ii Investment review: Q3 2020

Trading typically slows down over the holiday season, but this summer has been anything but normal.

9th October 2020 12:30

Trading typically slows down over the holiday season, but this summer has been anything but normal.

Market round-up

A recovery from the collapse in financial markets began at the end of March and, for most major stock indices, continued through the third quarter of 2020. However, there were significant differences in performance across regions and sectors.

Biggest story of the summer quarter by far was the incredible rise in demand for technology stocks, mainly those listed on the American Nasdaq tech index. The Nasdaq 100 soared 12.4% over the three months, buoyed by gains for companies benefiting from the trend towards home working during the pandemic.

- ii Super 60 fund review: Q3 2020

- ii ACE 30 ethical fund review: Q3 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

But it’s not only the companies making the tech that profit; the online retailers and delivery firms are in a purple patch too. As a result, many businesses in areas of the economy referred to as consumer discretionary have experienced a significant bounce back from the March lows. Others have not been so lucky and, predictably, the physical entertainment, leisure and motor industries are among those sectors slow to recover from the crash.

Elsewhere, investors regained confidence in the emerging markets story. A huge consumer boom in this part of the world carries the possibility of rich returns in the years ahead, but it is not without risk. It is also still playing catch-up with stocks in developed markets which were quicker to recover from the Covid-19 sell-off. A record high for gold amid ongoing social and economic upheaval over the summer months, plus strength among industrial metals, was a rare positive for the commodities sector. However, it remains in a battle with the beleaguered property sector to avoid winning the wooden spoon in 2020.

Looking ahead, and the final three months of the year will be jam-packed with potential market-moving events, most notably the US presidential election on 3 November. Joe Biden leads the polls currently, but this pro-regulation Democrat could also push the button on massive fiscal stimulus. The outcome of Brexit trade negotiations will inevitably drive UK-focused stocks, while a vaccine for Covid-19 would be a massive catalyst for financial markets.

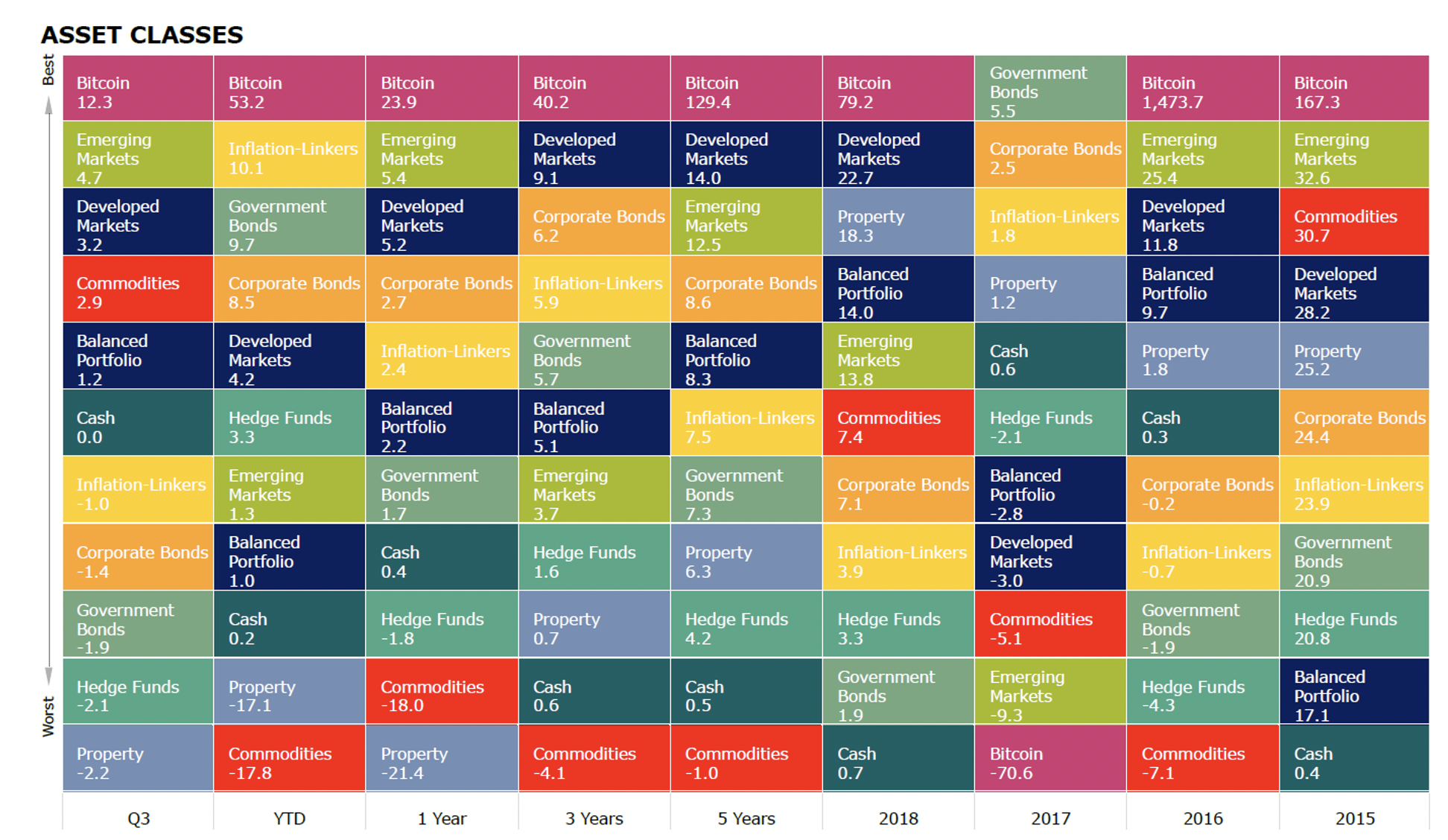

Source: Morningstar Total returns in sterling

Shares

Global equities posted positive returns during the quarter with Asia and the US outperforming Europe and the UK.

UK equities lagged other regions and extended their year-to-date underperformance, primarily due to the market's significant exposure to poorly performing stocks in the oil and financial sectors. Renewed fears about a second wave of Covid-19 infections along with uncertainty around Brexit negotiations also weighed on investor sentiment.

US equities recorded strong gains, supported by signs of economic recovery and loose monetary policy. The Federal Reserve will now use average inflation targeting to set interest rates, allowing for temporary overshoots in inflation. The new policy means the Fed is willing to wait until inflation has gone above 2% until it responds. Market volatility picked up at the end of the quarter due to an uptick in Covid-19 cases, as well as uncertainty over a smooth transition of power if President Donald Trump loses his re-election bid.

Eurozone equities delivered negative returns over the quarter. The rate of improvement in economic data slowed over the period, and worries took hold over sharply rising Covid-19 infections in the region.

Emerging market equities outperformed developed markets supported by ongoing economic recovery and US dollar weakness.

| Performance | |||||

|---|---|---|---|---|---|

| Q3 (%) | YTD | 1 Year | 3 Years | 5 Years | |

| India* | 9.87 | -2.17 | -4.16 | 3.38 | 8.61 |

| China* | 7.52 | 19.32 | 27.33 | 9.21 | 17.18 |

| Emerging Markets* | 4.71 | 1.28 | 5.37 | 3.69 | 12.48 |

| Asia Pacific Ex Japan* | 4.61 | 5.31 | 8.27 | 5.69 | 13.69 |

| S&P 500 | 4.11 | 8.18 | 9.76 | 13.68 | 17.82 |

| World | 3.15 | 4.22 | 5.24 | 9.08 | 14.03 |

| TOPIX Japan | 2.76 | 1.92 | 2.38 | 4.87 | 11.41 |

| FTSE 250 | 1.77 | -19.69 | -11.31 | -1.99 | 3.45 |

| FTSE Small Cap | 1.21 | -13.73 | -5.37 | -1.14 | 5.44 |

| Europe Ex UK* | 1.2 | -1.39 | -0.51 | 2.19 | 9.23 |

| FTSE All Share | -2.92 | -19.92 | -16.59 | -3.21 | 3.47 |

| FTSE 100 | -4.02 | -20.21 | -18.07 | -3.55 | 3.38 |

| Brazil* | -7.6 | -39.43 | -35.65 | -8.92 | 11.68 |

| Russia* | -8.93 | -26.25 | -19.9 | 5.39 | 14.63 |

Source: Morningstar *MSCI, Total returns in sterling

Sectors

The energy sector saw the sharpest declines during the quarter, still reeling from the hit to demand from the coronavirus. A boom in sales of computers, video games, laptops, printers and TVs has been a huge catalyst for online retailers and other stocks in the so-called consumer discretionary sector.

| Performance | |||||

|---|---|---|---|---|---|

| Q3 (%) | YTD | 1 Year | 3 Years | 5 Years | |

| Consumer Discretionary | 10.86 | 20.48 | 19.72 | 16.23 | 17.22 |

| Information Technology | 6.88 | 30.5 | 38.36 | 27.19 | 29.17 |

| Materials | 6.79 | 6.15 | 7.28 | 5.89 | 15.41 |

| Industrials | 6.74 | -0.77 | -0.9 | 4.89 | 13.33 |

| Communication Services | 3.51 | 9.02 | 9.43 | 8.79 | 11.18 |

| Consumer Staples | 2.77 | 3.8 | -0.95 | 7.03 | 10.6 |

| Health Care | 0.14 | 8.88 | 15.16 | 12.01 | 13.44 |

| Utilities | 0.1 | -1.76 | -6.74 | 7.37 | 11.36 |

| Real Estate | -2.4 | -10.38 | -15.66 | 2.94 | 7.84 |

| Financials | -2.71 | -19.7 | -18.76 | -3.6 | 6.6 |

| Energy | -19.68 | -44.58 | -45.88 | -17.5 | -4.75 |

Source: Morningstar, Total returns in sterling

Bonds

Global bonds declined as many investors decided they were happy to take on extra risk and buy stocks during the quarter. But low inflation and dovish central banks are expected to limit the rise in bond yields during the economic recovery from global lockdowns.

| Performance | |||||

|---|---|---|---|---|---|

| Q3 (%) | YTD | 1 Year | 3 Years | 5 Years | |

| EURO Corporate | 1.77 | 7.84 | 2.77 | 3.07 | 7.15 |

| Sterling Corporate | 1.17 | 4.59 | 3.87 | 4.70 | 5.50 |

| Global High Yield | 0.27 | 2.96 | -0.96 | 4.92 | 10.08 |

| Global Inflation Linked | -1.02 | 10.08 | 2.40 | 5.91 | 7.52 |

| UK Gilts | -1.23 | 7.59 | 3.41 | 5.66 | 5.08 |

| Global Corporate | -1.42 | 8.49 | 2.69 | 6.23 | 8.55 |

| Global Government | -1.87 | 9.69 | 1.66 | 5.73 | 7.26 |

| Global Aggregate | -1.88 | 8.34 | 1.26 | 5.39 | 7.27 |

| UK Inflation Linked | -2.18 | 10.05 | 0.23 | 6.59 | 7.75 |

Source: Morningstar, Total returns in sterling

Commodities and Alternative investments

Gold posted positive returns in sterling terms amid concern around the global economy, the coronavirus and social unrest. The yellow metal made an all-time high in August. Despite drifting back during the rest of the quarter, it still trades at an historically high $1,900 an ounce. Elsewhere, oil declined amid concern over the sustainability of the recovery in global growth.

| Performance | |||||

|---|---|---|---|---|---|

| Q3 (%) | YTD | 1 Year | 3 Years | 5 Years | |

| Commodity | 2.9 | -17.79 | -17.98 | -4.07 | -0.99 |

| Gold | 1.66 | 26.72 | 20.68 | 14.95 | 14.48 |

| Cash | 0.02 | 0.2 | 0.38 | 0.55 | 0.48 |

| Hedge Funds | -1.92 | -5.94 | -9.63 | 2.08 | 5.19 |

| Global Natural Resources | -2.39 | -15.37 | -13.76 | -1.57 | 10.1 |

| UK REITs | -2.62 | -26.1 | -16.87 | -3.13 | -3.16 |

| Global Infrastructure | -2.91 | -16.05 | -17.92 | -0.16 | 7.82 |

| Brent Crude Oil | -4.89 | -36.42 | -35.78 | -9.61 | -0.16 |

| CBOE Market Volatility (VIX) | -17.18 | 116.69 | 54.78 | 42.24 | 4.75 |

Source: Morningstar, Total returns in sterling

Most-traded shares on the ii platform in Q3

| Most-bought |

|---|

| BP (LSE: BP.) |

| Boohoo (LSE: BOO) |

| Lloyds Banking Group (LSE: LLOY) |

| GlaxoSmithKline (LSE:GSK) |

| Royal Dutch Shell (LSE:RDSB) |

| Most-sold |

|---|

| Boohoo (LSE: BOO) |

| Synairgen (LSE: SNG) |

| Lloyds Banking Group (LSE: LLOY) |

| International Consolidated Airlines (LSE: IAG) |

| Omega Diagnostics (LSE: ODX) |

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks