Shares for the future: this company deserves more credit

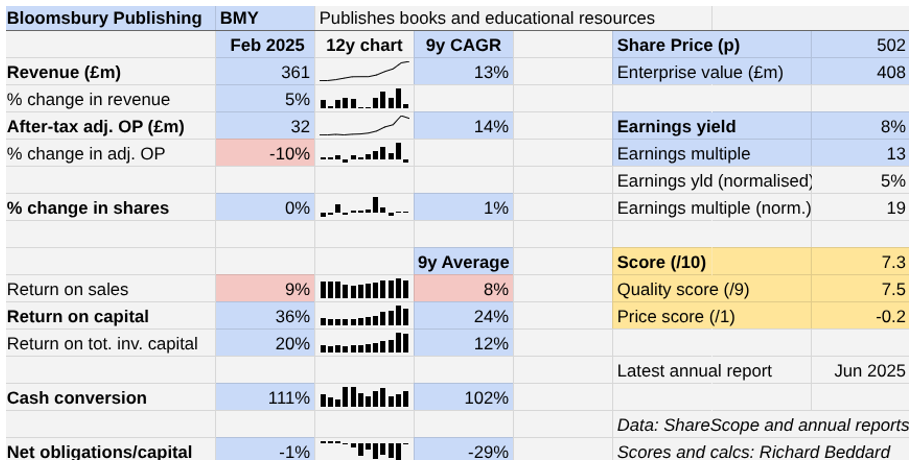

A rally in 2024 has unwound to prices not seen in over a year, but analyst Richard Beddard thinks this stock is probably a good long-term investment.

4th July 2025 15:16

Twenty years ago and more, shareholders in Bloomsbury Publishing (LSE:BMY) would wait for each Harry Potter book launch. Other books paled into insignificance in financial as well as cultural terms.

The last book in the series was published in 2007, but the series still contributes significant but undisclosed revenue. The books remain on the bestseller lists and Bloomsbury augments them with derivative works each year.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

These days, though, it is books by romantasy writer Sarah J Maas that send waves of profit through Bloomsbury.

In the year to February 2024, the launch of Maas’ 23rd book Crescent City: House of Flame and Shadow lifted her already lofty sales 161% and contributed much of a 30% increase in revenue and a 53% increase in adjusted profit that year.

The paperback edition of Crescent City: House of Flame and Shadow was published earlier this month.

With no new Sarah J Maas titles published in the year to February 2025, Bloomsbury experienced a hangover.

What a non-SJM launch year looks like

But we are not waking up with as thick a head as I thought we might last year.

Revenue increased 5% due to Bloomsbury’s biggest ever acquisition early in the financial year, but selling in-demand hardbacks in huge quantities is highly profitable and Bloomsbury could not match 2024 for profit. It declined 10%.

Even so, Bloomsbury earned 36% return on capital. That was higher than its long-term average. As usual, it earned even more in cash terms.

Despite the acquisition, Bloomsbury ended the year with marginally more cash than financial obligations.

It starts the new financial year expecting to improve revenue and profit modestly. Although Sarah J Maas is contracted to write six more books, no publication dates have been announced.

A story of two segments

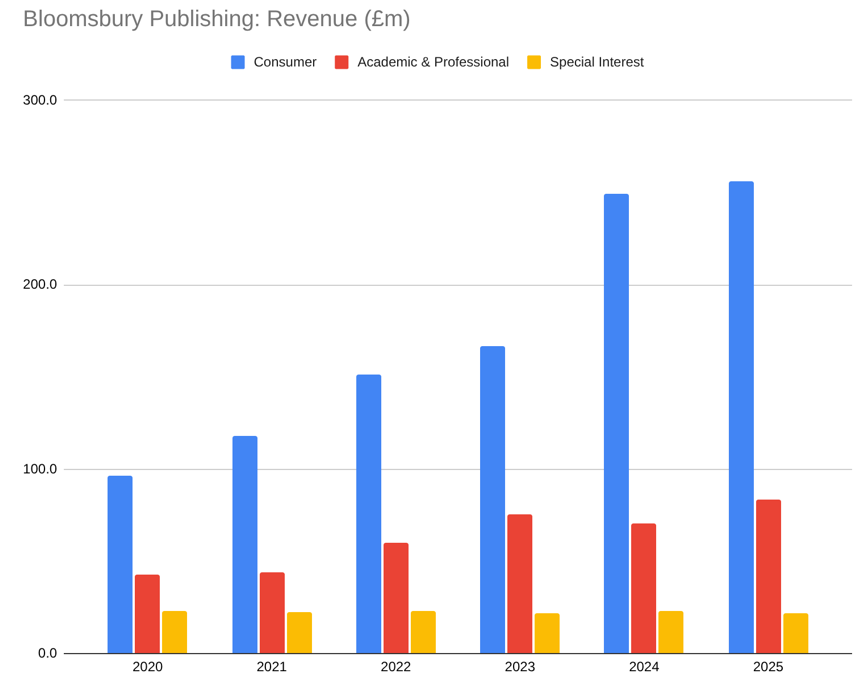

We can see the impact of Sarah J Maas sales in the surge in Consumer revenue (blue bars) between 2023 and 2024. Bloomsbury did well to follow this up with 3% segment growth in 2025.

Sarah J Maas books remained in the bestseller lists all year, but reassuringly the company says its resilient performance had a broad base, including new titles from Gillian Anderson and Samantha Shannon.

Only the acquisition of Rowman & Littlefield returned Bloomsbury’s other big division to growth. It doubled the size of the company’s Academic and Professional business and meant US revenue contributed more to the segment’s revenue than revenue from the UK, its other big geographical market.

Bloomsbury established Academic & Professional, which specialises in the humanities and social sciences, to diversify the business and provide a more stable source of growth.

In 2025, it contributed 23% of total revenue and 29% of total profit. But its customers, predominantly UK and US universities and schools, are facing funding shortages which are limiting how much they can spend.

- Takeover boom: more UK companies gobbled up by wealthy suitors

- Labour set to slash cash ISA limit. Is it the right approach?

The funding challenges appear to be entrenched, so Bloomsbury may have a better chance of growing in the US, where it is a small fish in a big pond, than the UK. It also plans to tap growing numbers of students in Asia by opening an office in Singapore, in addition to offices in Sydney and New Delhi.

In addition to cash strapped customers, digitisation requires academic publishers to develop new capabilities and change their business models.

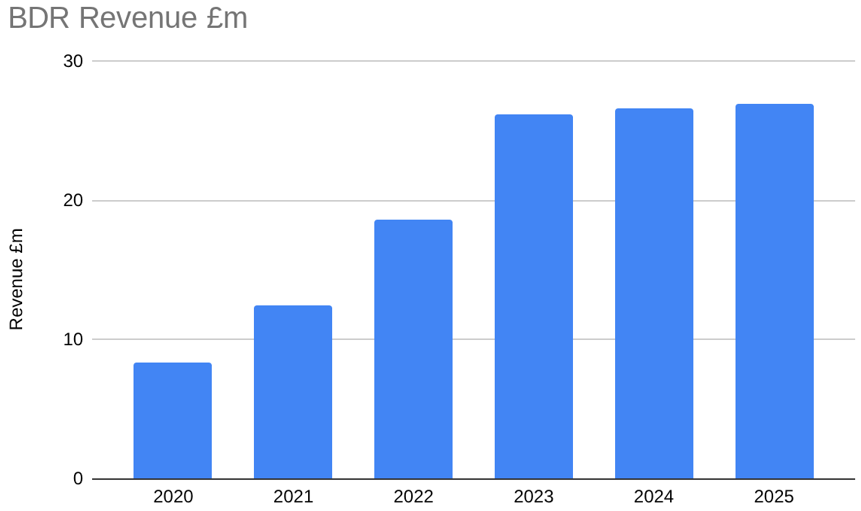

Bloomsbury set up Bloomsbury Digital Resources (BDR), its digital offering, to address the shift from print to electronic publication. BDR grew rapidly before and during the pandemic, but its growth has been subdued over the last two years. It should start picking up again during this financial year as the company adds Rowman & Littlefield titles to its collections.

Source: Bloomsbury annual reports

In addition, the traditional subscription and licensing models of academic publishing are being challenged by Open Access. Governments are seeking to make scholarly books based on publicly funded research available online for free.

Typically, this means the authors, institutions or funders pay publishers a fee, instead of publishers footing the bill and charging for access. Bloomsbury is concerned that if the trend continues there may not be enough funding, so it is pioneering a commercial open access model funded by a coalition of academic libraries.

- Five things for investors to watch in the second half of 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Also looming is the potential impact of artificial intelligence, which is swallowing content and making the original publications less relevant.

Bloomsbury says it is “progressing opportunities to monetise academic content in authors’ best interests”.

Whenever I look at Bloomsbury’s books, and its financial track record, I feel confident in the company. When I think about the changes coursing through publishing, that confidence gets shaken.

Excellence and originality

Perhaps that does not give Bloomsbury enough credit.

Under 39 years of leadership, founder and chief executive Nigel Newton has fostered a culture of excellence and originality. It publishes blockbusters, Nobel prizewinners and classic special interest titles like Wisden Cricketers’ Almanack, the Writers’ and Artists’ Yearbook, and Who’s Who.

These achievements have given Bloomsbury a strong reputation

Employees are the interface between publisher and author, and Bloomsbury aims to be the best publisher to work for. Median pay is decent, and the company reports that 92% of employees are proud to tell others who they work for, 81% say it is a Great Place To Work, according to the certification scheme of the same name.

I think if any publisher can adapt to the considerable challenges it faces, Bloomsbury can. The consumer business adapted before, to the ebook and audiobook revolutions. It thrived despite the creation of a dominant retailer in Amazon. Through judicious acquisitions that have not come at great cost, it has built a viable second income in Academic & Professional.

|

Bloomsbury Publishing |

BMY |

Publishes books and educational resources |

02/07/2025 |

7.3/10 |

|

How capably has Bloomsbury Publishing made money? |

3.0 | |||

|

Under co-founder and chief executive Nigel Newton, Bloomsbury has developed blockbuster book franchises and acquired a second income stream in academic publishing. Double-digit revenue and profit CAGRs and high returns on capital have rewarded its pursuit of excellence and originality. | ||||

|

How big are the risks? |

1.5 | |||

|

Revenue and profitability in consumer publishing is dependent on two enduring franchises. A second division, Academic & Professional, earns most of its income from Universities in the UK and the USA, which are strapped for cash and shifting to digital resources, open access, and perhaps AI. | ||||

|

How fair and coherent is its strategy? |

3.0 | |||

|

Finding blockbuster authors is unpredictable, but Bloomsbury's reputation attracts good publishers and authors. High ROTIC implies Bloomsbury is good at acquiring them too. The A&P division is digitising, internationalising, getting customers to fund open access, and exploring deals with AI firms. | ||||

|

How low (high) is the share price compared to normalised profit? |

-0.2 | |||

|

High. A share price of 502p values the enterprise at £408 million, about 19 times normalised profit. | ||||

|

A score of 7.3/10 indicates Bloomsbury Publishing is a good long-term investment. | ||||

|

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

Auto Trader Group (LSE:AUTO) and Oxford Instruments (LSE:OXIG) have published annual reports and are due to be re-scored.

|

company |

description |

score |

qual |

price |

ih% | |

|

1 |

James Latham |

Imports and distributes timber and timber products |

8.0 |

1.0 |

8.0% | |

|

2 |

Churchill China |

Manufactures tableware for restaurants etc. |

7.5 |

1.0 |

7.0% | |

|

3 |

Howden Joinery |

Supplies kitchens to small builders |

8.0 |

0.5 |

6.9% | |

|

4 |

FW Thorpe |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.5 |

-0.1 |

6.7% | |

|

5 |

Renishaw |

Whiz bang manufacturer of automated machine tools and robots |

7.5 |

0.5 |

6.1% | |

|

6 |

Focusrite |

Designs recording equipment, loudspeakers, and instruments for musicians |

7.0 |

1.0 |

6.0% | |

|

7 |

Dewhurst |

Manufactures, distributes and fits lift components |

7.0 |

1.0 |

6.0% | |

|

8 |

Oxford Instruments |

Manufactures scientific equipment |

7.0 |

1.0 |

6.0% | |

|

9 |

Bunzl |

Distributes essential everyday items consumed by organisations |

7.5 |

0.4 |

5.7% | |

|

10 |

Hollywood Bowl |

Operates tenpin bowling and indoor crazy golf centres |

7.5 |

0.3 |

5.6% | |

|

11 |

Porvair |

Manufactures filters and laboratory equipment |

8.0 |

-0.3 |

5.5% | |

|

12 |

Renew |

Repair and maintenance of rail, road, water, nuclear infrastructure |

7.5 |

0.2 |

5.5% | |

|

13 |

Solid State |

Assembles electronic systems (e.g. computers and radios) and distributes components |

7.5 |

0.2 |

5.4% | |

|

14 |

Macfarlane |

Distributes and manufactures protective packaging |

7.0 |

0.7 |

5.4% | |

|

15 |

Anpario |

Manufactures natural animal feed additives |

7.0 |

0.6 |

5.1% | |

|

16 |

James Halstead |

Manufactures vinyl flooring for commercial and public spaces |

7.0 |

0.5 |

5.0% | |

|

17 |

Games Workshop |

Manufactures/retails Warhammer models, licences stories/characters |

9.0 |

-1.7 |

4.7% | |

|

18 |

Bloomsbury Publishing |

Publishes books and educational resources |

7.3 |

7.5 |

-0.2 |

4.6% |

|

19 |

Jet2 |

Flies holidaymakers to Europe, sells package holidays |

7.5 |

-0.4 |

4.3% | |

|

20 |

Advanced Medical Solutions |

Manufactures surgical adhesives, sutures and dressings |

6.5 |

0.6 |

4.3% | |

|

21 |

Softcat |

Sells hardware and software to businesses and the public sector |

8.0 |

-0.9 |

4.2% | |

|

22 |

Auto Trader |

Online marketplace for motor vehicles |

8.0 |

-1.0 |

3.9% | |

|

23 |

YouGov |

Surveys and distributes public opinion online |

7.5 |

-0.6 |

3.9% | |

|

24 |

Volution |

Manufacturer of ventilation products |

8.0 |

-1.1 |

3.7% | |

|

25 |

DotDigital |

Provides automated marketing software as a service |

6.5 |

0.1 |

3.3% | |

|

26 |

4Imprint |

Customises and distributes promotional goods |

8.0 |

-1.4 |

3.2% | |

|

27 |

Dunelm |

Retailer of furniture and homewares |

8.0 |

-1.4 |

3.1% | |

|

28 |

Quartix |

Supplies vehicle tracking systems to small fleets and insurers |

7.5 |

-1.3 |

2.4% | |

|

29 |

Goodwin |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

8.0 |

-2.3 |

1.4% | |

|

30 |

Judges Scientific |

Manufactures scientific instruments |

7.5 |

-1.8 |

1.4% | |

|

31 |

Tristel |

Manufactures disinfectants for simple medical instruments and surfaces |

7.5 |

-2.2 |

0.5% | |

|

32 |

Cohort |

Manufactures military technology, does research and consultancy |

7.5 |

-2.3 |

0.5% | |

|

33 |

Keystone Law |

Runs a network of self-employed lawyers |

7.0 |

-2.4 |

0.0% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Bloomsbury Publishing and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks