Why this blue-chip needs a miracle

Independent analyst Alistair Strang turns his focus to one of the world’s top 10 exchange groups.

13th August 2025 07:31

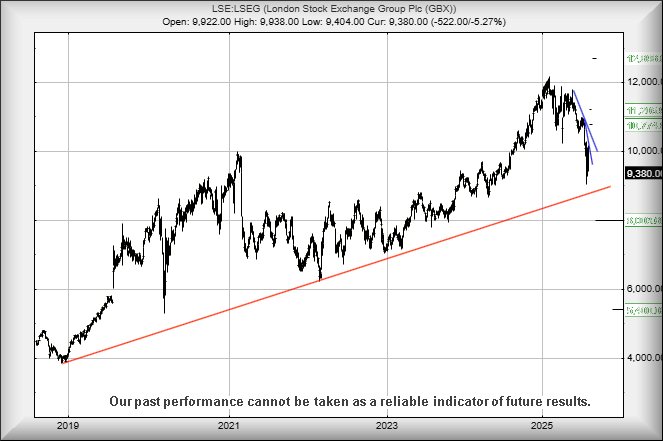

London Stock Exchange Group’s share price isn’t reflecting the usual boost from a share buyback initiative, quite the opposite currently.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Embracing the misery usually seen against UK shares suffering a problem, below 9,036p for London Stock Exchange Group (LSE:LSEG) risks triggering reversal to an initial 8,003p with our secondary, if broken, at 8,400p and an attempt to match the low of the year Covid-19 arrived.

Surprisingly, the bounce from the 2020 low quickly exceeded the highs from before the artificial drop was invented, creating a situation where recovery to 11,900p could be calculated as possible.

LSEG achieved this recovery at the start of 2025, even exceeding our 11,900 target for a handful of sessions before falling backwards quite dramatically.

Source: Trends and Targets. Past performance is not a guide to future performance.

However, who knows? Perhaps LSEG will experience a rapid turnaround in fortunes.

This being the case, maybe movement above just 10,020 (blue) will trigger recovery to an initial 10,774 with our longer-term secondary, if bettered, at 11,205p. This secondary is liable to prove an issue, taking the share price into a zone where a distant 12,695 is seen as presenting a distant attraction.

This would be a miracle, a new all-time high and a sign that the UK is indicating hope for the future.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks