Japan: is the party over?

Amid moves to tighten policy, some investors are left wondering if it truly is time to turn off the music and evacuate Tokyo dancefloors. Find out why Alex Smith says ‘far from it.’

6th March 2025 10:00

Alex Smith from abrdn

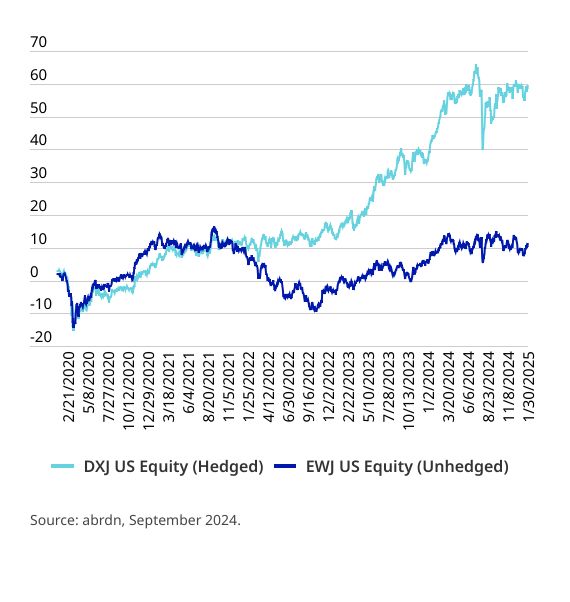

Since the second quarter of 2020, Japanese equities have experienced a remarkable rally, with gains of approximately 70% in yen terms, translating to an annualized return of 10%.[1]

This impressive performance has led many to question whether the drivers of this rally are now unwinding.

Traditionally, Japanese equity rallies are associated with a weaker yen (Chart 1), and with moves to tighten policy afoot, concerns are mounting.

Chart 1. The yen remains cheap

However, we believe the party is far from over. Japan has significant potential to continue its upward trajectory as an investment story.

Economic reforms and growth potential

Japan's domestic economy has substantial scope for growth, driven by ongoing reforms. These reforms aim to address inefficiencies in corporate structures, the labor market, and digitalization. By tackling these areas, Japan can unlock major untapped economic potential, leading to better productivity and growth.

Corporate structures

One of the key issues in Japan's corporate landscape is the inefficiency of corporate structures. Approximately 50% of TOPIX constituents trade below book value, indicating a widespread waste of capital. Japanese companies have generated the worst returns on capital among major markets since World War II. This problem is rooted in complex corporate structures, which result in a lack of focus on shareholders, excess cash, and inefficient subsidiaries.

To address this, the Japanese government introduced new corporate governance standards in 2014, and the Tokyo Stock Exchange has recently taken more drastic measures. Companies will be de-listed by 2025 if they do not improve their governance, with naming and shaming beforehand. The changes are much broader than addressing ESG concerns. These measures are expected to lead to a sustainable improvement in productivity across the economy, as capital will be invested in newer and more productive ventures, boosting growth and improving the capital market.

Labour market

Japan's labor market is another area that has been undergoing reform. There is not enough risk-taking and entrepreneurship, and Japan suffers from low female participation and insufficient foreign workers. These issues put a ceiling on potential productivity gains.

Reforms initiated under former Prime Minister Abe, including the Womenomics program, aimed to make the labor market more flexible and diverse.[2] These reforms have sparked a cultural shift in the Japanese workplace, and ongoing investments in automation-related companies are expected to enhance productivity further. Higher wages, as seen in the record increases during the 2023 and 2024 Shuntō negotiations, signal an end to the deflationary mindset and a revival of the domestic economy.

Digitalisation

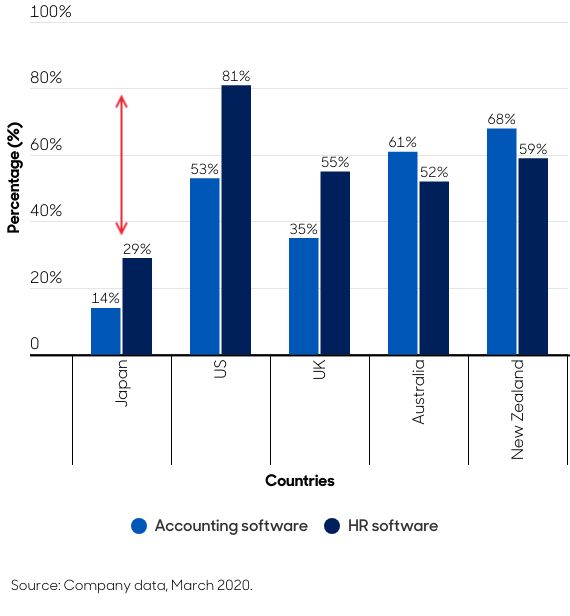

Despite being a leader in engineering and information technology (IT) hardware, Japan lags in digitalization. Most Japanese corporates use outdated software systems, and only 34% of companies use SaaS (Software as a Service) solutions (Chart 2).[3] This inefficiency hampers productivity and innovation.

Chart 2. SaaS penetration rate in Japan still relatively low

The lack of IT investment characterizes the issues with capital, allocation, and labor. Companies have been far too conservative with their IT investments, backing legacy systems, while IT talent is wrapped up maintaining them. However, the scope for catch-up is interesting from an investment perspective.

Moving from in-house to SaaS models, adopting cloud solutions, and addressing the IT talent bottleneck are crucial for Japan. These changes will foster a burgeoning domestic software industry that may improve companies' returns. Digitalization is a key productivity driver alongside capital and labor market reforms.

Monetary policy and the yen

Monetary policy in Japan is directed towards normalization, which should support the yen. The Bank of Japan (BoJ) has taken steps to adjust Yield Curve Control and has raised rates multiple times since March 2024. While the yen initially weakened after these efforts, the long-term outlook is towards policy normalization, which supports the yen in the long term.

The right base rates will be beneficial for Japan. They can help insulate the economy from inflationary shocks and encourage rational investing behavior. Normalizing rates will also help bring the huge amount of Japanese overseas capital back to Japan, funding growth in areas like digital transformation.

Equity market dynamics

The Japanese equity market is not solely reliant on cheap exports and a weak yen. While value stocks have driven the recent rally, higher-quality stocks have underperformed. This presents an opportunity for quality-focused investors as the market broadens and focuses on sustainable earnings.

Japan's global leaders in sectors like healthcare, IT hardware, renewable energy, and robotics tend to perform well when the yen strengthens, showing their resilience. These companies offer a combination of earnings per share uplift, carry, and large swings in asset flows. The domestic opportunity is also compelling for some solid domestic consumer businesses. With consensus growth in operating income expected to be around 8% next year, there is strong fundamental support for this trend.

Outlook for quality

The last three years have been challenging for quality-focused investors in Japan, with a sharp rotation to value stocks. However, the drivers of the value rally are starting to fade, and the market is now focusing more on sustainable earnings. We believe this shift is favorable for quality investments, as the re-rating pattern could reverse.

Structural growth trends, such as energy transition, digitalization, deglobalization, and domestic revival, present significant opportunities for Japanese companies. These trends are reinvigorating real assets globally, and Japanese engineering is playing a leading role. The market currently underappreciates the corresponding earnings power.

Expanding opportunity set

The unwinding of cross-shareholdings and structural reforms will continue, but the focus should shift from cheap stocks to more transformational, sustainable changes. While returning excess cash to shareholders has boosted returns, the real opportunity lies in companies that generate sustainable returns. The opportunity set for quality investors is growing, and the market is poised to shift towards higher-quality investments.

Final thoughts

Japan's economic history is characterized by periods of stagnation followed by rapid reform and growth. The current reform program is gathering pace and having a major impact. With significant potential for productivity improvements in corporate structures, the labor market, and digitalization, we believe Japan is well-positioned for continued growth, with the normalization of monetary policy to further support this outlook.

Alex Smith is head of equities investment specialists, Asia Pacific, abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

1 Bloomberg, January 2025.

2 "Womenomics: Reimagining Gender Equality in Japan's Workforce." Asia Society, February 2024. https://asiasociety.org/new-york/womenomics-reimagining-gender-equality-japans-workforce.

3 "SaaS Market Entry in Japan: A Complete Guide." ULPA, October 2025. https://www.ulpa.jp/post/saas-market-entry-in-japan-a-complete-guide-for-2024.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Editor's Picks