Shares for the future: why I like this highly rated market leader

This company is the largest player in its industry and ranks in the top half of analyst Richard Beddard’s list of 40 stocks. Here’s why it could be a good long-term investment.

31st January 2025 15:02

A sub-par performance from Hollywood Bowl Group (LSE:BOWL) in the year to September 2024 does not undermine the long-term investment case for a smooth operator.

Scoring Hollywood Bowl: gateway employer

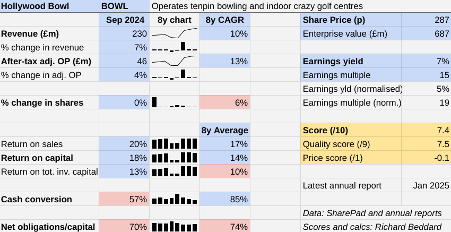

Tenpin bowling centre operator Hollywood Bowl increased annual revenue by 7% and after-tax adjusted operating profit by 4%, below its long-term average growth rates.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

It achieved 18% Return on Capital (ROC) which is typical, with the exception of two years of pandemic when, with support, it had to contend with closures and social distancing rules.

The Past (dependable) [2.5]

- Profitable growth: 10% revenue and profit growth (CAGR) [1]

- Strong finances: Net obligations more than 50% of capital [0.5]

- Through thick and thin: lowest ROC 17% (exc. 2020/21) [1]

In the UK, where Hollywood Bowl earns 87% of revenue, four new centres added sales, but like-for-like sales were flat.

The company says we were distracted by the Olympics and Euro 2024, and the previous year benefited from bad weather, which drove people indoors.

In Canada, where Hollywood Bowl earned 13% of revenue, all the metrics moved in the right direction.

Cash conversion was low by historical standards as Hollywood Bowl more than doubled capital expenditure to refurbish old centres and kit out new ones.

Net obligations were stable at 70% of operating capital.

Like all big employers, Hollywood Bowl must cope with the rise in employer’s national insurance which will be implemented in April. It will cost the company £1.2 million a year.

Considering Hollywood Bowl made nearly £50 million in after-tax profit in 2024, the increase in costs should be a minor ding.

The company is upbeat about its prospects. As a low-cost source of indoor fun, it is likely to prosper even when weaker operators struggle.

The Present (distinctive) [3]

- Discernible business: Large, efficient bowling centre operator [1]

- With experienced people: Very experienced executives [1]

- That creates value for customers: Affordable fun [1]

Hollywood Bowl is the UK’s biggest chain of bowling centres. The main activity, tenpin bowling, brings in just under half of revenue. The rest comes from food, amusements, and small contributions from crazy golf and the installation of bowling equipment in Canada.

The bowling centres are generally located in out-of-town retail and leisure parks, co-located with cinemas and restaurants so Hollywood Bowl can benefit from high footfall.

Landlords favour Hollywood Bowl because of its profitability. While the leases are a big financial obligation, landlord and tenant are mutually dependent. When centres were shut during the pandemic, landlords reduced, waived, or delayed the rent rather than risk losing a reliable tenant.

Steadily growing earnings also finance innovations in the format, refurbishment of existing centres, and new centres.

Hollywood Bowl has introduced pins on strings, a more reliable method of setting up the bowling pins than old-school pin-spotting machines. This reduces downtime and increases the profitability of lanes. Pins on strings are now installed in all but two of the company's UK centres.

- BATS among 10 blue-chip stocks set to pay £3.2bn in dividends

- Stockwatch: a share to benefit from infrastructure spending

The company also uses dynamic pricing, charging more for bowling at busy times and encouraging higher usage in quiet times with lower prices.

During 2024, Hollywood Bowl introduced a new booking system developed in-house. It is cheaper to operate than the prior third-party system and integrated with the company’s marketing and other systems.

Efficiencies like these means Hollywood Bowl can offer customers the lowest price per game in the UK and a cheap outing for friends and families relative to other leisure activities. It says a family of four can bowl for £26.

This well-oiled business model was developed by the current executives, chief executive Stephen Burns and chief financial officer Lawrence Keen. The company’s long-standing chair, Peter Boddy, has just retired.

The Future (directed) [2]

- Addressing challenges: Limits to growth in the UK? [0.5]

- With coherent actions: New formats, international expansion [0.5]

- That reward all stakeholders fairly: Customer/employer focus [1]

Although Hollywood Bowl has increased the revenue and profit it earns from established centres over the years, its main source of growth is rolling out new centres.

A glance at the map of Hollywood Bowl locations shows that it has the more densely populated areas of the UK pretty well covered. Since rivals fill in some of the gaps, the company may one day find it harder to locate viable new sites here.

This would explain the company’s enthusiasm for diversification. In 2020, it opened the first of five Puttstars mini golf centres and in 2022 it acquired Splittsville, a small Canadian chain of bowling centres.

Since Hollywood Bowl floated in 2016, it has increased the number of centres it operates by 31, from 54 UK centres to 85 centres in total, 72 of them in the UK and 13 in Canada.

It is targeting growth in its UK brand, Hollywood Bowl, by 28 centres to 100 by 2035. It reckons the Canadian brand Splittsville can grow by 17 more centres (to a total of 30) in the same time frame.

If it achieves these targets the company will have grown its estate by 53%, 39% in the UK and 131% in Canada.

Canada is attractive because it is a fragmented and under-invested market, a bit like the UK was before Hollywood Bowl’s roll-out.

The market of more than 170 centres is mostly independents. With just 13 centres, Splitsville is the biggest chain.

- High-flying Raspberry Pi optimistic about 2025

- Why the pound’s decline can be a shrewd investor’s gain

Splittsville is acquiring and opening new centres and rolling out elements of the Hollywood Bowl format, like the new booking system and pins on strings. It is testing others, allowing bowlers to wear their own shoes and dynamic pricing for example.

The roll-out is supported by Striker Bowling Solutions (SBS), a supplier and installer of bowling equipment in Canada that Hollywood Bowl acquired with Splittsville.

Owning an equipment supplier also gives the company insight into other Canadian operators, and might acquire.

The roll-out requires trade-offs. The Hollywood Bowl format is less appealing to some bowling enthusiasts who frown on pins and strings. But these are issues the company has also faced in the UK as it has broadened the activity’s appeal.

The immaturity of the chain is probably weighing on adjusted operating profit margins. At roughly 15% in 2024, they were little more than half of the Hollywood Bowl’s brands. This should improve centres to reach their potential and immature new centres are less of a drag on the existing estate.

Puttstars has not lived up to expectations and the company no longer sees it as a priority for investment. It has renamed the existing five centres “Putt & Play from Hollywood Bowl”, written down the value of property and leases related to them, and folded one into an adjacent bowling centre.

The company is still interested in other activities, and Stoked (acquired in 2014) may point the way. Stoked is a large footprint multi-activity centre in Saskatoon, Canada. As well as bowling it has electric go-kart racing, indoor high ropes and a zip line.

The company believes customer satisfaction is driven by value for money, cleanliness, friendliness, and service speed, which it achieves with trained and motivated teams.

Centre staff are often young and paid an hourly living wage rate plus bonuses. Pay is modest but the company says staff turnover is lower than the high turnover hospitality sector in general.

Perhaps this is because of the emphasis the company puts on engaging with team members and the opportunity for promotion. Managers meet employees face to face at least once a month, and 11% of employees participated in management development programmes in 2024.

This resulted in internal candidates being promoted to 58% of management appointments in 2024. At management level incentives really kick in. Centre managers received 65% of their pay in bonuses.

Judging by a high customer Net Promoter Score (NPS) of 70%, and generally positive reviews for bowling centres, the system works.

The price (discounted?) [-0.1]

- No. A share price of 287p values the enterprise at about £687 million, 19 times normalised profit.

A score of 7.4 out of 10 suggests Hollywood Bowl is a good long-term investment.

It is ranked 16 out of 40 shares in my Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Renew Holdings (LSE:RNWH) and RWS Holdings (LSE:RWS) have published annual reports and are due to be re-scored.

|

0 |

Company |

* |

Description |

Score |

|

1 |

Manufactures tableware for restaurants and eateries |

10.0 | ||

|

2 |

Imports and distributes timber and timber products |

9.0 | ||

|

3 |

Supplies kitchens to small builders |

8.8 | ||

|

4 |

Repair and maintenance of rail, road, water, nuclear infrastructure |

8.6 | ||

|

5 |

Makes light fittings for commercial and public buildings, roads, and tunnels |

8.6 | ||

|

6 |

Manufactures pushbuttons and other components for lifts and ATMs |

8.5 | ||

|

7 |

Distributor of protective packaging |

8.4 | ||

|

8 |

Manufactures computers, battery packs, radios. Distributes components |

8.4 | ||

|

9 |

Manufacturer of scientific equipment for industry and academia |

8.0 | ||

|

10 |

Designs recording equipment, loudspeakers, and instruments for musicians |

8.0 | ||

|

11 |

Flies holidaymakers to Europe, sells package holidays |

7.8 | ||

|

12 |

Sells hardware and software to businesses and the public sector |

7.8 | ||

|

13 |

Manufactures filters and filtration systems for fluids and molten metals |

7.5 | ||

|

14 |

Manufactures surgical adhesives, sutures, fixation devices and dressings |

7.5 | ||

|

15 |

Manufactures/retails Warhammer models, licences stories/characters |

7.4 | ||

|

16 |

Hollywood Bowl |

Operates tenpin bowling and indoor crazy golf centres |

7.4 | |

|

17 |

Whiz bang manufacturer of automated machine tools and robots |

7.3 | ||

|

18 |

Distributes essential everyday items consumed by organisations |

7.3 | ||

|

19 |

Surveys and distributes public opinion online |

7.2 | ||

|

20 |

Manufactures vinyl flooring for commercial and public spaces |

7.2 | ||

|

21 |

Online marketplace for motor vehicles |

7.1 | ||

|

22 |

Translates documents and localises software and content for businesses |

7.0 | ||

|

23 |

Manufactures PEEK, a tough, light and easy to manipulate polymer |

7.0 | ||

|

24 |

Acquires and operates small scientific instrument manufacturers |

6.9 | ||

|

25 |

Online retailer of domestic appliances and TVs |

6.8 | ||

|

26 |

Sells promotional materials like branded mugs and tee shirts direct |

6.8 | ||

|

27 |

Sources, processes and develops flavours esp. for soft drinks |

6.8 | ||

|

28 |

Manufactures natural animal feed additives |

6.8 | ||

|

29 |

Retails clothes and homewares |

6.5 | ||

|

30 |

Supplies vehicle tracking systems to small fleets and insurers |

6.0 | ||

|

31 |

Manufactures military technology, does research and consultancy |

6.0 | ||

|

32 |

Publishes books, and digital collections for academics and professionals |

5.9 | ||

|

33 |

Casts and machines steel. Processes minerals for casting jewellery, tyres |

5.8 | ||

|

34 |

Manufactures sports watches and instrumentation |

5.5 | ||

|

35 |

Manufactures power adapters for industrial and healthcare equipment |

5.5 | ||

|

36 |

Manufactures disinfectants for simple medical instruments and surfaces |

5.4 | ||

|

37 |

Makes marketing and fraud prevention software, sells it as a service |

5.3 | ||

|

38 |

Runs a network of self-employed lawyers |

4.8 | ||

|

39 |

Develops and manufactures hygiene, baby, and beauty brands |

4.4 | ||

|

40 |

Manufactures specialist paper, packaging and high-tech materials |

3.8 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

For more on the Decision Engine see Richard’s end of year explainer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks