Shares for the future: big upgrade for this stock

Reassessing the business following results published in the summer, analyst Richard Beddard’s new score fires this company an incredible 22 places up his rankings.

13th September 2024 15:08

Like the previous years, Cohort’s scorecard for the 12 months ending April 2024 reads “could do better”.

That is not to say Cohort (LSE:CHRT) performs badly at all...

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Scoring Cohort: it’s complicated

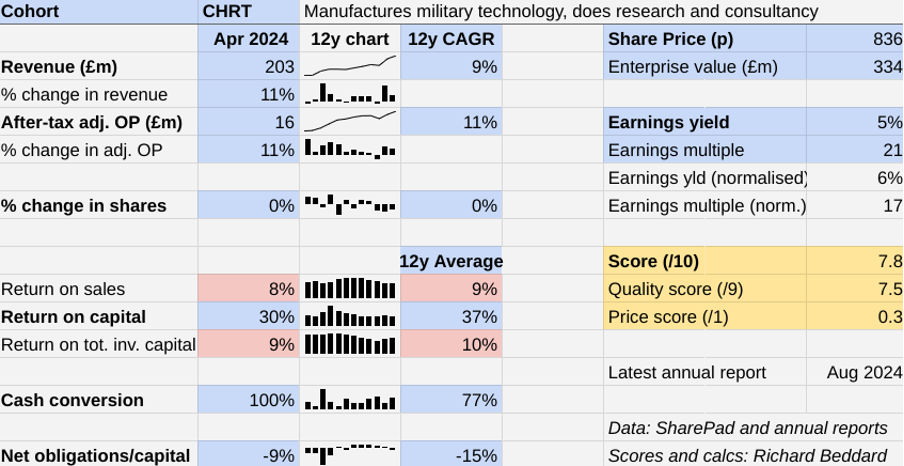

Revenue and profit in 2024 grew 11%, more or less matching the defence technology company’s long-term compound annual growth rate (CAGR).

The Past (dependable) [3]

- Profitable growth: Roughly 10% CAGR in revenue and profit [1]

- Strong finances: Net cash, decent cash conversion [1]

- Through thick and thin: Lowest RoC 28% (2022) [1]

At 30%, after-tax operating Return on Capital (RoC) remained high but below the company’s historical averages. The group’s profit margin was 8%.

Cohort thinks it can increase net profit margin, a slightly different measure from mine, from about 10% to a percentage in the mid-teens over the next three to five years.

The main cause of the modest profit margin is misfiring subsidiaries.

Cohort says it improved net profit margin at Chess Dynamics from 2% to 10% in 2024. The company terminated underperforming contracts after wallowing in them for a couple of years, and hints at more margin gains to come.

The big challenge currently is to reverse losses at EID. Losses were reduced in 2024, but Cohort says its Portuguese subsidiary is not winning enough new orders to operate efficiently.

EID is heavily reliant on orders from its biggest customers, the Portuguese army and navy. Now that long-delayed orders worth €45 million (£38 million) have been secured and a new managing director is reviewing the business, it should start to recover.

Margins may be depressed at ELAC SONAR too. Cohort’s German subsidiary has completed the development phase of a large contract to supply sonar systems for three new submarines (with an option on a fourth).

The subs are bound for the Italian navy.

Recognising the revenue from long-term contracts requires Cohort to estimate the profitability of the contract at completion. The company takes a conservative view, building contingency into its estimates.

If all goes well, it releases the contingencies later. Of course, the company may require them. We cannot be sure margins will improve at ELAC, but management is setting a confident tone as it enters production.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- The Income Investor: lower rates to boost this stock’s dividend

Analysts forecast £220 million revenue in the year to April 2025, slightly below Cohort’s long-term growth, but there’s a high degree of confidence because £181.4 million (95%) of it is already in the order book.

Cohort is benefiting from increased defence spending triggered by Russia’s invasion of Ukraine, and also Chinese posturing in the South China Sea.

It says its electronic warfare, battlefield intelligence and counter-drone systems are in demand in Ukraine.

And it is “very optimistic” it will supply Asian navies and new submarines being bought under the AUKUS alliance between Australia, the UK, and the US.

It may also acquire more revenue; indeed it made a very small acquisition after the year end.

The Present (distinctive) [2.5]

- Discernible business: Group of defence technology businesses [0.5]

- With experienced people: Very experienced board [1]

- That creates value for customers: Niche expertise, responsive subsidiaries, confidence [1]

Cohort is a group of six businesses, all of them acquired and some of them augmented by bolt-on acquisitions

They have recently been organised into two divisions, Communications and Intelligence, and Sensors and Effectors.

The jewel in the crown of the Communications and Intelligence division is MASS, one of Cohort’s founding acquisitions in 2006.

MASS’ expertise is in electronic warfare data management, tools, training and support. Mass earned more than double the group’s net profit margin in 2024, which is typical.

The Sensors and Effectors division makes sonar, radar, and visual sensor systems, which detect threats. It also makes targeting and fire control systems, the brains of weapons systems such as torpedo launchers and anti-drone systems.

In July, one of the division’s subsidiaries, Chess, contracted for more than £25 million to supply the contractor Rheinmetall with electro-optical tracking surveillance systems and multi-sensor units. They will be incorporated into air defence systems.

Head office gives the managing directors of these subsidiaries autonomy so they can respond to their customers efficiently.

Being part of a larger group also confers advantages. It gives customers the confidence to sign multi-year contracts, because together the subsidiaries are financially stronger and more stable.

Cohort says this distributed business model requires a smaller head office, which is cost effective. And it is more attractive to recruits, who can have entrepreneurial careers at the subsidiaries.

The company has changed strategy over the past decade. It has become more product-focused as it has become more export oriented. Products are easier to export than services such as training and operational support. Also, the Ministry of Defence, its biggest customer, has insourced many services.

The basic blueprint of autonomous businesses backed by a financially resourceful group has been there from the start, though.

So has management. The chair is one of Cohort’s two founders, the other is still a significant shareholder. Both already had years of defence industry experience.

Chief executive Andrew Thomis was one of Cohort’s first employees and briefly served as managing director of MASS before taking the top job. Cohort’s finance director, Simon Walther, joined in Cohort’s first year.

They were former colleagues of the founders.

The Future (directed) [2]

- Addressing challenges: Large long contracts, complexity [0.5]

- With coherent actions: Collaboration, acquisitions [0.5]

- That reward all stakeholders fairly: Rewarding careers, good shareholder communication [1]

Large customers are an occupational hazard for defence firms due to the state monopoly of military force, and Cohort still relies on the Ministry of Defence for about half its revenue.

Revenue is sensitive to the level of UK defence spending. That said, Cohort performed well in its first 15 years when spending was constrained. Now it seems there will be a tailwind.

Besides agile and long-standing relationships with many of its customers, Cohort competes by designing better technology. In 2024, research and development increased 26%, to 7% of revenue.

The annual report highlights Ancilia, SEA’s new decoy launcher system. Along with MASS, SEA is one of the original Cohort acquisitions.

Ancilia also shows us how the company is getting its subsidiaries to work together.

It provides a more rapid response to anti-ship missiles because the ship does not have to reposition itself before firing decoys. It fires them from a turntable designed and made by Chess.

In 2024, Cohort agreed a £135 million contract, its largest and probably longest ever, to equip 17 vessels with Ancilia between now and 2037.

Although the group is highly profitable, returns are not as impressive when we consider the cost of acquisitions. After-tax Return on Total Invested Capital is only 8%.

No doubt, loss-making EID (Cohort acquired stakes in 2016 and 2017) and struggling Chess (acquired in 2018) are part of the explanation.

The good news is that Cohort tends to sort out problems in its subsidiaries before acquiring new ones. Since Chess, it has made only two acquisitions, ELAC, the sonar business, and ITS in May this year.

ITS is so small it barely registers. It is being folded into MCL, part of the Communications and Intelligence division. MCL supplies the MoD with kit. ITS, a supplier to MCL, writes technical manuals and provides support and training.

Despite its underperforming acquisitions, Cohort has proved it can grow profitably as a group. Nevertheless, I have docked the company a point because of apparent contradictions in how its strategy addresses the risks.

- 11 ways SIPPs can help you achieve a dream retirement

- How the October Budget could impact your personal finances

Cohort is a technical and commercially complex business due to the nature of the products and services it sells and length of the contracts it enters into.

As it acquires more businesses its capabilities grow but so does the size of the contracts it can fulfil, the range of products and services it can offer, and the number of markets it exports to. This complexity requires more oversight and coordination.

I wonder if the company will grow so complex that the need for coordination undermines the autonomy of the subsidiaries, a source of competitive advantage.

Over the years, Cohort has toughened up its financial controls, and become more involved in strategic reviews, leadership development, and performance management. Head office also assists subsidiaries with exports.

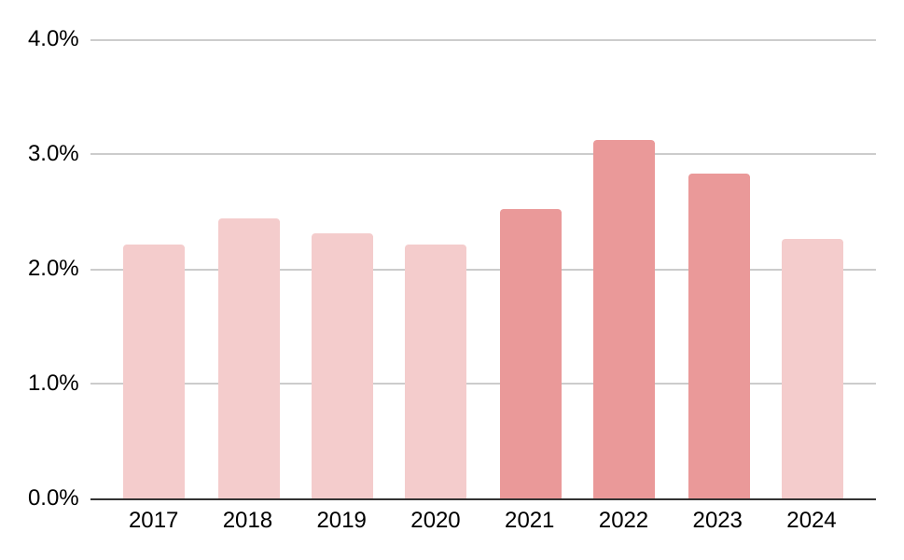

I have been tracking central costs, thinking perhaps that might give away creeping centralisation. In the previous three years, central costs rose as a proportion of revenue, from the historical norm of just over 2% to 3%.

In 2024, central costs fell back, but the company tells me that is because some have migrated to the two new divisions, which is itself evidence of more complexity.

There is no rule that prevents complex businesses from growing, but I think they’re riskier.

The price (discounted?) [0.3]

- Yes. A share price of 836p values the enterprise at about £334 million, 17 times normalised profit.

A score of 7.8 implies Cohort is a good long-term investment.

It is ranked 13 out of 40 shares in my Decision Engine.

24 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Goodwin (LSE:GDWN) and Cropper (James) (LSE:CRPR) have published annual reports and are due to be re-scored.

I have moved PZ Cussons (LSE:PZC) to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

|

0 |

Company |

* |

Description |

Score |

|

1 |

Manufactures tableware for restaurants and eateries |

10.0 | ||

|

2 |

Designs recording equipment, loudspeakers, and instruments for musicians |

9.0 | ||

|

3 |

Imports and distributes timber and timber products |

9.0 | ||

|

4 |

Manufactures pushbuttons and other components for lifts and ATMs |

8.5 | ||

|

5 |

Distributor of protective packaging |

8.4 | ||

|

6 |

Supplies kitchens to small builders |

8.3 | ||

|

7 |

Whiz bang manufacturer of automated machine tools and robots |

8.3 | ||

|

8 |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.1 | ||

|

9 |

Flies holidaymakers to Europe, sells package holidays |

8.0 | ||

|

10 |

Manufacturer of scientific equipment for industry and academia |

7.9 | ||

|

11 |

Manufactures/retails Warhammer models, licences stories/characters |

7.9 | ||

|

12 |

Manufactures filters and filtration systems for fluids and molten metals |

7.9 | ||

|

13 |

Cohort |

Manufactures military technology, does research and consultancy |

7.8 | |

|

14 |

Manufactures computers, battery packs, radios. Distributes components |

7.6 | ||

|

15 |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

7.5 | ||

|

16 |

Sells hardware and software to businesses and the public sector |

7.5 | ||

|

17 |

Sources, processes and develops flavours esp. for soft drinks |

7.3 | ||

|

18 |

Surveys and distributes public opinion online |

7.3 | ||

|

19 |

Sells promotional materials like branded mugs and tee shirts direct |

7.2 | ||

|

20 |

Manufactures surgical adhesives, sutures, fixation devices and dressings |

7.1 | ||

|

21 |

Distributes essential everyday items consumed by organisations |

7.1 | ||

|

22 |

Manufactures vinyl flooring for commercial and public spaces |

7.0 | ||

|

23 |

Translates documents and localises software and content for businesses |

7.0 | ||

|

24 |

Manufactures natural animal feed additives |

7.0 | ||

|

25 |

Online marketplace for motor vehicles |

6.7 | ||

|

26 |

Operates tenpin bowling and indoor crazy golf centres |

6.7 | ||

|

27 |

Manufactures specialist paper, packaging and high-tech materials |

6.6 | ||

|

28 |

Online retailer of domestic appliances and TVs |

6.5 | ||

|

29 |

Repair and maintenance of rail, road, water, nuclear infrastructure |

6.4 | ||

|

30 |

Supplies vehicle tracking systems to small fleets and insurers |

6.4 | ||

|

31 |

Retails clothes and homewares |

6.1 | ||

|

32 |

Publishes books, and digital collections for academics and professionals |

5.9 | ||

|

33 |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

5.9 | ||

|

34 |

Acquires and operates small scientific instrument manufacturers |

5.8 | ||

|

35 |

Manufactures sports watches and instrumentation |

5.7 | ||

|

36 |

Manufactures disinfectants for simple medical instruments and surfaces |

5.5 | ||

|

37 |

Manufactures power adapters for industrial and healthcare equipment |

5.5 | ||

|

38 |

Makes marketing and fraud prevention software, sells it as a service |

4.9 | ||

|

39 |

Runs a network of self-employed lawyers |

4.5 | ||

|

v Frozen v | ||||

|

? |

Develops and manufactures hygiene, baby, and beauty brands |

7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Cohort and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks