What we’re buying after trimming US and tech funds

Saltydog Investor’s dialling down on risk after reducing exposure to two exciting sectors.

10th March 2025 13:42

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Although funds investing in equities can produce the best returns when conditions are favourable, they also tend to suffer the most when markets turn. Funds investing in bonds tend to be more stable, and that has certainly been the case in recent months.

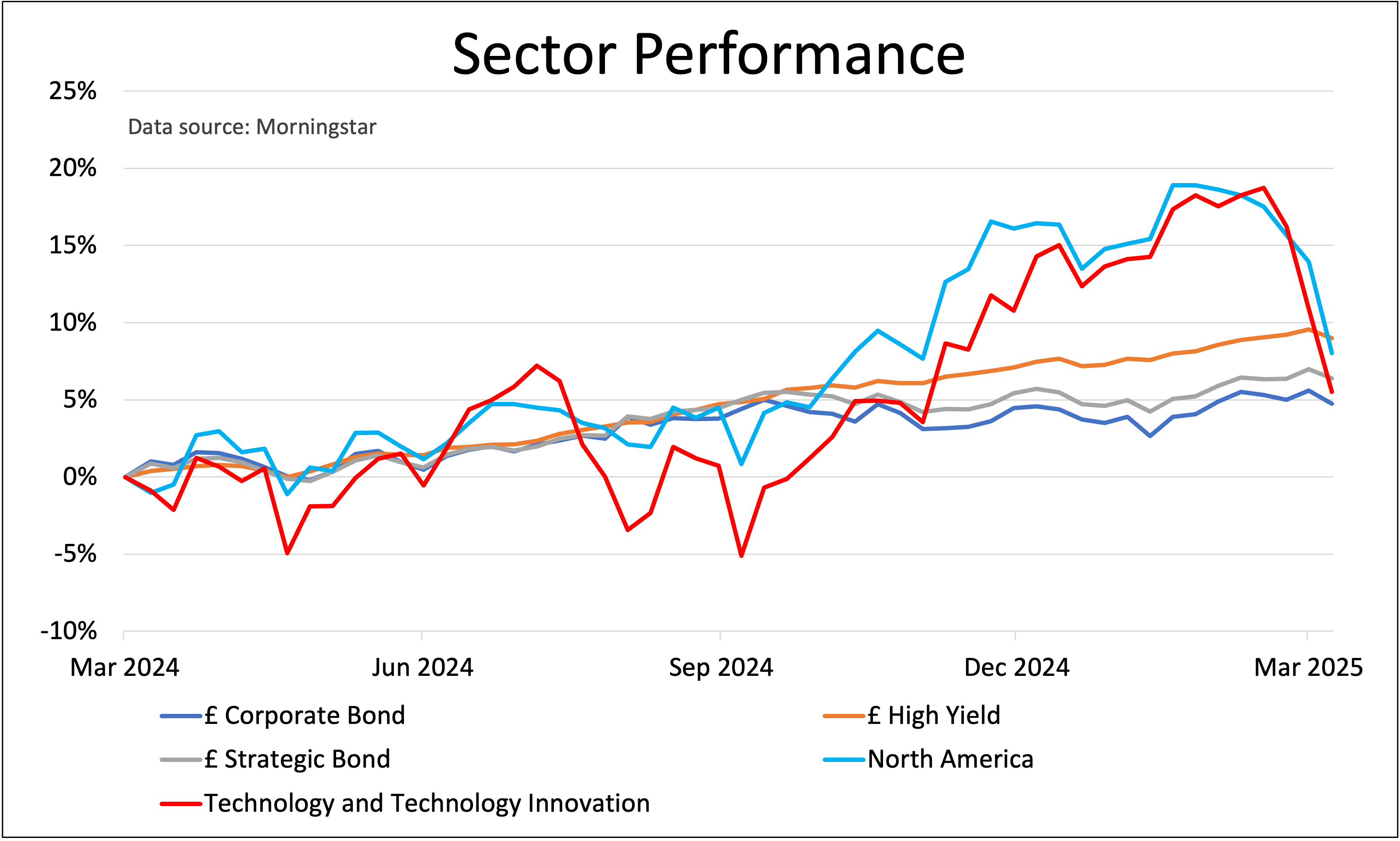

This trend is evident when comparing the performance of the North America and Technology & Technology Innovation sectors with some of the bond sectors.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Past performance is not a guide to future performance.

The American stock markets have performed exceptionally well in recent years, and this has been reflected in the returns generated by the North American and Technology sectors. In 2023, the North American sector rose by 16.7%, and last year it made a further 22%. The Technology & Technology Innovation sector did even better, gaining 38.7% in 2023, and 23.5% in 2024.

Both sectors got a boost at the end of last year, when Donald Trump won the US election, and continued to make gains in January. However, they fell in February, and March has not started well.

Since Donald Trump’s inauguration on 20 January, the global financial and geopolitical landscape has become more unsettled. His political interventions, in the Russia-Ukraine and Israel-Hamas conflicts, have made America’s stance harder to predict than under the previous administration. Assumptions that for a long time have been taken for granted are now being questioned.

On top of that, there’s the direct impact of the import tariffs that America has already put in place, and others that are on the way. The fact that some have been confirmed, then delayed, then implemented, and then amended, only adds to the uncertainty.

- 10 hottest ISA shares, funds and trusts: week ended 7 March 2025

- Where pro fund buyers are investing their ISAs in 2025

- Market update: US stocks extend losses in 2025

When the tariffs against Mexico and Canada were delayed in early February, US stock markets rebounded after a small drop. However, when they were imposed at the beginning of March, markets tumbled. The partial rollback has yet to restore market confidence.

Last week, the Dow Jones Industrial Average went down by -2.4%, the S&P 500 lost -3.1%, and the Nasdaq did even worse, falling -3.5%.

Over the past couple of weeks, we have reduced our exposure to the North America and Technology sectors and added to some of our longer-term bond holdings.

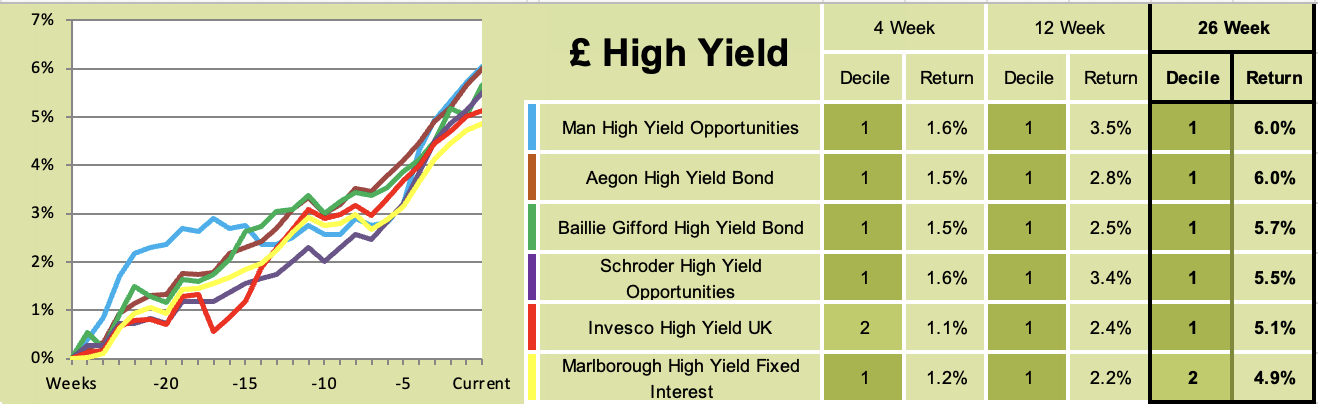

We invested in the Invesco High Yield and Schroder High Yield Opportunities funds in September 2023 and now also hold the Baillie Gifford High Yield Bond B Acc and Man High Yield Opportunities funds. Last week, all four were still showing in our table highlighting the best-performing funds in the Sterling High Yield sector over the past 26 weeks.

Past performance is not a guide to future performance.

We also hold the L&G Strategic Bond I Acc, from the £ Strategic Bond sector.

Past performance is not a guide to future performance.

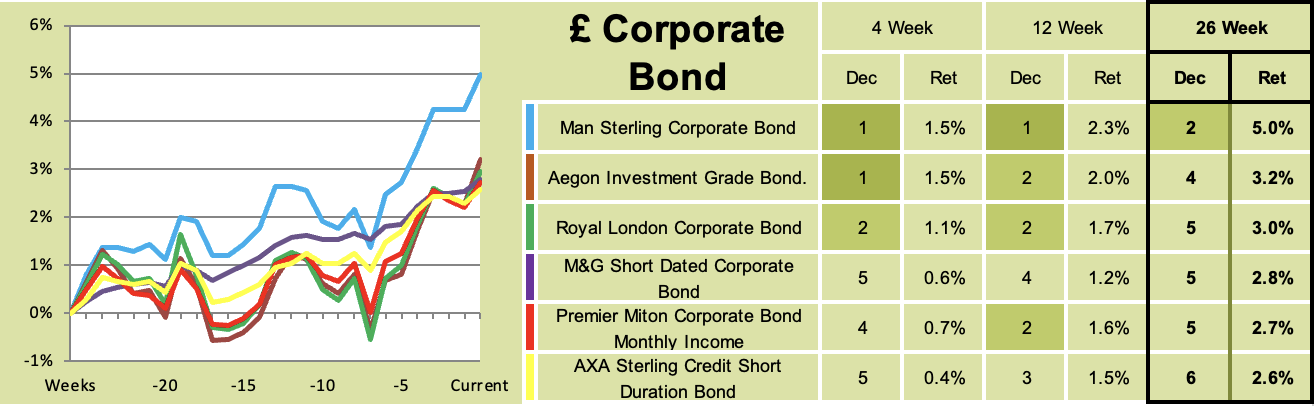

And the Man Sterling Corporate Bond fund.

Past performance is not a guide to future performance.

Although funds from these sectors may not necessarily produce the largest gains over any given period, they can deliver steady returns.

In our Saltydog demonstration portfolios, we manage the overall volatility by having a mix of funds from different sectors. Given the low-risk profile of our portfolios, we allocate the largest portion of our capital to funds that have a track record of being relatively slow and steady. That is where these bond sectors naturally fit.

For the icing on the cake, we will invest smaller amounts in the more exciting sectors, such as North America and Technology & Technology Innovation, but only when they are generating superior returns.

That has not been the case in recent weeks. With the current uncertainty in the markets, it feels like now might be a good time for a bit more cake, and a little less icing.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks