Shares for the future: another maximum score for this business

It’s his favourite company, but many investors appear not to agree with his bullish stance. Analyst Richard Beddard explains why he’s giving it top marks again.

14th June 2024 15:09

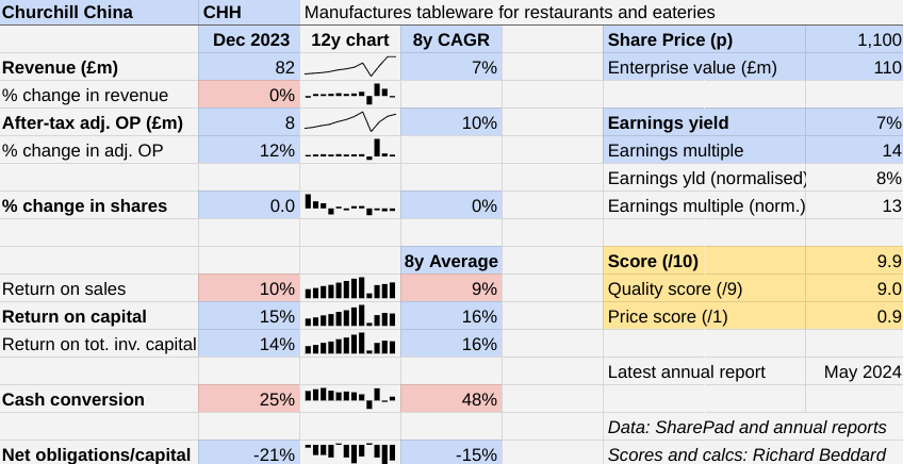

A year ago, I gave Churchill China (LSE:CHH) a maximum score. Its relatively low share price means it has topped the Decision Engine table for much of 2024.

Today is judgement day. I must decide whether it is me that is mad, or the many investors who are apparently indifferent to Churchill China.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top UK Shares

Scoring Churchill China

Churchill China supplies tableware to restaurants and pubs, businesses that closed and restricted the numbers of customers they could serve during the pandemic.

Inevitably, demand fell dramatically during the lockdowns and came back strongly when they were lifted. Churchill China’s factories operated inefficiently at low volumes and again as it took on temporary staff to ramp up production. Profitability suffered.

In the year to December 2023 the rising cost of energy, labour and food ate into customers’ profits, encouraging them to close outlets and reduce capital expenditure, which meant they bought less tableware.

Over the year, things have returned to normal inside Churchill China though.

The Past (dependable) [3]

- Profitable growth: 7% revenue compound annual growth rate (CAGR), 10% profit CAGR [1]

- Strong finances: Net cash [1]

- Through thick and thin: Lowest ROC 14% (2015) excluding pandemic (2% low) [1]

Revenue at Churchill China was flat in 2023 despite reduced volumes, due to price increases introduced in 2022. But revenue in 2023 was 22% above its level in 2019, so Churchill China has grown in the most difficult of markets.

One of the attractive features of the business model is that unlike retail customers, which bring in less than 2% of revenue, commercial caterers are repeat purchasers because they need tableware that matches what they already own.

Tough times, therefore, are when companies like Churchill China find it easiest to gain market share because rivals go out of business, or cannot maintain service levels.

Churchill China’s service levels suffered during the pandemic, but not as much as many of its rivals. They have normalised now and the company believes it has continued to take market share.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- How to become an ISA millionaire

The issue vexing traders is probably profit. Adjusted after-tax profit in 2023 is 12% below its 2019 peak.

In the 2010’s the company gradually improved its overall profit margin which increased from 8% in 2015 to 13% in 2019. In 2023, the profit margin was 10%, higher than in 2022, but only a shade above the eight-year average.

This is in part because Churchill China has been producing more tableware than it is selling to build up stocks, a vital part of its strategy to supply customers the next day if necessary.

It is also because of Churchill China’s reliance on less capable contract labour during the post-Covid recovery.

But Churchill China has been reducing the number of temporary workers and recruiting the best of them as full-time employees, resulting in a smaller, more capable, and more efficient workforce at the end of the year.

Building up stock though is a drain on cash, which is the main reason cash conversion was below par.

Even in a typical year, Churchill China only converts about half of adjusted operating profit into cash. This is due to heavy investment in its factories in Stoke on Trent, another vital element of its strategy. Not only are the factories more efficient due to the investment, but the innovative processes enable the company to develop better products.

- Share Sleuth: the stock I’ve sold after a roller-coaster ride

- Stockwatch: Aviva shares remain a priority for income investors

Product development activity was relatively low in the period from 2020 to 2022 as the company wrestled with violently fluctuating demand, but Churchill China expanded the product range by about 17% with its biggest ever launch in 2023.

The tenor of the annual report is positive. Churchill China is operating more efficiently, stock levels have been replenished, customer service levels have normalised, and the company anticipates “more innovation, differentiation, and growth,” once demand picks up.

It thinks that will happen in the second half of the financial year, which is imminent.

The Present (distinctive) [3]

- Discernible business: Vertically integrated tableware manufacturer [1]

- With experienced people: Two of three execs are very experienced [1]

- That creates value for customers: Availability, durability, affordability [1]

Churchill China’s tableware is known for its durability, which is a product of clays unique to the UK and a manufacturing process unique to the company.

Durability is important because the tableware must survive many dishwasher cycles per day. One of the ways this is achieved is by incorporating the pattern under the glaze, a process developed by Churchill China that makes highly patterned and textured plates cheaper to manufacture.

The development of patterned and textured tableware has been one of the main drivers of growing profit margins as the hospitality industry has moved away from the standard plain white plate.

Churchill China shared control of its clay supply with two other Staffordshire Potteries until 2019, when it acquired one of them, Dudson, and acquired the interest of the other, Portmeirion. Now it is a supplier to most of the UK pottery industry.

- Raspberry Pi shares surge on UK stock market debut

- Insider: directors spend £1.4m on two FTSE 100 stocks

Having control of the intellectual property in materials and processes enables Churchill China to be even more innovative.

Customers also want to know they will be able to buy more tableware in the same design, so Churchill China maintains a strong balance sheet and high levels of stock. Customer service has returned to pre-pandemic levels, it says, which means over 90% of orders are completed in two days.

High levels of service and the fact that the company has been making tableware for 225 years, gives it something of a reputation.

Chief executive David O’Conner joined the firm 32 years ago, joined the board in 1999, and has led the firm since 2014, a period in which it has flourished. Finance director Michael Cunningham joined in 2023, replacing David Taylor, who was one of the longest serving UK financial directors at a listed company before he retired.

James Roper, sales and marketing director, has worked for the company since 2001. The Roper family bought the company in 1922 and a number of family members still own substantial holdings.

The Future (directed) [3]

- Addressing challenges: Maturity in UK market [1]

- With coherent actions: Established European expansion [1]

- That reward all stakeholders fairly: Customer focused, loyal employees [1]

Churchill China does not say how big its market share is in the UK, but it is the market leader.

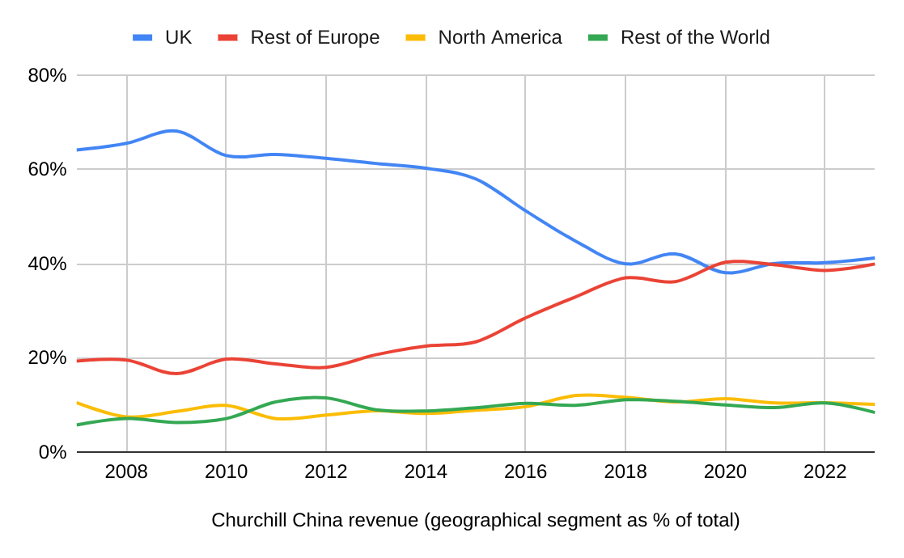

Since 2008, it has grown UK revenue by just 23%, although this is partly explained by its withdrawal from retail sales. Meanwhile, European sales have grown 300% and have in recent years reached parity with the UK. If the company meets its growth expectations, Europe will soon be its biggest market.

High levels of investment will also continue, as Churchill China ensures its factories become more innovative, efficient and greener, principally by reducing gas consumption. Initially, its focus is on solar power, and electrical processes.

This investment-led strategy is an indication of Churchill China’s long-term ethos.

It says, subject to controls in place to protect the business, colleagues “are given the space to make decisions without fear of failure”.

In this way, it says it is developing future leaders. The average staff member has been at Churchill China for more than 11 years, so it is likely there are leaders among them.

The price (discounted?) [0.9]

- Yes. A share price of £11.00 values the enterprise at about £110 million, 13 times normalised profit.

It is a maximum score again from me for the business, 9 out of 9, and the collective indifference of the market gives Churchill China a near maximum score for price of 0.9 out of 1.

A total score of 9.9 out of 10 indicates that Churchill China is a good long-term investment.

It is ranked 1 out of 40 shares in my Decision Engine.

19 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Advanced Medical Solutions Group (LSE:AMS) and Anpario (LSE:ANP) have published annual reports and are due to be re-scored.

If a share is likely to be downgraded next time I score it, there is a “?” before its name in the table. This is usually because events have revealed something about the company that I had not previously considered adequately.

I am phasing this system out in favour of re-scoring companies when the facts change or my opinion does mid-term.

|

0 |

Company |

* |

Description |

Score |

|

1 |

Churchill China |

Manufactures tableware for restaurants and eateries |

9.9 | |

|

2 |

Designs recording equipment, loudspeakers, and instruments for musicians |

9.0 | ||

|

3 |

Supplies kitchens to small builders |

8.7 | ||

|

4 |

Manufactures pushbuttons and other components for lifts and ATMs |

8.5 | ||

|

5 |

Distributor of protective packaging |

8.3 | ||

|

6 |

Manufactures/retails Warhammer models, licences stories/characters |

7.8 | ||

|

7 |

Manufacturer of scientific equipment for industry and academia |

7.8 | ||

|

8 |

Makes light fittings for commercial and public buildings, roads, and tunnels |

7.8 | ||

|

9 |

Manufactures filters and filtration systems for fluids and molten metals |

7.8 | ||

|

10 |

Distributes essential everyday items consumed by organisations |

7.8 | ||

|

11 |

Manufactures natural animal feed additives |

7.8 | ||

|

12 |

Imports and distributes timber and timber products |

7.8 | ||

|

13 |

Develops and manufactures hygiene, baby, and beauty brands |

7.5 | ||

|

14 |

Whiz bang manufacturer of automated machine tools and robots |

7.5 | ||

|

15 |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

7.5 | ||

|

16 |

Online retailer of domestic appliances and TVs |

7.4 | ||

|

17 |

Manufactures surgical adhesives, sutures, fixation devices and dressings |

7.3 | ||

|

18 |

Sources, processes and develops flavours esp. for soft drinks |

7.3 | ||

|

19 |

Translates documents and localises software and content for businesses |

7.0 | ||

|

20 |

Sells promotional materials like branded mugs and tee shirts direct |

6.8 | ||

|

21 |

Sells hardware and software to businesses and the public sector |

6.8 | ||

|

22 |

Manufactures vinyl flooring for commercial and public spaces |

6.7 | ||

|

23 |

Makes marketing and fraud prevention software, sells it as a service |

6.7 | ||

|

24 |

Operates tenpin bowling and indoor crazy golf centres |

6.6 | ||

|

25 |

Flies holidaymakers to Europe, sells package holidays |

6.6 | ||

|

26 |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

6.5 | ||

|

27 |

Manufactures specialist paper, packaging and high-tech materials |

6.4 | ||

|

28 |

Retails clothes and homewares |

6.4 | ||

|

29 |

Repair and maintenance of rail, road, water, nuclear infrastructure |

6.4 | ||

|

30 |

Supplies vehicle tracking systems to small fleets and insurers |

6.3 | ||

|

31 |

Manufactures military technology, does research and consultancy |

6.2 | ||

|

32 |

Online marketplace for motor vehicles |

6.2 | ||

|

33 |

Manufactures rugged computers, battery packs, radios. Distributes electronics |

6.2 | ||

|

34 |

Surveys and distributes public opinion online |

6.2 | ||

|

35 |

Manufactures sports watches and instrumentation |

6.0 | ||

|

36 |

Acquires and operates small scientific instrument manufacturers |

5.9 | ||

|

37 |

Manufactures power adapters for industrial and healthcare equipment |

5.5 | ||

|

38 |

Manufactures disinfectants for simple medical instruments and surfaces |

5.5 | ||

|

39 |

Publishes books, and digital collections for academics and professionals |

5.4 | ||

|

40 |

Runs a network of self-employed lawyers |

4.4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

An asterisk (*) next to a share’s name indicates that it has been re-scored since it was scored. Click the asterisk to see why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Churchill China and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks