Top funds from first quarter still leading the way

The leading fund of 2025 is up nearly 50%. Saltydog Investor explains why funds in this specialist sector have soared.

24th June 2025 08:33

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

In April, we highlighted the best-performing funds over the first three months of the year.

At the top were four funds from the Specialist sector, all focused on companies involved in the mining and production of gold and other precious metals. Since then, they have delivered further double-digit returns.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

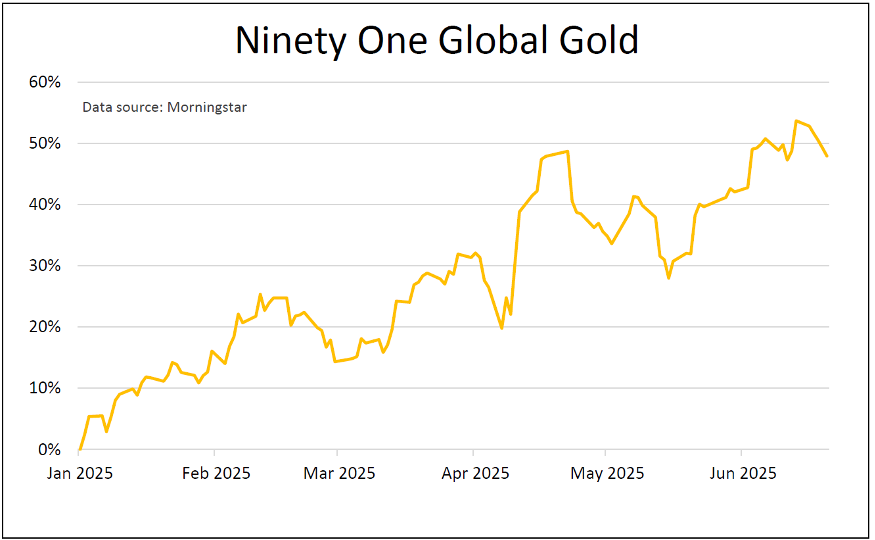

The leading fund, Ninety One Global Gold, has risen by 47.9% so far this year. BlackRock Gold and General and SVS Sanlam Global Gold &Resources have also gone up by more than 40%, while WS Ruffer Gold is close behind, up by nearly 39%.

Past performance is not a guide to future performance.

Gold has long been viewed as a safe-haven asset, particularly by so-called goldbugs. These investors believe that gold is the ultimate store of value. They typically favour gold as protection against inflation, weakening currencies, and uncertainty during periods of political or economic instability.

They maintain that gold has several key qualities that make it an excellent store of value. It is scarce, with only modest annual increases in global supply, and it is physically durable. It does not corrode, tarnish, or degrade, allowing it to last for millennia without losing quality or value.

Almost all the gold ever mined is still in existence and in circulation in some form. All of it would fit into a cube approximately 22 metres on each side, which is roughly the size of a large two-storey house.

Its compact size makes it relatively easy to store and move, even when handling large amounts of money. Gold is highly liquid, widely recognised, and has a track record spanning centuries as a trusted store of value across cultures and economies.

Gold also has practical applications in electronics, medicine and aerospace, adding to its long-term value.

Goldbugs tend to distrust fiat currencies, which are not tied to any physical asset and depend entirely on confidence in the governments that issue them. Since the US dollar was decoupled from gold in 1971, it has lost much of its purchasing power.

Over the same period, US government debt has ballooned from $400 billion (£299 billion) to more than $36 trillion. Many gold investors believe this level of debt accumulation could not have occurred under a gold-backed currency. They argue that the ability to “print money” undermines long-term trust in fiat systems.

Although governments would maintain that their own fiat currencies are perfectly stable, they do not necessarily trust each other. That’s why they still actively exchange and purchase gold.

Recent data shows that central banks worldwide have been significantly increasing their gold reserves in recent years. Over the last three years, they have purchased more than 1,000 metric tons of gold annually. That is more than double the average for the previous decade. The BRICS countries (Brazil, Russia, India, China, and South Africa) are particularly keen to reduce their dependence on the US dollar.

In times of market stress and political uncertainty, it’s not unusual to see the price of gold rise as investors head for safe-haven assets. In recent years, the geopolitical situation has become increasingly unstable following the Russian invasion of Ukraine and the escalation of the war between Israel and Hamas.

- Fund types offering investors a chance to ‘buy low’

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Since the inauguration of US President Donald Trump the situation has worsened. He’s been accused of many things, but reducing uncertainty and creating stability is not one of them. Trump’s negotiating tactics on tariffs have led to growing concerns of a trade war and potentially a global recession. His recent attack on the Iranian nuclear facilities could potentially lead to another US war.

Last year, the price of gold broke through $2,800/oz for the first time, and it has kept on going up. It briefly traded above $3,500, but is now around $3,400.

Given this backdrop, it’s not surprising that gold funds from the specialist sector remain near the top of our performance tables.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks