Which of these four bank stocks should you be buying?

This sector, like many others, suffered during the tariff crash, but is now stabilising. Analyst Rodney Hobson assesses the industry dynamics and gives his view on these leading lenders.

16th April 2025 07:45

There is good news and there is bad news. Which do you want first? Alas, this is not the prelude to a joke. This is the reality of first-quarter financial results from American companies reporting in what is one of the trickiest situations that most investors have ever faced.

We will have the good news first. Banks have got the reporting season off to a great start. The biggest in the bunch, JPMorgan Chase & Co (NYSE:JPM), set the pace as usual by beating market expectations, with revenue up 8% and profits 14% higher, thanks mainly to a jump in equities trading, as Keith Bowman reported.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

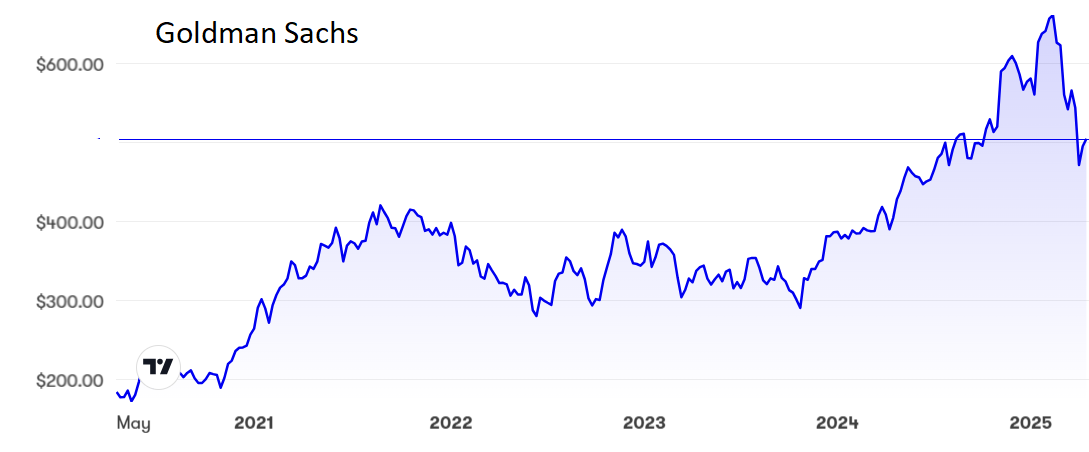

The Goldman Sachs Group Inc (NYSE:GS) had a similar story with revenue from equities hitting a new record at $4.2 billion, a rise of 27%. Net earnings in the quarter rose 15% to $4.7 billion on revenue 6% ahead at just over $15 billion.

Citigroup Inc (NYSE:C) is another bank to beat forecasts with rising revenue and profits in the first quarter, as Keith Bowman reported.

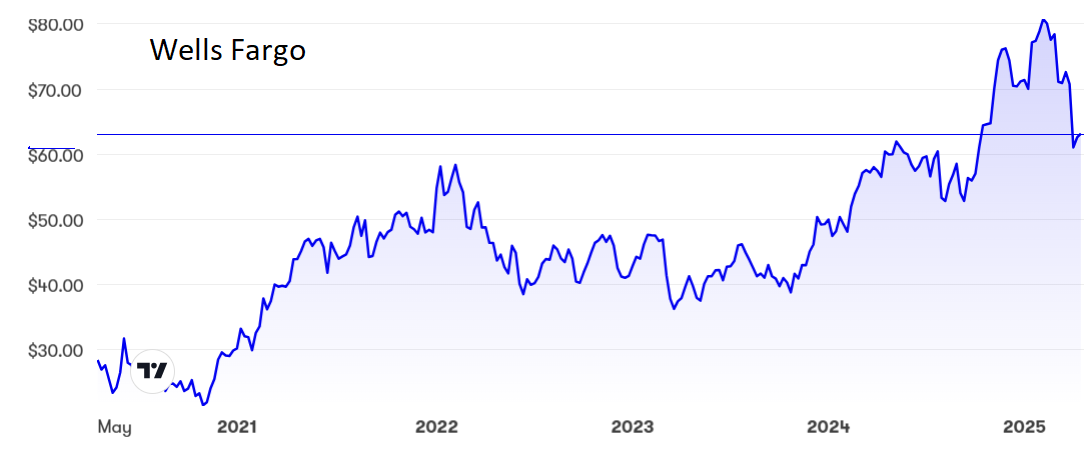

Wells Wells Fargo & Co (NYSE:WFC), as often seems to be the case, was out of line with the sector, this time producing mixed quarterly results. Revenue fell fractionally to $20.15 billion, failing to reach the consensus figure, although net income offered consolation, rising 5.8% to $4.9 billion.

Now for the bad news. That quarter came entirely before the impact of US President Donald Trump’s so-called Liberation Day when his much-delayed up-and-down tariffs were introduced. There is almost certainly worse to come in the second quarter and beyond. How far beyond not even Trump himself seems to know.

JP Morgan chief executive Jamie Dimon went so far as to say there was a 50-50 chance of recession in the United States. His opposite number at Goldman, David Solomon, was perhaps a little wiser in making no reference to the global economic background or the likely impact of rising tariffs. The fact is that no-one, not even the heads of large global banks, knows where we are heading, especially with the chief protagonist of the tariff wars seemingly changing his mind at random.

Already there are some weaknesses in banking results. Goldman reported investment banking fees down 8% and asset and wealth management revenue 2.9% lower. More worrying was a 3.2% slippage in revenue from Platform Solutions, its financial technology and transaction banking services arm, which one might have expected to be growing. Wells Fargo suffered falling revenue and profits from falling interest rates.

- Stockwatch: let’s see how tariff chaos affects company profits

- ii investment performance review: Q1 2025

- Investing through the storm: Q&A with ii experts on market volatility

The big fear for banks is stagflation, which is a real possibility in the United States given the uncertainties of Trump’s economic policies. Tariff wars are likely to hold back economic growth, at least in the short term, by disrupting the supply chain. They are also inflationary, in that cheap imports are choked off and consumer choice is restricted.

Inflation will lead to higher interest rates, whatever pressure Trump puts on the Federal Reserve Board to reduce them. Higher interest rates normally suit banks as they allow a widening of the spread between borrowing and lending rates. However, if the economy is stagnating at the same time, then borrowers will find it harder to pay higher interest, and bad debts will rise. Already JPMorgan has raised its bad debt provisions from $1.9 billion to $3.3 billion.

Banking shares do seem to be stabilising after a shaky start to April, although there is a long arduous road ahead. Goldman shares dropped from $585 to $460 but have now recovered to around $495, where the price/earnings (PE) ratio is less demanding than that of most New-York listed shares at 12.2 and the yield is reasonable at 2.38%.

Source: interactive investor. Past performance is not a guide to future performance.

JPMorgan took a 16% hit from over $250 to $210 but has recovered comparatively well to $234. The PE stands at only 11.6 but the yield is a little light at 2.14%.

Source: interactive investor. Past performance is not a guide to future performance.

Citigroup’s attack of nerves took the shares from $74 to $58 but the recovery has gone as far as $65, with a PE of 10.4 and an attractive yield of 3.6%.

Source: interactive investor. Past performance is not a guide to future performance.

Wells Fargo shares have followed a similar pattern and at $64 have a PE of 11.35 and a yield of 2.46%.

Source: interactive investor. Past performance is not a guide to future performance.

- One common hedge-fund trade could bring down financial systems – and it nearly backfired this week

- Ian Cowie: bargains for the bold as tariffs take toll on markets

Hobson’s choice: Bank shares are likely to show continued volatility, which will be music to the ears of short-term traders looking for quick profits. Those investing for the long term will do well to buy on the dips and grit their teeth.

Goldman seems a decent prospect below $500 but the shares may well struggle to get above $530, at least until the dust settles. Citigroup looks the most attractive in the sector at current levels with a low PE and a better yield as consolation if the sector runs into difficult times. Wells Fargo is least tempting as it seems to be suffering most from economic uncertainty. Holders of JPMorgan should hang in there, but it may be a bumpy ride.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks