Why we’re reducing our exposure to the US

Would a Kamala Harris presidency be good for stock markets? Saltydog thinks it may well be, but there's less certainty and that seems to have spooked markets.

29th July 2024 15:31

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The US stock markets, and the Nasdaq in particular, have significantly outperformed the UK, eurozone and other developed markets over the past 15 years.

The US economy has experienced robust growth, fuelled by innovation and a strong entrepreneurial ecosystem, especially in technology, biotechnology, and digital services. The Nasdaq is heavily weighted towards these tech companies, some of which are now the largest companies in the world. Companies such as Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), and Google-owner Alphabet Inc Class A (NASDAQ:GOOGL) have driven much of its performance.

- Invest with ii: Buy Global Funds | What is a Managed ISA? | Open a Managed ISA

Since 2010, the FTSE 100 has gone up by just over 50%. The FTSE 250 has done better and is up almost 130%. The French CAC 40 has risen by 90%, the German DAX has gained over 200%, and the Japanese Nikkei 225 is up 250%.

However, over the same time period, the Dow Jones Industrial Average has risen by around 290%, the S&P 500 has made 390%, and the Nasdaq has gone up by an impressive 665%.

Stock markets rarely go up in a straight line for long and there have been some setbacks along the way. In 2022, the Nasdaq lost around a third of its value.

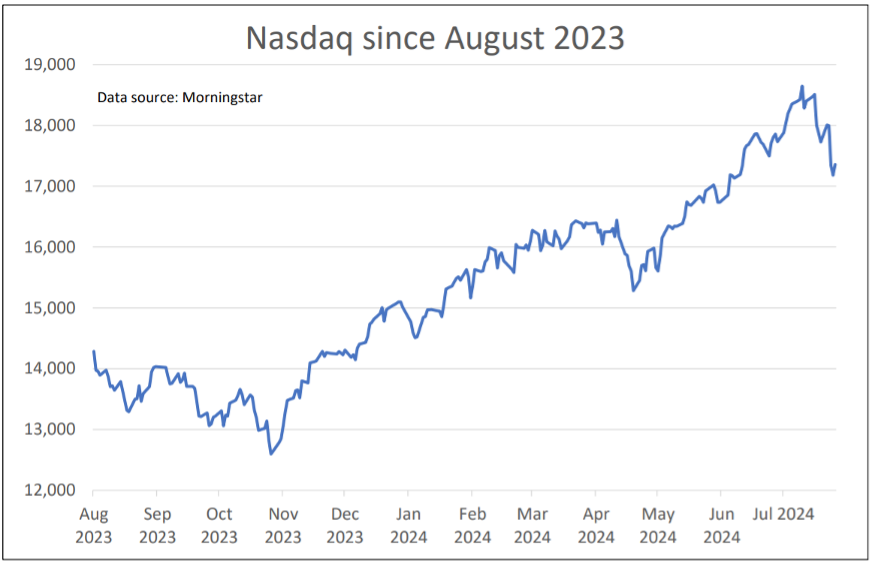

If you look over the past 12 months, you can see that it went down between the beginning of August and the end of October last year, but since then has rallied. It briefly fell during April, but then recovered and went on to set new all-time highs. In the past few weeks, it has had another downturn, falling by 7%.

Past performance is not a guide to future performance.

The performance of US markets has a significant influence on a large number of funds. The funds in the North America, North American Smaller Companies, and Technology & Technology Innovation sectors are the most directly affected. However, there are also funds in the Global and Mixed Investment sectors that have a high level of exposure to the US markets.

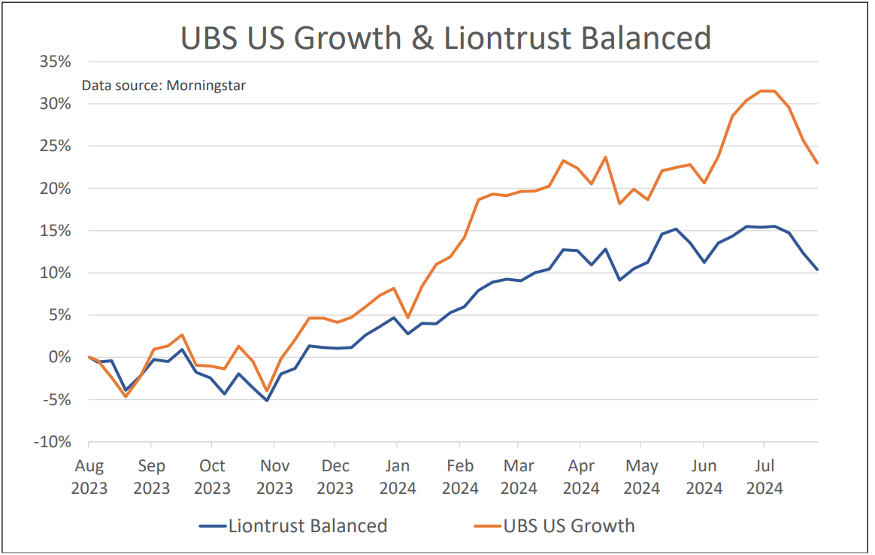

There are two funds that we’ve held in our demonstration portfolios for the last year that tend to rise and fall in sync with the US markets.

The UBS US Growth fund is in the North America sector and invests in US stocks with a bias towards the large technology companies. Its largest holdings are Microsoft, Amazon, Apple, NVIDIA Corp (NASDAQ:NVDA), Meta Platforms Inc Class A (NASDAQ:META), and Alphabet, which explains why it almost mirrors the Nasdaq.

- 10 hottest ISA shares, funds and trusts: week ended 26 July 2024

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

We went into the fund last June and since then the fund has risen by 27.5%. We added to our holding last July and again in February, but then reduced it in March. Last month, we bought some more, but since then it has gone down. We are now reducing our holding.

The other fund is in the Mixed Investment 40-85% Shares sector. This is for funds that “are required to have a range of different investments. However, there is scope for funds to have a high proportion in company shares (equities). The funds must have between 40% and 85% invested in company shares.”

The Liontrust Balanced fund currently has around 70% invested in shares. It has 55% invested in the US, and its largest holdings also include Microsoft, Nvidia, Meta, and Alphabet.

We went into the fund last July, just over a year ago, and since then it has risen by 12.4%. We have added to our position a couple of times during the past year, but last week took the decision to trim our holding.

Past performance is not a guide to future performance.

It is not unusual for us to increase or decrease our exposure to funds as market conditions ebb and flow.

As we approach the US election there could be more volatility in the markets. A couple of weeks ago it looked likely that Donald Trump would win the election. The markets felt that they knew what they had in store and strengthened. The last time he was in office, stock markets performed well and his policies were generally pro-business.

When President Joe Biden announced that he was no longer running, things changed. The probability of a Trump victory fell and a new unknown was thrown into the mix. Would a Kamala Harris presidency be good for stock markets? It may well be, but there is less certainty and that seems to have spooked the markets.

We still hold funds that invest in the US markets and the technology sector, but have reduced our overall exposure. If the political situation settles and we see the funds starting to go back up again, then we will consider adding to our holdings.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks