A popular technology stock with enormous potential

Rallying almost 400% over the past 17 months, this American tech firm is one of the best performing US stocks. Analyst Rodney Hobson explains what he’d do with them now.

2nd October 2024 08:27

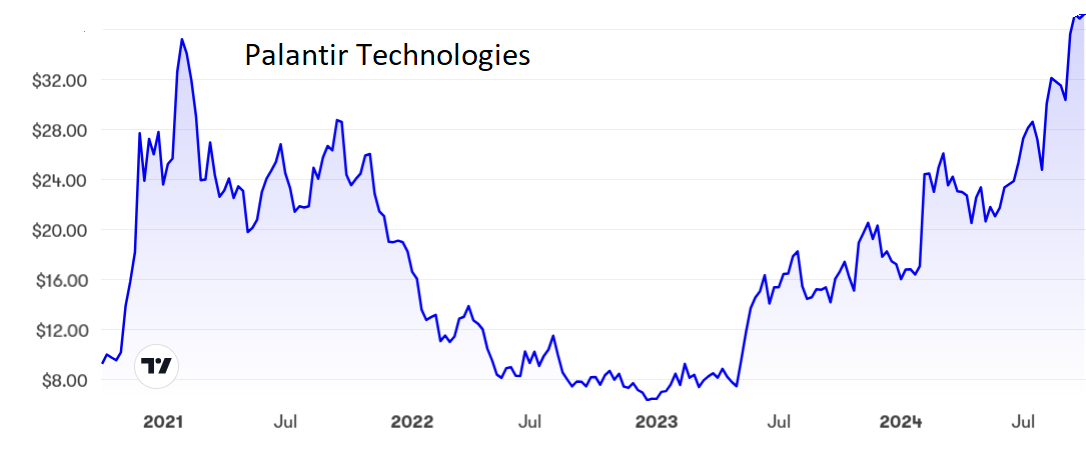

One of the big leaders in the upward surge of American tech stocks has been Palantir Technologies Inc Ordinary Shares - Class A (NYSE:PLTR), which has been a great favourite among interactive investor customers. The valuation has, however, now got quite silly and it is surely time to consider taking profits. If the shares run out of steam, the downside could be rather severe.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

It is worth rereading Edmond Jackson’s excellent analysis, published in April, of Palantir’s partnership with Oracle Corp (NYSE:ORCL) to provide secure cloud and artificial intelligence (AI) solutions to businesses and governments around the world.

Palantir’s shares at that stage stood around $22 and Edmond rightly identified potential upside. They are now just below $37, having reached prices not seen since February 2021. Yet results have not justified a valuation of more than 200 times earnings.

The problem is that although Palantir has enormous potential it has been lossmaking for most of the time since it was set up in 2003. There is no dividend and no hope of one for several years as developing products – an expensive aspect of tech stocks – soak up any cash generated in a competitive sector. There are enough producers of clouds and artificial intelligence snapping at the heels of the pacemakers to force tech companies to push constantly for the next big breakthrough.

It does seem highly likely that annual revenue will take off rapidly from the current level of $2.2 billion, as Palantir’s products will be in increasing demand from both the public and private sectors where the company operates to equal effect.

Palantir started as a supplier of big data analytics software to the Department of Defense and intelligence agencies in the United States, expanding to winning contracts with other governments including the UK. A series of potentially lucrative new contracts with the US government have been signed over the summer.

- Three investments that thrive after the Fed’s first rate cut

- Terry Smith: two reasons why I haven’t bought Nvidia

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Commercial sales have just about caught up and continue to grow faster. The group is also expanding its customer numbers, so it is becoming increasingly sheltered from a turndown at any one company that it supplies. New customers tend to spend more with each passing year.

Total sales are projected to grow a very impressive 24% this year. However, that projection compares with growth of 40% when the shares were last on a fantastic valuation and there is likely to be a further slowdown, with 20% last year. While many companies would be delighted with 20% sales growth, not many are on hard-to-justify valuations.

More important than revenue growth is profitability. This is hard to judge as Palantir has only recently swung into profit, although now at least has a positive operating margin, albeit only 12%, which is much lower than for other software providers but massively better than the minus 40% reported only two years ago. Some better indication will come with the next quarterly figures due in early November, but it is fair to assume that there will be profits from now on.

As for the share price, investors should remember that what goes up can come down just as quickly. The last peak was followed by a collapse to only $6 in just under two years.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have advised taking profits in Palantir twice before. The first time was spectacularly right at above $20 before the shares lost 70% of their value. However, I was premature to issue the same advice after the recovery reached $15. At current levels the risks outweigh the potential rewards. Even on an optimistic forward rating the shares sell at 100 times potential earnings, double the ratings for more reliable investments such as Microsoft Corp (NASDAQ:MSFT) and Amazon.com Inc (NASDAQ:AMZN). Sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Editor's Picks