A Trump trade, an obvious buy and a riskier stock idea

There’s a solid prospect that’s worth buying following the US presidential election, according to analyst Rodney Hobson. He also picks out a green stock to own and another big hitter that’s cheap again.

20th November 2024 07:52

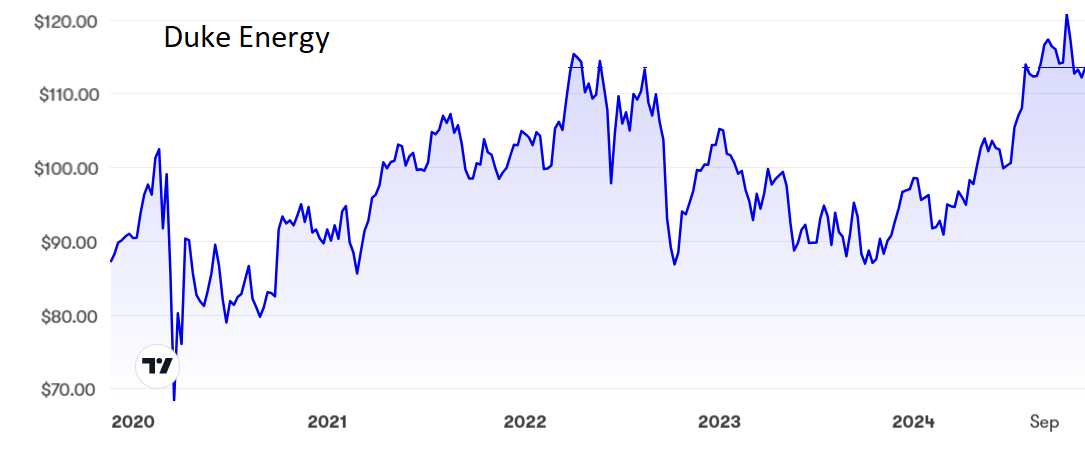

American energy stocks stand to gain if President-elect Donald Trump goes ahead with his oil sector vow to “drill, baby, drill”. Plentiful supplies of oil and gas should reduce costs for power supply companies as extra oil and gas production in the United States helps to offset production cuts by Opec nations. This could be a good time to consider buying Duke Energy Corp (NYSE:DUK) after a recent share price fall.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Once again, as in 2016, Trump will inherit an economy in pretty good shape, with demand for energy at work and home increasing rather than tailing off. The only worry is that he will spark trade wars that damage the US economy, but his bark is likely to be worse than his bite.

Duke shares have slipped back from a peak at $120 in October to around $113 now, where the price/earnings (PE) ratio is only a little on the high side at 20, while the dividend is pretty good for the New York Stock Exchange at 3.65%.

In addition, those seeking to take a contrarian view or looking for promising smaller companies that normally fall off the radar, may like to consider companies whose shares reacted badly to Trump’s election.

Fears that green energy will be cast aside by the new Trump administration took solar storage firm Sunnova Energy International Inc (NYSE:NOVA) down from $7.06 immediately before the poll to $3.65 and solar panel manufacturer First Solar Inc (NASDAQ:FSLR) from $215 to $195.

Sunnova has been on a steady decline since topping $50 in 2021 and First Solar has been slipping back after peaking near $280 in May, so the fall is not all Trump-related by any means. First Solar’s PE ratio is now a comfortable 16.4 but it does not pay a dividend.

Yet green energy surely still has a place in America’s plans even if it does not get the priority it had under Joe Biden.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Will US shares really return 3% a year for the next decade?

- How to protect yourself against a major tech correction

Hobson’s choice: I have long regarded Duke Energy as a solid prospect to hold in any long-term portfolio and that view does not change. After the recent slippage from a new peak, the shares have become a buy again. If, instead, you fancy a risky punt, I think the prospects at First Solar are far better than at Sunnova.

Source: interactive investor. Past performance is not a guide to future performance.

Update: When one company reports lower than expected sales of a particular product, it could be that demand is less than everyone assumed, or it could be that someone else is snatching market share. So when Eli Lilly and Co (NYSE:LLY) produced disappointing sales figures for its weight-loss drug, attention turned to rival Novo Nordisk AS ADR (NYSE:NVO).

The Danish drugs company reported that sales of weight-loss jab Wegovy in the third quarter were a full 80% higher than they had been a year earlier. Revenue from the diabetes drug Ozempic, also used to reduce weight, increased 26%.

Demand for Wegovy has outstripped supply since it was launched three years ago even though production has been tripled. There is surely enough demand for both companies to boost sales.

- Nvidia Q3 results preview: assessing blockbuster potential

- Why we’ve dipped our toes back into Baillie Gifford American

Novo Nordisk shares topped $140 in June but have fallen back heavily to around $101. They look an obvious buy below $100, where they should find support. Two weeks ago, I recommended selling Lilly at $806 and they are now down to a more realistic $717. This is a hard company to call, as I have discovered several times over the past few years, but the next support level could be as low as $600. If you have stayed in during the fall, I would be inclined to hold and hope for the best but it is far too soon to buy in for recovery.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks