Shares for the future: a speculative FTSE 100 investment

It’s by far the biggest business in its field and makes good money, but can it keep growing? Analyst Richard Beddard takes a look under the bonnet in search of clues.

18th July 2025 14:58

Once a classified advertising magazine, Auto Trader Group (LSE:AUTO) describes itself as a data and technology platform built around the UK’s largest online car marketplace.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Auto Trader: scale advantage

Auto Trader says it accounted for more than 75% of the time spent on automotive marketplaces in 2025 and it is more than 10 times larger than its nearest classified competitor.

Mostly, Auto Trader sells used cars. In 2025, it listed an average of 429,000 used car adverts a month, typically for a two-to-six-week duration. Since total used car transactions in the UK were 7.6 million in 2025, an average of 600,000 a month, Auto Trader may have advertised most of them.

No other classified site has the depth of stock or the number of car buyers visiting it. These two factors, stock and buyers, reinforce each other. The more listings, the more attractive Auto Trader is to buyers. The more buyers, the greater the incentive to list stock.

This network effect has been building since the first edition of Hurst’s Thames Valley Trader was published in 1977. It is why Auto Trader is peerless, but it also raises questions about growth.

How can a business that already dominates the market get bigger?

Scoring Auto Trader: doing the right thing

|

Auto Trader |

AUTO |

Online marketplace for motor vehicles |

16/07/2025 |

6.8/10 |

|

How capably has Auto Trader made money? |

3.0 | |||

|

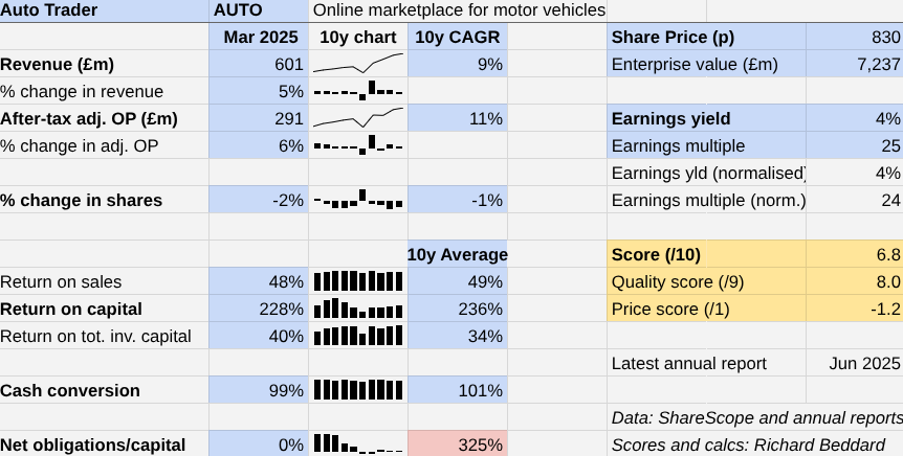

Auto Trader has grown revenue and profit at about 10% compound annual growth rate (CAGR) over the last decade by selling advertising subscriptions to car dealers and additional packages to generate, promote and price listings. As the biggest classified site by far, powerful network effects pull in buyers and dealers. | ||||

|

How big are the risks? |

2.0 | |||

|

Because Auto Trader is dominant it must do more for existing retail customers to grow. It is not clear to me what the potential for growth is and retailers have new competitors: leasing companies, online leasing comparison sites, and manufacturers themselves. | ||||

|

How fair and coherent is its strategy? |

3.0 | |||

|

The Autotrader app is highly rated, and the company tries to do the right thing. Its employees are motivated and loyal. Auto Trader has acquired a leasing platform but despite trying it has yet to find a listings solution for manufacturers. | ||||

|

How low (high) is the share price compared to normalised profit? |

-1.2 | |||

|

High. A share price of 830p values the enterprise at £7,237 million, about 24 times normalised profit. | ||||

|

A score of 6.8/10 indicates Auto Trader is a somewhat speculative investment. | ||||

|

NB: Bold text indicates factors that reduce the score. Bold and italicised text doubly so. The maximum score is 3 for each criterion except price, which has a maximum of 1 (explained here) | ||||

Autotrader magazine published its last edition in 2013, but it had been operating as a website since 1996. Its flotation in 2015 spurred a new phase of digital transformation.

The company has developed products to promote adverts, populate listings with vehicle specifications, value cars, and use trend data to help sellers decide which cars to stock. In 2025, it introduced AI to improve descriptions and imagery in listings and call out the most saleable aspects of each vehicle.

Its focus now is to bring more of the car buying process onto Auto Trader. Car buyers can arrange a test drive, reserve a car and arrange part-exchange or finance through Auto Trader.

Auto Trader earns side incomes amounting to 15% of total revenue in numerous ways. It sells advertising to private sellers and home traders, supplies data to leasing and finance companies, allows logistics companies to bid to transport cars, and sells display advertising to car manufacturers.

- Nick Train reveals new share he ‘should have owned years ago’

- ii view: AI helps drive performance at Auto Trader

Its main customers, though, are car retailers (aka dealers) who subscribe to advertising packages and add-ons. This is why it is focusing on developing new ways to help them sell cars and charge them for it.

The strategy is coherent, but earning more from the same set of customers presents challenges. I can think of two.

The first is the competitive position of retailers, which appears to be weakening, particularly in the new car market. New car listings on Auto Trader are a small fraction of used car listings, but the company is hoping to grow them.

More of us are buying cars online, which has encouraged some manufacturers to sell directly rather than through retailers. And more of us are leasing cars, which has encouraged the growth of leasing price comparison sites.

The company moved to cover leasing when it acquired an online lease broker in 2021 and subsequently integrated lease offers. This business earned £36 million revenue in 2025, although it has yet to break even.

Auto Trader wants to sell more listings to manufacturers, but it says it has yet to find a solution that is “scalable and effective”.

It is also not clear to me how much innovation Auto Trader can do by bringing more of the online sales process on to the platform. If it is not much, growth will be more limited in the future.

I feel confident it will keep trying though.

- Here’s where professional investors are piling in

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Auto Trader says it strives to “do the right thing”. Its search results are not as polluted by paid promotions as famous platforms like Amazon and Google. The Autotrader app is loved by users too. It has a 4.8* rating on each of the two major app stores and Auto Trader has a 4.7* rating on Trustpilot.

I wish the company would publish the results of its retailer satisfaction surveys so we could be more confident its paying customers are happy.

Auto Trader seems to be doing the right thing when it comes to employees. 91% said they were proud to work for Auto Trader in 2025. This number was 6% lower than 2024 but the company explains that result followed the announcement of a second tranche of shares awarded under a scheme that pays employees an additional 10% of their salary vesting over a three-year period.

Employee attrition in 2025 fell 1% to 10%.

Auto Trader by the numbers

The year to March 2024 was a typical year in terms of profitability and cash conversion, but sub-par in terms of growth.

Net financial obligations have declined gracefully to zero since the acquisition of leasing platform Autorama in 2021, which put Auto Trader modestly into debt.

Revenue and profit grew 5% and 6%, which is at the low end of Auto Trader’s normal range (excluding 2021). It follows three years of faster than normal growth after the pandemic.

The company says demand increased throughout the year, which meant cars sold faster. This reduced the length of time stock was listed on Auto Trader and meant retailers relied less heavily on “prominence products” to promote their listings.

22 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score more than 7 out of 10 to be good value. Shares that score 7 or less are good businesses that are not obviously cheap at the moment.

Keystone Law Group Ordinary Shares (LSE:KEYS) and Solid State (LSE:SOLI) have published annual reports and are due to be re-scored.

|

0 |

company |

description |

score |

qual |

price |

ih% |

|

1 |

James Latham |

Imports and distributes timber and timber products |

8.0 |

1.0 |

8.0% | |

|

2 |

Howden Joinery |

Supplies kitchens to small builders |

8.0 |

0.6 |

7.2% | |

|

3 |

Churchill China |

Manufactures tableware for restaurants etc. |

7.5 |

1.0 |

7.0% | |

|

4 |

FW Thorpe |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.5 |

-0.2 |

6.6% | |

|

5 |

Renishaw |

Whiz bang manufacturer of automated machine tools and robots |

7.5 |

0.6 |

6.1% | |

|

6 |

Solid State |

Assembles electronic systems (e.g. computers and radios) and distributes components |

7.5 |

0.5 |

6.1% | |

|

7 |

Focusrite |

Designs recording equipment, loudspeakers, and instruments for musicians |

7.0 |

1.0 |

6.0% | |

|

8 |

Dewhurst |

Manufactures, distributes and fits lift components |

7.0 |

1.0 |

6.0% | |

|

9 |

Oxford Instruments |

Manufactures scientific equipment |

7.0 |

1.0 |

6.0% | |

|

10 |

Bunzl |

Distributes essential everyday items consumed by organisations |

7.5 |

0.4 |

5.8% | |

|

11 |

Macfarlane |

Distributes and manufactures protective packaging |

7.0 |

0.9 |

5.8% | |

|

12 |

Hollywood Bowl |

Operates tenpin bowling and indoor crazy golf centres |

7.5 |

0.3 |

5.7% | |

|

13 |

Porvair |

Manufactures filters and laboratory equipment |

8.0 |

-0.2 |

5.7% | |

|

14 |

Anpario |

Manufactures natural animal feed additives |

7.0 |

0.7 |

5.3% | |

|

15 |

Renew |

Repair and maintenance of rail, road, water, nuclear infrastructure |

7.5 |

0.2 |

5.3% | |

|

16 |

James Halstead |

Manufactures vinyl flooring for commercial and public spaces |

7.0 |

0.6 |

5.2% | |

|

17 |

Jet2 |

Flies holidaymakers to Europe, sells package holidays |

7.5 |

0.1 |

5.2% | |

|

18 |

Bloomsbury Publishing |

Publishes books and educational resources |

7.5 |

-0.1 |

4.9% | |

|

19 |

YouGov |

Surveys and distributes public opinion online |

7.5 |

-0.1 |

4.8% | |

|

20 |

Games Workshop |

Manufactures/retails Warhammer models, licences stories/characters |

9.0 |

-1.7 |

4.7% | |

|

21 |

Softcat |

Sells hardware and software to businesses and the public sector |

8.0 |

-0.7 |

4.5% | |

|

22 |

Advanced Medical Solutions |

Manufactures surgical adhesives, sutures and dressings |

6.5 |

0.7 |

4.4% | |

|

23 |

Auto Trader |

Online marketplace for motor vehicles |

6.8 |

8.0 |

-1.2 |

3.6% |

|

24 |

Dunelm |

Retailer of furniture and homewares |

8.0 |

-1.2 |

3.5% | |

|

25 |

4Imprint |

Customises and distributes promotional goods |

8.0 |

-1.3 |

3.5% | |

|

26 |

Volution |

Manufacturer of ventilation products |

8.0 |

-1.3 |

3.4% | |

|

27 |

DotDigital |

Provides automated marketing software as a service |

6.5 |

0.1 |

3.2% | |

|

28 |

Quartix |

Supplies vehicle tracking systems to small fleets and insurers |

7.5 |

-1.1 |

2.9% | |

|

29 |

Keystone Law |

Operates a network of self-employed lawyers |

7.0 |

-0.7 |

2.6% | |

|

30 |

Judges Scientific |

Manufactures scientific instruments |

7.5 |

-1.5 |

2.0% | |

|

31 |

Goodwin |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

8.0 |

-2.3 |

1.4% | |

|

32 |

Tristel |

Manufactures disinfectants for simple medical instruments and surfaces |

7.5 |

-2.3 |

0.4% | |

|

33 |

Cohort |

Manufactures military technology, does research and consultancy |

7.5 |

-2.3 |

0.4% |

Click on a share's score to see a breakdown (scores may have changed due to movements in share price). Key: qual is the share’s score out of 9 for the three quality factors (capabilities, risks, and strategy), price is the price score from -3 to +1, and ih% is the suggested ideal holding size as a percentage of the total value of a diversified portfolio.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Auto Trader and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks