Stockwatch: analysing equity markets as tariff deadline looms

Countries have just days to sign some kind of trade deal with the US or face massive tariffs. Analyst Edmond Jackson discusses whether a green light for risk assets is about to turn amber?

1st July 2025 12:15

Subdued oil prices have bolstered risk appetite, and US share indices reached all-time highs, but mind how President Trump’s victory of sorts in the Middle East could embolden him for some tough street-fighting on tariffs as a 9 July reprieve period expires.

A remarkable aspect of the biggest outbreak of Israel/Iran conflict for years has been the oil market’s measured view – especially given America’s surprise involvement in this latest war. Beforehand, this possibility was being described as likely to open Pandora’s Box, inviting retaliation on US interests and a conflict escalating out of control.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

But far from the oil market panicking, a brief 20% blip in Brent crude to $79 a barrel when the US bombed Iranian nuclear facilities, was followed by a 13% fall last week to $66.6 currently.

While retaliation by Iran and its proxies may yet happen, it appears they recognise US military might, and Trump’s bombastic threats may even have helped contain the situation. Versus fear stories about the blocking or mining of the Strait of Hormuz, Iran appears to have recognised how this would undermine its own interests by way of oil exports and relations with China.

Trump has even suggested he might back eventual sanctions relief for Iran “if they can be peaceful”, presumably including oil. Also weighing on prices were reports that OPEC was set to raise output by 411,000 barrels a day in August after a similar hike planned for July.

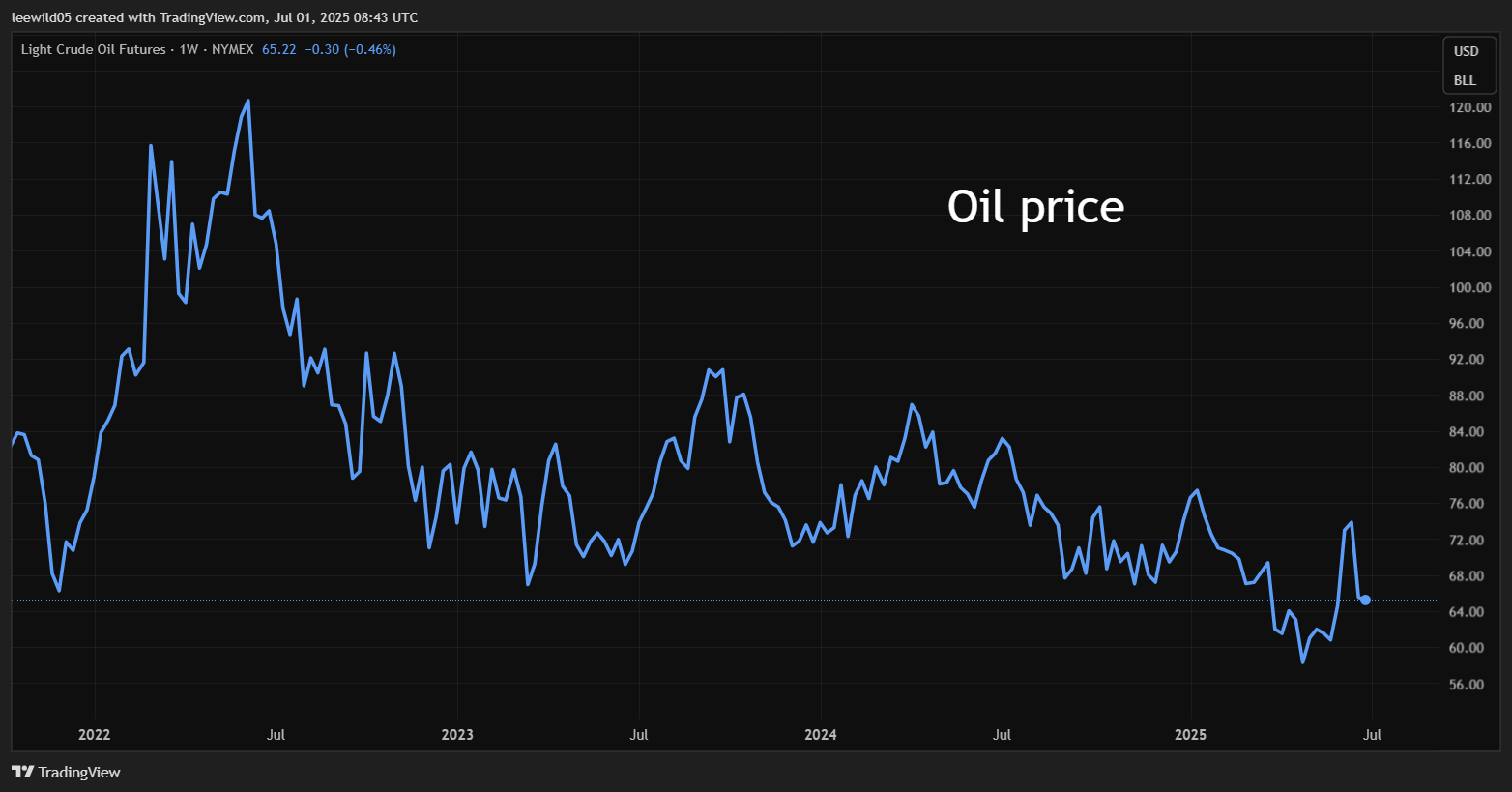

It therefore retains a three-year declining chart in oil prices, which is pertinent for investment tactics:

Source: TradingView. Past performance is not a guide to future performance.

Prices are well below an $80 range we saw only a year ago, in support of a “falling inflation/interest rates” narrative – with lending rate cuts targeted for later this year. Perhaps US equity markets reaching all-time highs is being assisted by high liquidity, but the rate cut story indeed looks more realistic now. US inflation data for June, due mid-July, could be key.

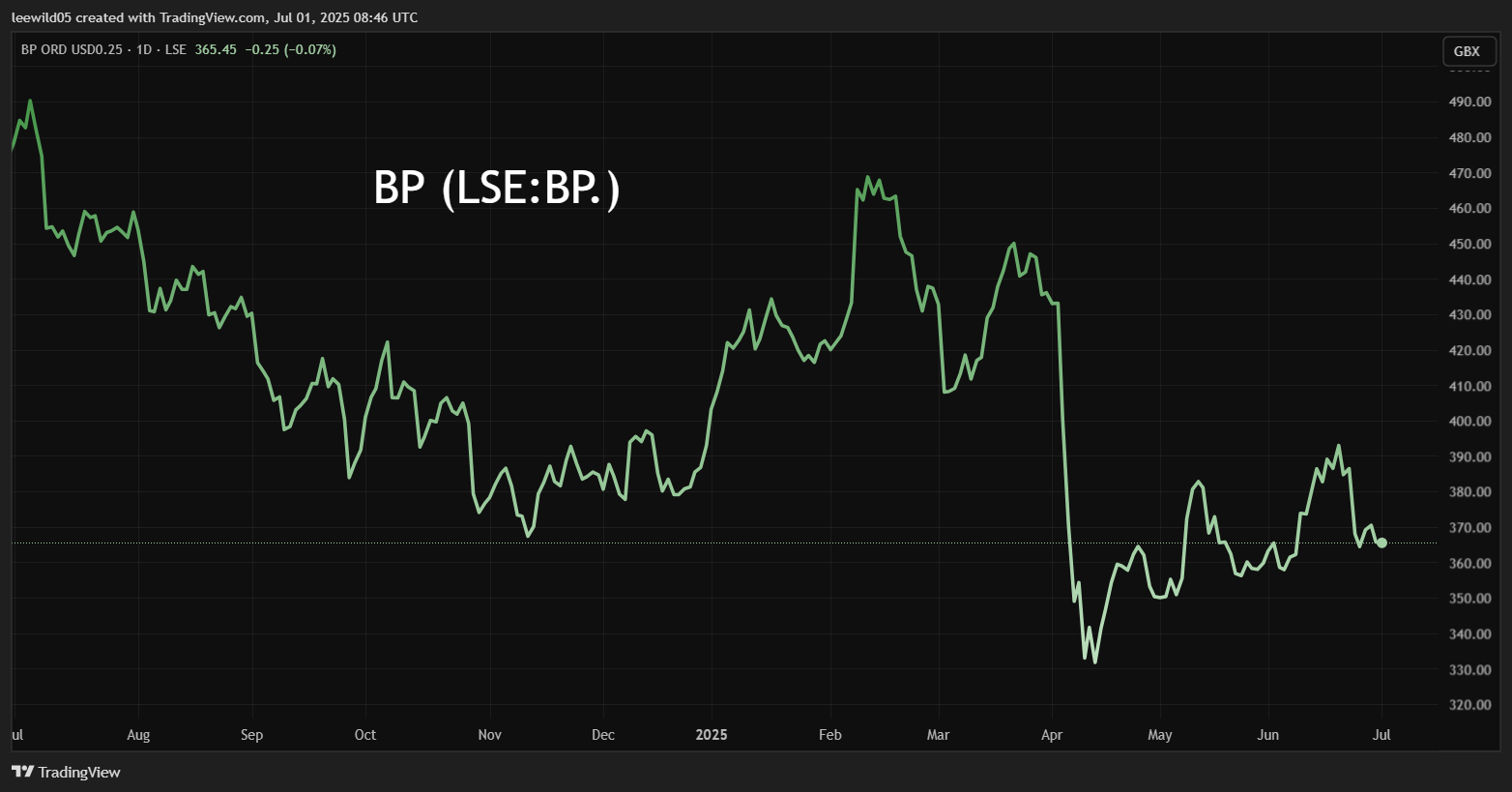

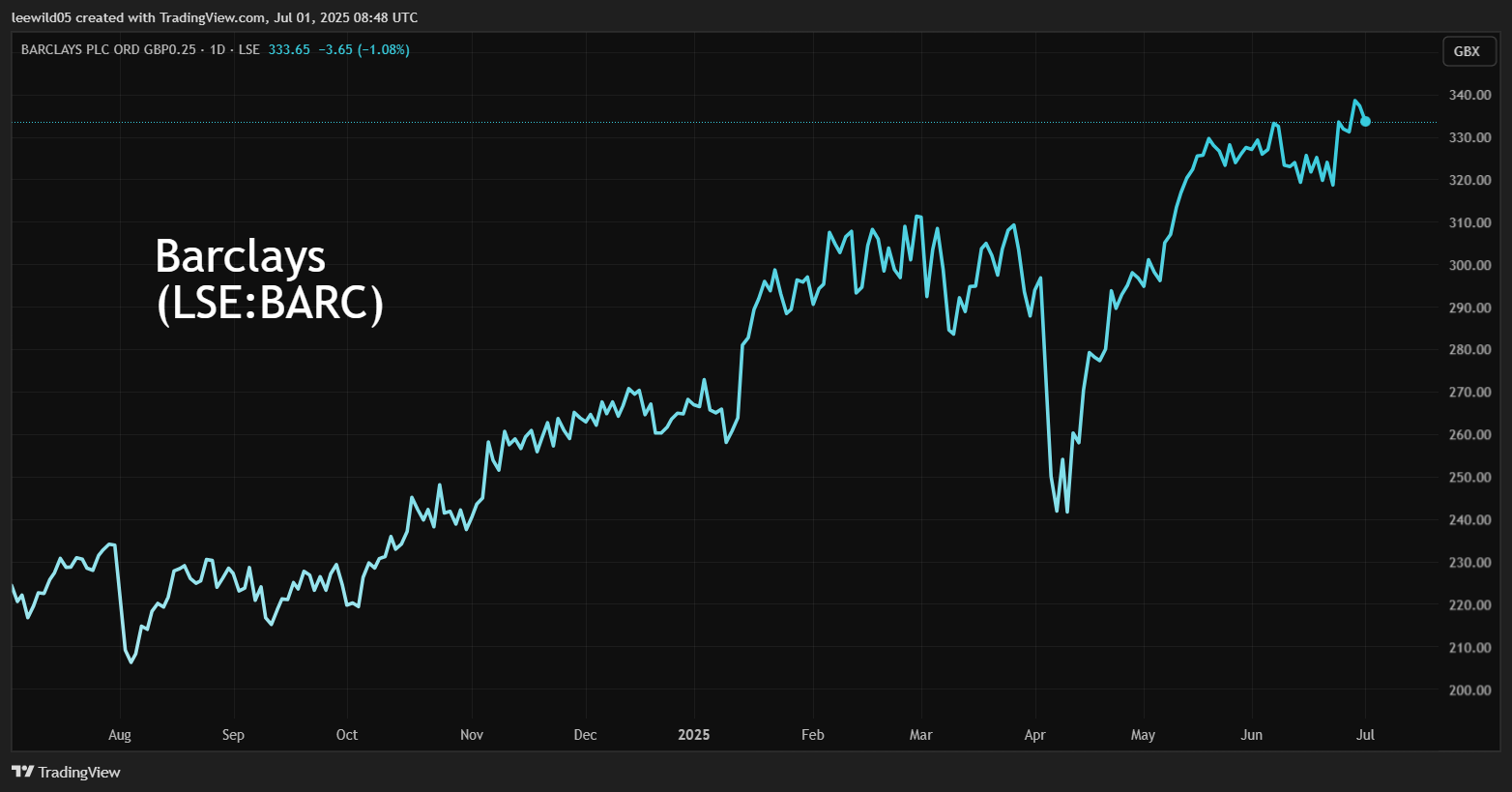

It also blows up the typical tactic for smaller investors during a Middle East war, namely weighting portfolios towards oil shares and cash, anticipating lower stock markets. For example, BP (LSE:BP.) is up around 9% from early April lows whereas financial shares have been a better play, with Barclays (LSE:BARC) sustaining a 28% rally over the same timeframe:

Source: TradingView. Past performance is not a guide to future performance.

Source: TradingView. Past performance is not a guide to future performance.

The common assumption would have been to avoid financials given such shares tend to be more sensitive, but in this Middle East “skirmish” (it is hastily being revised as) higher-beta shares (more volatile than the market) have been the way to go - a defensive approach meant missing rallies.

So is the macro context genuinely bullish for risk assets?

Reflecting current sentiment, Goldman Sachs’ chief global equity strategist has appeared in a video clip arguing for $60 oil by year-end, reinforcing the prospect of lower inflation and interest rates.

Consensus among forecasters expects June US inflation data to be soft, in line with recent data. Employment numbers due this Thursday will also count and be weighed by the Federal Reserve, but already on the Federal Open Market Committee Messrs. Bowman and Waller have broken ranks to publicly argue for an interest rate cut this month. That would seem less likely unless inflation data obliges, but amid political pressure on Federal Reserve chair Jerome Powell, the market is certainly expecting cuts in the Fed’s lending rate in September and December.

I remain quite sceptical that this ignores potential inflation from US tariffs, or assumes Trump will back off their implementation. With the 90-day tariff reprieve soon to expire, if the US does not get what it wants then supposedly the horrendous 2 April “reciprocal tariffs” resume.

This may however be brinkmanship. Last Friday, Trump declared the US was terminating all trade negotiations with Canada on account of a digital service tax due to start yesterday, an effective tactic given Canada rescinded the tax.

- Insider: directors bet this FSE 100 stock's best days are ahead

- Shares for the future: a half-billion-pound powerhouse

-

Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Lower US interest rates would also reinforce moderation in the dollar’s value which is driving a trend in international diversification – also US private equity takeover bids - with the UK well-positioned to feel this tailwind. The dollar has fallen nearly 11% against a basket of currencies since the start of 2025, its worst performance over six months of any year since 1973, and also the worst half-year since the second half of 1991.

It is a major sea-change for asset allocators to grapple with. It takes the dollar index to its lowest level since March 2022, helping explain sterling at a three-year high of $1.37 – up from $1.25 at the start of the year.

Such de-risking from Trump-induced chaos, with public debt being driven higher, looks a medium-term trend – yet in the short term at least, involves some opportunity cost even in currency-adjusted terms. The S&P 500 rose nearly 5% in June, the Nasdaq by 6.5%, a remarkable turnaround from an 18% fall for the year in early April.

Yet there are major risks to UK public finances

Government bonds and sterling must reckon with Prime Minister Keir Starmer’s government mouthing about the US special relationship and defence spending, similarly as Tony Blair got entangled with George W. Bush over Iraq. But delivery on defence constituting 5% of GDP as Trump wants, cannot happen without cuts elsewhere.

The government is already capitulating on people’s demand for welfare payments, hence if taxes are not to rise then what way is there out of a fiscal bind without, say, abandoning “net zero”?

It’s unclear whether this now poses a risk of a bond market rebellion somewhat akin to the Truss/ Kwarteng mini budget of September 2022, although much follow-through to equities would probably be seen as another buying opportunity, as before.

Could tariffs disrupt tailwind from lower oil prices?

A downside to Trump feeling emboldened by his current outcome in the Middle East is re-asserting his agenda for tariffs, say with fresh ones appearing out of the blue to confuse and weary negotiations, so the US gets what it wants. Pharmaceuticals are one key risk area, also for EU retaliation.

“Sell in May” has been comprehensively quashed by the ongoing bear market in oil and an apparently quick resolution to the Israel/Iran conflict, but how sustainable is optimism since mid-April?

Mind how the US tariff deadline looms.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks