ii investment review: Q1 2021

Despite a few hiccups, the beginning of 2021 has been another fruitful period for many investors.

20th April 2021 11:08

Despite a few hiccups, the beginning of 2021 has been another fruitful period for many investors.

Market round-up

Unsurprisingly, the pandemic and the world’s response to it remained the biggest driver in financial markets through the first quarter of 2021. Investors paid particular attention to vaccination rates and the possibility of economies reopening as the year progresses.

America’s new president was a distraction from the coronavirus crisis, and Joe Biden’s promised $1.9 trillion stimulus plan has been approved by Congress. Combined with a more positive outlook on emergence from widespread lockdowns and suppressed economic activity, equities remain flavour of the month.

- Month in the markets: value rally in US and Europe continues

- Check out our award-winning stocks and shares ISA

Indeed, global equities outperformed bonds at the start of the year and delivered positive returns during the quarter, supported by the successful roll-out of Covid-19 vaccines in the US and the UK and the US fiscal stimulus news. As a result, investors were confident enough to move into riskier assets where potential returns are higher. Commodities also gained, with the energy sector boosted by stronger demand and expectation of higher inflation.

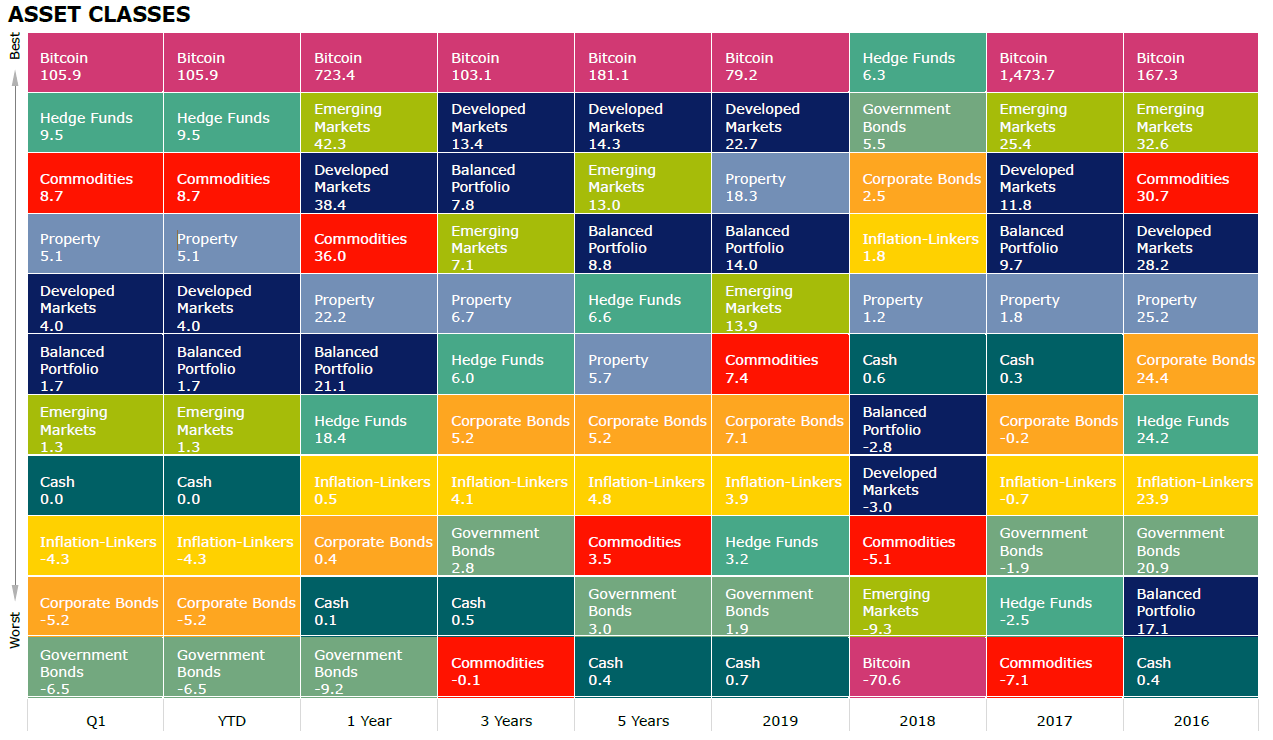

Source: Morningstar Total returns in sterling

Shares

Global stock markets delivered mostly positive returns for the first quarter, with developed markets outperforming emerging markets. The period was dominated by rising bond yields and a rotation away from growth, including the runaway tech sector, into value equities.

In the US, the broad-based S&P 500 index rose 5.2% in the quarter to a record high above 4,000. President Biden confirmed a fiscal stimulus package of $1.9 trillion, which was followed up with an additional promise of $2 trillion in infrastructure spending. This has led to upgrades in consensus forecasts for US growth this year, with 7% growth now expected.

However, tech stocks didn’t have a completely smooth ride, as a sell-off which began mid-February spilled over into March. An increase in commodity prices fuelled by hopes for a sharp rebound in the global economy caused concerns about a rise in inflation. This triggered a spike in US Treasury yields, which makes growth stocks less attractive.

In the UK, the FTSE All Share delivered a good performance with 5.2% returns. Small cap stocks, which tend to be more domestically focused, also delivered strong returns, with the FTSE Small Cap index up 9.6%.

- How the AIM market took over the world in 2020

- The stocks behind the AIM market comeback

- Discover how to be a better investor here

Emerging market equities also ended in positive territory in Q1, despite their vaccine programmes lagging developed markets. Only Brazil and China delivered negatives returns for the quarter.

| Performance | ||||

|---|---|---|---|---|

| Q1 (%) | 1 Year | 3 Years | 5 Years | |

| FTSE Small Cap | 9.6 | 63 | 9.9 | 11.6 |

| FTSE 250 | 5.4 | 45.1 | 6 | 7.7 |

| S&P 500 | 5.2 | 40.5 | 17.4 | 17.2 |

| FTSE All Share | 5.2 | 26.7 | 3.2 | 6.3 |

| FTSE 100 | 5 | 21.9 | 2.3 | 5.8 |

| India* | 4.1 | 58.5 | 9.8 | 12.1 |

| Russia* | 4 | 29.7 | 8.7 | 15.1 |

| World | 4 | 38.4 | 13.4 | 14.3 |

| Europe Ex UK* | 2.5 | 33.5 | 7.8 | 10.4 |

| Asia Pacific Ex Japan* | 1.8 | 42.6 | 9.7 | 14 |

| Emerging Markets* | 1.3 | 42.3 | 7.1 | 13 |

| TOPIX Japan | 1.1 | 24.8 | 6.1 | 11.5 |

| China* | -1.3 | 29.1 | 8.8 | 17 |

| Brazil* | -10.8 | 31.6 | -6.1 | 8.9 |

Source: Morningstar. *MSCI. Total returns in sterling

Sectors

Value-focused cyclical equities extended their recovery since November, when Pfizer (NYSE:PFE) announced the first Covid vaccine. The first-quarter performance was reflected in very strong returns from energy, financials, and industrials.

But technology, consumer staples, healthcare and utilities lagged.

Rising US Treasury yields, mostly on concerns about higher inflation, gave growth stocks a worrying few weeks, causing a sell-off in tech plays, including Tesla (NASDAQ:TSLA) and Apple (NASDAQ:AAPL). The benchmark 10-year yield ended the first quarter at around pre-pandemic levels following the biggest quarterly increase in four years.

| Performance | ||||

|---|---|---|---|---|

| Q1 (%) | 1 Years | 3 Years | 5 Years | |

| Energy | 20.7 | 35.9 | -5.6 | 0.6 |

| Financials | 12.2 | 45.0 | 5.9 | 12.0 |

| Industrials | 6.8 | 46.4 | 10.7 | 13.3 |

| Communication Services | 5.8 | 43.1 | 17.6 | 10.4 |

| Real Estate | 5.1 | 18.0 | 7.0 | 6.3 |

| Materials | 4.7 | 54.6 | 11.4 | 15.4 |

| Consumer Discretionary | 2.6 | 62.9 | 19.1 | 17.8 |

| Information Technology | 0.4 | 50.8 | 27.2 | 27.2 |

| Health Care | -0.2 | 16.1 | 14.1 | 12.5 |

| Utilities | -0.5 | 9.8 | 10.8 | 8.7 |

| Consumer Staples | -1.5 | 11.1 | 8.3 | 7.0 |

Source: Morningstar. Total returns in sterling

Bonds

Bonds delivered negative returns in sterling terms as yields rose in Q1. Corporate bonds outperformed government bonds, but still ended in negative territory. High yield bonds outperformed produced moderate positive returns amid healthy risk appetite and rising growth expectations.

| Performance | ||||

|---|---|---|---|---|

| Q1 (%) | 1 Year | 3 Years | 5 Years | |

| Global High Yield | -1 | 12.9 | 6.5 | 8.5 |

| Sterling Corporate | -4.1 | 7 | 4.1 | 4.6 |

| Global Inflation Linked | -4.3 | 0.5 | 4.1 | 4.8 |

| Global Corporate | -5.2 | 0.4 | 5.2 | 5.2 |

| Global Aggregate | -5.3 | -5.9 | 3.4 | 3.5 |

| EURO Corporate | -5.6 | 4.6 | 1.4 | 3.8 |

| UK Inflation Linked | -6.3 | 2.5 | 3.4 | 6 |

| Global Government | -6.5 | -9.2 | 2.8 | 3 |

| UK Gilts | -7.2 | -5.5 | 2.5 | 2.9 |

Source: Morningstar. Total returns in sterling

Commodities and Alternative investments

Commodities were mostly higher, including a 22% increase for oil, although gold was down 12% in the first quarter. Commodities are showing further signs of strength on the back of expectation of higher inflation.

The oil market grabbed headlines in March when crude traded above $70 a barrel for the first time since the Covid-19 pandemic. The price had been rising fast since the announcement of Covid vaccines last November.

More recently, the OPEC oil cartel agreed to maintain its reduced output, contrary to what many industry experts had expected. Military conflict in the Middle East also served to hike prices, as fighting in neighbouring Yemen spilled over into Saudi Arabia. A numbering of Saudi oil installations were hit by missiles.

| Performance | ||||

|---|---|---|---|---|

| Q1 (%) | 1 Year | 3 Years | 5 Years | |

| Brent Crude Oil | 21.5 | 151.1 | -2.8 | 10.8 |

| Global Natural Resources | 10.8 | 50.7 | 6.0 | 12.3 |

| Hedge Funds | 9.5 | 18.4 | 6.0 | 6.6 |

| Commodity | 8.7 | 36.0 | -0.1 | 3.5 |

| UK REITs | 3.2 | 19.6 | 0.8 | 1.8 |

| Global Infrastructure | 2.0 | 23.2 | 6.3 | 7.6 |

| Cash | 0.0 | 0.1 | 0.5 | 0.4 |

| Gold | -11.7 | -5.6 | 9.0 | 7.3 |

| CBOE Market Volatility (VIX) | -15.5 | -67.4 | -0.4 | 7.7 |

Source: Morningstar. Total returns in sterling

Most-traded shares on the ii platform in Q1 2021

| Most-bought | Most-sold |

|---|---|

| GlaxoSmithKline | Argo Blockchain |

| BP | Lloyds Banking Group |

| Argo Blockchain | International Consolidated Airlines |

| Rolls-Royce | Rolls-Royce |

| Vodafone | BP |

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks