off-shore A and H shares, and is offered at a very reasonable charge of just 0.28%.”

*See graph: Total returns achieved by investing full ISA allowance in MSCI World/FTSE All Share from 6 April 1999 to 5 April 2025

**interactive investor is the most-popular investment platform among ISA millionaires. The number of ISA millionaires on interactive investor, the UK’s second largest DIY investment platform, now stands at 1,607 (as of 28 February 2025) - almost 300 more than the total from our largest competitor Hargreaves Lansdown (1,322 as of December 2024).

There were some 4,850 Britons with a seven-figure ISA portfolio by the end of the financial year in 2022 (latest figure available), according to data obtained following a freedom of information (FOI) request.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Please remember, investment value can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a stocks & shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Editor's Picks