Shares for the future: a FTSE 250 stock with earning power

With a lucrative contract where orders should run and run, this company’s share price reflects increased optimism. Analyst Richard Beddard explains why he just upgraded his score.

5th September 2025 15:03

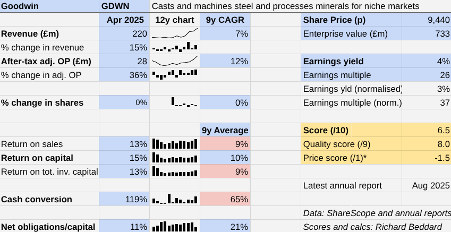

Last year, Goodwin (LSE:GDWN) hit a milestone. It exceeded the profit that it had achieved over a decade earlier, before the oil price crashed and revenue and profit went into a tailspin.

The primary reason for Goodwin’s recovery is an extended pivot to supply cast and machined products to the nuclear industry and UK and US navy frigate and submarine building programmes.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

The company had begun fulfilling a long-anticipated contract to supply 237 steel boxes, each weighing 29 tonnes, for the containment of nuclear waste at Sellafield. So far, it has supplied 90 boxes, and ultimately 747 may be required.

As the only company in the UK that can supply the boxes contractually, Goodwin is confident that orders will run and run. Due to the size of the castings required and their metallurgical specification, Goodwin tells me it is probably the only UK company that could make the boxes any way.

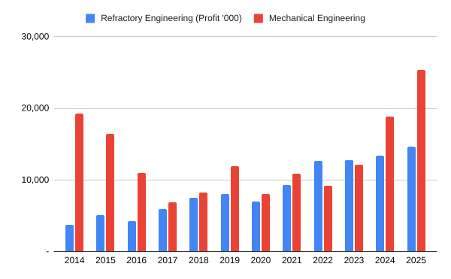

Now that it has ironed out the manufacturing processes for these newish products and ramped up production, profitability may be returning to levels long anticipated in its Mechanical Engineering division. Profit increased 36% in the year to April 2025, and Goodwin earned a higher than average 15% return on capital.

Goodwin still makes valves for oil and gas pipelines, and in November its German subsidiary Noreva won its biggest-ever order ($15 million) to be supplied to a Liquefied Natural Gas (LNG) project over the next few years.

During the year to April 2025, perennially loss-making Easat, another subsidiary, also made a modest profit.

Easat originally made antennas for surveillance and air traffic control, but by developing and delivering whole air traffic control systems Goodwin says it has lowered the cost compared to those supplied by systems integrators.

It has taken longer than expected to convert prospects into sales, but later in the year Easat will have fully installed an air traffic control system at Cranfield Airport. It is also supplying the Royal Thai Airforce and an airport in Vietnam, so the business appears to be gaining momentum.

- Stockwatch: does AI justify this cyclical share’s growth rating?

- Oil sector top picks: what the City thinks of Shell and BP

Cash conversion exceeded 100% as Goodwin dialled back investment. In the past decade it has equipped its foundry to cast bigger components and built a new factory to manufacture a high-performance polymer resin, Ducoya, using a newly patented process.

Customer trials of the resin are under way, and Goodwin has installed powder-pressing machinery at Noreva, its German subsidiary, to make stock shapes and finished parts. Initially, Goodwin is targeting the aerospace and semiconductor industries.

Source: Goodwin annual reports.

There has been so much action in Mechanical Engineering, the division housing all the aforementioned businesses, that it’s easy to forget Refractory Engineering, Goodwin’s second, smaller segment which has been much more reliable in recent years.

Refractory Engineering processes minerals used to make jewellery and tyres, and vermiculite, which has insulating and fire-resistant properties.

Here, too, Goodwin has been investing. A new processing plant in India is supplying the huge domestic jewellery market, and manufacturing lithium ion battery fire blankets made from vermiculite. The company has developed a vermiculite fire extinguishing agent, AVD, and vermiculite fire extinguishers, which it believes outperform rivals. Sales, Goodwin, says, are building slowly.

- Thinking behind Rolls-Royce price target downgrade

- Why investors shouldn’t worry about weak stocks in September

Neither division has been adversely affected by tariffs. Castings for the US navy are exempt, valves for US LNG customers are often imported into tariff-free countries. On a few occasions it has split the cost but mostly US customers pay the 10% surcharge. Exports to China have benefited from high tariffs on rival US refractory products.

Scoring Goodwin: price is the problem

Goodwin says its success comes from numerous unique, sometimes patented, and often vertically integrated capabilities applied to niche markets worth hundreds of millions of pounds, not billions. These do not attract large multinationals because of their small size and high barriers to entry.

To grow in the medium term, Goodwin must fill the niches it has been entering over the last decade. Meanwhile, it will be developing and extending its niches. One prospect is the next generation of nuclear submarines being developed by the AUKUS partnership. It is under contract to work on pre-manufacturing activities.

Developing new niches is complicated and it has often taken longer than Goodwin expects, but Goodwin has rewarded shareholders’ patience in the past.

|

Goodwin |

GDWN |

Casts and machines steel and processes minerals for niche markets |

03/09/2025 |

6.5/10 |

|

How capably has Goodwin made money? |

2.5 | |||

|

Over the last six years, family-run Goodwin has grown revenue modestly and profit in the low double-digits while building capacity and capabilities in niche markets new and old. Although capital expenditure has reduced cash conversion in the past, Goodwin should be less thirsty for capital, for a while at least. | ||||

|

How big are the risks? |

2.5 | |||

|

Contracts with military and nuclear customers are lumpy but secure and diverse revenue streams insulate Goodwin from variations in any one business. Its chair and two managing directors are family members, representing generations of experience. New projects often take longer than expected to commercialise. | ||||

|

How fair and coherent is its strategy? |

3.0 | |||

|

The company has maintained decent levels of profitability while proving it can develop new markets, justifiably raising expectations of growth and confirming its long-term ethos. It has trained a highly skilled workforce, employee retention is high, and the directors pay themselves a relatively modest 10 times the median income of £46,000. | ||||

|

How low (high) is the share price compared to profit? |

-1.5 | |||

|

High. A share price of 9,440p values the enterprise at £733 million, about 26 times profit. | ||||

|

A score of 6.5/10 indicates Goodwin is a somewhat speculative investment. | ||||

|

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

The most difficult aspect of scoring Goodwin this year is the price score. Ordinarily, I use a normalised earnings multiple to calculate it. This is very high (the price is 37 times normalised profit).

The normalised multiple is calculated using average return on capital over the nine years since the oil price crashed in 2016. While the company pivoted, revenues were low, its foundry often operated at a loss, and capital expenditure was high. Although Goodwin remained profitable, after-tax return on capital was unusually low (it bottomed out at 7% in 2017).

Goodwin may experience a similar shock in future, but given the long-term pipeline of work in its mechanical engineering division, that seems unlikely. Even if history repeats itself, Goodwin is more diversified now. Indeed, it believes its newest business, Duvelco, will be the largest and most profitable in years to come (although this is jam tomorrow. It expects the first commercial sales later this year).

I think normalised profit underestimates Goodwin’s earning power. The company earned 26 times adjusted profit in 2025 when the company achieved 15% return on capital. This is probably a more sensible basis for judging the price. It elevates Goodwin’s score by almost a point. Last year, I gave a total score of 5.8 points.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

Cohort (LSE:CHRT) and Jet2 Ordinary Shares (LSE:JET2) have published annual reports and are due to be re-scored.

|

company |

description |

score |

qual |

price |

ih% | |

|

1 |

FW Thorpe |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.5 |

0.1 |

7.3% | |

|

2 |

Howden Joinery |

Supplies kitchens to small builders |

8.0 |

0.6 |

7.2% | |

|

3 |

James Latham |

Distributes imported panel products, timber, and laminates |

7.5 |

1.0 |

7.0% | |

|

4 |

Oxford Instruments |

Manufactures scientific equipment |

7.0 |

1.0 |

6.0% | |

|

5 |

Solid State |

Manufactures electronic systems and distributes components |

7.0 |

1.0 |

5.9% | |

|

6 |

Macfarlane |

Distributes and manufactures protective packaging |

7.0 |

0.9 |

5.8% | |

|

7 |

Jet2 |

Flies holidaymakers to Europe, sells package holidays |

7.0 |

0.9 |

5.8% | |

|

8 |

Renew |

Repair and maintenance of rail, road, water, nuclear infrastructure |

7.5 |

0.4 |

5.8% | |

|

9 |

Hollywood Bowl |

Operates tenpin bowling and indoor crazy golf centres |

7.5 |

0.4 |

5.8% | |

|

10 |

Porvair |

Manufactures filters and laboratory equipment |

8.0 |

-0.1 |

5.7% | |

|

11 |

Renishaw |

Whiz bang manufacturer of automated machine tools and robots |

7.5 |

0.3 |

5.5% | |

|

12 |

Bunzl |

Distributes essential everyday items consumed by organisations |

7.5 |

0.2 |

5.4% | |

|

13 |

Anpario |

Manufactures natural animal feed additives |

7.0 |

0.6 |

5.2% | |

|

14 |

Softcat |

Sells hardware and software to businesses and the public sector |

8.0 |

-0.5 |

5.1% | |

|

15 |

Churchill China |

Manufactures tableware for restaurants etc. |

6.5 |

1.0 |

5.0% | |

|

16 |

Focusrite |

Designs recording equipment, synthesisers and sound systems |

7.5 |

6.5 |

1.0 |

5.0% |

|

17 |

Bloomsbury Publishing |

Publishes books and educational resources |

7.5 |

0.0 |

4.9% | |

|

18 |

YouGov |

Surveys and distributes public opinion online |

7.5 |

-0.2 |

4.6% | |

|

19 |

Advanced Medical Solutions |

Manufactures surgical adhesives, sutures and dressings |

6.5 |

0.7 |

4.4% | |

|

20 |

Auto Trader |

Online marketplace for motor vehicles |

8.0 |

-0.9 |

4.2% | |

|

21 |

Keystone Law |

Operates a network of self-employed lawyers |

7.5 |

-0.4 |

4.1% | |

|

22 |

4Imprint |

Customises and distributes promotional goods |

8.0 |

-1.0 |

4.0% | |

|

23 |

Games Workshop |

Designs, makes and distributes Warhammer. Licences IP |

8.5 |

-1.6 |

3.9% | |

|

24 |

Judges Scientific |

Manufactures scientific instruments |

7.5 |

-0.7 |

3.7% | |

|

25 |

Volution |

Manufacturer of ventilation products |

8.0 |

-1.3 |

3.5% | |

|

26 |

James Halstead |

Manufactures sheet vinyl and LVT |

6.7 |

6.0 |

0.7 |

3.5% |

|

27 |

Dunelm |

Retailer of furniture and homewares |

8.0 |

-1.3 |

3.4% | |

|

28 |

Goodwin |

Casts and machines steel and processes minerals for niche markets |

6.5 |

8.0 |

-1.5 |

3.0% |

|

29 |

Cohort |

Manufactures/supplies defence tech, training, consultancy |

5.9 |

7.5 |

-1.6 |

2.5% |

|

30 |

Quartix |

Supplies vehicle tracking systems to small fleets and insurers |

7.5 |

-1.9 |

2.5% | |

|

31 |

Tristel |

Manufactures disinfectants for simple medical instruments and surfaces |

7.5 |

-2.0 |

2.5% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio, and ss% is the actual size of the Share Sleuth portfolio’s holding.

Last week’s Decision Engine table contained erroneous ih% sizes for Advanced Medical Solutions Group (LSE:AMS), Churchill China (LSE:CHH), Focusrite (LSE:TUNE) and James Halstead (LSE:JHD). I apologise for the error.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Goodwin and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks