Is this type of bond fund the best option for DIY investors?

16th August 2022 09:29

These ‘go anywhere’ bond funds have the flexibility to protect in turbulent times and profit during good times. But as Cherry Reynard explains, such promises are not necessarily in sync with reality.

It has been the worst start to the year for the bond market in living memory. Investors may have known that low yields couldn’t last for ever, but few could have been expecting double-digit losses from the ‘safer’ parts of their portfolio.

Short of ignoring bonds altogether, the temptation has been to leave it to an expert – a fund manager who can find that sliver of the bond market that happens to be doing well at any given moment.

This is where strategic bond funds come in. These are billed as ‘go anywhere’ bond funds that will tilt according to the market environment. Such funds can invest in any time of bond – not restricted to countries or types of bond (corporate or government).

- Find out about: Investing in Bonds | Free regular investing| Opening a SIPP

Adam Norris, investment analyst on the multi-manager people team at Columbia Threadneedle, says: “The nirvana for a strategic bond investor would be a fund that protects capital during periods of market turmoil, but is flexible enough to capture returns for investors in more buoyant times.”

However, he admits that the promise isn’t necessarily matched by reality: “Such funds rarely exist due to the heavy dependence on market timing, a skill notoriously hard to find.”

Look under the bonnet

In other words, it is difficult to predict the moments at which markets turn, so investing in the right fixed income asset class at the right moment isn’t easy. While there are some genuinely flexible funds, most strategic bond funds tend to pick a few levers – interest rates, duration, credit – and exploit them rather than trying to do everything.

To reflect these nuances, Square Mile puts its strategic bonds into different categories. Eduardo Sanchez, head of fixed income and absolute return research, says: “Because there are such a variety of investment outcomes – some invest more in credit, or government bonds, others more duration risk (sensitivity to interest rate rises) – we put them in different groups.”

Within the Investment Association’s (IA) strategic bond fund sector are lower-risk funds, which may limit themselves to high-quality corporate or government bonds, with lower interest rates and credit risk. At the other end, are funds with most of their assets in investment grade and high-yield corporate bonds, which are higher risk. As a result, higher yields are on offer to compensate.

Also bear in mind that strategic bond funds will have different benchmarks and will behave differently at various points in the market cycle. Some will provide a core, flexible exposure to fixed income markets, but others will be quite specialist.

- The bond funds the pros are buying to snap up high income

- Why bonds are at a major turning point, according to veteran investors

- Bonds are back as a diversifier, despite rate rises

Norris adds: “Strategic bonds can often be a misnomer. There are plenty of funds found in the sector that are not that strategic. A criticism levelled at the grouping is that many of its constituents tend to be, almost exclusively, a mixture of investment grade and high-yield bonds. While this can often be a sweet spot for investor returns, static positioning probably isn’t the objective many investors are looking for.”

It also means that the gap in the performance of strategic bond funds is enormous. In mid-July, the weakest fund is down 22.9% (VT EPIC Diversified Income) over three years, while the strongest is up 13.3% (Merian Global Strategic Bond). The Merian fund has more than 80% in government bonds and less than 10% in corporate bonds, while the VT EPIC Diversified Income, a minnow at just £6 million, invests in a portfolio of bond funds.

Tread carefully

Sanchez says performance comes down to both the mandate and the skill of the manager, so investors need to tread carefully.

Ariel Bezalel, manager of the Jupiter Strategic Bond fund, a member of interactive investor’s Super 60, says: “The degree of flexibility clearly depends a lot on the mandate and on the portfolio manager. At Jupiter, being flexible means that we are not forced to invest in areas of the market where we do not find value, and being able to make broad shifts in asset allocation, and sensitivity to interest rates.”

- Watch our video interview with Ariel Bezalel: why interest rates will fall in 2023 and how we are profiting

- Watch the other part of this video interview with Ariel Bezalel: an 8% bond yield and the ‘biggest opportunity’ for years

Also, it is worth noting that there are times in the market where no amount of asset allocation will deliver a positive return – and this year has been one of them. All fixed income asset classes are down by varying degrees.

Sanchez says: “In the first few months of 2022, it has been very difficult for all managers. All asset classes performed in a similar way.”

Bezalel agrees. He points out that investors typically buy fixed income for yield and diversification, but so far in 2022 diversification has failed. “You had to be short the market (which a typical strategic bond fund can’t do), or just invest in energy. It’s the first period where we’ve seen something similar for 40 years,” says Bezalel.

‘Best time to buy bonds since financial crisis’

Against that backdrop, investors need to be careful what they expect from strategic bond funds and that the fund they pick does what they want it to do. However, with that caveat, it looks like it could be a more fruitful period for the strategic bond sector. The horrible performance for bonds since the start of the year has left valuations looking appealing.

Bezalel says: “Looking forward, fixed income yields have become incredibly attractive – perhaps this is the best time to buy bonds since the global financial crisis. Over the longer term, once central banks pull back from increasing rates – which we think may be sooner than many think – the normal relationship between bonds and equities should reassert itself. Today, you can buy a diversifying strategy at a markedly higher yield than we’ve seen over the past decade.”

- Vanguard says ‘bonds are back’ following worst spell for 150 years

- Don’t be shy, ask ii...why do some bond funds have such high yields?

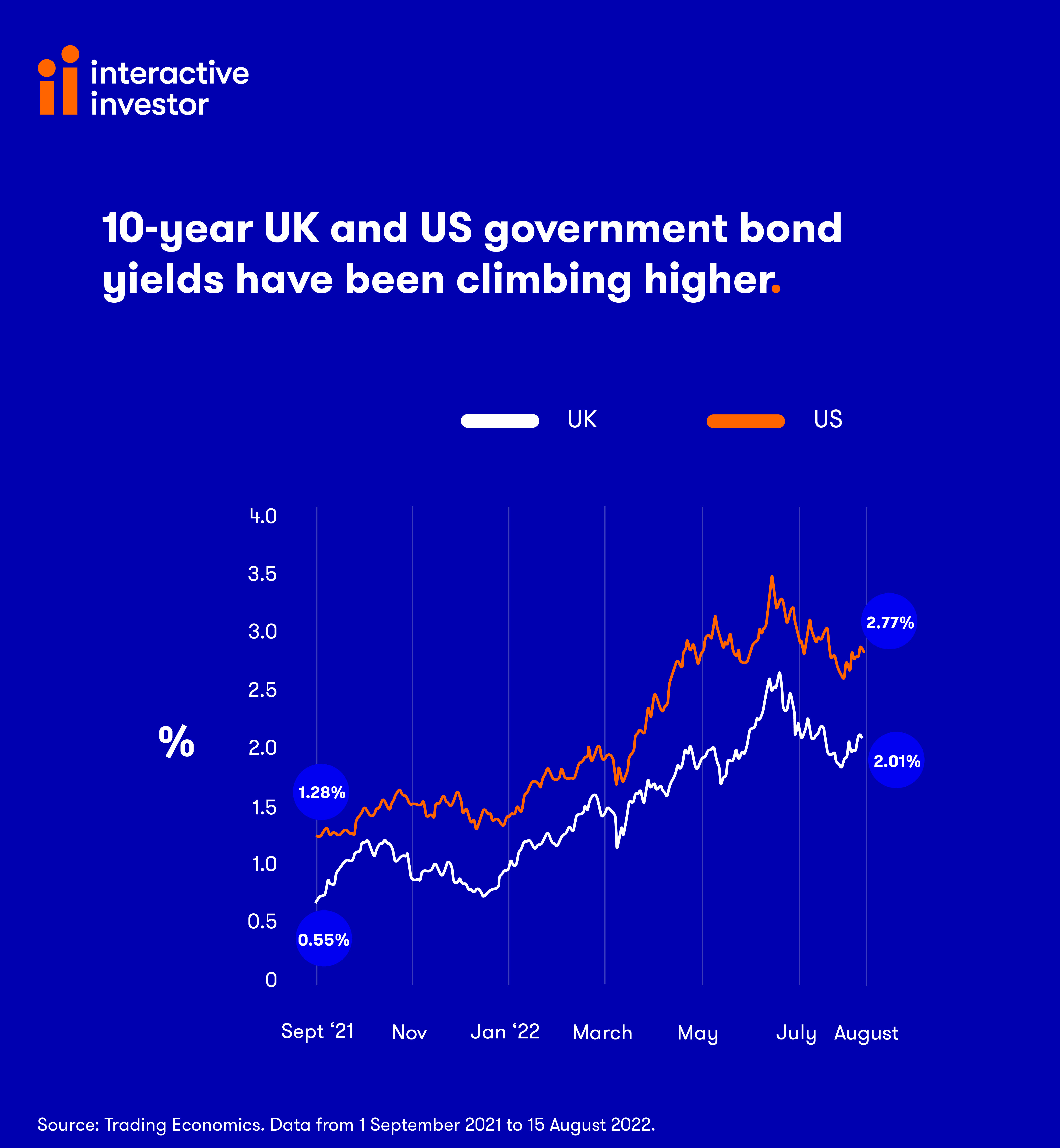

Bond markets have already started to reverse the run of weakness seen since the start of the year. The US 10-year treasury yield appeared to peak in early July, and has moved lower since. The UK 10-year gilt yield has seen a more dramatic move, falling from 2.65% in late June to around 2.1% today. Yields move inversely to price, so investors have started to see gains on their investments after six months of brutal capital losses.

While the opportunities may be there, strategic bond fund managers will have very different approaches to harnessing it. Bezalel, for example, is finding opportunities in bonds viewed as being more risky in the high-yield market, especially in Europe. He is pairing interesting valuations and uncertain fundamentals with a focus on short duration bonds (those with less sensitivity to interest rate rises), defensive sectors and special situations.

The funds that standout from the crowd

Meanwhile, the Allianz Strategic Bond fund, one of the most consistently strong performers in the sector, has significant holdings in emerging market government debt, including South Africa, Mexico and Indonesia. Manager Mike Riddell is also bullish on UK government bonds - gilts.

The Invesco Tactical Bond fund, another standout performer, is taking a more diversified approach with the portfolio split between investment grade corporates (38%), high-yield corporates (28%) and investment grade government bonds (27%), with a smattering of emerging market debt.

Norris says: “We try to refine the sector into funds which are more nuanced; aggressive when an opportunity set arrives and/or have a particular sector skill.

“Often, we will then supplement our core strategic bond fund selections with smaller allocations to specialist funds to express a particular view; a constructive view on high yield or emerging market debt, for example.”

- Recessions are becoming more likely – here’s how to invest

- Economic woes mean bonds are finally worth investing in

He has allocations to the Allianz Strategic Bond and Janus Henderson Strategic Bond, managed by Mike Riddell and Jenna Barnard/John Pattullo respectively.

He adds: “Our core view is that the macroeconomic outlook is deteriorating rapidly – inflation is savaging household spending and eating into corporate profit margins. This backdrop is ugly for risk-asset performance.

“Both managers have historically proved excellent protectors of capital when economies struggle. In addition, we use MI TwentyFour AM Dynamic Bond Fund; financial sector experts in a time [when] bank bond yields are approaching multi-year highs.”

Sanchez likes the M&G UK Inflation Linked Corporate Bond bond fund in the lower-risk category.

“It has very little credit and interest rate risk and a lot of exposure to inflation-linked bonds. For medium risk, we like the Invesco Tactical Bond fund. It provides a good balance of returns with not a lot of risk. For core fixed-income exposure, we like the Waverton Sterling Bond and Allianz Strategic Bond funds – as these have good diversification and low correlation to equities.”

In interactive investor’s Super 60 list of rated funds, flexible bond options include the M&G Global Macro Bond and Jupiter Strategic Bond.

The strategic bond sector has plenty of great funds and can be the solution to the complexities of the fixed income market for investors who don’t feel comfortable choosing between government, corporate or emerging market bonds. However, the sector contains a wealth of different styles and approaches, so investors need to pick with care.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks