Trust discounts narrow amid sentiment shift

A Kepler analyst considers what’s behind investment trust re-ratings.

18th July 2025 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

After a prolonged period of wide discounts across much of the investment trust universe, sentiment is starting to shift. Since late 2023, a number of trusts have seen their discounts narrow significantly, some even moving into premium territory for the first time in years.

At the same time, a smaller group of trusts continues to trade consistently at a premium, reflecting strong investor demand and, in many cases, structural features that support higher ratings, such as unique mandates, differentiated income profiles, or long-term records of performance over varying market cycles.

This article explores these trends: first, with those trusts that have re-rated meaningfully, often in response to stronger performance, income appeal, or improved market conditions; and second, those trading on a premium and why they continue to command one in today’s environment. In both cases, the focus is on what’s driving these re-ratings and whether these changes signal a broader shift in investor priorities.

Discount dynamics

Discounts have widened dramatically over the past few years. Notably, from mid-2022 through to late 2023, the sector endured a harsh derating, driven by rapidly rising interest rates, spiralling inflation, broader risk-off sentiment and structural headwinds facing close-ended funds. However, this trend has significantly reversed since then.

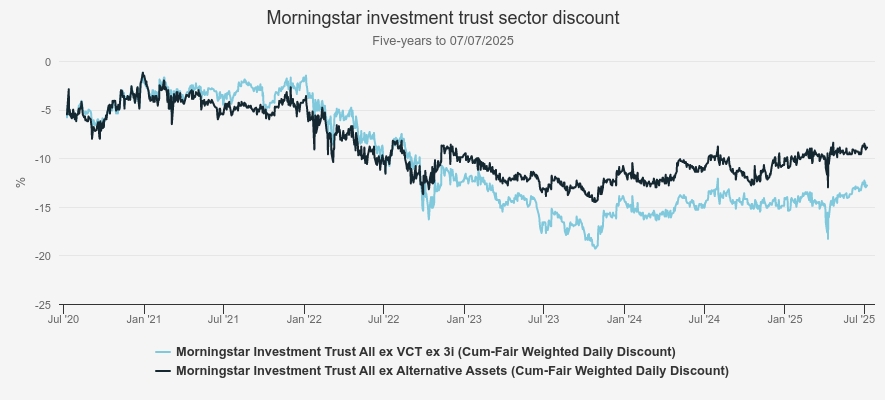

This is illustrated in the five-year chart below, which tracks the average sector discounts using Morningstar’s investment trust sector classifications. One line excludes 3i and VCTs to give us a full list of trusts, whilst the other strips out alternatives to focus more directly on equity-oriented strategies. In both cases, the trend is clear: discounts widened steadily, reaching a low point in late 2023.

INVESTMENT TRUST SECTOR DISCOUNT MOVEMENTS

Source: Morningstar

Since the discount peak in October 2023, both lines have started to climb, denoting a broader narrowing of investment trust discounts and perhaps an indication that sentiment is shifting. Re-ratings have taken hold across the board, but notably equity-focussed trusts are trading much closer to par and really began to diverge in September 2022. They have narrowed back onto an average single-digit discount. The wide discount on the sector is largely due to the alternatives, which have been harder hit by the implications of a higher interest rate environment for yield and asset valuation. But even including alternatives, where many names still trade on wide absolute discounts, the average has improved to around 13%, down from a peak of nearly 20%.

Crucially, this doesn’t appear to just be a rebound in a select few areas. Since the start of the year, discounts have narrowed in 29 AIC sectors and widened in just seven, strong evidence of a sector-wide reappraisal, according to AIC data.

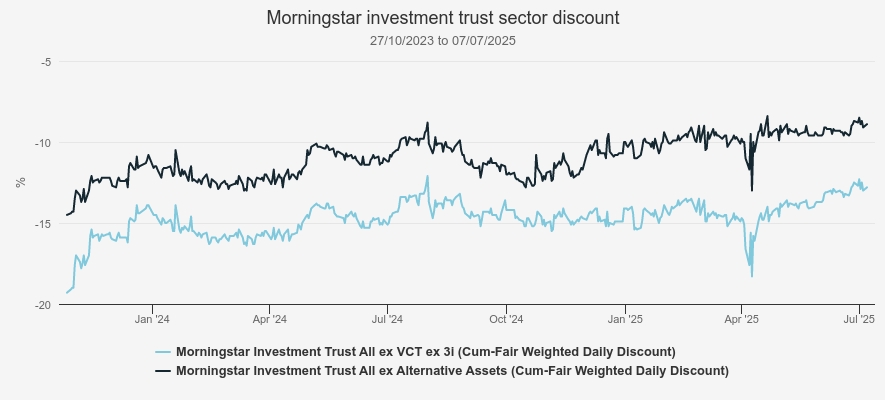

The chart below brings this into sharper focus. Since late 2023, the trend has clearly shifted upward, reflecting what we believe is improving sentiment and growing demand. In a market where persistent discounts have long weighed on total returns, even modest re-ratings can meaningfully lift shareholder outcomes. To illustrate: the discount across all trusts (excluding 3i and VCTs) has narrowed from 19.3% to 12.8%, a move that, assuming no change in NAV, equates to a share price gain of approximately 8.1%. For equity trusts, excluding alternatives, the narrowing from 14.5% to 8.9% represents a 6.6% gain. Crucially, these are pure re-rating effects, no underlying NAV change, just improved market sentiment and rising demand pulling share prices closer to NAV, providing investors a potentially powerful kicker to returns.

INVESTMENT TRUST SECTOR DISCOUNT MOVEMENTS

Source: Morningstar

But what’s behind the re-rating?

In our view, the key driving factor is the decline in interest rates we have seen in the UK. The Bank Rate has been cut from 5.25% to 4.25% since last June, and more rate cuts are widely expected. Even if these rate cuts reflect a weakening economy, for those who can invest they change the game financially: more risk needs to be taken to get yield. We think this is why equity income trusts have been leading the way as discounts narrow.

Take Shires Income Ord (LSE:SHRS) as a case in point. The trust moved from a 13.4% discount nine months ago to a premium of 0.6% at the end of June, its first time in two years. Whilst this has eased slightly in recent days, the trust still trades close to par, a meaningful shift, whichever way you look at it.

Performance has been helpful: over the past year, SHRS delivered a NAV total return of 11.4%, ahead of the FTSE All-Share Index’s 10.7%, buoyed by a rebound in small caps and strength in financials. But the yield is arguably what’s resonated most with investors.

SHRS blends high-yielding stocks, resilient payers and dividend growers, typically in SMID-caps, with an allocation to preference shares, which yield around 7.5%, to enhance its income. This is a core differentiator in delivering consistent income through the cycle. The trust now yields 5.3% above the FTSE All-Share Index’s 3.5% and UK Equity Income sector average of 4.0%.

With UK fundamentals improving and expectations for interest rate cuts rising, the appeal of cash and high-yielding bonds could fade in a lower-rate environment. In that context, SHRS’s combination of elevated income and capital growth potential is becoming harder to ignore.

But the sentiment shift isn’t limited to UK equity income alone.

Alternative income strategies have also started to re-rate, with discounts narrowing in names like Cordiant Digital Infrastructure Ord (LSE:CORD) and Sequoia Economic Infrastructure Inc Ord (LSE:SEQI), and M&G Credit Income Investment Ord (LSE:MGCI) consistently trading on a premium.

SEQI provides exposure to infrastructure debt, higher in the capital structure than equity and backed by private, off-market deals. This allows the specialist team managing the portfolio to generate a very high yield for investors, without the use of gearing. CORD, meanwhile, invests in real infrastructure assets underpinning the digital economy, such as fibre networks and data centres, sectors with long-term structural growth tailwinds.

Both have delivered strong share price performance this year, potentially reflecting growing investor demand for differentiated income profiles. CORD’s discount has narrowed from a peak of 48.2% to 27.4%, whilst SEQI’s has narrowed from 24.6% to 14.2%. Their current yields – 4.6% for CORD and 8.6% for SEQI – stand out, in our view, particularly as expectations for rate cuts rise and the growing desire to shift capital out of cash or government bonds into more resilient, higher-yielding alternatives. However, despite this momentum, both trusts remain on wide absolute discounts, suggesting potential for further reappraisal if these trends continue.

MGCI also offers something different in today’s environment. Its blend of public and private credit with a majority floating rate portfolio allows it to generate a high and differentiated yield without taking high credit risk. The trust targets SONIA +4%, equating to a current yield of 8.2%, achieved without leverage. Share issuance capacity was also exhausted in 2024, prompting shareholder approval for further share creation, a clear vote of confidence in the strategy.

Whilst falling rates may moderate income eventually, consistent demand for its offering has kept it near par or at a premium for much of the past year. Additionally, MGCI still offers a healthy spread over cash and government bonds, with a more defensive credit profile than typical high-yield funds. Overall, this combination makes it particularly appealing for investors seeking sustainable income with lower volatility, something that’s potentially supported its premium rating.

We think that same trend is gaining momentum across Europe, especially given early signs of investors rotating out of pricey US growth stocks. With US valuations stretched, political uncertainty mounting and economic slowdown signals emerging, perhaps European markets offer better value.

One trust potentially benefitting from this trend is JPMorgan European Growth & Income Ord (LSE:JEGI), which provides core European equity exposure with selective smaller company opportunities. JEGI has long traded on a persistent double-digit discount but since its 13.5% peak in October 2024, its discount has narrowed sharply to just 2.8%, at the time of writing.

This re-rating reflects strong performance: a 12.1% NAV total return, outperforming the MSCI Europe ex UK Index’s 9.0%. We think its distinctive income profile may have also played a role. JEGI pays a quarterly dividend equivalent to 4% of NAV annually, funded through a combination of income and reserves, allowing the managers greater freedom to prioritise capital growth whilst still delivering a reliable income, above both market and sector average levels. This sets it apart within the European trust space and enhances its appeal to income-focussed investors in a lower-rate environment. Meanwhile there has been some consolidation in the Europe sector which may have boosted demand for the trust.

With European valuations attractive relative to the US, and demand rising for diversified, dependable yield, JEGI’s strategy appears to be resonating. As the green shaded area in the chart below shows, the trust’s discount has narrowed both in absolute terms and versus its sector since late 2024, underscoring its growing appeal not only to income-focussed investors but, in our view, also those seeking total return opportunities beyond the US.

JEGI DISCOUNT RELATIVE TO EUROPE SECTOR

Source: Morningstar

Another subtle yet important driver behind discount re-ratings is the sector’s response to activism. The most prominent example is the actions of New York-based hedge fund Saba Capital. Many criticised founder Boaz Weinstein’s approach as aggressive or self-serving and not without reason. Whilst proposals to wind up trusts may have unlocked value for Saba, they risked reducing investor choice by eliminating differentiated strategies. Some of Saba’s targets also appeared unwarranted.

However, some could also argue the broader impact shook boards out of inertia. In some cases, this pressure has translated into shareholder-friendly reforms that have boosted sentiment and narrowed discounts, something we discussed in detail in a previous article, ‘A spoonful of Saba’. The wave of consolidation and mergers we have seen has cut down the number of options for investors, which may also be helping the ratings of the survivors.

Take Montanaro UK Smaller Companies Ord (LSE:MTU). In early 2025, the board launched its first significant buy-back since 2008, repurchasing around 12% of its shares. This coincided with a revamped dividend policy targeting a 6% annual yield and tweaks to its fee structure. Within days of the announcement, MTU’s discount narrowed from 13.6% to 10.5%, lifting it above the sector average, indicating the changes landed well with investors.

What’s more, MTU isn’t alone. Other trusts have introduced measures like performance-based tender offers, dividend uplifts and portfolio reallocations. Whilst not all were driven directly by activist pressure, the heightened scrutiny may have encouraged boards to act. It’s too soon to declare activism a sector-wide driver of discount narrowing, but its presence, and perhaps anticipation, is influencing parts of the market.

Premium territory

Only a handful of trusts have entered or maintained premium territory in recent years. These moves often reflect the trends we’ve discussed already: growing demand for differentiated strategies like income and diversification away from pricey US stocks. But premiums can also signal deeper investor conviction in a trust’s uniqueness, quality, or resilience beyond shorter-term numbers.

Long-time followers won’t be surprised to see UK Equity Income stalwarts like City of London Ord (LSE:CTY) and Law Debenture Corporation Ord (LSE:LWDB) consistently trading at premiums. At the time of writing these are 1.7% and 1.3%, respectively.

CTY is the heavyweight of UK Equity Income: the largest, lowest-cost trust with the longest unbroken dividend growth streak in the entire investment trust universe. Managed by Job Curtis since 1991, CTY’s strength lies in its consistency. Job applies a cautious, valuation-conscious approach to a broad portfolio of UK-listed equities, blending high-yielding names with more growth-oriented holdings. He doesn’t chase themes, instead, prioritising quality companies and steady navigation through cycles. This approach has driven CTY’s long-term outperformance and 58 consecutive years of dividend increases. With a current yield of 4.7%, backed by substantial reserves, and an OCF of just 0.37%, CTY offers dependable income at a competitive cost.

Whilst CTY briefly dipped into discount territory during the last 18 months, reflecting negative UK equity sentiment, it has recovered quickly. We think this reflects CTY’s core proposition: a high-quality, low-cost vehicle for long-term income and capital growth, managed by a trusted veteran. In a market uncertain about UK re-rating, CTY continues to pay investors to wait.

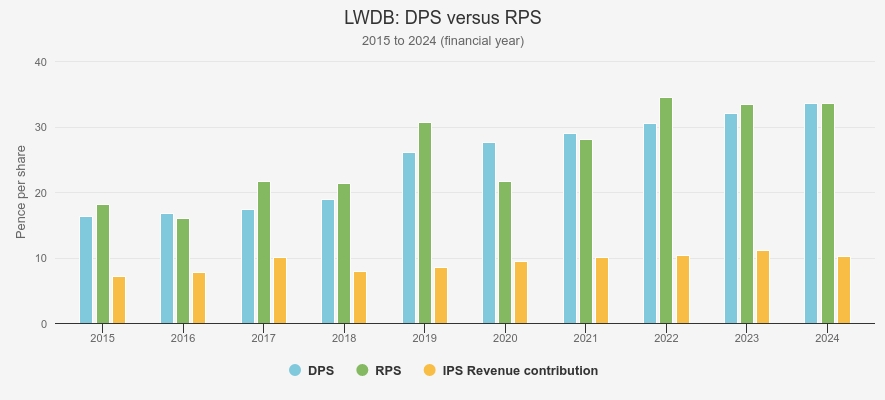

LWDB takes a very different approach, one investors seem to value. It combines a UK-focussed equity portfolio with its Independent Professional Services (IPS) business, which funds over a third of the trust’s dividend through recurring revenues. This stable income stream gives managers freedom to invest beyond traditional equity income stocks, often targeting under-researched small- and mid-caps. LWDB’s unique model supports a 44-year record of maintaining or increasing dividends, even during stress periods like the 2020 pandemic when IPS revenues grew 9.1%, cushioning the equity portfolio’s revenue decline, illustrated below. With a more modest 3.4% yield than peers, we think LWDB’s appeal lies instead in its unique structure, income resilience and total return potential through diversified capital drivers and income sources.

DPS AND RPS

Source: Law Debenture Corporation

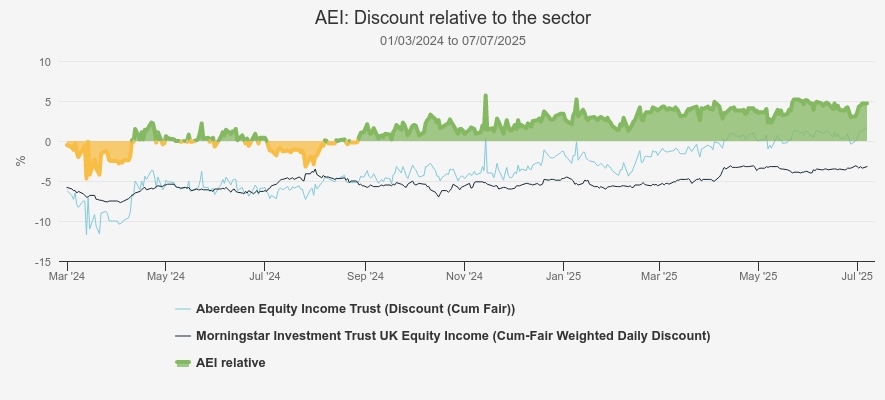

But what may surprise some is the significant re-rating elsewhere in the sector, notably Aberdeen Equity Income Trust (LSE:AEI). As the chart below illustrates, AEI traded at a 11.7% discount in March 2024 but has since seen it narrow, denoted by the rising green data point which tracks its relative discount against the Morningstar UK Equity Income sector, to a 1.0% premium, the first time since 2023.

AEI DISCOUNT RELATIVE TO THE SECTOR

Source: Morningstar

Whilst index outperformance played a role, we think the standout driver is yield. AEI currently yields 6.4%, well above the FTSE All-Share Index’s 3.5% and the UK Equity Income sector average. Manager Thomas Moore focusses on mispriced yield and unrecognised growth opportunities, often in smaller companies. AEI’s flexible, index-agnostic portfolio prioritises the best risk-adjusted income prospects, without sacrificing quality or growth potential.

Although AEI’s style lagged during recent large-cap, growth-led rallies, we see the market backdrop increasingly shifting in its favour. Supported by strong free cash flow and a 24-year dividend growth record, AEI’s elevated income plus capital growth blend is gaining traction. The move from a double-digit discount to premium suggests investors are starting to take notice, especially those looking for high, diversified yield as interest rates fall.

Invesco Global Equity Income Trust ord (LSE:IGET) is another newer entrant into premium territory. Following its 2023 restructuring, introduction of a discount control mechanism maintaining a single-digit range and an enhanced dividend policy, IGET repositioned as a differentiated global income strategy. The new dividend policy targets at least 4% of NAV per annum, supported by a blend of income and capital, giving managers Stephen Anness and Joe Dowling flexibility to invest across the yield spectrum.

The contrarian, valuation-driven strategy is split across dividend growers, low-yielding growth stocks, and temporarily challenged names with recovery potential. With an active share of 89% and a mid-cap bias, IGET differs markedly from typical global equity income funds skewed to US mega-caps, something that could appeal to investors rotating away from the US market darlings. Over the past 12 months, the trust’s NAV total return outpaced the MSCI World Index, whilst its share price surged 39.6%. From a 17% discount in August 2023, IGET trades at a 1.3% premium, at the time of writing. For investors seeking an actively managed, differentiated global equity strategy blending income and capital growth, IGET is increasingly compelling, especially amid a US rotation and as global rates decline.

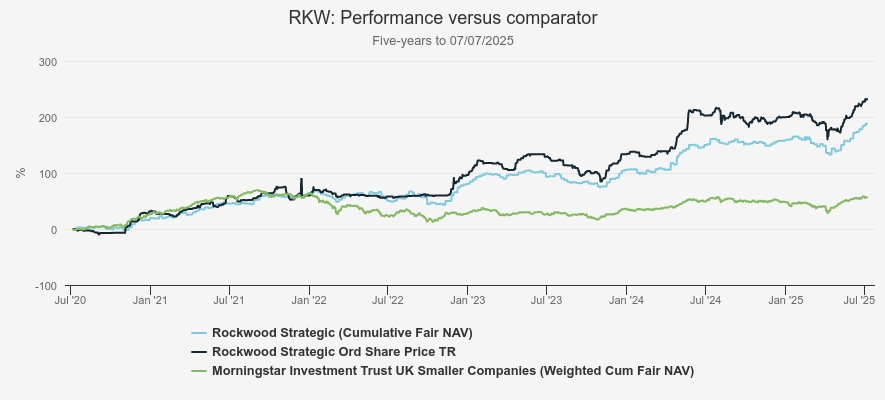

Rockwood Strategic Ord (LSE:RKW) is a very different proposition and one in which yield plays no significant role: differentiated access to UK smaller companies combined with a compelling performance record.

Since Richard Staveley returned as manager in 2022, RKW has delivered exceptional results, outpacing the FTSE Small Cap ex-IT Index (its closest comparator, albeit not the formal benchmark) by 103 percentage points, notable given the tough environment for UK small- and micro-cap stocks, where many peers have struggled. RKW’s selective, bottom-up stock picking has proven genuinely uncorrelated, producing strong returns despite subdued broader UK equity sentiment. The trust has traded around NAV or at a small premium since mid-2023 and at a premium of 2.4%, at the time of writing.

We believe RKW appeals to investors seeking alpha outside crowded global trades, offering a niche, high-conviction alternative, especially for those wanting differentiated performance beyond traditional growth/value or UK/US divides.

FIVE-YEAR PERFORMANCE

Source: Morningstar

Conclusion

After a prolonged period of broad-based discounts, sentiment across the investment trust sector is clearly shifting. Discounts are narrowing across many trusts, driven by an array of factors: from improving performance and growing income demand in a falling-rate environment to a rotation away from crowded trades. In some cases, we’re also seeing proactive board actions supporting this re-rating. These moves reflect genuine investor engagement and a seemingly renewed appetite.

At the same time, an increasing number of trusts are trading at premiums, with several entering this territory for the first time in years. What stands out is not just strong performance, but those with compelling propositions: structural advantages, unique income strategies, and specialised mandates offering meaningful diversification to global portfolios.

Whether narrowing discounts or persistent and new premiums, we think the message is consistent: investors are becoming more discerning. Trusts that deliver clarity, quality, and distinctiveness are being recognised. Whilst premiums may not last and discounts could widen, this recent shift is encouraging and could bode well for a healthier, more vibrant investment trust market going forward.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Editor's Picks