Why this part of the market is where the value is

A Morningstar analyst explains why this area is among the most undervalued segments of the global equity market.

16th June 2025 09:20

UK equities, in particular smaller companies, are among the most undervalued segments of the global equity market and have had a wave of geopolitical and macroeconomic shocks to contend with over the past decade, including:

- Brexit: since the 2016 referendum, UK small caps have faced persistent uncertainty, with investor sentiment dampened by political and regulatory ambiguity

- Covid-19: the pandemic exposed structural weaknesses in small-cap business models, particularly in services sectors such as hospitality and leisure. Supply chain disruptions and demand shocks pressured both revenues and liquidity

- Political instability: the 2022 mini-Budget triggered a sharp rise in interest rates, undermining confidence in domestically oriented small caps more exposed to UK macro conditions

- Geopolitical conflict: the war in Ukraine drove commodity prices higher and destabilized global markets. Smaller companies, with tighter margins and less pricing power, absorbed the brunt of the cost inflation

- Interest rates being ‘higher for longer’: persistent inflation led central banks to tighten aggressively. Elevated rates and weak consumer sentiment continue to weigh on growth-sensitive small caps, increasing financing stress and suppressing valuations

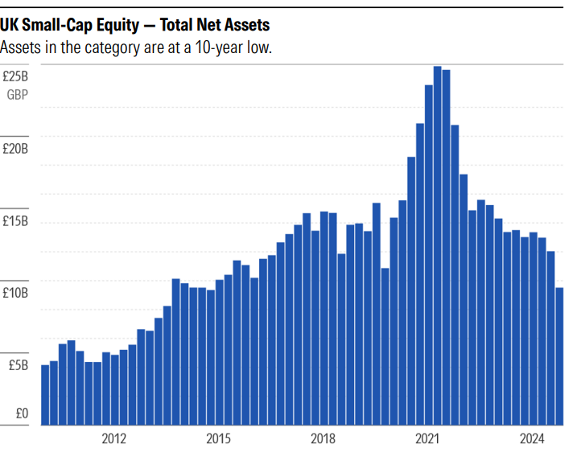

The ongoing negative sentiment surrounding UK equities, coupled with an insatiable appetite for US equities, has meant that assets in UK equities have plummeted to a 10-year low, down 62% from their 2021 peak post-Covid rebound. The few funds receiving inflows, along with private equity and corporate buyers, have been the marginal buyers. Consequently, many funds have been forced sellers.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

Source: Morningstar Direct. Data as of 31 March 2025.

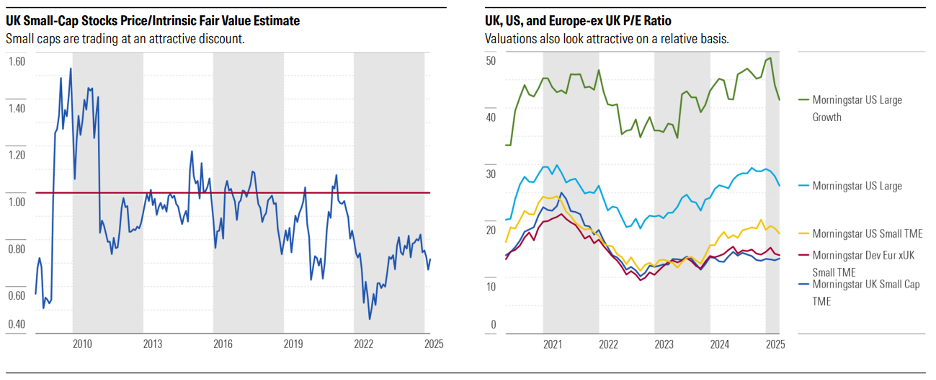

Despite all this negative news flow, UK small caps are among the most undervalued segments of the UK equity market. Our analysts estimate that these stocks trade at a significant discount to their fair value, well below historic averages. This presents a potentially attractive entry point. Globally, small caps also appear attractively valued, especially compared with US large caps, particularly in the growth sector.

Past performance is not a guide to future performance.

Aside from the valuation argument there are several additional factors which currently favour investing in UK smaller companies. These include:

- an increase in mergers and acquisitions activity, which has been evident among both corporate and private equity buyers

- Share buyback activity has soared to record levels in recent years, particularly among UK large caps, such as Shell (LSE:SHEL), HSBC Holdings (LSE:HSBA) and Centrica (LSE:CNA). In addition, UK smaller companies are also repurchasing shares, using excess cash

- A favourable macro backdrop. With inflation easing and interest rates falling, this has typically been supportive for UK smaller companies

- The Mansion House Accord commits 17 workplace pension providers to allocate at least 10% of their defined-contribution default funds to private markets by 2030, with at least half earmarked for UK-specific assets

- Despite all the uncertainties surrounding trade and tariffs, the UK remains relatively insulated from the tariffs of US President Donald Trump. Recent trade deals with the US and India highlight the continued attractiveness of doing business with the UK.

One of the UK Smaller Companies funds, which currently features on the ii Super 60 list of investment ideas, is WS Amati UK Listed Smaller Companies fund.

Paul Jourdan has managed the strategy since September 2000, initially at First State, then at Noble Group, before establishing Amati in 2010. He is supported by three other co-managers/analysts who joined the team over the past four years.

The attributes generally sought in a company include a clear competitive advantage, sustainable growth and ability to finance that growth, and high returns on cash invested. The managers generally avoid companies in markets dominated by larger rivals and those with aggressive accounting practices and/or significant liabilities. Longer-term sustainable growth ideas are the primary focus, but they also invest in cyclical stocks while seeking to maintain an emphasis on quality. The primary focus is on the fundamentals of the business rather than notional valuations as signals for buying or selling.

As well as some of the smaller AIM-listed companies, the managers also invest at the other end of the spectrum up into the FTSE 250 index. Overall, this results in a smaller market-cap profile than the UK small-cap equity Morningstar Category average, with a larger allocation to micro-caps. Versus its Numis Smaller Companies plus AIM ex Investment Trust benchmark the fund has a slightly larger market-cap profile and a growthier style bias, with higher-quality metrics. These biases will impact relative returns at times.

Overall, Jourdan’s lengthy tenure provides stability and continuity for investors and he is well-supported. The key differentiator and potential source of added value of this process over smaller-cap peers is the focus on the smaller end of the AIM market.

While not a dedicated small-cap fund per se, another fund which features on the ii Super 60 list and typically has a bias to smaller companies is Fidelity Special Values Ord (LSE:FSV). The investment trust is managed by Alex Wright who has been at the helm since 2012 and has been at Fidelity since 2001. Prior to this fund he successfully managed a small-cap strategy, and the all-cap nature of this fund clearly builds on that experience. An additional benefit is the support of the extensive Fidelity analytical resource.

- Fidelity Special Values: why I no longer invest in US shares

- Fidelity Special Values: why UK market will weather tariff storm, and backing the banks

The process looks to identify unloved companies that have the potential to recover based on factors such as a business model/corporate change or industry cycles. The manager may buy into such situations at an early stage, which tends to result in contrarian value biases.

The portfolio shows biases down the market-cap scale versus the FTSE All-Share Index, and to value factors. At the sector level there's often an overweight to industrials and an underweight to consumer staples. These biases will impact relative returns at times, but over the longer-term returns have been strong.

The thorough and well-defined contrarian value approach leads us to have a positive view on the fund’s investment process. Wright is an experienced manager with expertise in smaller-cap equity and we feel the fund is a strong option for investors seeking a contrarian and value-oriented approach to investing across the market cap spectrum of the UK market.

Ruli Viljoen is head of manager selection at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks