Trust tips for an efficient income portfolio

Income investors want the UK’s high yields, but consider these investment trusts for greater resilience, urges Kepler Trust Intelligence.

2nd August 2024 14:03

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

For all of the hand-wringing concern over the future of the UK stock market, it remains a popular destination for equity income investors. The market is one of the highest-yielding developed markets and therefore plays a significant role for investors looking to generate an income from their investments.

Despite this, a considerable portion of the income can come from a narrow range of stocks that are centred around just a few sectors. This could offer concentration risk if they come under pressure, as well as creating sector biases in terms of income or capital risks.

For investors willing to look further afield, there are some potentially overlooked geographies that can offer the benefits of diversification which may provide complementary income streams, as well as increase dividend resilience and growth in the future.

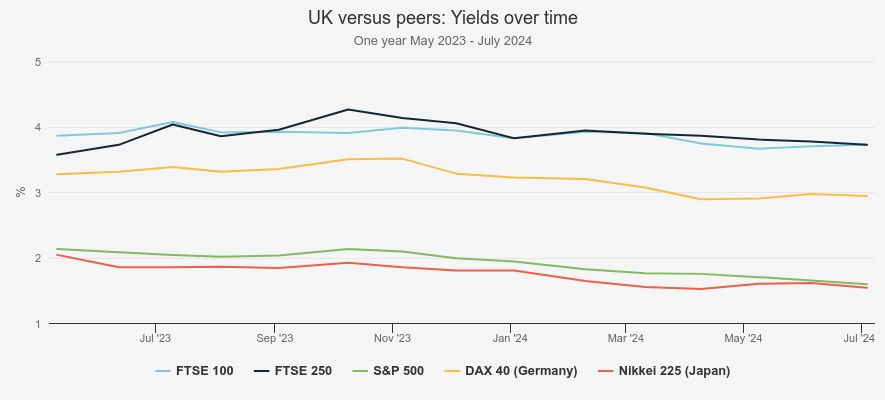

Yield incoming

The primary reason behind the UK’s popularity with income investors is, quite simply, its tendency to offer higher dividends. The yield on the FTSE All Share index as of 4 July 2024 was 3.7%. This was considerably higher than peers, such as the US S&P 500 index, which yielded circa 1.6%, Germany’s DAX 40 which yielded circa 2.9%, and Japan’s Nikkei of circa 1.5%. These levels have been largely persistent over the past year as we show in the chart below.

UK VS PEERS YIELD OVER TIME

Source: interactive Investor

While the headline yield figures look comparatively attractive, the UK market has a number of drawbacks. A large portion of the income from the UK comes from a relatively few number of stocks, especially in the large-cap FTSE 100.

In 2023, for example, over half the income of the index came from just 10 companies. This means there is significant concentration risk should one of these companies become challenged and need to reduce or cut its dividend. The risks are further exacerbated by the underlying sectors represented in the index. The UK market has a relatively high proportion of companies in the financials and energy sectors. The fortunes of these companies are typically exposed to factors outside their control, such as the oil price.

Equally, they can be influenced by external pressures, like when banks were forced to suspend their dividends during the pandemic. Furthermore, the two highest-yielding stocks in the index are tobacco firms which may be off-putting for some investors. In contrast, the UK market has relatively few companies in the technology sector which typically offer higher growth potential.

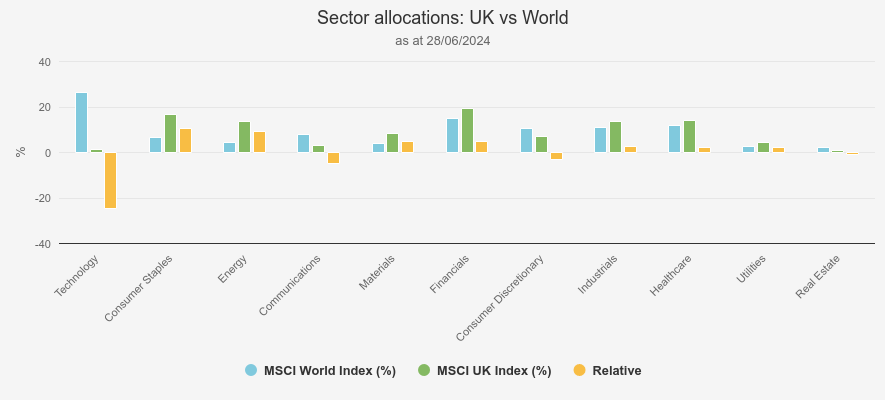

These factors have contributed to the UK being a more value-orientated index, hence the higher yield. This can be a headwind when the style is out of favour, such as in periods of low interest rates, although the signs are that this has been beneficial more recently as rates have risen. In the chart below we show the contrast in the sector allocations between the UK and a global index.

UK VS WORLD SECTOR ALLOCATIONS

Source: MSCI

Opportunities for diversification

Therefore, while the UK offers a higher yield, this clearly comes with some risks. However, these risks could be mitigated to some extent by holding a trust with a low correlation to the UK equity income sector.

In the chart below, we have shown the correlation of several income-orientated trusts over the past five years versus the UK equity income sector average. Many of these trusts offer exposure to geographies not typically acclaimed for their income generation. However, by utilising elements of the investment trust structure, they still generate attractive yields as well as diversification benefits for UK equity income investors.\

NAV CORRELATIONS TO UK EQUITY INCOME SECTOR AVERAGE

| Trust/index | Yield (%) | Discount (%) | 5-yr return % per annum | NAV correlation |

| JPMorgan China Growth & Income | 4.8 | -10.7 | -2.2 | 0.41 |

| JPMorgan Japan Small Cap Growth & Income | 4.1 | -14.0 | -1.0 | 0.64 |

| JPMorgan Asia Growth & Income | 3.7 | -8.6 | 4.7 | 0.73 |

| Invesco Asia | 3.8 | -10.8 | 7.3 | 0.75 |

| abrdn Diversified Income & Growth | 5.6 | -34.3 | 1.9 | 0.80 |

| Henderson Far East Income | 10.5 | 2.3 | -0.3 | 0.80 |

| JPMorgan Global Emerging Markets Income | 3.5 | -12.1 | 5.8 | 0.82 |

| CC Japan Income & Growth | 2.6 | -5.4 | 10.2 | 0.85 |

| abrdn Asian Income Fund | 4.8 | -13.9 | 5.1 | 087 |

| Schroder Oriental Income | 4.1 | -4.9 | 6.7 | 0.87 |

| JPMorgan Global Growth & Income | 2.1 | -9.5 | 2.4 | 0.88 |

| STS Global Income & Growth | 3.3 | 1.0 | 15.8 | 0.88 |

| Middlefield Canadian Income | 3.0 | -1.3 | 5.9 | 0.89 |

| Scottish American | 4.2 | -13.6 | 6.7 | 0.89 |

| Murray International | 2.6 | -8.0 | 9.7 | 0.91 |

| North American Income | 4.3 | -8.1 | 7.6 | 0.91 |

| JPMorgan European Growth & Income | 3.6 | -10.9 | 6.0 | 0.93 |

| JPMorgan UK Small Cap Growth & Income | 3.7 | -9.1 | 10.1 | 0.93 |

| Henderson International Income | 5.2 | -3.0 | 8.7 | 0.95 |

| Invesco Global Equity Income | 4.1 | -11.6 | 6.7 | 0.95 |

| Morningstar IT UK Equity Income | 5.5 | 1.0 |

Source: Morningstar

One standout from this table is those trusts with the lowest NAV correlation to UK equity income are Asia-focussed. The investment case for the region for some time has been the expansion of the middle classes and increases in regional consumption as wealth grows. The driver of these earnings will be considerably different to those affecting the UK’s largest companies, and therefore the dividends are likely to provide a differentiated income stream. This is likely to improve income resilience in a diversified portfolio. Furthermore, these drivers are arguably secular and therefore could offer style diversification benefits, versus the more cyclical exposure typically seen in the UK market.

Whilst the Asia-focussed trusts provide diversification benefits, there is less of a dividend culture in the region and therefore dividend yields on the underlying portfolio are typically lower. However, many trusts have mitigated this through enhanced dividend policies. This is a unique advantage for investment trusts, where a trust pays a higher income than the portfolio naturally generates by combining the underlying revenue with a contribution from capital. Not only does this increase the income potential from an otherwise low-yielding asset class, but it also increases the resilience of the income as the managers are not reliant on the income generation of the underlying portfolio. One example is JPMorgan Asia Growth & Income Ord (LSE:JAGI). JAGI pays 1% of NAV per quarter, therefore yielding c. 4.4% at the current share price, which is around double what the underlying portfolio generates. This approach provides the managers the flexibility to pick the best opportunities from a total return perspective, without being beholden to yield requirements, whilst still providing investors a good level of income. The managers have used this flexibility to focus on growth stocks which has clearly contributed to the lower correlation to the UK equity income sector, as well as a strong total return performance. As such, an investment in JAGI alongside a UK equity income trust would not only offer a balance of styles but also a robust and differentiated income stream, with the potential for capital growth.

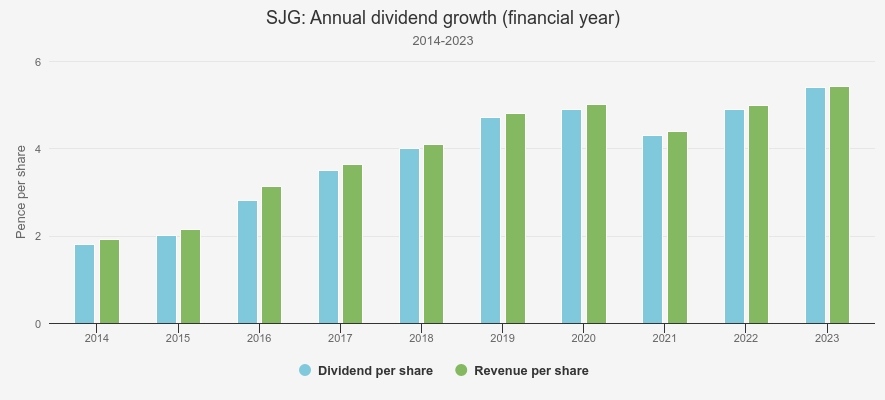

Asia also has good dividend growth potential. There is a growing dividend culture in the region, albeit from a low base, which is supported by several regional governments. Japan has had policies in place for a number of years, something we discussed in a recent blog, with Korea also adopting similar measures. This is something that Masaki Taketsume, manager of Schroder Japan Trust Ord (LSE:SJG) (SJG) noted in the recent decision to adopt a new dividend policy. The trust has grown its annual payout substantially in the past few years, from 1.8p per share in 2014, to 5.4p in 2023. However, in July 2024, the board announced the introduction of an enhanced dividend of 4% of NAV. Japan can offer significant correlation benefits to UK equity income and therefore SJG’s new policy could offer investors totally different exposure to the UK, whilst still supporting investors’ need for income.

SJG DIVIDENDS

Source: Schroders

Beyond Asia, the US market also offers diversification benefits to UK equity income. However, the dividend culture in the US is not as prevalent, with firms instead generally preferring to return excess capital through share buybacks. Furthermore, the US has a much higher proportion of companies in high-growth industries such as technology. These firms typically use excess capital to grow their business, rather than paying it out to shareholders meaning the market offers more opportunities for growth investors than income. This does mean that the US market offers a contrast of sectors and investment styles that are found in UK equity income, which offers diversification, albeit at the expense of yield potential.

However, once again investment trusts, with their more flexible structures, are able to offset this and therefore can still be useful for income investors. One example is North American Income Trust Ord (LSE:NAIT). The trust seeks to generate resilient growth and a rising income through a portfolio of predominately equities, though it uses the flexibility of the trust structure to hold fixed-income holdings too which help it achieve a significantly higher yield than the market. Furthermore, the managers can write options on their holdings which can generate additional revenue that can supplement the income. NAIT’s current yield is c. 3.9%, which is about three times the index level. The trust has significant revenue reserves too, over 1.1x the 2024 dividend as of the date of the annual report on 31/01/2024. We should note the trust is currently undergoing a change of management firm to Janus Henderson, though it is expected that the current manager, Fran Radano, will retain his position.

Alternatively, investors could consider BlackRock Sustainable American Income (LSE:BRSA). Here, manager Tony DeSpirito and his team take a value approach to the American market, which increases the yield potential. BRSA has paid a dividend of 8p per share per annum since 2018, offering a current yield of c. 4%. This comes from a combination of underlying revenue and distributable reserves. Whilst not a guaranteed amount, the history of a consistent dividend could offer investors increased certainty, which may provide investors income resilience in a wider portfolio, as well as the diversification benefits of the US market.

Moving closer to home, investors could consider Europe. The region yields more than the US and Asia, albeit still slightly less than the UK, and whilst the sector breakdown is quite similar, there are notable differences, with less concentration in the biggest payers, and some more unique sectors such as listed infrastructure firms. The continent is also home to many global leaders in their industry which offer good growth potential and yield, therefore contributing resilience to an income portfolio. Whilst the options for high-yielding trusts are limited, there are several trusts with impressive dividend growth track records which could provide investors with an attractive differentiator.

One example is Fidelity European Trust Ord (LSE:FEV). Managed by Sam Morse and Marcel Stötzel, the trust has increased its dividend for 13 consecutive years which, with the exception of 2020, has been covered by earnings. Whilst not the primary focus of the managers, they do consider dividends as part of the total return potential from a stock, and highlight the portfolio’s dividend growth rate of 6.1%, nearly double that of the index as a supportive indicator to the future of the income. The trust has delivered very strong NAV returns over the long-term too, delivering performance of 66.6% to 24/07/2024 versus a benchmark return of 41.6%. As such, whilst the share price yield of 2.14% may be slightly below what investors could achieve in the UK, FEV offers the potential for a growing income stream that supports future dividends, as well as increasing the capital growth potential of the portfolio.

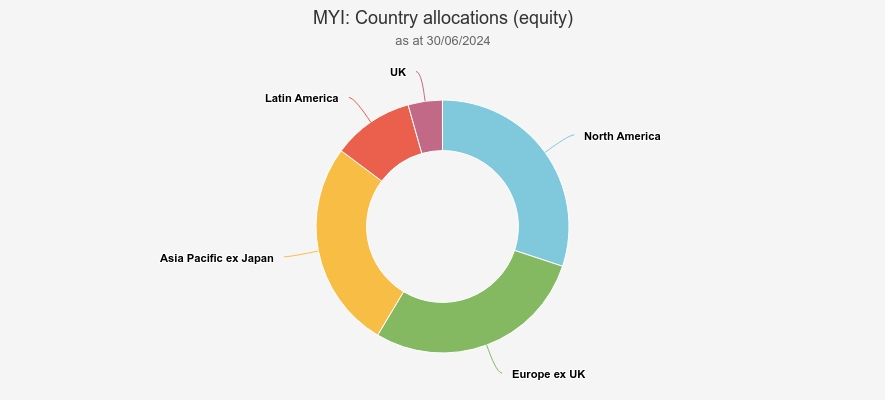

Alternatively, for investors wanting to outsource the allocation decision, there are several global equity income trusts to consider. Here, the managers can choose between the different geographies and blend the income streams together to create a ‘one-stop-shop’ for investors. One example is Murray International Ord (LSE:MYI). After a long handover period, the management has recently passed to Martin Connaghan and Samantha Fitzpatrick who maintain a benchmark-agnostic approach, with the aim of generating an above-average dividend yield, coupled with long-term growth of both dividends and capital. At present, the trust yields an attractive c. 4.6% from a mix of geographies, including emerging markets. The managers can also hold fixed income, which could add to the downside protection of the diversified trust. Martin and Samantha are underweight in the UK which could make MYI a complementary holding to a portfolio otherwise weighted heavily to the country, or even as a standalone investment.

MYI GEOGRAPHIC DISTRIBUTION

Source: abrdn

Conclusion

The UK is a popular market for income investors as a result of its higher-yielding companies in more mature sectors. However, by concentrating in these areas, investors are missing out on the potential from overseas markets, where income investing is beginning to gain traction, while also running the risk of concentration by being too reliant on a few key names. Investment trusts are excellent vehicles to support this diversification due to the many tools at their disposal such as being able to retain earnings for future dividends and the ability to enhance a portfolio’s yield from other sources such as fixed income to increase income and add resilience. At present, many of these trusts are trading at wide discounts and therefore could offer very attractive entry points. Beyond this, investors could also consider investments beyond just equities. Whilst increasing geographic diversification can help dampen risk and improve the resilience of income streams, further diversifying into other asset classes, such as renewable energy infrastructure which have dividend yields in excess of what is available in equities, as well as strong track records in raising those dividends too, could offer even more diversification and resilience for a truly efficient income portfolio.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Editor's Picks