Seven stocks that analysts think are on the up

25th August 2021 13:57

Ben Hobson from Stockopedia

A strategy tracked by Stockopedia targeting shares with strong earnings upgrades has performed well. Here are the latest qualifiers.

Companies that are enjoying solid upgrades to their earnings forecasts have been in short supply over the past year. With so much uncertainty in the economy, it’s no surprise that brokers have been cautious about making bold upward revisions to their calculations. But there are signs of improvement.

For investors, this is important because material earnings upgrades are a useful clue that the outlook has changed. While many are sceptical about relying on analysts, positive changes in the outlook are taken seriously. After all, good analysts know the firms they follow better than most, so a change in outlook may well deserve a second look.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Analysts at work

Detailed research and regular access to management means that analysts should be well-placed to create accurate valuation models and make predictions about future sales and profitability.

While individual forecasts can end up being wrong, many think they are important because the consensus - or average - opinion of analysts can be helpful in predicting company performance.

- 10 AIM shares trading close to record highs

- 10 blue-chip shares for contrarian investors

- Check out our award-winning stocks and shares ISA

Research over the past 30 years has pinpointed earnings forecast upgrades as one of the most important events connected to analyst research. That’s because they’ve been shown to influence the behaviour of investors and can cause upward price ‘drift’ that lasts anywhere up to a year.

The idea is that the market is forced to reassess firms that are getting strong earnings upgrade revisions. Investors have to absorb the news that the stock is performing, or expected to perform, better than expected. If the price is reaching new highs, it can take time for the market to bid it higher - even if it deserves it - and that ultimately leads to price momentum.

Earnings momentum performance

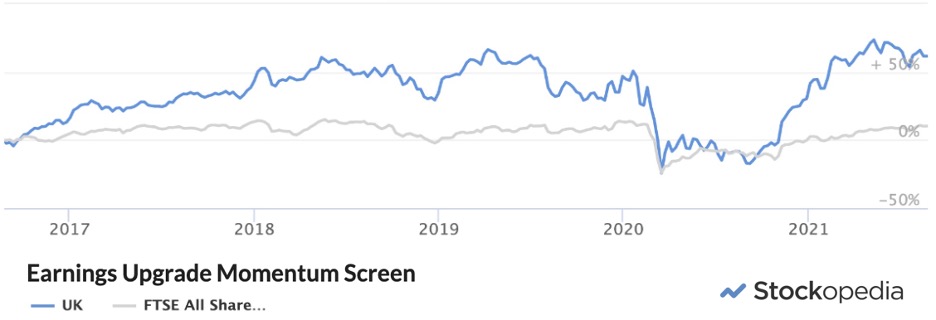

Over the past five years, a strategy tracked by Stockopedia that targets stocks with the strongest earnings upgrades has performed well. It specifically looks for the strongest recent (1 month) consensus upgrades for the next financial year (FY1) and the year after (FY2).

Source: Stockopedia Past performance is not a guide to future performance.

Like many momentum strategies, it suffered in the uncertain conditions over the past 18 months and saw very few companies passing the screen rules. But since last autumn, we’ve started to see the number of companies begin to rise.

- Read more Stockopedia articles here

- Subscribe to the ii YouTube channel and catch all our latest interviews and video content

Among the qualifiers are companies ranging from mining operators such as Atalaya (LSE:ATYM) and Glencore (LSE:GLEN) to advertising-driven media groups like ITV (LSE:ITV) and Future (LSE:FUTR), as well as industrial stocks such as the engineering specialist Senior (LSE:SNR) and chemicals business Synthomer (LSE:SYNT).

Here’s how the list looks:

|

Name |

Mkt Cap (£m) |

% 1m EPS Upgrade FY1 |

% 1m EPS Upgrade FY2 |

# 1m Upgrades |

# Brokers |

Sector |

|

436.7 |

9.08 |

21.3 |

2 |

4 |

Basic Materials | |

|

737.3 |

- |

12.9 |

2 |

12 |

Industrials | |

|

2,928 |

29.2 |

8.53 |

2 |

20 |

Financials | |

|

43,385 |

-5.57 |

7.83 |

2 |

19 |

Energy | |

|

2,294 |

12.2 |

6.59 |

5 |

14 |

Basic Materials | |

|

4,656 |

3.21 |

6.48 |

5 |

8 |

Consumer Cyclicals | |

|

4,635 |

10.4 |

6.19 |

2 |

16 |

Consumer Cyclicals |

An improving outlook for earnings

While analyst research and earnings forecasts need careful handling by investors, they can offer useful ways of finding stocks on the move. Earnings forecast upgrades hinge on the views of analysts and how companies perform against them.

These stocks have been shown to benefit from price momentum caused by the market being slow to react to these kinds of changes. Momentum strategies are vulnerable in bearish conditions, but when the outlook starts to brighten, a strategy like this can be an early pointer to those stocks with the potential to recover

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks