Why China funds are bouncing back

China is the standout bright spot for global markets this year, writes Saltydog Investor.

24th February 2025 14:40

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Of the 12 global stock market indices we regularly track, the Hang Seng Index (HSI) has been the standout performer this month. By the end of last week, it had posted a month-to-date gain of 16.1% and had risen by 17% since the start of the year.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

| Stock Market indices | 2024 | 2025 | ||||||

| Index | Q1 | Q2 | Q3 | Oct | Nov | Dec | Jan | 1 to 22 Feb |

| FTSE 100 | 2.8% | 2.7% | 0.9% | -1.5% | 2.2% | -1.4% | 6.1% | -0.2% |

| FTSE 250 | 1.0% | 2.0% | 3.8% | -3.2% | 1.9% | -0.7% | 1.6% | -1.6% |

| Dow Jones Ind Ave | 5.6% | -1.7% | 8.2% | -1.3% | 7.5% | -5.3% | 4.7% | -2.5% |

| S&P 500 | 10.2% | 3.9% | 5.5% | -1.0% | 5.7% | -2.5% | 2.7% | -0.5% |

| NASDAQ | 9.1% | 8.3% | 2.6% | -0.5% | 6.2% | 0.5% | 1.6% | -0.5% |

| DAX | 10.4% | -1.4% | 6.0% | -1.3% | 2.9% | 1.4% | 9.2% | 2.6% |

| CAC40 | 8.8% | -8.9% | 2.1% | -3.7% | -1.6% | 2.0% | 7.7% | 2.6% |

| Nikkei 225 | 20.6% | -1.9% | -4.2% | 3.1% | -2.2% | 4.4% | -0.8% | -2.0% |

| Hang Seng | -3.0% | 7.1% | 19.3% | -3.9% | -4.4% | 3.3% | 0.8% | 16.1% |

| Shanghai Composite | 2.2% | -2.4% | 12.4% | -1.7% | 1.4% | 0.8% | -3.0% | 4.0% |

| Sensex | 2.0% | 7.3% | 6.7% | -5.8% | 0.5% | -2.1% | -0.8% | -2.8% |

| Ibovespa | -4.5% | -3.3% | 6.4% | -1.6% | -3.1% | -4.3% | 4.9% | 0.8% |

Data source: Morningstar. Past performance is not a guide to future performance.

The HSI is not only a key benchmark for the Hong Kong Stock Exchange but also widely recognised as a barometer for broader Asian markets. Additionally, it serves as the dominant gateway for foreign investment into Chinese companies.

Until 2002, foreign investors were restricted from investing in China’s internal (A-share) markets. Since then, China’s stock markets have begun to open up, although some restrictions remain. However, since 1993, companies incorporated in China have been able to list H-shares on the Hong Kong Stock Exchange, and there are now more than 300 H-share companies listed in Hong Kong.

Even before the introduction of H-shares, many Chinese companies chose to incorporate in Hong Kong due to its business-friendly environment, its role as a bridge to international markets, and its stable legal system.

As a result, the Hong Kong stock market is a more accessible way for foreign investors to gain exposure to China. They can freely trade H-shares and other Hong Kong-listed Chinese companies, with fewer restrictions than mainland Chinese markets.

- Two China fund ideas for Year of the Snake

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Although both the Hong Kong and mainland Chinese stock markets list many of the same companies, the HSI and mainland indices have different sector weightings. The HSI has a greater concentration in internet and international finance, while mainland indices focus more on manufacturing, industry, and state-owned enterprises.

Hong Kong’s market is generally considered more mature, with a longer history of international exposure and sophisticated financial services. This makes it more responsive to international investors, whereas mainland markets are primarily driven by domestic retail investors.

As a result, the performance of these two markets isn’t as closely correlated as one might assume. For example, while the HSI has surged this month, the Shanghai Composite has only risen by 4%.

Funds investing in China fall into the Investment Association’s (IA China/Greater China sector. This is for funds which “invest at least 80% of their assets directly or indirectly in equities of the People’s Republic of China, Hong Kong or Taiwan. Funds may invest solely in China or be diversified across Greater China.”

- ISA ideas: around the world in 10 funds in 2025

- China: opportunities, risks, and Trump’s tariff threats

Baring that in mind, it is probably fair to say that the HSI is generally a better reflection of the performance of the funds in the IA’s China/Greater China sector than the mainland Chinese indices.

So far this month, the China/Greater China sector has risen by 8.5%.

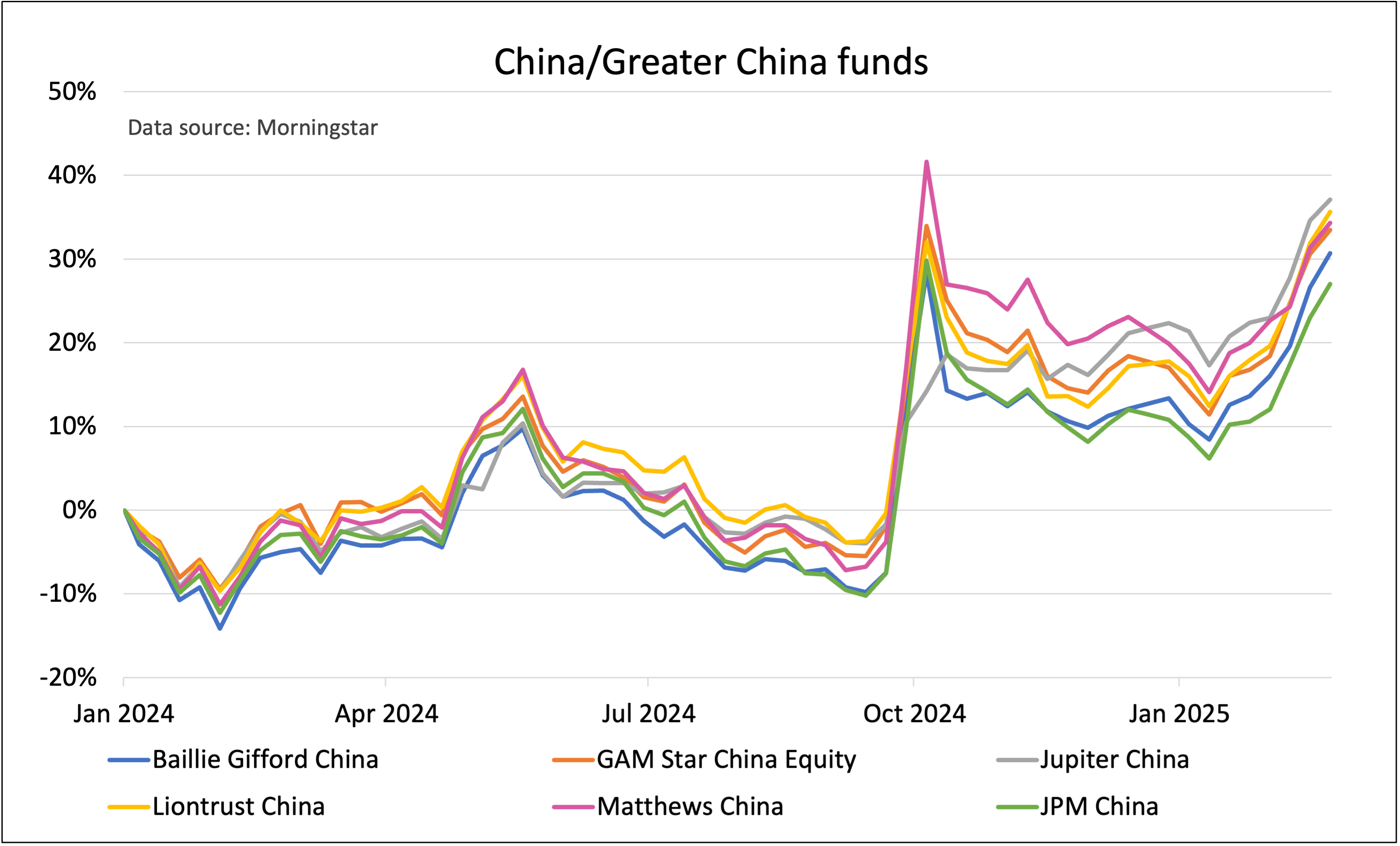

Here’s a graph showing the performance of some of the leading funds based on their performance over the past six months.

Past performance is not a guide to future performance.

As you can see, they all had a disappointing start to 2024, but rallied from the beginning of February until the middle of May. They then trended down until mid-September, at which point they were all showing year-to-date losses.

However, at the end of September they saw a dramatic rise as markets responded to China’s central bank announcing its largest stimulus package since the Covid-19 pandemic. As is often the case, it soon became apparent that the markets had overreacted, and the value of these funds eased back towards the end of the year.

They all dipped in January but have rebounded sharply in the past few weeks.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks