eyeQ: the importance of this event cannot be overstated

Experts at eyeQ have used AI and their own smart machine to analyse macro conditions and generate actionable trading signals. Now, it spots a signal that the financial system is creaking.

9th April 2025 10:27

Huw Roberts from eyeQ

“Our signals are crafted through macro-valuation, trend analysis, and meticulous back-testing. This combination ensures a comprehensive evaluation of an asset's value, market conditions, and historical performance.” eyeQ

- Discover: eyeQ analysis explained | eyeQ: our smart machine in action | Glossary

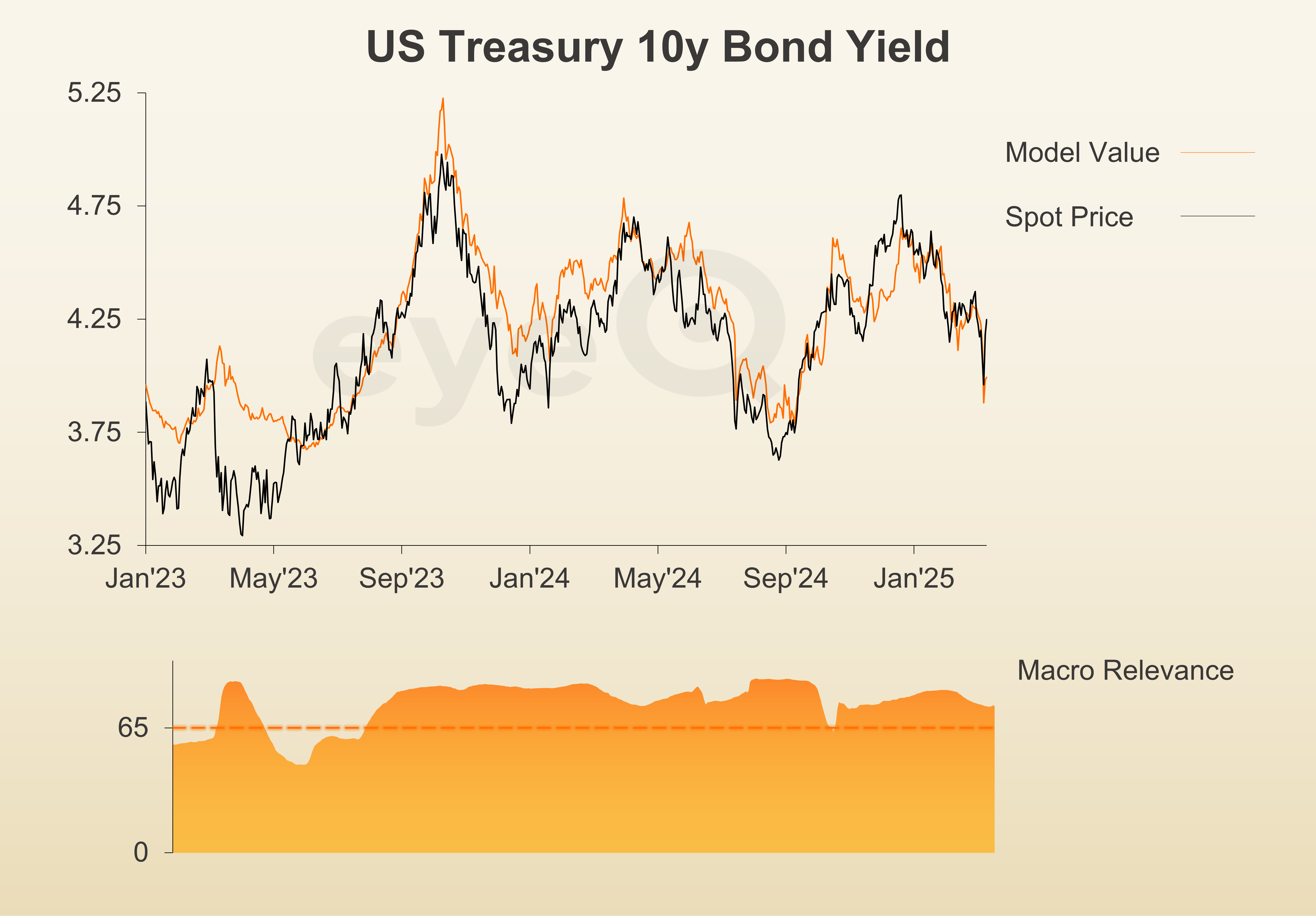

US Treasury 10-year yield

Macro Relevance: 76%

Model Value: 4.10%

Fair Value Gap: +23bp

Data correct as at 9 April 2025. Please click glossary for explanation of terms. Long-term strategic model.

Very few UK investors trade US Treasuries, American government bonds, which are the equivalent of our gilts. But they are vital to the global financial system.

They act as the global benchmark - it is the rate that the cost of borrowing that other countries, companies and mortgage providers around the world are based off. They are also the most liquid “safe-haven” asset that investors flock to in times of turbulence.

US bond yields had been falling in 2025. Over Q1, it was an orderly move driven primarily by expectations that Department of Government Efficiency (DOGE) cost-cutting would slow the economy and help reduce the budget deficit (a smaller deficit means less bond supply).

In April, after the announcement of Trump’s tariffs, the fall in yields accelerated because markets became increasingly fearful of a full-blown recession. In round numbers, 10-year US Treasury yields fell from around 4.75% at the start of the year to below 4.00% on the initial Trump headlines.

Now, though, yields have backed up to 4.40% in a matter of days. A 50-basis point move in just a few sessions is massive in itself but the direction of the move is even more striking. It’s completely counterintuitive for yields to move higher when inflation expectations are falling, recession fears are growing, and the Federal Reserve is expected to cut rates. It suggests panic selling.

The importance of this cannot be overstated.

The implication is that this period of volatility in financial markets is stepping up another gear and becoming even more dangerous. Funds sell US Treasuries only when it makes no financial sense, when they absolutely have to - when they sell not what they want, but what they can. It speaks to desperation and the need to raise cash to help offset losses elsewhere or pay margin calls.

That point is apparent, too, looking at eyeQ’s model. Ten-year US Treasury yields are now 23 basis points above where macro conditions (especially growth and inflation) say they “should” be. But these markets aren’t being driven by macro fundamentals. Even with high model confidence (76% macro relevance), this is a market being pushed around by forced selling and capitulation.

This is not a signal for investors to think about locking in US Treasury yields. It is a signal that the entire financial system is creaking, and that you need to be even more cautious.

The only consolation for investors is the US Treasury market is the ultimate example of “too big to fail”. The US authorities simply cannot allow the US bond market to become disorderly. If this deteriorates further, we will see a policy response.

Source: eyeQ. Past performance is not a guide to future performance.

Useful terminology:

Model value

Where our smart machine calculates that any stock market index, single stock or exchange-traded fund (ETF) should be priced (the fair value) given the overall macroeconomic environment.

Model (macro) relevance

How confident we are in the model value. The higher the number the better! Above 65% means the macro environment is critical, so any valuation signals carry strong weight. Below 65%, we deem that something other than macro is driving the price.

Fair Value Gap (FVG)

The difference between our model value (fair value) and where the price currently is. A positive Fair Value Gap means the security is above the model value, which we refer to as “rich”. A negative FVG means that it's cheap. The bigger the FVG, the bigger the dislocation and therefore a better entry level for trades.

Long Term model

This model looks at share prices over the last 12 months, captures the company’s relationship with growth, inflation, currency shifts, central bank policy etc and calculates our key results - model value, model relevance, Fair Value Gap.

These third-party research articles are provided by eyeQ (Quant Insight). interactive investor does not make any representation as to the completeness, accuracy or timeliness of the information provided, nor do we accept any liability for any losses, costs, liabilities or expenses that may arise directly or indirectly from your use of, or reliance on, the information (except where we have acted negligently, fraudulently or in wilful default in relation to the production or distribution of the information).

The value of your investments may go down as well as up. You may not get back all the money that you invest.

Equity research is provided for information purposes only. Neither eyeQ (Quant Insight) nor interactive investor have considered your personal circumstances, and the information provided should not be considered a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised financial adviser.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks