The Analyst: the benefits of owning commodities in your portfolio

There are good reasons why investors should have exposure to natural resources. ii fund analyst Dzmitry Lipski explains and finds a fund with a competitive advantage versus others in the sector.

13th February 2025 11:54

As investors prepare their portfolios for the year ahead, they may consider maintaining some exposure to commodities. Natural resources tend to be a good hedge against inflation and geopolitical risk. Additionally, increasing exposure to commodities can help diversify a portfolio due to their low correlation to equities and bonds.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

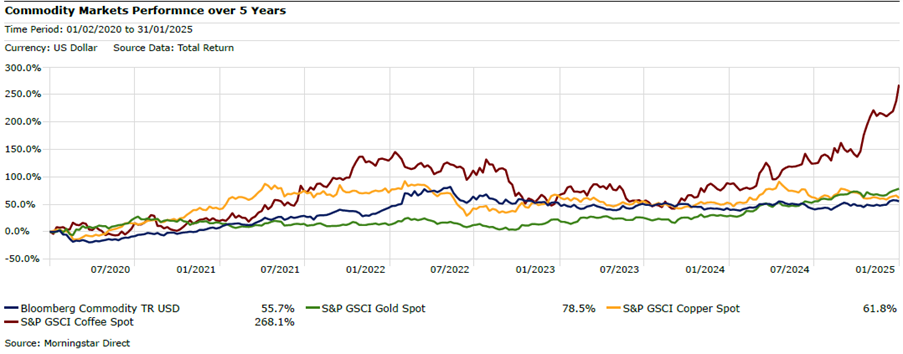

Except for 2021 and 2022, commodity markets have struggled in recent years and are likely to remain under pressure until there is greater certainty regarding global growth, inflation, and the impact of Trump's trade policies. That said, some markets, such as gold, copper, and coffee, have been notable exceptions.

Source: Morningstar. Past performance is not a guide to future performance.

Gold has been the standout performer, not only within the commodity basket but across all asset classes in 2024. Since last year the spot price of gold have consistently broken all-time highs and most recently has gone through $2,900 level, driven by more dovish positioning from central banks and increased geopolitical uncertainty, pushing investors to perceived safer heaven asset.

Another factor supporting gold prices has been central bank gold buying since 2022, especially by China, which has bolstered demand for the precious metal. Over the past few weeks, escalating trade tensions and tariff threats have increased market volatility, making gold an attractive option for investors seeking stability. The outlook for the metal remains positive, with prices expected to go above $3,000 in the next couple of months.

Copper has been making headlines for its strong performance in recent years. It hit an all-time high last year, and prices are expected to rise further. Analysts predict prices could surpass $10,000 per tonne this year. Often called the "new oil," copper plays a key role in the shift to green energy, it being essential for batteries, motors, and cables. While Trump's policy agenda threatens to hinder progress on decarbonization, China plays a crucial role in driving demand for copper, accounting for more than 50% of global consumption.

In energy markets, the outlook remains uncertain and cautious due to expectations of a significant surplus in oil and gas supply. Trump's 'drill, baby, drill' message to US oil producers could spur increased production, potentially driving prices lower.

Within so-called ‘soft’ commodities, the price of coffee has risen exponentially in the past year on account of pressure on supply chains and adverse weather affecting harvests in South America. The spot coffee price rose by nearly 70% in 2024 and has continued to improve in 2025. These effects felt in the commodity market ultimately are making their way through to more expensive coffee for retail buyers across the globe.

With Trump's commitment to implementing policies that could be inflationary, including tax cuts and imposing heavy tariffs on imported goods, inflation may remain elevated for an extended period. The longer-term outlook for commodities seems encouraging as major global central banks continue easy monetary policy.

- The Income Investor: upbeat about this FTSE 100 dividend stock

- 16 UK stocks least likely to be impacted by Trump tariffs

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Furthermore, the prospect of additional fiscal stimulus from China should support commodity prices, particularly for precious metals like gold and silver, and energy transition metals like copper. Some economists and experts are even speaking of the early stages of a new commodities supercycle, led by copper. A commodity super cycle is a period of consistent commodity price increases lasting more than five years. The last commodities supercycle began around the early 2000s and lasted until around 2014. It was largely driven by the rising demand from emerging markets, particularly China.

Higher inflation remains a key risk, making commodities an important component of a diversified portfolio. Historically, commodities have served as an effective hedge against inflation surprises.

For instance, a one percentage point unexpected rise in US inflation has, on average, led to a 7-percentage point real (inflation-adjusted) return for commodities. In contrast, the same inflation shock caused stocks and bonds to decline by 3 and 4 percentage points, respectively, according to Goldman Sachs research.

Beyond inflation protection, commodities offer valuable diversification benefits. A strategic allocation of around 10% as an alternative asset class, can enhance portfolio resilience. However, investors should take a long-term perspective, holding commodities for at least three to five years to fully capitalize on their benefits.

How to play the theme

Instead of investing in individual metal and commodity exchange-traded funds (ETFs), investors may consider a broad commodity fund for greater diversification. WisdomTree Enhanced Cmdty ETF - USD Acc GBP (LSE:WCOB) offers investors a broad and diversified commodity exposure, covering major commodity sectors such as industrial metals, precious metals, energy and agriculture. This ETF combines both passive and active investing. It aims to track the performance of the so-called rule-based index, the Optimised Roll Commodity, while looking to outperform the widely followed passive Bloomberg Commodity Index over the long term.

The fund is well positioned to benefit from the current market environment and potentially deliver higher real returns. Its effective cost management and lower risk profile gives the strategy a competitive advantage against other funds in the sector.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks