An alternative to one of the world’s biggest companies

This sector leader has grown fast, and analyst Rodney Hobson believes it is no longer good value. But there’s a rival with much more attractive fundamentals that he thinks is a buy.

27th November 2024 08:47

As Christmas approaches, investors start wondering which retailers will come out of the festive season saying “ho, ho, ho” and which will complain “bah, humbug”. However cash-strapped consumers may feel, few ever want to pass up the chance to spend big at this time of year.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

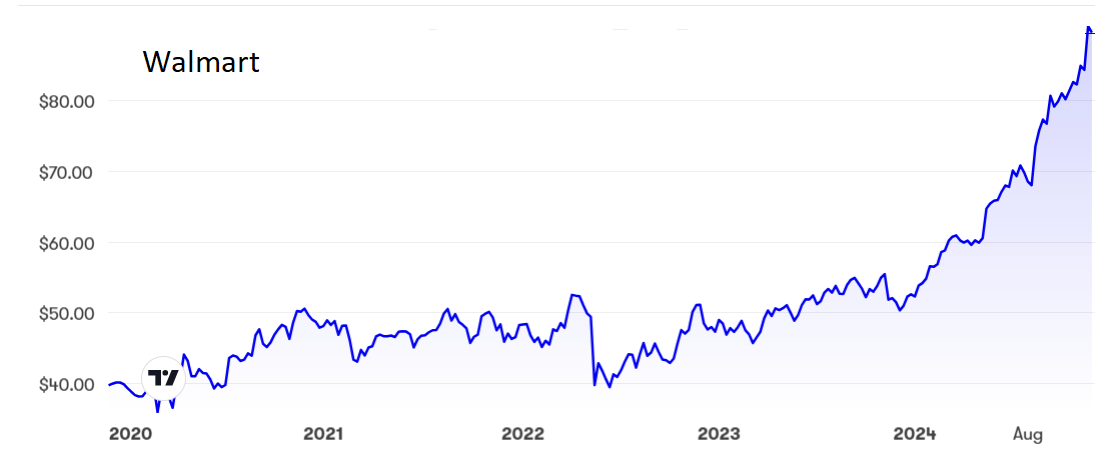

Investors mostly consider investing in the centre of consumerism, the United States, and to the forefront is inevitably one-stop shopping chain Walmart Inc (NYSE:WMT). An expert analysis of its most recent results was provided by Keith Bowman ii view: value at Walmart after profit upgrade a week ago, and Walmart’s upgrade to its 2024 forecast has gone down well with shareholders, with the shares gaining from $82 to $91.50 this month alone.

The price/earnings (PE) ratio of 37 factors in an awful lot of further progress, as does the yield of only 0.9%. This could be a good time to look for smaller but promising alternatives.

Source: interactive investor. Past performance is not a guide to future performance.

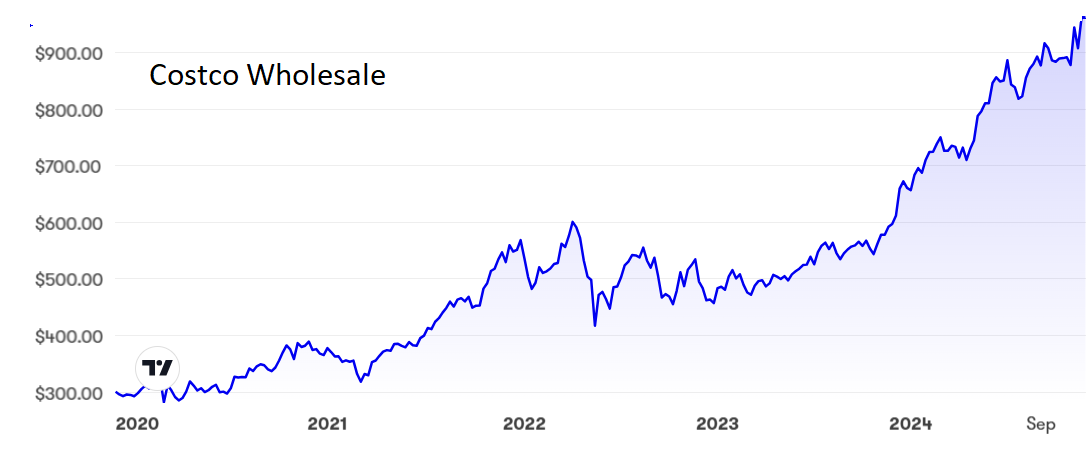

Costco Wholesale Corp (NASDAQ:COST), which is a retailer despite its name, enters the spending season in good spirits after announcing strong recent sales figures. In its fourth quarter to 1 September, it saw revenue of $79.7 billion, up 1% from a year earlier – not a fantastic result but at least moving in the right direction. Far better was a 9% year-on-year improvement in net income to $2.35 billion.

There was admittedly some slowdown in the final three months. Full-year revenue was 5% higher at $254.45 billion and net income was up 17% to $7.37 billion.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- A Trump trade, an obvious buy and a riskier stock idea

- What is tipped to be the best asset class of 2025?

Figures for the first five weeks of the current financial year suggested that momentum in sales and profits has resumed. Net sales rose 9% year-on-year to $24.6 billion.

The shares have also enjoyed a great November, rising from $880 to nearly $1,000, where the PE is even heftier than Walmart’s at 58 and the yield even smaller at 0.5%.

Source: interactive investor. Past performance is not a guide to future performance.

Target Corp (NYSE:TGT) is much smaller but is still America’s seventh largest retailer. Unlike its larger rivals, its shares have had a torrid November, falling from $156 to $120 before paring some of the loss at $126. Quarterly results fell short of expectations and Target reduced its full-year forecast for good measure.

While digital sales grew more than 10% thanks to the promise of same-day deliveries, like-for-like store sales declined by nearly 2%, as higher prices imposed to recoup higher operating costs prompted customers to reduce their average basket size by 2%. In particular, customers cut back on discretionary items.

This is particularly disappointing as Target has spent heavily on opening new stores and refurbishing existing ones.

Target hopes to reverse the situation by running daily and weekly sales over the holiday season. The company has run into trouble before and managed to turn itself around, so there is reason to hope that history will repeat itself. Meanwhile its PE is a very reasonable 13.8 while the yield is 3.4%, both figures reflecting the uncertain future compared to its peers.

Hobson’s choice: The case for buying Walmart after the latest surge is hard to make but those who are already in should hold on. Those who want to buy will have to hope that the stock slips back a little. Much the same applies to Costco.

The much more attractive fundamentals at Target make the stock a buy despite its recent problems. I recommended it at $86 and again at $140. Well done anyone who got out at or near the peak of $178 last April. Do bear in mind though that $155 could prove to be a ceiling and, if that is broken, then $178 could again prove as far as the shares will move.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks