Stock market winners and losers during Trump’s first 100 days

So much has happened since President Trump took charge again, City writer Graeme Evans rounds up the action and names the stocks and financial markets that have thrived or dived.

30th April 2025 15:09

Picture credit: Chip Somodevilla/Getty Images.

A wild ride for investors has left portfolios looking vastly different after Donald Trump’s first 100 days in the White House served up the chance to buy Rolls-Royce Holdings (LSE:RR.) and income stocks at much cheaper prices and led to big losses for holders of BP (LSE:BP.) and Glencore (LSE:GLEN).

Many UK-focused blue-chips weathered the turbulence, with over a fifth of the FTSE 100 index up by 10% or more in the period since the inauguration in mid-January.

- Learn with ii: Cash ISA vs Shares ISA | Can you Transfer Shares into an ISA? | Transfer a Stocks & Shares ISA

The biggest beneficiaries have included the defence-focused BAE Systems (LSE:BA.) and Babcock International Group (LSE:BAB) after gains of 41% and 60% respectively, while the flight to the safe haven of gold helped Endeavour Mining (LSE:EDV) to jump 32%.

Hopes that the UK economy is better insulated than many against the growth shock of Trump’s Liberation Day tariffs helped Next (LSE:NXT)and Lloyds Banking Group (LSE:LLOY) to feature among the top 10 best performers after adding 29% and 25% respectively between close of business on Friday 17 January and end of day on 29 April.

Just under half the pair’s gains followed Trump’s announcement of a 90-day pause on most global tariffs, a concession that has led to much calmer market conditions in recent weeks.

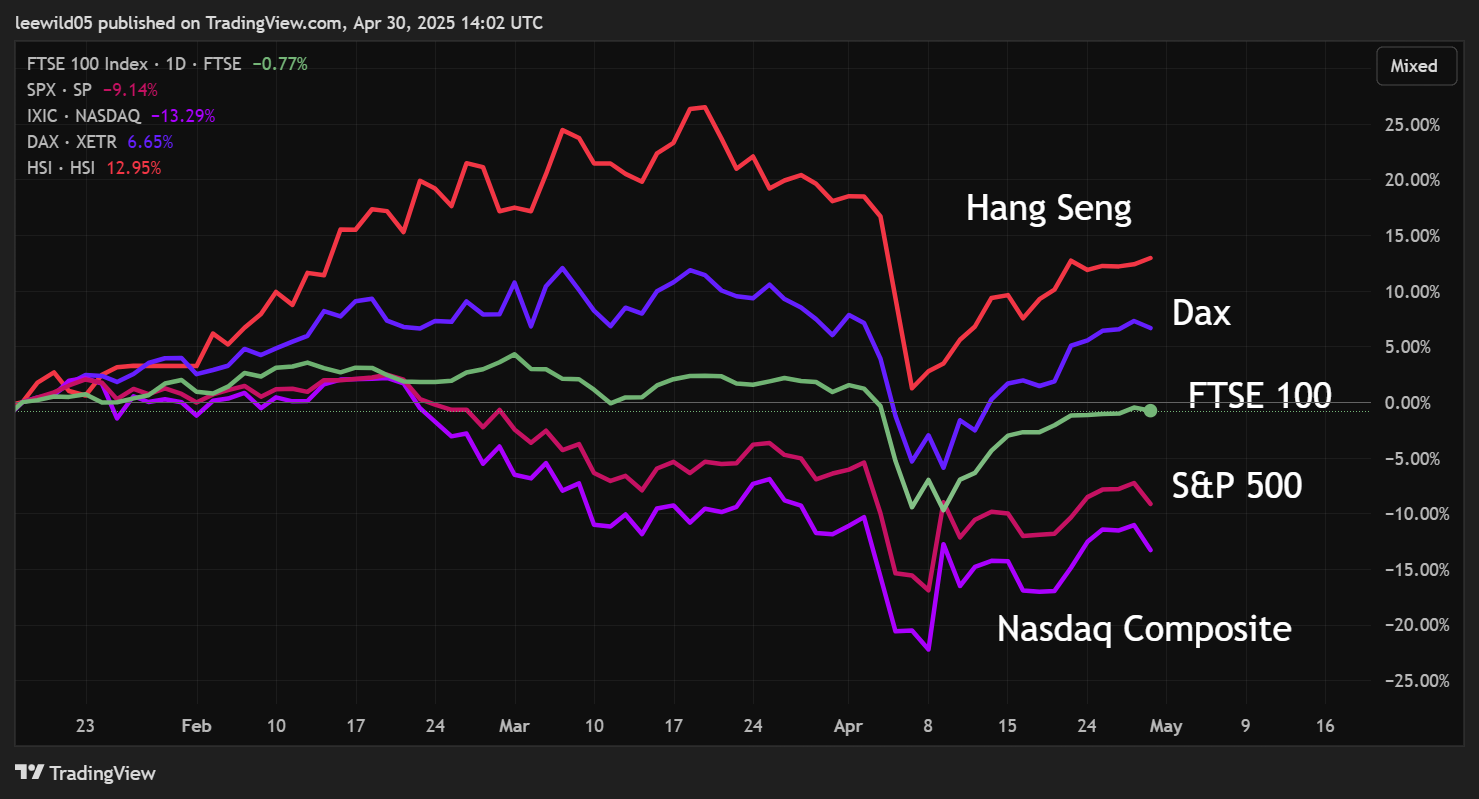

A 7% advance since the 9 April low, which included the top flight’s best run since 2017, means the FTSE 100 index is among the best-performing benchmarks of Trump’s administration.

Source: TradingView. Past performance is not a guide to future performance.

The apparent resilience shown in the flat performance in the past 100 days masks some big individual moves, with the initial tariff turmoil leaving Rolls-Royce back at levels seen before February’s beat-and-raise annual results.

From 588p on the eve of Trump’s inauguration, the shares touched a record of 818p before falling as far as 635.8p. They have since rallied back to 750p.

Investors were also presented with an opportunity to lock in income plays such as Legal & General Group (LSE:LGEN) or Aviva (LSE:AV.) at much cheaper prices. The latter has since rallied 12%, ranking it alongside NatWest Group (LSE:NWG), Centrica (LSE:CNA) and Admiral Group (LSE:ADM) among the 25 best performing blue-chip stocks of the first 100 days.

Others include the defensively positioned Imperial Brands (LSE:IMB) and National Grid (LSE:NG.), while Games Workshop Group (LSE:GAW) has attracted new followers with a rise of 14% in the past few weeks.

On the other side of the FTSE 100, the impact of tariffs uncertainty on commodity prices or the outlook for global trade has left a quarter of the top flight down 10% or more.

The worst-performing stock has been Bunzl (LSE:BNZL), which has fallen 33% after its own operational challenges added to US economic uncertainty in April’s profit warning.

Fears that weaker China demand will further delay the recovery of coal prices was one factor as Glencore fell 30% as the hardest hit of all the mining industry players.

- What City thinks of BP shares after profit slip-up

- Stockwatch: should you buy into L&G’s dividend dip?

- Investment outlook as US/China force world to pick sides

A decline of 19% to a three-year low for BP reflected fears over how a reverse in the Brent crude price to below $65 a barrel will impact the capacity for shareholder distributions. Shell (LSE:SHEL) fell by 10%.

Apart from Bunzl, the worst-performing stocks of the Trump administration all showed an improvement in the period since 9 April. They included British Airways owner International Consolidated Airlines Group SA (LSE:IAG), which rallied 12% to narrow the 100-day deficit to 17% after worries over the outlook for transatlantic demand earlier derailed its turnaround.

Other recoveries have been achieved by the tech-focused Pershing Square Holdings Ord (LSE:PSH), Scottish Mortgage Ord (LSE:SMT) and Polar Capital Technology Ord (LSE:PCT), although they remain sharply lower after tariff volatility extended an ongoing retreat for Magnificent Seven stocks.

Professional investors were calling time on the period of “US exceptionalism” even before the Liberation Day announcement, with March’s biggest rotation out of US stocks the biggest in the three-decade history of Bank of America’s survey of global fund managers.

The following month’s report showed the end of the Magnificent Seven’s two-year run as the most crowded trade.

As investors have dumped their US positions, Deutsche Bank points out that Germany’s Dax index has outperformed the S&P 500 in dollar terms by 25.5 percentage points since Trump’s inauguration day.

Despite a recent steadying of sentiment, the S&P 500 index and Nasdaq 100 are sitting on global-leading declines of 7% and 9% respectively during Trump’s tenure.

Tariffs are not the only explanation for the loss of confidence in mega-cap assets, given that valuations were already elevated following a strong run up until inauguration day.

- Stockwatch: is trade tariff risk really receding?

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The emergence of the low-cost DeepSeek model also fuelled jitters over China’s threat to American dominance of AI. Investors are also dealing with the fallout from Trump signing 142 executive orders, which Deutsche Bank points out eclipses the 42 of Joe Biden’s first 100 days and the next best of 99 by Franklin Roosevelt in 1933.

The bank added: “From here, the next big milestone will be 9 July, when the current 90-day tariff extension runs out. Markets are fairly sanguine right now that the 90-day reprieve will become permanent for most countries. Nevertheless, the most likely steady state for tariffs at that point is still the highest rate since the end of the 1930s.”

The impact of White House restrictions on chip exports to China means NVIDIA Corp (NASDAQ:NVDA) has been one of the worst-performing tech giants of the Trump administration. It recently said a requirement to obtain licences to export its H20 chips to China will mean an inventory charge of $5.5 billion (£4.1 billion) in the current quarter.

Nvidia ended the first 100 days of the Trump administration 21% lower for a market capitalisation of $2.7 trillion, behind Apple Inc (NASDAQ:AAPL) at $3.2 trillion and Microsoft Corp (NASDAQ:MSFT) with a valuation near $2.9 trillion at last night’s closing bell.

The decline for Nvidia included the benefit of a frenzied session of buying due to relief at the 90-day pause for most global tariffs.

The announcement caused the S&P 500 index to jump 9.5% in its third-best percentage performance since 1939, while the tech-focused Nasdaq Composite bounced 12% as Nvidia shares put back 19%.

Apple also rallied 15% in one session, but remains under pressure given the key role that China and other Asian countries play in the supply chain for iPhones, MacBooks and other hardware.

- What 100 days of Trump 2.0 has meant for investors

- Shares for the future: my view of Bunzl after share price crash

Tesla Inc (NASDAQ:TSLA), whose market value jumped 93% in the wake of the US election from $800 billion to December’s $1.5 trillion, has fallen 31.5% since Trump took office.

The slide as the third-worst performing Nasdaq 100 stock came as tariffs led to materially weaker volumes across the automotive industry and demand suffered from the negative perception of Elon Musk’s involvement in US politics.

Overall, this is the worst performance by Wall Street and the US dollar out of the first 100 days of all presidential terms since 1980.

The best guess of Capital Economics is that the next 100 days will be more favourable for US stocks and the dollar as the focus of the Trump administration shifts to fiscal policy.

The consultancy said: “How things pan out over the next 100 days in the US and elsewhere will partly hinge on whether US markets (Treasuries in particular) and corporate America continue to act as effective guardrails against Trump’s policies, as they appear to have done since 2 April.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks