Why this regional rally has legs

After a lacklustre 2024, these three sectors have made a strong comeback in 2025, and could still have further to go.

28th July 2025 15:33

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

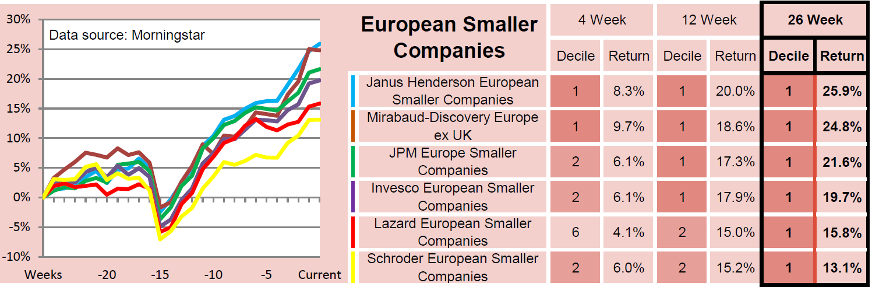

Funds investing in European equities are grouped into three Investment Association (IA) sectors: Europe including UK, Europe excluding UK, and European Smaller Companies. They all struggled in 2024.

Weak economic growth weighed on performance, with major economies such as Germany acting as a consistent drag and France rocked with political instability, including a snap election that rattled markets.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The war in Ukraine also amplified existing challenges, driving up energy prices, which hit European households and manufacturers harder than in other developed markets. That stoked inflation forcing the European Central Bank (ECB) to raise interest rates, which in turn dented consumer spending and corporate profits.

Several key sectors underperformed. European technology and automotive firms lagged their American counterparts, particularly as the booming tech and AI trends favoured their US rivals. Luxury goods also came under pressure due to weaker demand from China. Meanwhile, ongoing trade tensions, including the threat of new US tariffs, dented export revenues.

As a result, the Europe excluding UK sector rose by just 1.8% in 2024. Europe including UK did slightly better, gaining 2.5%, while European Smaller Companies only went up by 0.6%. To put that in context, the UK All Companies sector went up by 8.0%, Japan made 8.6%, China/Greater China gained 13.9%, and the North America sector ended the year up 22.0%.

- Ian Cowie: why I’m bullish on prospects for this area

- Equities: why invest in Europe's smaller companies amid US uncertainty?

However, this year the European sectors got off to a flying start. By the end of January, the European Smaller Companies sector had risen by 6.1%, while the Europe including UK and Europe excluding UK sectors were both up by more than 7%.

Although some of those gains were eroded over the following months, these sectors held up better than most. At the end of the first quarter, European Smaller Companies was still showing a gain of 2.4%, and the other two sectors had risen by more than 5%. In contrast, the UK All Companies sector was up just 0.1%, while North America was down 7.3%.

All three European sectors then made gains in April, May and June. By the end of the first half of the year they were all posting double-digit six month returns. Only one sector, Latin America, had done better.

Source Morningstar. Past performance is not a guide to future performance.

At the heart of this year’s recovery is a strengthening eurozone economy. After a prolonged period of sluggish growth, several key indicators have begun to improve. Business confidence, particularly in the manufacturing sector, has picked up, supported by resilient employment figures and rising consumer sentiment. Real wages have started to grow again as inflation has eased, fuelling domestic demand and household consumption. There has also been a turnaround in credit conditions, with lending to businesses and consumers increasing for the first time since 2022.

Monetary and fiscal policies have also become more supportive. After peaking in 2023, eurozone inflation fell to around 2.4% in 2024, allowing central banks to pause interest rate hikes and signal potential cuts. That has helped bring down borrowing costs. In addition, some governments, particularly Germany, have introduced targeted fiscal stimulus to support industry and infrastructure.

Investor sentiment has improved. For the first time since 2022, European equity funds have seen sustained inflows. Some of that reflects a shift away from the United States, where political uncertainty, high valuations, and ongoing trade tensions have made investors more cautious.

Defensive sectors such as utilities and telecoms, which are well represented in European indices, have come back into favour, offering relatively stable income in uncertain times. European shares also remain cheaper than their American counterparts, which has benefited many of the larger, more established companies.

- Where to invest in Q3 2025? Four experts have their say

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Looking ahead, the backdrop remains broadly supportive. Growth expectations have been revised up, the ECB is expected to cut rates again, and several governments are planning to increase infrastructure and defence spending.

Over the weekend, the US and the European Union signed a significant trade deal designed to avoid a major transatlantic trade war. Under the deal, a 15% tariff will be imposed on most European exports entering the US, including cars, which currently face a higher tariff of 27.5%. Some products, such as aircraft and certain chemicals, semiconductors, pharmaceuticals, and critical raw materials, are exempt from the tariffs under a “zero-for-zero” scheme.

Although the 15% tariff rate is higher than the EU is used to, it is significantly lower than the 30% rate that would have taken effect on 1 August if a deal had not been reached. Hopefully, this will bring stability and predictability to transatlantic trade relations after months of uncertainty.

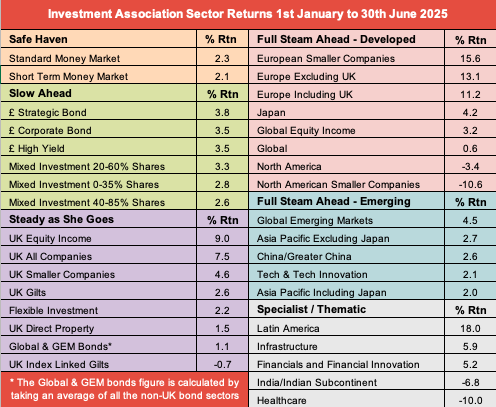

In our weekly analysis, we highlight the best-performing funds over various different time frames. We only track a handful of funds in the Europe including UK sector, so we usually combine them with the Europe excluding UK funds.

Here is an excerpt from last week’s reports showing the leading funds over the last 26 weeks.

Past performance is not a guide to future performance.

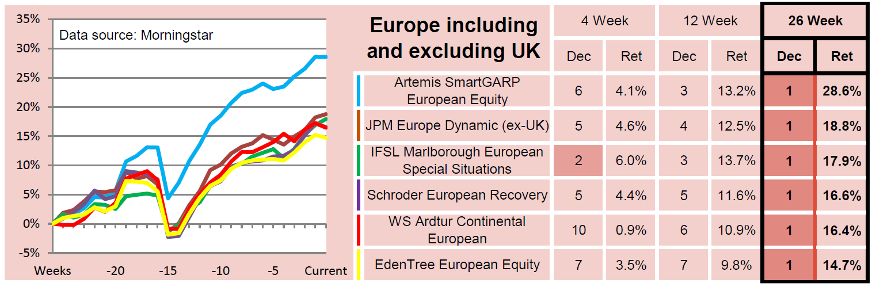

And here is a similar table for the European Smaller Companies.

Past performance is not a guide to future performance.

Another fund worth mentioning again is Barings German Growth, from the Specialist sector. We highlighted it in March when it was the best-performing fund in 2025. It has continued to do well and is currently one of the holdings in our demonstration portfolios. Last week, it was showing a 26-week return of 23.7%.

If current conditions hold, the second half of 2025 could offer further opportunities for investors in European funds.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks