An attractive stock that’s on the rebound

After reaching a bottom, this high-profile company is moving higher again, and analyst Rodney Hobson thinks there’s still time to take advantage of last year’s fall.

5th March 2025 07:59

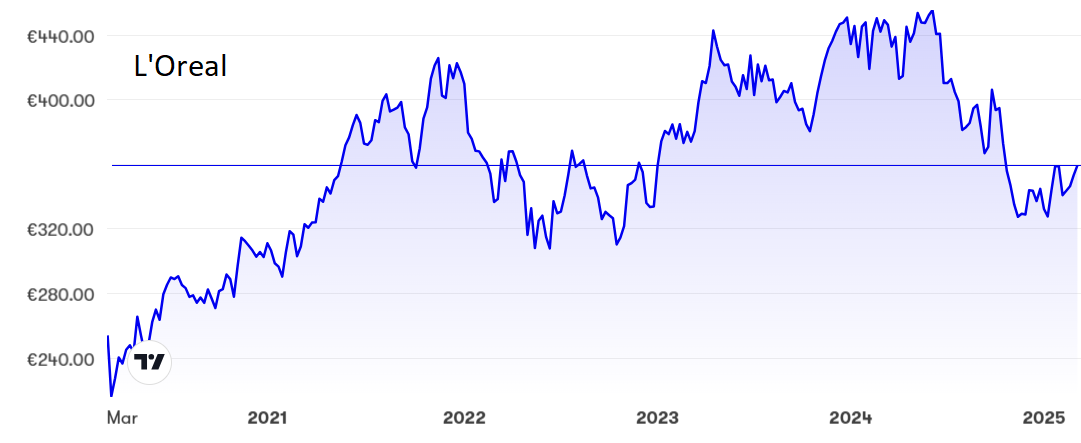

The largest cosmetics company in the world, L'Oreal SA (EURONEXT:OR), has run into difficulties in China, one of its largest markets. That problem is not going to go away anytime soon, but the shares have been heavily marked down over the past 12 months, and they now show serious signs of bottoming out.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

L’Oreal has a wide range of products, of which skincare is by far the largest category but also includes make-up, shampoos and perfume. There is a useful mix of premium and mass-market products, and a wide range of sales channels are used including department stores, other retailers and hair salons. The French company also sells widely across the world, with a third of revenue coming from Europe and over a quarter from North America. Markets also include those emerging in South Asia, Latin America and Africa but, significantly, North Asia accounts for just under a quarter.

That is a pretty good spread, and it has spared L’Oreal from being too heavily hit by a downturn in any one market, whether a product, sales outlet or a country. Nonetheless, the downturn in China, where incomes enjoyed by the growing middle class have been squeezed by a property crisis and high youth unemployment, has had a severe impact on the group. Weak demand in South Korea has added to the woes.

L'Oreal fell short of analysts’ forecasts in 2024. For the full year, organic sales rose 5.1% to €43.5 billion, not a bad performance and it was enhanced by a 20-point improvement in margins. What was worrying was that sales grew only 2.5% to €11.1billion in the fourth quarter, a distinct slowdown that came in below muted expectations of 3.8% growth.

First-quarter figures this year are unlikely to point to better times coming soon. Consumer confidence in China will take quite some time to recover and L’Oreal is up against strong comparatives, although the company does expect at least 4% growth for the year as a whole. Comparatives will become easier as the year progresses.

- India vs China: the battle of the two biggest emerging markets

- Why China funds are bouncing back

- ii view: Apple’s holiday quarter breaks records

This forecast sensibly assumes that the Chinese beauty market will remain flat, but the US and emerging markets will manage some improvement.

L’Oreal shares slumped from €450 to €330 during 2024, a fall of 26%, but they seem to have found a floor and have perked up a little to €355, where the price/earnings (PE) ratio is just under 30.

That may sound quite challenging given all the circumstances, but at least L’Oreal is still growing sales and profits in difficult circumstances. In any case, the figure is still towards the lower end of the 25 to 45 range that has held over the past eight years. The yield is 1.9%.

Source: interactive investor. Past performance is not a guide to future performance.

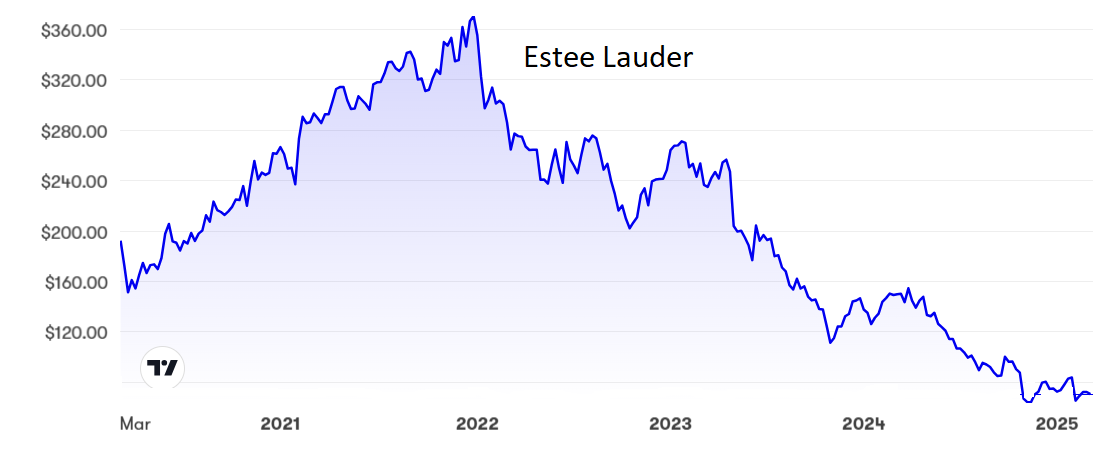

Shares in American rival The Estee Lauder Companies Inc Class A (NYSE:EL) have suffered even more, and over a longer period of time, for much the same reasons. The stock peaked at €370 on the last day’s trading of 2021 and have slumped to around $70 now, which at last seems to be a floor – unless President Donald Trump upsets more trading partners with tariffs that spark damaging retaliation. Certainly, it will be much tougher for Lauder to make any headway in China this year.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: This is all a far cry from the days when both companies were recovering strongly from the impact of the pandemic and I rated them both a buy last June, though with a very cautious note about Lauder. I have always preferred L’Oreal, and its shares are still just ahead of my last recommendation and well ahead of my previous buy ratings. That preference is all the stronger now and, although its shares are off the bottom, it is not too late to take advantage of last year’s fall. Buy up to €380. Lauder is no more than a hold until the future looks clearer.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks