Odds very much favour buying this stock now

Near a multi-year low, this company should be riding the crest of a wave following recent results, argues analyst Rodney Hobson. He also issues an update on Boeing.

29th January 2025 09:01

Energy is one of the sectors that should benefit from President Donald Trump’s promise to “drill, baby, drill” for oil, yet one of the key support players has warned of potentially lower activity in North America this year. A sharp fall in the company’s share price has opened up a buying opportunity.

The world’s second-largest energy services company is Halliburton Co (NYSE:HAL), and it should be riding the crest of a wave after a great final quarter in 2024 when it beat analysts’ profit forecasts.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Net income in the quarter was up 7.7% to $615 million despite revenue narrowly falling short of forecasts at $5.61 billion. North America accounts for almost 40% of turnover, so a 9% fall in revenue there was a blow. In contrast, international markets thrived, with revenue 2.4% higher thanks to higher demand for drilling and pressure pumping in the North Sea and Asia.

On the whole, it was not a bad year. More than $2.6 billion free cash flow was generated and $1.6 billion was distributed to shareholders.

However, Halliburton is cautious on prospects for the coming year with the supply of oil seen as remaining in excess of demand. It believes revenue will be flat as the oil industry will be reluctant to spend on exploration and production until supply and demand come closer into balance. Surprisingly, the company believes this will be especially true in North America despite Trump’s bravado.

On the plus side, Halliburton has a strong balance sheet and should continue to generate cash this year.

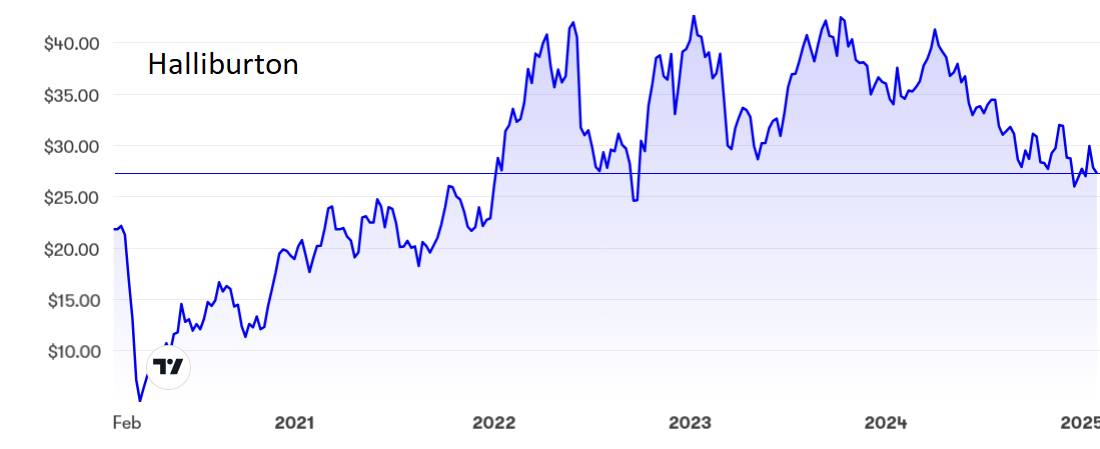

The shares have been on a downward trajectory since peaking at just over $40 last April but seem to be bottoming out after hitting $26 in mid-December. Investors should note that over the past 10 months there have been several dead cat bounces, notably at $33, $31 and $28, so the current $27 could be an equally false dawn.

Source: interactive investor. Past performance is not a guide to future performance.

However, the shares have found support between $25 and $30 over the past three years and should do so again. The price/earnings (PE) ratio of just below 10 prices in quite a lot of bad news while the yield of 2.5% looks very safe given the strong cash flow.

Hobson’s choice: It really does look as if the market is putting too much emphasis on Halliburton’s cautious tone instead of the reality of a likely upturn in business in North America coupled with steady progress elsewhere.

The potential downside looks limited to a $2 slippage at most while the upside is all the way to previous peaks at $41, which is $14 above the current level. The odds very much favour buying now with a view to taking profits at $40. That argument will take on even greater strength if, against the odds, there is slippage to $25.

- 14 stocks expected to move sharply after posting results

- How to become a superforecaster and beat Wall Street at its own game

- Why it’s not over for Nvidia or these mega-cap tech stocks

Update: New Year, new chief executive, same old problems at aircraft maker Boeing Co (NYSE:BA). Commercial aircraft sales were down heavily in the fourth quarter, which was hardly a surprise given the adverse publicity surrounding aircraft safety plus a damaging strike.

The company warns it will make a larger-than-expected loss for the final quarter of 2024 after taking into account the strike, the cost of the agreement with workers and one-off costs in its defence unit. Revenue will be well down on the previous fourth quarter and lower than analysts’ forecasts.

The shares are inexplicably up to nearly $180 from November’s low of $140, yet there has been no good news since then. The current level gives an excellent opportunity to sell. What on earth is the point of investing in a company that makes losses, has a damaged reputation and will not be in a position to pay a dividend in the foreseeable future?

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks