Stockwatch: multiple reasons to be bullish about UK stocks

UK shares trade at a big discount to developed market peers and tactical trading looks an intelligent response. Analyst Edmond Jackson studies the opinion of two leading US banks who back Britain.

26th November 2024 10:52

Labour’s first Budget has met with overall glum reactions, as the reality of tax rises sink in, after previous optimism that it would lay a foundation for growth.

Yet one major US bank was confident to rate domestic UK shares a “buy” ahead of seeing Budget details, and another reinforced this only last week, rating the UK an “outstanding buy” in a global context.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

In an 11 October note, strategists at JP Morgan argued UK shares represent a value opportunity not a trap. Discounts to fair value have run too far and, with a domestic recovery underway, takeovers limiting further downside and potential for supportive policy changes ahead (my italics) it may be opportune to buy.

At least the chancellor told the CBI conference yesterday: “Business can be certain that we’re never going to have to do a Budget like that again.” On this basis you could say policy will be relatively supportive, although it’s unclear whether that means “Things can only get better” as Labour proclaimed in 1997.

The dilemma for confidence is that attention has shifted from a £70 billion increase in public spending, and what “multiplier effect” that could have in the wider economy, to the employers’ national insurance rise compromising jobs and leading to higher prices, as businesses adjust. Is this a verbal over-reaction by employers who will settle down to cope, quite like farmers and inheritance tax, or does it set a medium-term basis more like stagflation?

We are already seeing some negative reactions in stocks. Kingfisher (LSE:KGF) plunged 13% yesterday, although a 10% rebound in JD Sports Fashion (LSE:JD.). following a 16% drop last Thursday upon warning of a “volatile October”, possibly shows the current situation as opportune for nimble traders.

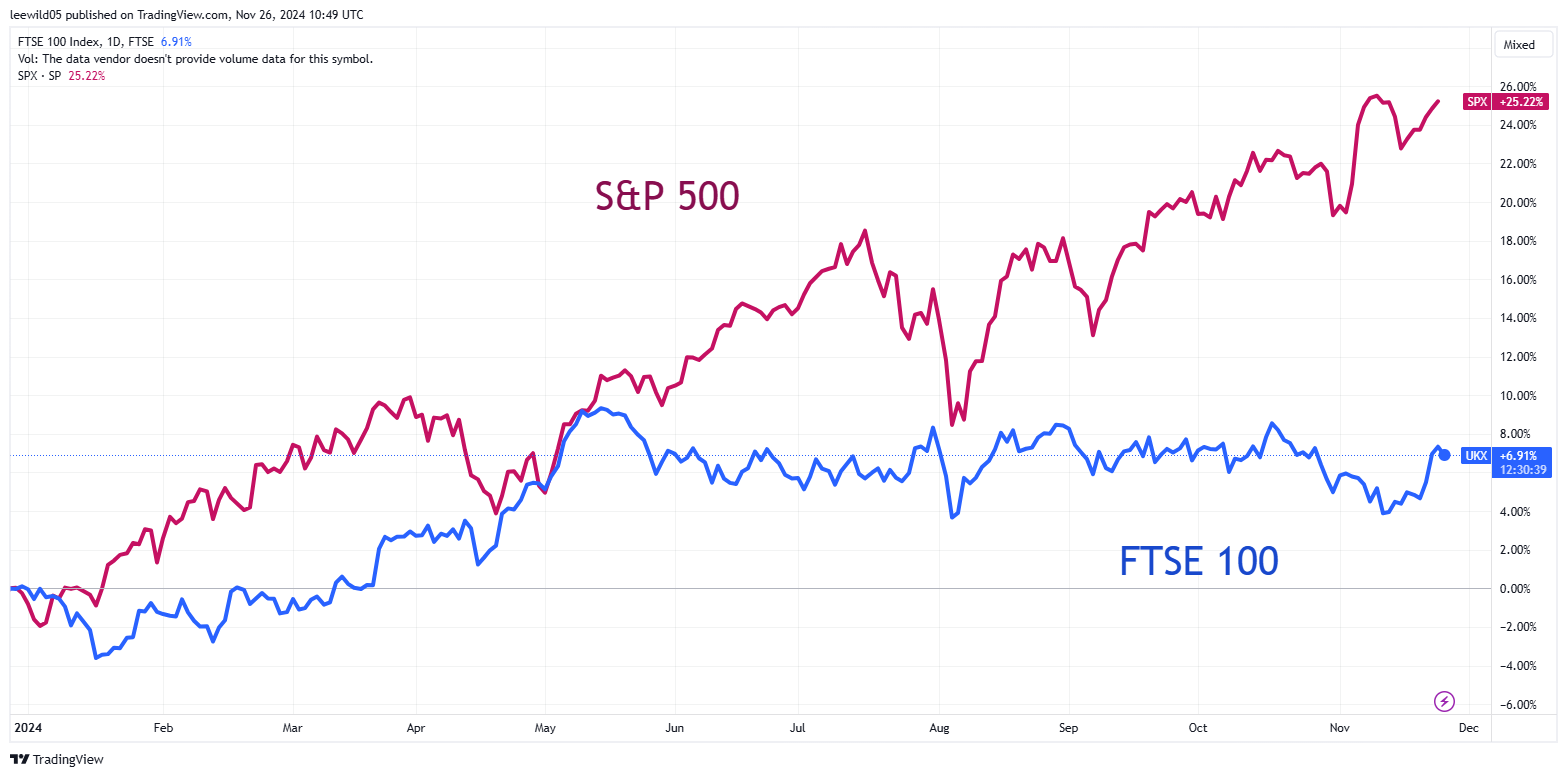

The first four months of 2024 saw the FTSE 100 rise around 10%, though it has since traded volatile-sideways versus the S&P 500 in overall linear uptrend, by nearly 30%.

Source: TradingView. Past performance is not a guide to future performance.

US outperformance is partly why Goldman Sachs proclaims ‘Buy British’ – suggesting the US market’s concentration of performance in The Magnificent Seven is a risk if tech values get disrupted. UK shares also have attractions relative to continental Europe. Goldman expects the UK to benefit from improving consumer sentiment and resilient demand for services also financial products.

But is this not the same as UK fund managers have been pitching to retail investors over the last year? As yet the critical case has prevailed: how underperformance relates substantially to Brexit disrupting our nearest major trading relations; also, chronic low productivity especially compared with the US.

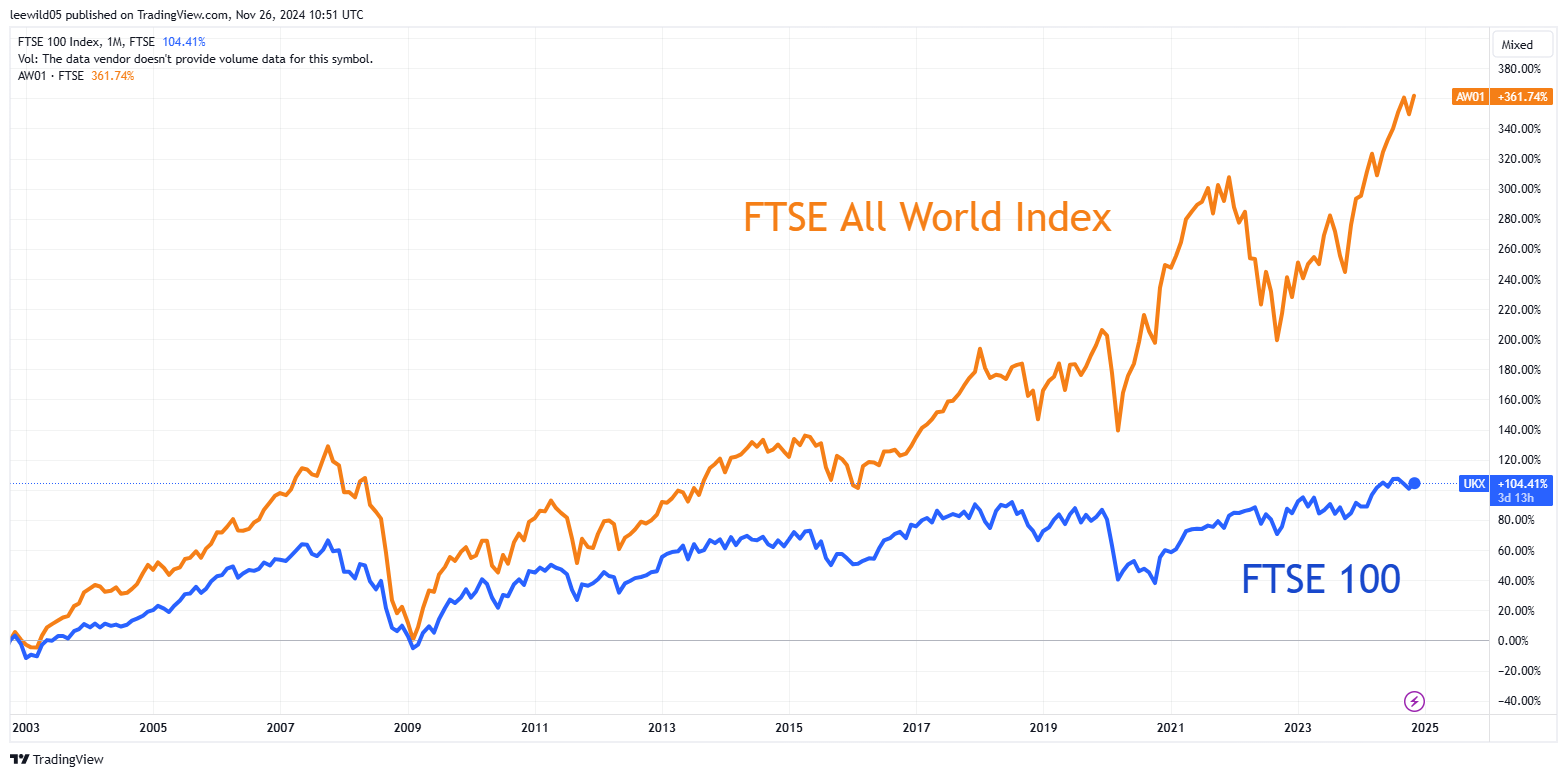

Source: TradingView. Past performance is not a guide to future performance.

Multiple reasons to be bullish according to JP Morgan

UK shares trade at a 40% discount to developed market peers, and our market’s composition could shift from being a drag on performance to a tailwind. Technology has contributed 32% of global returns since 2010, hence the FTSE All-Share’s 1% average weighting to tech been problematic.

Yet a weighting to energy and financials implies the UK market stands to benefit similarly as in 2022, after Russia’s invasion of Ukraine fuelled interest in energy security. I still see a question mark over financials: some bank shares have fallen lately amid concern their net interest margin will reduce as rates fall; also, asset managers’ outflows have yet to convincingly turn positive.

I agree with JPM regarding takeovers, at least during the last year. But if Brexit is a manifest disaster, why the rush of trade and private equity buyers for UK listed companies? Peel Hunt cites 19 transactions by FTSE 350 companies alone during the first three quarters of 2024, versus two for the whole of 2023.

JPM also notes buybacks – ahead of the US - as indicating UK companies consider their shares cheap. Indeed, each morning brings a tide of such announcements. Mind, and regarding the US differential, buybacks can also signal a lack of attractive investment projects.

These analysts appear to take a left-wing economic view of how “a redistribution of wealth towards lower income cohorts” implies net positive growth for the UK. “Recent public sector wage increases could add a further tailwind to growth.”

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Shares for the future: a UK tech firm with an ace up its sleeve

- Insider: FTSE 100 chiefs sell large stakes after results rally

Real wage growth has persisted for 14 months, they say, mitigating cost-of-living pressures. It remains to be seen how public and private sector pay, and also employment, balance out as higher national insurance takes effect.

A CBI survey shows that in response to the Budget raising costs, nearly two-thirds of firms plan to cut investment and a third to reduce workforces. Perhaps retailers are an acute example but Sainsbury SBRY, Asda and Morrisons have noted £1.3 billion higher costs from the NIS rise alone.

Kingfisher says: “Looking towards next year, recent political and macroeconomic developments have layered incremental uncertainty onto the near-term outlook in our markets.”

Goldman: benefit for UK consumer spending

Though Goldman’s note was published last week, after digesting likely effects of the Budget I struggle with the idea that UK consumer spending will benefit from lower inflation and wage growth.

Indeed, the publican behind a petition for another general election has said on radio today it is because “smaller businesses will get hit hard...Labour is taking Britain down the wrong road...beer will need to rise 25p a pint to cope with the rise in minimum wage and other costs.”

Are London-based investment bank strategists dialled into such realities? Goldman’s top picks are UK retail, travel and leisure stocks are linked to discretionary income. Lower interest rates will further support the stock market’s recovery.

I guess this would qualify as “contrarian” investing and yes perhaps it works – if you had deft timing for JD Sports, end-of last week.

Goldman is cautious on continental European stocks, anticipating only a circa 6% rise in 2025 due to sluggish underlying economies and war in Ukraine. Corporate earnings are projected to grow by 3%, well below historic averages.

The analysts argue that the UK’s more services-oriented economy is a plus compared with Europe’s manufacturing base, and would fare better in a scenario of US trade tariffs. Yet the Centre for Economics and Business Research here estimates a £20 billion hit to the UK economy if Trump follows through with 20% tariffs on US imports, reducing UK economic output by 0.9% by the end of his presidency.

Where is the feel-good factor around this new government?

Probably Labour wants to take tough actions early in its term, allowing time for enough people to forget by the next election, after benefits of public spending have manifested.

A key question for equity investors, however, is whether shares already discount a weak short to medium-term scenario – or it is going to mean further profit warnings?

The UK Purchasing Managers’ Index (PMI) eased to 49.9 in November from 51.8 in October, the first contraction in 13 months. The manufacturing PMI hit a nine-month low and services a 13-month low. This was attributed directly to government intending to raise taxes, thus affecting sentiment. Employment has fallen for two consecutive months.

One must be careful not to over-react – gross domestic product (GDP) is easing only at a 0.1% quarterly rate. Pantheon Macroeconomics’ chief economist says: “UK growth certainly slowed over the summer and we have had a couple of disappointing months. We were close to stalling in October. There’s any number of risks. We think growth will improve from here but growth could be worse than that.”

- 10 hottest ISA shares, funds and trusts: week ended 22 November 2024

- eyeQ: follow Buffett or buy Bitcoin?

- The Week Ahead: easyJet, Kingfisher, AO World

Government borrowing surged more than expected in October – to £17.4 billion against £12.3 billion expected – as spending on public services, benefits and debt repayments/interest out-stripped higher tax receipts. It’s unclear where this leaves public debt as a percentage of GDP, which was 98.5% at end-September. Mind, the US went over 100% in 2019 and was over 123% as of last June.

Tactical trading looks an intelligent response

Higher public debt and scope for more profit warnings suggests overall risk on UK shares is increasing, but it’s not clear whether and when we will see the rewards.

At 254p, Kingfisher continues to slip but in months ahead a sensible approach might be to see how the effects of new UK and US government affect business, with a view to buy shares in overall strong businesses – where any drops look overdone.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks