Five reasons not to write off oil and gas

Cleaner energy is on the rise, but that doesn’t mean fossil fuels are over. As Theodora Lee Joseph explains, this industry’s stocks still have a lot of miles in the tank.

21st June 2024 09:37

- Peak oil demand is still years off, and AI’s rising power needs and the underinvestment in oil and gas hint at a strong future demand for natural gas.

- Years of underinvestment have shortened the industry’s resource life and increased extraction costs, leading to potential price volatility, but also high profitability for oil companies.

- Consolidation in the oil sector is driving cost efficiency and boosting profitability, making energy stocks an attractive investment.

With a growing number of investors shunning the stocks of carbon-emitting firms and trillions of dollars going into the green transition, it’d be easy to write off fossil fuel companies. But I wouldn’t. These firms are some of the biggest players in clean energy – and their old-school operations are far from over. Here are five reasons why oil and gas companies are still worth your attention.

1. Peak oil demand is still years away

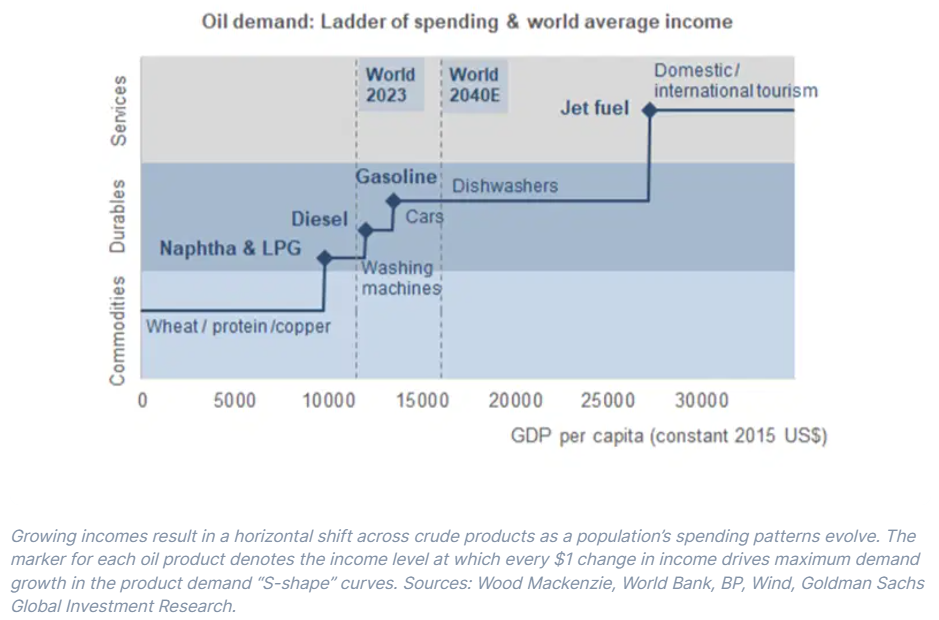

Predictions about when exactly oil demand will hit its max before slackening and sliding downhill have sparked a showdown between OPEC+ and the International Energy Agency (IEA). OPEC thinks this won’t happen until 2045, while the IEA is forecasting a peak by the end of this decade.

Figuring out how far we are from peak oil demand is a big deal. If it’s underestimated, that could scare off investments in new oil and gas projects, leading the price to surge as supply struggles to match demand. It could also make investors shy away from oil and gas companies, fearing their assets will become as useful as a typewriter.

And it’s entirely possible that oil demand will continue to climb beyond this decade. After all, the dream of a smooth transition to alternative energy has already hit some serious potholes. Offshore wind farms are being scrapped because of soaring costs, car manufacturers are slowing EV rollouts because consumers aren’t biting, and communities are pushing back against solar farms because they take up so much land. Add economic growth to the mix, which usually goes hand in hand with energy demand, and it becomes clear we’ll need both traditional fossil fuels and new energy tech to meet future needs.

Goldman Sachs isn’t as bullish about oil as OPEC, but it’s forecasting at least a decade’s worth of continued growth in demand, followed by a plateau that extends until 2040, or longer.

2. The AI boom will fuel natural gas demand

Generative AI is set to give human productivity a boost like the internet did 30 years ago. But it won’t just magically happen – AI will need a ton of power to do its thing. Morgan Stanley predicts a whopping 70% annual increase in AI’s energy demands this decade. And as AI technologies get smarter, their needs will only grow.

According to Rystad Energy consultancy, the surge in electricity demand will necessitate a power source that’s capable of filling the gap when renewables fall short. The natural gas industry is banking on becoming the preferred choice.

Wells Fargo estimates that gas demand could jump by 10 billion cubic feet per day by 2030 – 28% more than what the US currently uses for electricity and 10% more than its total gas consumption.

Analysts are just starting to calculate what the country’s growing crop of power-hungry AI data centers might mean for natural gas use. Goldman expects an increase of 3.3 billion cubic feet per day, while Tudor, Pickering, Holt, and Co. sees anywhere from 2.7 billion to 8.5 billion. That crystal ball might be cloudy, but it shows one thing very clearly: that natural gas demand will grow.

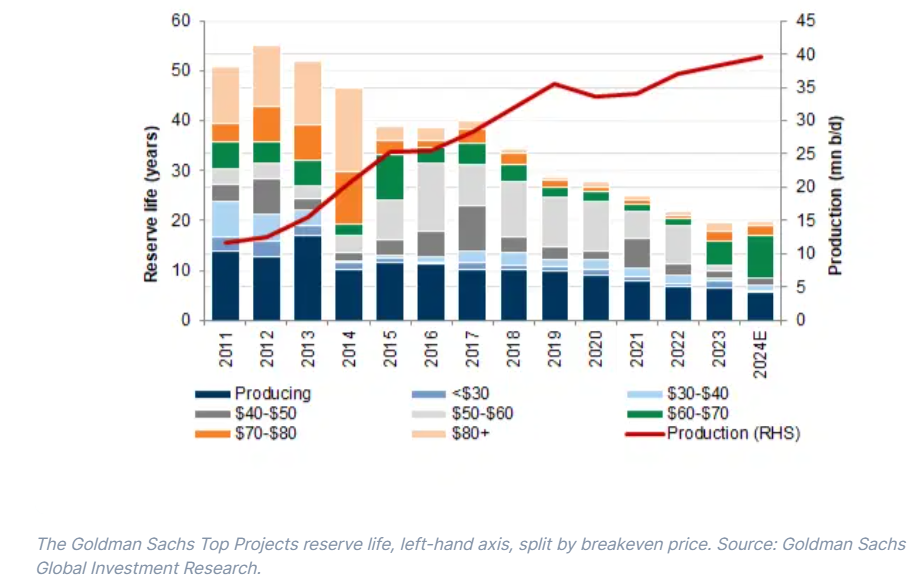

3. Oil supply is low after years of underinvestment

Companies have skimped on oil and gas development projects for years. And that’s shortened the industry’s “resource life”, the number of years existing oil reserves would last before they run dry, assuming there are no new major discoveries or changes in consumption. Goldman Sachs says the oil industry’s obsession with low-risk, quick-turnaround US shale projects has slashed the resource life to just 14 years – less than half of what it was a decade ago. So, unless the industry starts splurging on exploration and development, those resources will run out.

This penny-pinching has also made it more expensive to squeeze out the next drop of oil. And that’s because of how oil production works: each additional barrel of crude becomes significantly more expensive to produce than the last, as easily accessible resources are depleted. This “steepening of the oil curve” spells trouble for the price of the slippery stuff, setting the stage for price volatility. If demand unexpectedly jumps, prices could skyrocket because of the high supply cost – fantastic news for investors and companies, but a nightmare for consumers.

4. Oil profitability has returned to its golden age

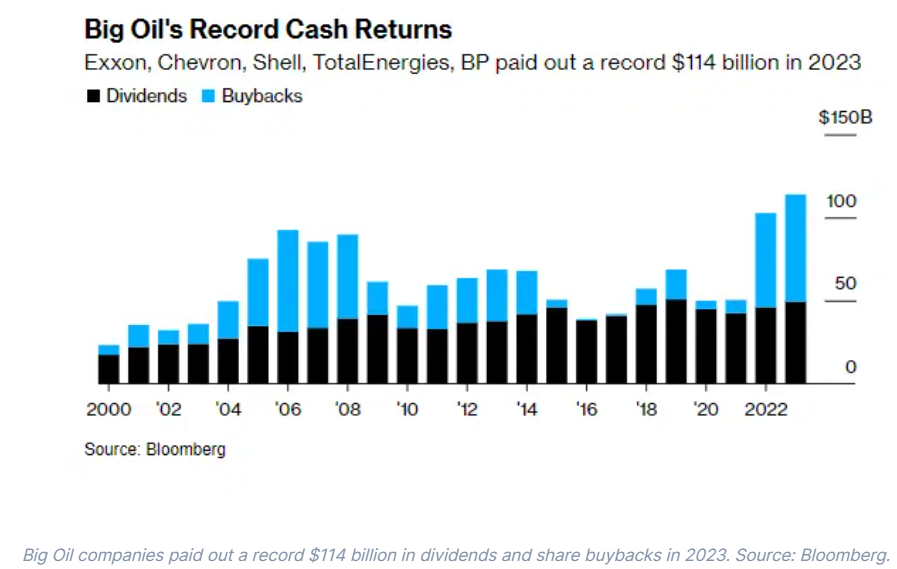

The oil and gas game is looking more profitable, with companies enjoying better market conditions, tighter financing, and stronger negotiation power with host governments. Projects launched between 2017 and 2022 are seeing returns over 20%, according to Goldman Sachs, levels similar to the industry’s golden age in the 1990s.

This means Big Oil is now better positioned to focus on shareholder returns. In 2023, the top five Western oil and gas firms – BP, Chevron, ExxonMobil, Shell, and Total – returned over $114 billion to shareholders in dividends and share buybacks, a slick 76% increase from the industry’s 2011-2014 heyday when oil was above $100 and the supermajors were stock market darlings.

And the top brass at these oil giants have hinted they might dish out even more dough this year if commodity prices stay solid. Their message to investors is clear: stick with us, and we’ll keep the money flowing your way.

5. Consolidation has started to transform the sector

In the past year, energy giants like Exxon, Chevron, Occidental Petroleum, and ConocoPhillips have shelled out a massive $194 billion on US shale deals – about three times more than in the year before. This wave of consolidation is great news for investors.

For starters, it’s expected to cut costs, making US oil and gas companies more resilient and profitable, even when commodity prices dip. Energy data firm Wood Mackenzie estimates these economies of scale could cut break-even costs by $5 a barrel in the Permian Basin, where most of the action is happening, bringing costs down to around $30-$35 per barrel.

And to top it off, more consolidation means more discipline, with companies increasing their focus on shareholder returns and cash generation. Gone are the wild days of 2016 when low interest rates had companies pumping oil until prices tanked. Now, with higher interest rates and debt levels, producers are being more cautious with their cash while improving production economics. The old “growth at all costs” mindset has given way to prioritizing shareholder returns, stock performance, and debt reduction.

Where’s the opportunity here?

Energy stocks led the S&P 500 in 2022, and they just might do it again this year. So if you’re light on this sector, you might want to put on some weight. The oil and gas energy chain is vast, with plenty of investment pockets to suit every risk appetite.

If you’re particularly bullish on oil or gas as a commodity, you could invest directly in US exploration and production (E&P) companies like EOG Resources and Devon Energy, or in gas E&P companies like EQT, Southwestern Energy, or Chesapeake Energy. Those firms are more levered to the price of the commodity itself.

On the other hand, if you prefer a more diversified approach, you could consider investing in Big Oil companies like Total, BP, Shell, Exxon, or Chevron – since they also invest billions in new energy technologies.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks