Stockwatch: time to buy this off-radar share

There’s been a decent recovery from the tariff crash low, but a lot of investors missed it. Analyst Edmond Jackson believes there’s still a buying opportunity here.

24th June 2025 10:30

The FTSE 250 shares in Rathbones Group (LSE:RAT), a wealth manager valued at around £1.9 billion, jumped from around 1,660p to 1,725p last week. That followed a “buy” note from Bank of America which argued that the market is missing synergistic benefits to kick in from the 2023 acquisition of Investec Wealth and Investment (IW&I).

Having eased to 1,710p, and based on consensus forecasts, the shares trade on a forward price/earnings (PE) multiple of a modest 10x if Rathbones achieves £174 million net profit this year, for normalised earnings per share (EPS) growth of 44% to 160p. This would be some advance on the £65.5 million profit made in 2024, the first year of including the Investec business.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

With near £200 million profit targeted for 2026 based on EPS of 180p, I notice it implies a 12-month forward earnings growth rate around 20%, hence a PE-to-growth ratio of an attractive 0.5x, where below 1.0x is the usual yardstick for a growth share.

Obviously, that is a snapshot view, and the longer-term trajectory counts more, but with the dividend expected to grow 7% to around 100p per share this year and 108p in respect of 2026, a 12-month forward yield of just over 6% - strongly backed by free cash flow – looks like another attraction.

The shares appear to have suffered a dilemma similar to other asset managers amid industry-wide net outflows, amid volatile returns and client disillusion with active fund management.

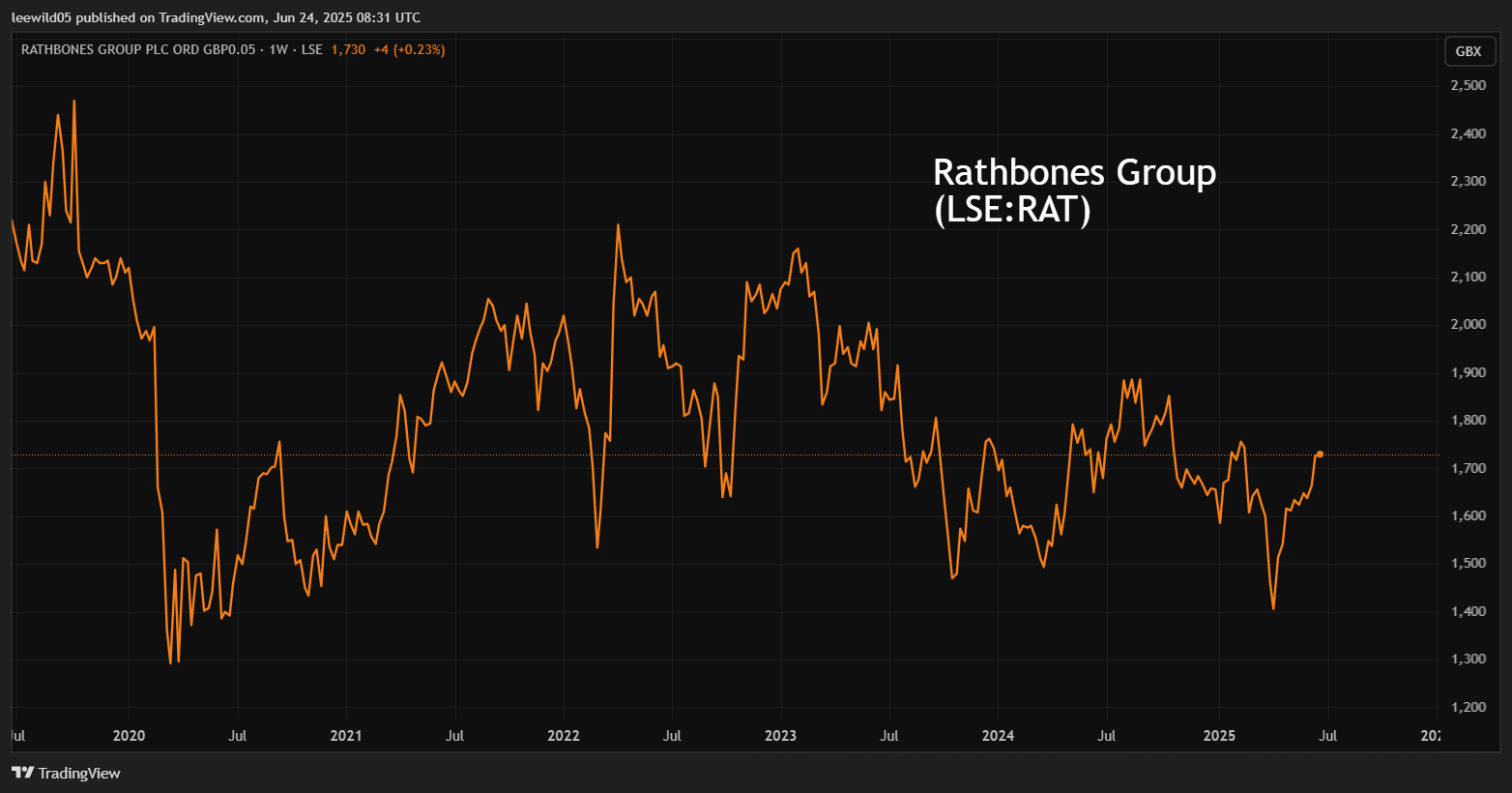

Having fallen from 2,800p in 2017, Rathbones has traded volatile-sideways over the last five years after reaching a 1,300p low in the March 2020 Covid sell-off:

Source: TradingView. Past performance is not a guide to future performance.

With £104 billion funds under management and capitalised near £1.9 billion, it is still one of the largest UK wealth managers. Demographics are favourable for savings and investment, hence this funds-flow issue should at least find equilibrium.

The market has tried to start anticipating this, pricing it into some asset manager shares. Mid-cap Jupiter Fund Management (LSE:JUP), for example, has risen from 70p to 95p since mid-April:

Source: TradingView. Past performance is not a guide to future performance.

Last May I concluded with a “hold” stance on Jupiter near 92p given the potential for earnings per share to recover somewhere between 20p (as before 2022) and the 7p recent consensus.

At 95p, it trades on a forward PE around 14x and yields 3.5%, hence investors have started to take notice, while Rathbones remains broadly off-radar.

Sensitivity to the overall trend in financial markets

A key attraction with asset manager shares is operational gearing where revenue increases from fees – due to the scale of funds and/or valuation rises – boosting profits if the cost base stays relatively fixed. The chief spoiler being whether bonuses soar with profits, but a capable board should strike a balance between retaining good managers and shareholder returns.

It does mean, however, that should recent euphoria from the “Trump always chickens out” (TACO) trade lately (around his tariff threats) expire and shares plunge, the rally in the likes of Jupiter could reverse. Some may see Trump’s latest pronouncement of a ceasefire in the Middle East as repeating his form.

But overall markets have remained resilient against fears that stocks would sell off if America got drawn into another Middle East war. Despite the weekend’s bombing mission on Iran, on Monday US stocks rallied and oil plunged over 9% to near $70 a barrel, as traders took the view that a doomsday scenario of a blocked or mined Strait of Hormuz would be a shot in the foot by Iran as an oil exporter.

- Investors optimistic again, but not for all markets

- Why Warren Buffett could back Britain in final mega-deal

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Still showing how asset managers tend to trade more sensitively than their market, Rathbones eased 0.8% to 1,712p and Jupiter 0.4% to 94.6p relative to the FTSE 250, which was down 0.13%.

Takeover action should support the UK market and remind investors what they may be missing. Despite claims that all the uncertainty would stall business decisions, mid-cap Spectris (LSE:SXS) has just received and recommended an offer from Advent private equity at a near 90% premium to where it traded only recently. Kohlberg Kravis Roberts, another private equity group, has declared itself in late-stage due diligence and financing for a possible rival offer.

This situation also shows capital re-allocating from the US, a trend that could gather pace and benefit UK-based wealth managers.

On 13 June, I made a “buy” case for Spectris at 3,200p on the rationale that a 3,763p per share possible offer was likely to materialise, and the implied 15% upside was likely greater than downside risk. The shares have jumped to a near 1% premium to Advent’s offer terms as the market senses a bid battle. I therefore suggest Spectris now rates at least a “hold”.

Is Rathbones a worthwhile choice?

At first sight, the financial summary table suggests plenty to improve: low single-digit returns on capital, an operating margin down from double to high-single digits, and a mixed record of free cash flow. Dividend growth has been consistent yet not always covered by earnings.

Chiefly due to amortisation charges, there's quite a gap between reported and normalised earnings, which in fairness did improve the normalised operating margin from 22.3% in 2023 to 25.4% in 2024. If forecasts are fair, earnings cover for the dividend should be rising over 1.6x in the current/next financial year.

Rathbones - financial summary

Year end 31 Dec

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 384 | 397 | 469 | 511 | 678 | 1,014 |

| Operating profit (£m) | 39.7 | 43.8 | 95.0 | 64.1 | 57.6 | 99.6 |

| Net profit (£m) | 26.9 | 26.7 | 75.2 | 49.0 | 37.5 | 65.5 |

| Operating margin (%) | 10.3 | 11.0 | 20.3 | 12.5 | 8.5 | 9.8 |

| Reported earnings/share (p) | 48.7 | 47.6 | 129 | 81.6 | 50.8 | 60.5 |

| Normalised earnings/share (p) | 94.0 | 85.1 | 143 | 98.7 | 89.8 | 111 |

| Operational cashflow/share (p) | 904 | 57.2 | -291 | 488 | -121 | 271 |

| Capital expenditure/share (p) | 32.5 | 24.2 | 21.8 | 21.9 | 14.5 | 52.3 |

| Free cashflow/share (p) | 872 | 33.0 | -312 | 466 | -135 | 219 |

| Return on total capital (%) | 1.2 | 1.3 | 2.9 | 1.9 | 1.4 | 2.3 |

| Cash (£m) | 1,933 | 1,803 | 1,463 | 1,413 | 1,038 | 1,166 |

| Net debt (£m) | 817 | 836 | 967 | 1,195 | 1,342 | 1,275 |

| Net assets (£m) | 485 | 514 | 623 | 635 | 1,350 | 1,359 |

| Net assets per share (p) | 861 | 894 | 1,005 | 1,085 | 1,303 | 1,314 |

Source: company accounts.

An 8 May first-quarter trading update cited 90% of IW&I clients having transferred on to Rathbones’ platform as of April, the remainder on track to do so by end-June. It seems to have been an extended process, a bit hard to swallow as an excuse for continued net outflows of funds “due to a lower level of gross inflows in the final stages of the migration…”

It also appears that some Investec managers left, adding to disruption and delaying a sense as to when benefits of the merger will accrue.

Assets under management eased 4.7% on end-December with gross inflows of £2.7 billion versus £3.5 billion outflows. Yet total operating income remained resilient at £220 million, and synergies rose to over £30 million on an annualised run rate basis, with the majority expected to materialise in the second half.

- Insider: directors sell £670k of Lloyds and another UK bank share

- Shares for the future: seven stocks removed from my top 40

- Stockwatch: choosing between these two mid-cap shares

With February’s 2024 results, management said synergies were expected to improve cash generation, hence “capacity for surplus returns” to shareholders after the IW&I business consolidates on to a single operating platform. It had also taken steps towards improving organic growth and had made “good progress towards an underlying operating margin of 30% from September 2026”. Various roles from the Investec business have been removed.

Bank of America contends that benefits arising from the second half also include enabling teams to focus on sales and distribution, which would partly seem to depend on whether the financial environment is suitable for asset gathering. I'm inclined not to be too sceptical as demographics should be a longer-term tailwind.

Case for a starter position

Let’s assume that forecasts about asset managers need a pinch of salt given the way that unexpected events can impact markets. Ideally, you would buy when “blood is on the streets” rather than after stocks have enjoyed a curiously optimistic rally despite trade tariff negotiations soon coming to a head, war in the Middle East and US debt issues.

Barring a market slide, however, it appears that Rathbones is quite off-radar – similarly as was instruments-maker Spectris – explaining its weaker chart versus Jupiter lately.

A pragmatic conclusion is therefore to take a starter position, looking to average-in according to how updates evolve. There seems a risk of missing the boat if the market gets more anticipatory over Rathbones like it has over Jupiter. Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks