A solid long-term investment plus my view on Palantir Technologies

A reasonable valuation and respectable dividend yield continue to make this a share to own, argues overseas investing expert Rodney Hobson. He also looks at a high-flying tech super stock.

19th February 2025 08:36

With tech stocks capturing the attention of investors over the past few months, some solid companies have been unfairly overlooked. However exciting you want your portfolio to be, it does make sense to include defensive stocks in case excitement turns into disappointment.

Such a reliable prospect is Johnson & Johnson (NYSE:JNJ), which ended 2024 in great form, claiming that results demonstrated it was sustaining its high pace of growth and innovation. Behind the rhetoric was 5.3% growth in sales to $22.5 billion in the last three months of the year but, alas, there was a 17% fall in net earnings to $3.4 billion.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

So sales growth improved from earlier in the year but earnings, which had been growing strongly during the first nine months, tailed off disappointingly. J&J continued to perform well in its home base in the United States but it struggled somewhat overseas, especially in China where headwinds are expected to continue.

Undaunted, chair and chief executive Joaquin Duato is confident that sales will rise by around 3% this year. Some caution is required. The figure for the whole of 2024 was 4.3% so Duato’s projection is fine but no great shakes. Nor should investors take too much notice of fine words about “a transformative year” and “an accelerating pipeline and industry-leading investments in innovation”. Figures speak louder than words.

What does count is that J&J is specialising in diseases where treatments are few, non-existent or ripe for improvement such as myeloma, lung cancer, inflammatory bowel disease and heart failure. It has a strong and diversified pipeline of drugs, which is essential for any pharmaceutical company in a world where so many promising treatments fail to make it to market and where patent protection is short-lived.

- Cash at 15-year lows triggers ‘sell’ signal

- Focus on booming Chinese tech sector

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

That pipeline has been boosted by carefully chosen acquisitions, most recently neurological drug development company Intra-Cellular Therapies which takes J&J into mental health treatments.

This diversification does ensure that the group has an enviably broad range of products on the go but it can present challenges. For instance, Stelara, a treatment for psoriasis, saw sales decline 15% worldwide in the final quarter. This was not a one-off problem as Stelara’s decline in sales is accelerating. Sales of Covid-19 vaccine are also understandably falling off a cliff edge.

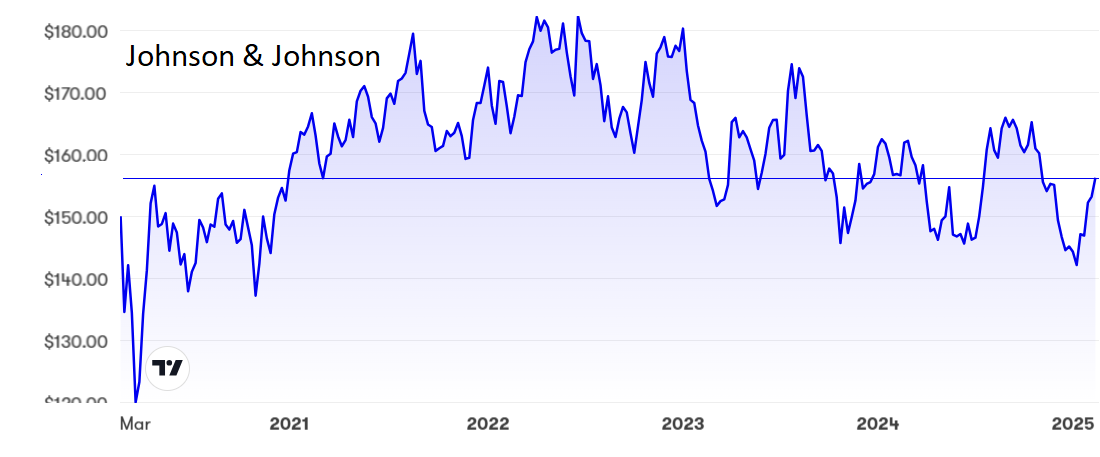

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have tipped J&J several times at prices ranging from $147 to $159, and am disappointed that the shares have stuck around $155, where the price/earnings (PE) ratio is lower than for most American stocks at 27 while the dividend is just over 3%. This company is ideal for anyone seeking a long-term solid investment. The shares are still a buy.

Update: It really is impossible to make a sensible comment on Palantir Technologies Inc Ordinary Shares - Class A (NASDAQ:PLTR), a technology company whose share price is based entirely on sentiment rather than hard facts. I felt the share price had got a bit silly at $37, given that there was no prospect of any dividend and the PE ratio had topped 200. The valuation has since got three times sillier at $117, where the PE is more than 600. Yes, that’s right: at the current rate of earnings it will take 600 years to recover the cost of your investment. This share has soared along with the wider technology sector in the United States, where there are far better prospects with high ratings that are easier to justify. I still believe that reality will prevail and that when it does there will be blood on the carpet. All my earlier warnings to get out have proved spectacularly wrong, but some day I expect to be proved spectacularly right. If you are in, do at least consider taking some profits. If you are out, stay well clear.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks