One solid performer and reassessing a successful stock tip

This company operates in a solid sector, pays a decent dividend and offers potential upside. Analyst Rodney Hobson also gives an update on a housebuilder that returned over 40%.

4th December 2024 07:50

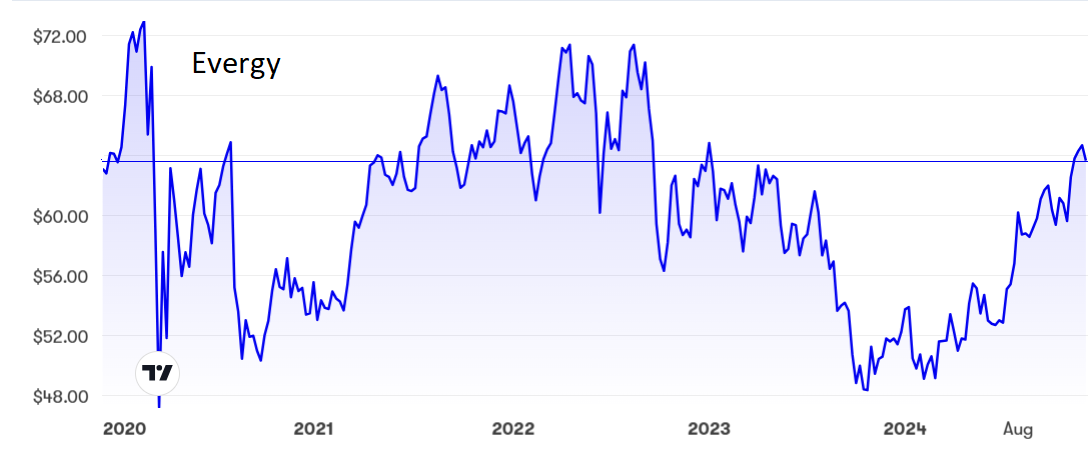

There has been a partial recovery in shares at electricity provider Evergy Inc (NASDAQ:EVRG). This is hardly overwhelming news, but it does suggest renewed interest among small investors in a comparatively small but solid company.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Evergy is a regulated electric utility serving parts of just two states, Kansas and Missouri, but it is a steadily profitable enterprise. The company generates electricity through a wide range of sources. Some are fossil fuels such as coal, gas and oil, while others are renewables including wind and solar. Its customers range from homeowners to commercial firms to local government and it also supplies power to other electric utilities.

This wide range of sources and customers is one of its great strengths. The retail side of the business in particular is benefitting from increased demand and higher charges.

Revenue in the third quarter rose 8.5% year-on-year to $1.8 billion. While that was well short of analysts’ somewhat unreasonably high forecasts, earnings per share of $2.02 were better than expected. Net income rose 32% to $465.6 million as profit margins improved from 21% to 26%.

Forecasts for the medium-term are more realistic. Revenue is expected to rise 3.7% on average in each of the next three years as Evergy invests $16.2 billion in improving infrastructure in Kansas and Missouri.

- Close-up on Ulta: why beauty’s in the eye of the shareholder

- UK Budget? US election? Responding to big events

The shares are now back up to $63.25, where the price/earnings (PE) ratio is hardly challenging at 17.5. The dividend was increased by 4% in the latest quarter and the yield of 4% offers considerable solace if the price eases back.

Evergy is highly unlikely to shoot away any time soon, if ever, but it is a solid performer in a solid sector where there will always be demand.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: The shares slipped back after my earlier suggestion to buy at $65 and again at $68, but at least I was right to suggest in June that $52 would prove to be a floor.

However, I believe that the chart is heading back to the peak around $71 that was achieved in 2022. The best chance to buy has now been missed but the shares are still worth considering as a decent source of income. If you took my earlier advice to buy you should stay in.

Update: I returned housebuilder D.R. Horton Inc (NYSE:DHI) to the buy list in June after the shares slipped back to $140 from a peak of $165. That was slightly premature as the stock edged down further to $135 but, sure enough, Horton was soon on the rise again.

I suggested taking profits if the previous peak was attained again but that certainly was premature as the shares surged away to nearly $200. Well done anyone who delayed selling until the rise was truly over.

Source: interactive investor. Past performance is not a guide to future performance.

One positive factor for all housebuilders is that the Federal Reserve decided to start reducing its official interest rate uncharacteristically early, and initially by a full half percent as opposed to the usual quarter point. A quarter-point cut followed. However, the threat of renewed inflation now hangs over the United States and further reductions in interest rates look unlikely for the foreseeable future, although the Fed will be reluctant to turn about face one more time and start raising rates again. As such, the outlook for housebuilders is probably as good as it gets for now.

Horton is back down to around $167, having been as low as $162 earlier this month. At current levels the PE is below average at 11.7 but the dividend is a measly 0.8%. If you have stayed in you may as well hold for now but I cannot honestly recommend a purchase until the outlook becomes clearer.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks