Bitcoin and crypto stocks: examining the risk

Historic and potential gains look attractive, but buying bitcoin and crypto assets is a high-risk strategy. Industry expert Gary McFarlane looks at some of the issues investors should be aware of.

6th March 2025 12:55

Should I invest in crypto?

Bitcoin investors can be broken into at least three parts: those who are true believers who think it is the future of money and that cryptocurrency’s underlying blockchain technology can disrupt “legacy industries”; those who doubt that, but think it could be a useful store of value, like gold, in distressed times; and, third, those who are attracted by the price volatility and potential for outsized returns - so-called high beta - and note the staying power of the asset, so want a piece of the price action.

If you don’t fit into any of those three subsets, you might want to think carefully before investing in bitcoin and crypto. If you do, the real question is how best to quantify and mitigate the risk while capturing the upside.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Deciding whether to invest in crypto depends heavily on your risk profile. If you find it hard to resist the urge to sell when a stock falls 5% in a day, you will be doing a lot of panicked selling in crypto land, where volatility is generally of a different order of magnitude, with drops of 10% to 20% being common.

If your risk tolerance can cope with crypto, then you should consider whether you are investing or making a trading bet. If you’re investing, it assumes at least a five-year timescale to see a return, and that your cash is invested in something you think has a market for its products that will deliver the profits you hope for.

But people often ask of crypto, where’s the cash flow and what are the fundamentals? Without those basics, how can prospective investors conduct due diligence and make an informed decision? But it is not strictly true that there are no cash flows in crypto. From the crypto exchanges to the stablecoin issuers, money is being made (stablecoin is a cryptocurrency pegged to cash or cash equivalents or some other real-world asset – the market leader is Tether).

- Bitcoin, cryptocurrencies and blockchain – how it all works

- Bitcoin and crypto stocks: how to invest in them

If you think decentralised networks (information processing distributed across multiple computing devices with no centralised controlling entity) can disrupt a range of industries by bringing efficiency gains to business operations, then, as with any new technology, it becomes a question of picking the winner(s).

Yes, there will be further peaks and troughs, but even critics and sceptics agree that crypto is probably here to stay. That’s partly because of its usefulness and its generational buy-in, with younger people more likely to invest in crypto than they are in stocks, according to a 2023 survey by the FINRA Investor Education Foundation.

If you decide to add some high-beta spice to your portfolio with a small holding of crypto, what exactly are the risks?

Is crypto too risky?

Bitcoin has experienced price declines of 20% or more on 46 occasions, so let’s agree that it’s risky. However, 37 of those sell-offs took place in periods when the price was trending higher.

Nevertheless, by any measure bitcoin is volatile, as you would expect with this type of speculative asset.

Volatility is another way of describing risk. The Sharpe ratio – a measure of risk-adjusted returns – does this more precisely than counting the price drops. Broadly speaking, it calculates how much risk must be taken for a given investment return. A score above 1 is considered good, with a score above 3 deemed excellent.

With that in mind, the Sharpe ratio for bitcoin over the last year is about 1.765, although for the Nasdaq 100 tech index, it’s about 4.080.

But there are ways to reduce risk when investing in bitcoin.

Is there any way to help reduce risk?

At least where bitcoin is concerned, there are some predictable things we can factor into our risk-reward analysis, chiefly its ‘halving’ cycles. Every four years, the block reward paid to miners is cut in half, reducing the rate at which the supply of bitcoin increases, until it reaches a maximum of 21 million tokens.

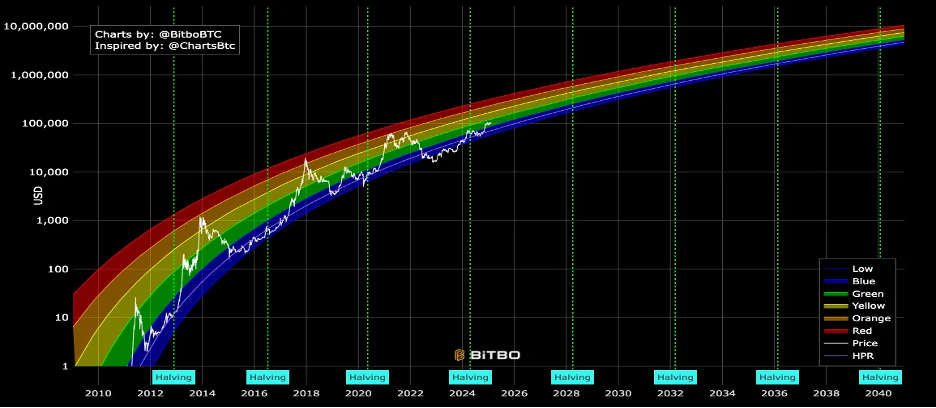

There have been four bitcoin halvings, with the final one expected to take place in 2140. In each cycle (we are now at the beginning of the fifth) the price has ended higher than it did in the previous one. This pattern can be seen most clearly on a log chart of the price.

If you held bitcoin across any of the four discrete periods you would have realised a positive return if you sold at the end of the cycle, although most bitcoin owners tend to hold for the long term (they’re known as “HODLers” in crypto parlance). According to crypto analytics firm Glassnode, long-term bitcoin owners – defined as holding for at least 155 days – account for 66% of the theoretical circulating supply (13.1 million out of 19.8 million as at 16 February 2025). Bitcoin held longer than 155 days has been found to be statistically unlikely to be spent.

The bitcoin halving price regression (HPR) chart below uses a rainbow to show how close in time the bitcoin price is to its projection.

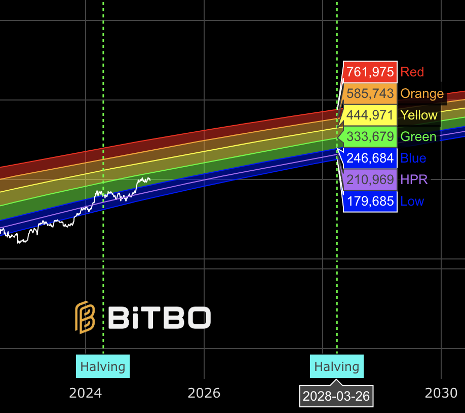

The blue band shows the area in which the price is within six months of where it should be according to the HPR projection (the line in the middle of the blue band is the projected price). The current price is running ahead of the forecast.

Where the actual price is now (as of 17 February 2025) – in the green band – shows the price as being one year ahead of where it could have expected to be according to the rainbow projection. Green represents one year, yellow two years, orange three years and red four years.

If we zoom into the chart (below), we can see that the HPR predicts the price will be at $210,969 in 2028 at the time of the fifth halving.

Breaking down the return in each of the four bitcoin halving cycles and comparing it to the return on the Nasdaq Composite index over the same periods, we have a very different picture to that inferred by the Sharpe ratio (although in that example we used the large-cap Nasdaq 100 as our comparator):

|

Cycle number |

Start date |

End date |

Start price ($) |

End price ($) |

Price return (%) |

Price multiple |

Nasdaq Composite return (%) |

|

1 |

28/11/2012 |

09/07/2016 |

12.35 |

655.48 |

5,209 |

53.1 |

67 |

|

2 |

09/07/2016 |

11/05/2020 |

655.48 |

8,581.50 |

1,209 |

13.1 |

82 |

|

3 |

11/05/2020 |

20/04/2024 |

8,581.50 |

64,981.02 |

657 |

7.6 |

70 |

|

4 |

20/04/2024 |

2025-02-04* |

64,981.02 |

98,721.55 |

52 |

1.5 |

25 |

Note: *Bitcoin's fourth halving cycle ends on 25 March 2028. The final halving will occur sometime in 2140 when the supply reaches its maximum of 21 million. Also notice how the return percentage falls in each successive halving cycle.

Bitcoin is the “original gangster” of the crypto world, with a moat (the total computational power of the hardware used to mine it – known as the hashrate) that has maintained its enduring dominance of the crypto market. In terms of market capitalisation (price multiplied by the number of tokens in theoretical circulation), it has never fallen below 33.4% share. Bitcoin dominance on 4 February 2025 stood at 60.4%.

Therefore, it is necessary to treat bitcoin differently from all other coins in the market. Broadly speaking, these other coins evolved as alternatives to bitcoin by pitching their own specific value differential, with varying degrees of success. This is where the term “altcoins” is derived from.

Better-known altcoins include Ethereum, XRP, Solana, BNB, Dogecoin, Cardano, Tron, Chainlink, Litecoin, Bitcoin Cash, Stellar, Sui, Hedera, Polkadot, Toncoin, Uniswap, Monero, and Internet Computer.

Crypto data site CoinGecko divides the 17,046 coins it lists into 510 categories, with new ones being created almost daily as trends and themes shift and mutate, and innovation continues apace. But such is the proliferation of categories, they are probably unhelpful to those coming to crypto for the first time, and even for the more experienced and knowledgeable.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks