Lump sum vs regular investing: which is best for my ISA?

Craig Rickman compares whether annual lump sums or investing monthly has performed best since ISAs launched in 1999, and helps you to decide which strategy might work for you.

22nd April 2024 12:53

Investing for your future would be much easier if stock markets went up in a straight line. For starters, you wouldn’t have to worry about your portfolio plummeting shortly after committing a chunk of your savings.

The reality, however, is that while markets typically ascend over time, ups and downs are very much par for the course. What we don’t know is when these fluctuations will arrive, and in which direction they will travel.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

According to the random walk theory, proposed by French mathematician Louis Bachelier in 1900, markets move in an unpredictable way and thus cannot be accurately forecast.

“Time in the market, not timing the market” is a maxim that investors are encouraged to adopt. To add some meat to the bone here, the concept is that if you wait for ruts before ploughing any spare cash into stocks and shares, you could miss out on the upside.

But at the same time, experienced investors are acutely aware that investing a single lump sum has its risks; hence why a tactic called pound cost averaging, where you drip-feed investments over time, has become widely used.

This strategy is a way to mitigate investment risk by staging your contributions over, say, a 12-month period. This means that you buy shares at 12 different prices throughout the year, smoothing out returns by ameliorating potential losses should stocks suffer.

Although conversely, if markets were to boom, some of the stocks you purchased would be more expensive, which could stymie some of your gains - if only we had a crystal ball!

Whether to commit a single lump or invest regularly is a predicament that some individual savings account (ISA) investors may face. For those with the financial muscle to fill up their ISA at the start of the tax year, you might be wondering which one is best.

Which has historically performed best, lump sum or regular investing?

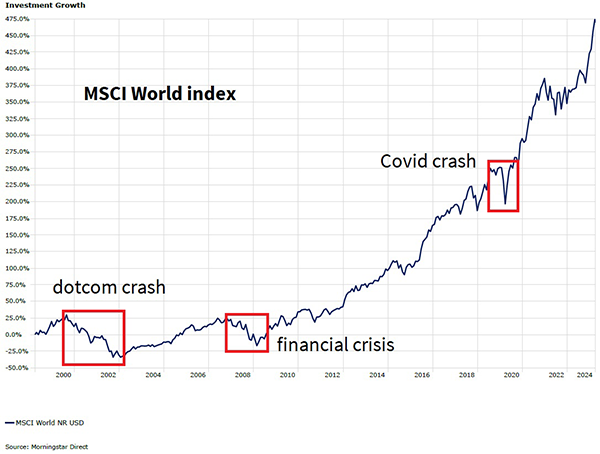

We crunched some numbers to pit lump sums against regular investing, analysing the performance of the MSCI World index over two periods: 6 April 1999 (the date when ISAs were launched) to 5 April 2024, and 6 April 2014 to 5 April 2024.

|

Time Period |

Regular investment £250pm (£) |

Annual Lump sum investment (£) |

Total contributions (£) |

|

10 years |

57,015 |

61,280 |

30,000 |

|

25 years |

297,795 |

304,330 |

75,000 |

Source: interactive investor/Morningstar Direct. Total return. The regular investing calculations assume a monthly investment amount of £300 made at the end of every month (with a starting amount of £300 on 6 April, rather than 31 April). The annual lump sum calculations assume a monthly investment amount of £3,000 made at the beginning of each calendar year (with a starting amount of £3,000 on 5 April of the first year of investment). The calculations do not take into account any investment fund, platform or trading fees.

What immediately jumps out is that both strategies have fared well. When you compare the total contributions over 10 and 25 years against the total returns, it makes for impressive reading, underscoring the benefits of sticking your savings in the stock market.

A £3,000 lump sum invested on 6 April 1999, and then at the turn of the calendar year thereafter (so the next investment would be made 1 January 2001) would have grown to £304,330 by the end of the 2023-24 tax year - a total return of 306%.

Meanwhile, the regular investing strategy, which split the £3,000 lump sum into 12 monthly contributions of £250 from 6 April 1999, then at the start of each month thereafter, would have grown to £297,795, or 297%. Equally encouraging stuff.

- Where ISA early birds have invested their cash

- How I plan to invest my ISA allowance in 2024

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

When we examine the previous 10 years, the performance gap between the two strategies is more pronounced, but both are still impressive.

Using the same assumptions, a lump sum investment of £3,000 per year would have grown to £61,280, compared to the £57,015 for the regular investing strategy. This equates to percentage returns of 104% and 90% for lump sums and drip-feeding, respectively.

Which method is right for me?

As with all areas of financial planning, which method suits you best depends on your personal circumstances, affordability (namely capacity to invest lump sums), and appetite for risk.

But more broadly, there are advantages and disadvantages that it’s important to be aware of.

-

Regular investing

Drip-feeding investments monthly helps to smooth out bumps in the market - you’re not putting all your eggs in one basket at a single point in the year when markets may be high or low. This approach can work for investors nervous about investing a hefty lump sum when markets are particularly volatile.

Committing money to the market monthly can also be a great way for novice investors to start and strengthen the habit of investing. Squirrelling away something affordable every month offers the potential for better long-term returns than what you might get if you channelled the money into a savings account.

- ISA ideas: I’m a beginner investor, where should I put my first £1,000?

- My first five years as an ISA investor

The main drawback here is that if markets rise over the investing period in question, and volatility is low, you’ll have less money in the market to capture the gains.

-

Lump sums

This strategy won’t be available to everyone as it requires having a large chunk to invest in one go. It may be reserved by those with big incomes or profits, have beefed up their savings accounts over many years, received a bonus from work, or pocketed a windfall, such as an inheritance.

As such, many investors, especially those who are employed and receive a monthly salary, will be restricted to drip feeding. But if you can commit lump sums of any size, it could give you an edge, as the data above shows.

A further benefit of investing a single amount every year is that you can avoid transaction fees associated with multiple smaller investments. Although that’s not a problem with interactive investor as regular investing is free.

Time in the market is really what counts

So, what can we take from all this? Well, the headline story here is that whether you invest lump sums or a regular monthly amount, the longer your investment time frame, the bigger your investment growth. The “time in the market, not timing the market” maxim really does hold weight.

Whichever strategy you use, it’s key to start the savings process as soon as you can. The superpower that is compound returns has the greatest impact over long periods.

Of course, as Bachelier’s random walk theory posits, we have no idea about the path markets will take.

But it’s worth noting that since 1999, several serious events have hit investor portfolios: the dot-com crash which kicked off in early 2000 and spilled into the following year; the global financial crisis in 2008 which saw many developed stock markets halve; and most recently the pandemic in 2020.

Past performance is not a guide to future performance.

Despite the effects of these on markets, investing your ISA in a globally diversified basket of stocks and shares still outpaced cash savings by a wide margin for both lump sums and regular investments.

And a great thing about ISAs - other than the fact that any gains, dividends, and income are tax free - is the flexibility they offer. You can choose to pay in ad-hoc lump sums, invest a monthly amount or use a mixture of the two strategies.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Please remember, investment value can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a stocks & shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Editor's Picks