Shares for the future: the stock I’ve chosen to replace Next

As part of a project to replace four stocks in his Decision Engine, analyst Richard Beddard revisits an old friend for inspiration.

7th March 2025 15:16

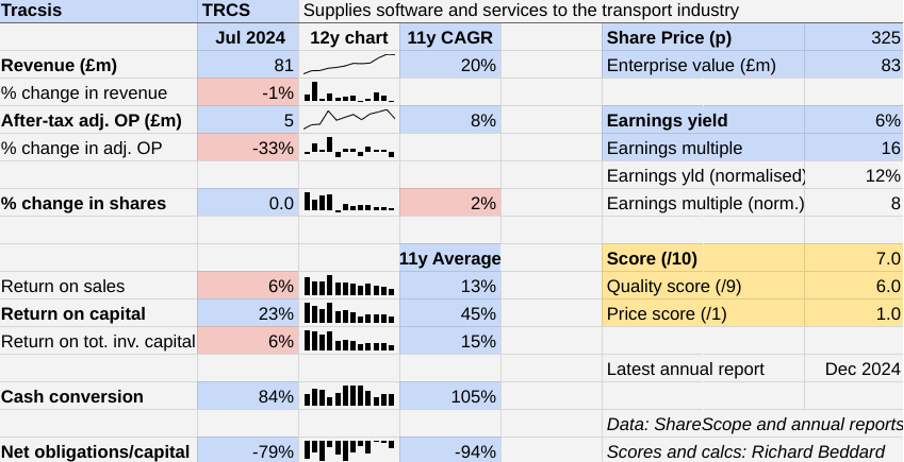

Today, I’m dusting off my notes on Tracsis (LSE:TRCS), a transport technology, services and consultancy company.

Tracsis used to be a constituent of the Decision Engine, but the last year I scored was the year to July 2022.

- Invest with ii: Open an ISA | Top ETFs | Transfer an ISA to ii

After more than a decade of strong growth, the share price was uncomfortably high and the company was about to reorganise itself. Rather than score it in 2023, I decided to wait and see what emerged.

Now, with the share price at levels last witnessed in 2014, it feels like a good time to take stock.

Scoring Tracsis: rail focus

Although profit fell sharply in the year to July 2024, and according to a trading update last week it has spluttered since, I am putting Tracsis back into the system.

The Past (dependable) [2.5]

- Profitable growth: Strong growth until 2023 [0.5]

- Strong finances: Very [1]

- Through thick and thin: Lowest Return on Capital 23% (2024) [1]

In the year to July 2024, revenue contracted slightly, but full-year adjusted profit fell 33%. The company blamed reduced activity during the UK general election, when government spending decisions were paused.

Most of the damage to profit was done in the Data, Analytics, Consultancy and Events division, which the company has restructured.

Adjusted profit also declined slightly in the company’s Rail Technology and Services division.

Rail revenue halved in North America, which contributed only 5% to total revenue in 2024 compared to 11% in 2023. This is a market Tracsis entered in 2022 with the acquisition of RailComm (now rebranded Tracsis US). Sales of rail yard automation systems were disrupted as it recruited a new sales team.

The Rail division is also sacrificing upfront revenue from perpetual licences as it moves software customers on to contracts that generate repeat revenue.

It feels odd giving Tracsis a near maximum score of 2.5 for dependability after such a strong decline in profit. The results are not sufficient to extinguish its long-term track record, though.

Tracsis has grown revenue handsomely (20% compound annual growth rate (CAGR)) over the long-term. Despite the fall in adjusted profit in 2024, profit has grown 8% CAGR.

The business in 2024 was half as profitable as the long-term average, but it still achieved a 23% return on capital after tax.

Cash flow fell as a proportion of profit due to higher than usual investment, and redundancies. Despite this, Tracsis added to its cash surplus.

The half-year results will be published on 24 April but Tracsis has already indicated that it achieved flat revenue and a reduced profit margin.

- Stockwatch: is talk of recession overly pessimistic or fair?

- Tax year end tips for six-figure earners

This was due to lower revenue from Remote Condition Monitoring (RCM) hardware in the Rail division, and an unexplained reduction in profitability in Tracsis’ Data, Analytics, Consultancy and Events division.

RCM systems monitor switches (aka points), grade crossings (aka level crossings) and other rail infrastructure, reporting potential problems.

Network Rail, the government-funded owner and operator of Britain’s rail network, is currently in the first year of a five-year funding and planning Control Period that started in March 2024. Tracsis says it started to experience a downturn in RCM revenue as the old Control Period ended.

The transition between Control Periods can cause disruption because priorities change and new projects take time to get under way. Based on past experience, Renew Holdings (LSE:RNWH), another company that maintains the railways, also expects spending to recover this year.

But the disruption is, along with last year’s election, a reminder that Tracsis is dependent on government funding, which presents more challenges just now.

Government finances are strained, and the government is planning to mash up Network Rail, the train operating companies and their umbrella organisation, The Rail Delivery Group, into the nationalised Great British Railways. The company says this may delay procurement decisions too.

Set against industry upheavals, Tracsis’ offers us its potential order book, a largely imaginary thing until it is converted into orders. It believes the pipeline of orders has ballooned due to new products in the UK, and the opportunity to sell a new rail dispatch system and its UK developed RCM systems in North America.

The Present (distinctive) [2]

- Discernible business: Rail-focused hotchpotch of technology, consultancy, and services [0.5]

- With experienced people: Somewhat [0.5]

- That creates value for customers: Safer more efficient transport [1]

Tracsis is the product of 16 acquisitions since it floated in 2007.

The biggest of the company's two divisions by revenue is the smaller by profit. As it sounds, the non-Rail division is a hotchpotch of businesses that survey traffic for highway authorities, monitor assets for utilities, manage traffic for large events and provide data services.

Tracsis’ growth prospects lie in the more profitable and reliable Rail division, which probably explains why it has spent substantially more on Rail acquisitions over the years.

- Stockwatch: coming of age as a global consumer technology share

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The company was spun out of a project to develop scheduling software at the University of Leeds in 2004. Since it floated, Tracsis has acquired and developed a range of operation performance software for train operators. It encompasses timetabling, stock and crew planning, delay logging, and train dispatch. Tracsis also supplies operators with software for tap and pay digital tickets and automatic delay repay.

It also supplies Network Rail and its contractors with remote condition monitoring software and RailHub, software for planning and managing work on the railway.

If that sounds like a complex agglomeration of small businesses to you, it does to me too. The task of making sense of it belongs to chief executive Chris Barnes. He joined from Ricardo in 2019 and his five-year stint has been eventful.

He steered Tracsis through the pandemic, established a foothold in North America, and is now reorganising the business.

Chief financial officer Andrew Kelly joined in 2021.

The Future (directed) [1.5]

- Addressing challenges: Complexity, Consolidation of large customers in GBR [0]

- With coherent actions: Centralisation, focus on Rail, acquisitions [0.5]

- That reward all stakeholders fairly: Employee focus [1]

Tracsis is facing up to its acquisitive past by uniting its disparate subsidiaries. This is changing the company’s culture, strategy, branding and technology platforms.

It has shifted from an “owner manager” culture, in which subsidiaries operate independently, to four collaborative business units, two in each of its divisions. They are: Rail Technology UK, Rail Technology North America, Traffic Data and Events, and Professional Services.

Within these divisions, all non-Tracsis brands also bear the mothership’s name, and the company is uniting software platforms to make its products easier to work on and more efficient to configure.

Tracsis has introduced new back-office systems, beefed up management, set up a leadership development scheme dubbed “OneTracsis”, and made job opportunities across the group available to internal candidates, facilitating career development.

At some point acquisitive companies often introduce measures to get their subsidiaries working more closely together. The expectation is that the group can be greater than the sum of its parts.

- Bitcoin and crypto stocks: how to invest in them

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

This is appealing in the Rail division because they all supply technology, often to the same customers. The company foresees Rail-focused growth and growing levels of recurring software revenue spurred by a new generation of products built on the common technology platform.

One of its promising new products is the Tap Converter System, which is contracted to be deployed in urban areas across National Rail from 2026. It did not disclose the potential value of the contract when it announced it in February.

Tap Converter is a smart ticketing system that processes data from smartcards, contactless bankcards and mobile apps when passengers tap in and out of commuter stations. It calculates the best fare, applies discounts, and provides the information to the operator so it can charge the customer.

The consolidation of technologies and people seems like coherent policy, but we have yet to see how this impacts performance. The rationale for owner-managed independent subsidiaries is that they can be more entrepreneurial than divisions in a heavily coordinated business, which can be more bureaucratic.

If the restructuring has ruffled staff, though, I cannot see it in the numbers. They may bear out the company’s mantra that “Technology makes it possible, people make it happen.” During a period of disruption, Tracsis reported 66% employee engagement compared to 60% in 2023. Employee retention was 89%.

It does not sound like staff are running for the exit and Chris Barnes says he is confident engagement has improved since Tracsis’ most recent survey, as the transformation has bedded in.

The price (discounted?) [1]

- Yes. A share price of 325p values the enterprise at about £83 million, 8 times normalised profit.

Normalised profit is the profit Tracsis would have achieved if it had earned its average return on capital of 45% in 2024, not the actual figure of 23%. It assumes 2024 was a bad year, not the new normal.

Usually, I would say a company with a score of 7 “may well be” a good long-term investment, but Tracsis feels more on the edge than that. Maybe it will be a good long-term investment! The story is complicated, and it is too early for me to be confident in the turnaround.

I want to see what develops, which is why I have added it to the Decision Engine. It takes the place of Next (LSE:NXT), for now.

It is ranked 24 out of 40 shares.

25 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Quartix Technologies (LSE:QTX) has published its annual report and is due to be re-scored.

|

0 |

Company |

* |

Description |

Score |

|

1 |

Manufactures tableware for restaurants and eateries |

10.0 | ||

|

2 |

Supplies kitchens to small builders |

9.1 | ||

|

3 |

Imports and distributes timber and timber products |

9.0 | ||

|

4 |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.7 | ||

|

5 |

Manufactures pushbuttons and other components for lifts and ATMs |

8.5 | ||

|

6 |

Distributor of protective packaging |

8.5 | ||

|

7 |

Repair and maintenance of rail, road, water, nuclear infrastructure |

8.3 | ||

|

8 |

Manufactures computers, battery packs, radios. Distributes components |

8.3 | ||

|

9 |

Manufacturer of scientific equipment for industry and academia |

8.2 | ||

|

10 |

Flies holidaymakers to Europe, sells package holidays |

8.1 | ||

|

11 |

Whiz bang manufacturer of automated machine tools and robots |

8.0 | ||

|

12 |

Designs recording equipment, loudspeakers, and instruments for musicians |

8.0 | ||

|

13 |

Distributes essential everyday items consumed by organisations |

7.8 | ||

|

14 |

Operates tenpin bowling and indoor crazy golf centres |

7.7 | ||

|

15 |

Manufactures vinyl flooring for commercial and public spaces |

7.7 | ||

|

16 |

Sells hardware and software to businesses and the public sector |

7.7 | ||

|

17 |

Surveys and distributes public opinion online |

7.5 | ||

|

18 |

Manufactures/retails Warhammer models, licences stories/characters |

7.4 | ||

|

19 |

Manufactures filters and filtration systems for fluids and molten metals |

7.4 | ||

|

20 |

Manufactures surgical adhesives, sutures, fixation devices and dressings |

7.4 | ||

|

21 |

Retailer of furniture and homewares |

7.4 | ||

|

22 |

Online marketplace for motor vehicles |

7.2 | ||

|

23 |

Sells promotional materials like branded mugs and tee shirts direct |

7.1 | ||

|

24 |

Tracsis |

Supplies software and services to the transport industry |

7.0 | |

|

25 |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

7.0 | ||

|

26 |

Sources, processes and develops flavours esp. for soft drinks |

6.9 | ||

|

27 |

Online retailer of domestic appliances and TVs |

6.8 | ||

|

28 |

Manufactures natural animal feed additives |

6.6 | ||

|

29 |

Acquires and operates small scientific instrument manufacturers |

6.6 | ||

|

30 |

Translates documents and localises software and content for businesses |

6.5 | ||

|

31 |

Publishes books, and digital collections for academics and professionals |

6.4 | ||

|

32 |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

5.9 | ||

|

33 |

Manufactures military technology, does research and consultancy |

5.7 | ||

|

34 |

Supplies vehicle tracking systems to small fleets and insurers |

5.7 | ||

|

35 |

Manufactures disinfectants for simple medical instruments and surfaces |

5.6 | ||

|

36 |

Manufactures sports watches and instrumentation |

5.6 | ||

|

37 |

Makes marketing and fraud prevention software, sells it as a service |

5.2 | ||

|

38 |

Runs a network of self-employed lawyers |

4.9 | ||

|

39 |

Develops and manufactures hygiene, baby, and beauty brands |

4.4 | ||

|

40 |

Manufactures specialist paper, packaging and high-tech materials |

3.8 |

Scores and stats: Richard Beddard. Data: ShareScope and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Tracsis and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine, please see Richard’s explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks