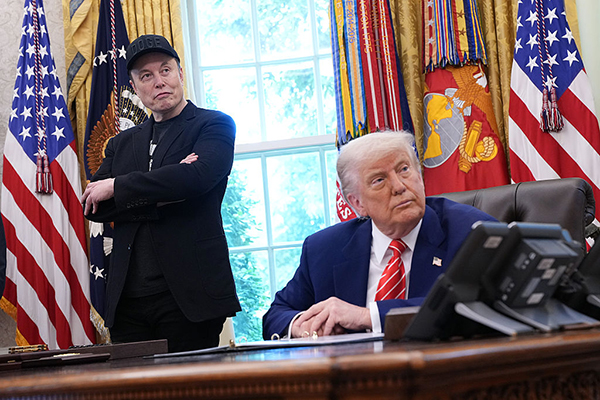

Market snapshot: Trump vs Musk upsets Wall Street

A very public row between the former powerful friends has only increased uncertainty among investors about Trump's policies. ii's head of markets explains the impact of the verbal volleys.

6th June 2025 08:36

Stocks endured a torrid session on Wall Street, with more verbal volleys from the White House adding to growing concerns over the strength of the domestic economy.

The President’s ire descended on Elon Musk, who seems to have turned from friend to foe overnight. A testy exchange of messages over social media sent the share price of Tesla Inc (NASDAQ:TSLA) plummeting by 14%, resulting in a loss of 25% in the year to date. Investors were quick to recognise that this could threaten the more relaxed regulatory approach towards the company which had been in the pipeline as Tesla looks to expand its robotic and self-driving technologies.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Perhaps more importantly, the latest feud has also heightened unease that the President’s seemingly irascible and erratic behaviour is symptomatic of the environment which has been created on a global scale. Companies have already been stepping back from providing guidance comments for the next few months, while consumer sentiment is brittle given the wider context of what could be a weakening outlook.

As such, news that there had been a conversation between the US and China cut little ice with investors on the basis that it seemed to promise nothing more than further meetings to come. The relationship between the two largest global economies is at the hub of the current dispute and has escalated over recent months to add to what was already a fractious relationship.

Attention now turns to the non-farm payrolls report later, which is often described as the most important individual economic release of any given month. The release will garner particular attention given that it could awaken the Federal Reserve from its current holding pattern should the number be much weaker than expected.

It also comes after reports earlier in the week which implied some softening in the labour market, with the ADP number being sharply short of expectations and jobless claims ahead of estimates. Non-farms are expected to show that 125,000 jobs will have been added in May as compared to 177,000 the previous month and that the 4.2% unemployment rate will remain unchanged.

- Tesla: stock of the future or better prospects elsewhere?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Amid the turmoil, US markets are currently hugging the flatline, although they have for the most part erased the strong losses seen over the last few months. In the year to date, the Dow Jones and Nasdaq have fallen by just 0.5% and 0.1% respectively, while the benchmark S&P500 is ahead by 1% and holding on to some uneasy gains.

While the latest developments did little to move the dial in UK markets at the open, nor did they particularly encourage investors to get involved. A tepid set of opening exchanges resulted from some unconvincing buying across defensive stocks which was offset by a broader mark down.

Nonetheless, as the FTSE100 opened marginally higher to leave the index ahead by 8% in the year so far, it also nudged further towards the previous record high recorded in March, and is now just 0.5% away from emulating that level.

The primary index may be far from insulated from the wider political and economic global turmoil, but its very constituents have allowed it to plough its own furrow to an extent. The moves within the index have also lessened the reliance on the miners and oil majors given the strength in the performance in the likes of the banks and defence sectors. This has underpinned a resilience which also comes with the bonus of stable dividend yields which add to the total return which investors have been seeking.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks