Which of these three turnaround stocks will win?

In a fiercely competitive industry, there’s a trio of famous companies battling for supremacy. Analyst Rodney Hobson reveals what he’d do with each share.

12th March 2025 07:57

It is a marathon, not a sprint, as Elliot Hill, who took over as chief executive of Nike Inc Class B (NYSE:NKE) last year, said. He was talking about his turnaround plans at the American sportswear company, but the same could be said about German arch-rival adidas AG (XETRA:ADS), which also has a comparatively new chief executive with a turnaround plan. Investors should see this sector as a long-term struggle for supremacy, not one for quick-fire gains.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Adidas shot quickly from hero to zero when news of bumper results for 2024 suddenly turned into a downgrade for 2025. A boom in demand for its retro trainers such as the Zamba and Gazelle brands pushed sales 12% higher last year. Guidance for the current year suggests that growth will slow to 10%.

Let us get this in perspective. That sort of growth would be the envy of most other companies. The big worry is what impact the trade war being unleashed by US President Donald Trump will have.

It could be worse. Adidas aims to be the biggest sportswear business in each of its markets except the United States, where it is already far behind Nike. A trade war with the US could actually help by restricting competition from Nike across most of the world.

Meanwhile, though, Adidas now expects operating profits between €1.7 billion (£1.4 billion) and €1.8 billion in 2025 against analysts’ expectations of €2.1 billion. Management is probably erring on the side of caution, so the risk is to the upside rather than the downside.

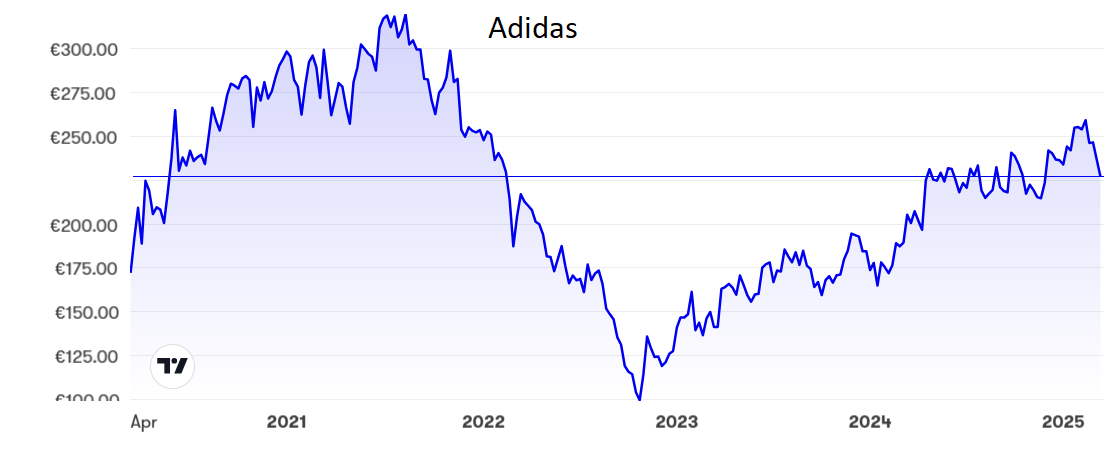

Source: interactive investor. Past performance is not a guide to future performance.

Nike’s recovery under Hill will probably not happen until next year, and this year’s results could well include one-off losses as he throws the kitchen sink into the mix. Hill has been very careful to manage down expectations so again there is scope for results to be a little better than indicated.

Hill is highly regarded as a successful former head of Nike’s consumer and marketplace operations who stepped down five years ago but returned in September in the top job. He promised to make Nike great again by returning it to its former strength as first and foremost a sports brand. Nike could lose some lower priced sales as he renews the emphasis on premium, full-priced sales.

We shall know more later this month when quarterly figures to the end of February come out. The last figures, for the group’s second quarter to 30 November, showed net income down 27% at under $1.2 billion (£900 million) on revenue 7.8% lower at $12.35 billion.

A similar contraction is expected in the second half to the end of May, with sales down more than 10% and slimmer gross margins.

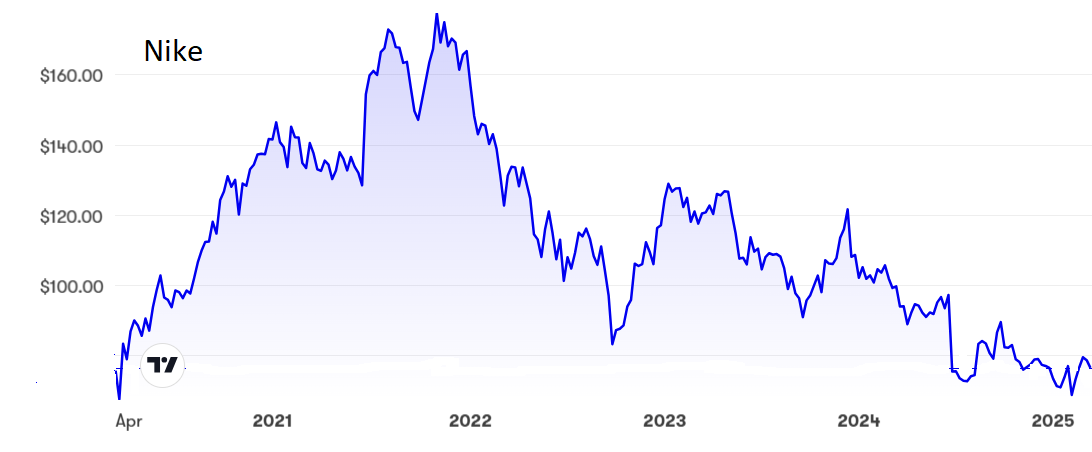

Source: interactive investor. Past performance is not a guide to future performance.

The outlook is equally difficult at smaller German rival Puma SE (XETRA:PUM), where the company has also reduced its guidance for this year after sales grew 9.8% to €2.3 billion in the fourth quarter. In this case, though, there was a decisive spurt in sales growth compared with earlier last year.

The problem was that last November analysts had been encouraged to expect even better. With full-year net income falling 7% to €282 million as margins crumbled, some have now downgraded expectations for 2025.

- DIY Investor Diary: I invest so I don’t have to worry about money

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Puma has joined its two bigger rivals in embarking on a turnaround programme, in its case aimed at controlling costs and improving efficiency. Unfortunately, it shows little sign so far that it can turn increased sales into higher profits.

Source: interactive investor. Past performance is not a guide to future performance.

All three companies have seen a sharp fall in their share prices to reflect the uncertain future. Nike was $126 just over two years ago but now looks to be bottoming out back where it was five years ago at around $75, giving a still quite challenging price/earnings (PE) ratio of 24 and a yield of only 2.0%.

Adidas has performed well since dipping to €100 in October 1922 but has come off its recent best to stand just above €220. The PE looks unrealistic at 56 while the yield is a measly 0.3%. However, €214 has been a recent floor and could be again given its better prospects

Puma peaked at €115 in November 2021 but has slipped below €30, where the PE is still a bit toppy at 17 and the yield does not offer sufficient compensation at 2.8%.

Hobson’s choice: Puma looks to be the highest risk of the three and rates no more than a hold. I would want some evidence that it can improve profitability before considering buying.

I last commented on Nike and Adidas at much higher share price levels in December 2021, when I suggested that since both had a demanding PE and tiny yield it was better to hold off buying until at least the next sales and profit figures. That proved to be quite an understatement.

Currently, Adidas offers the best prospects but the rating more than reflects this. Buy if the shares drop towards €200. Nike looks to be the best buy at the current price level.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks